1035 Exchange Chart

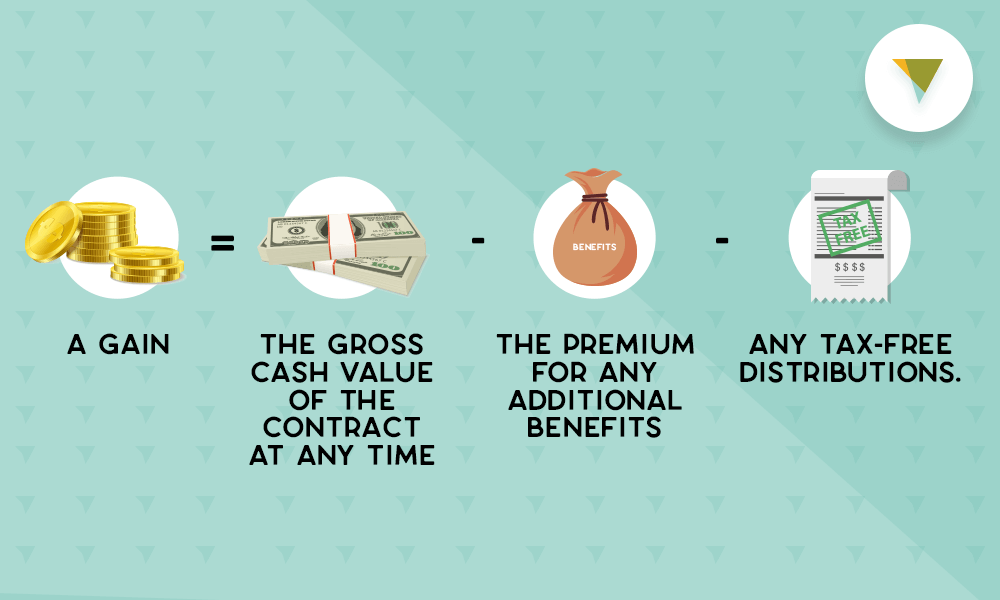

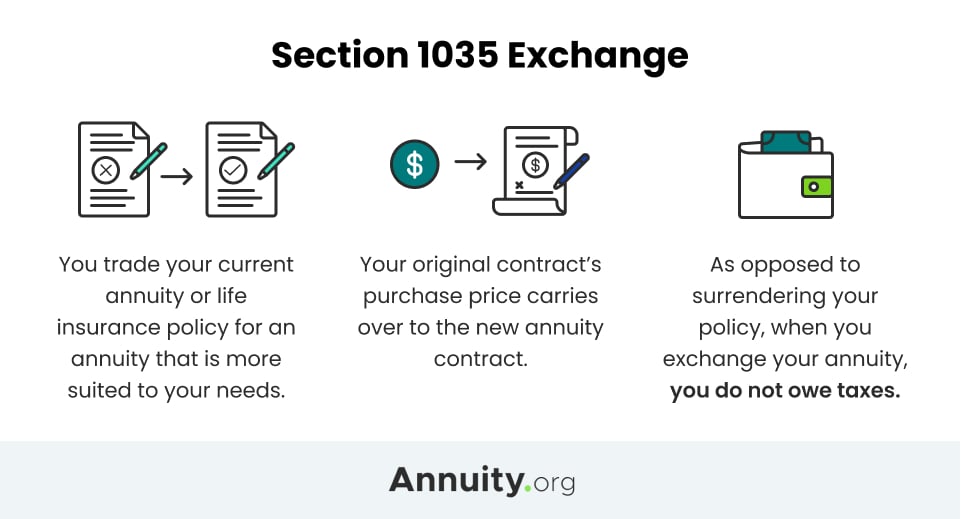

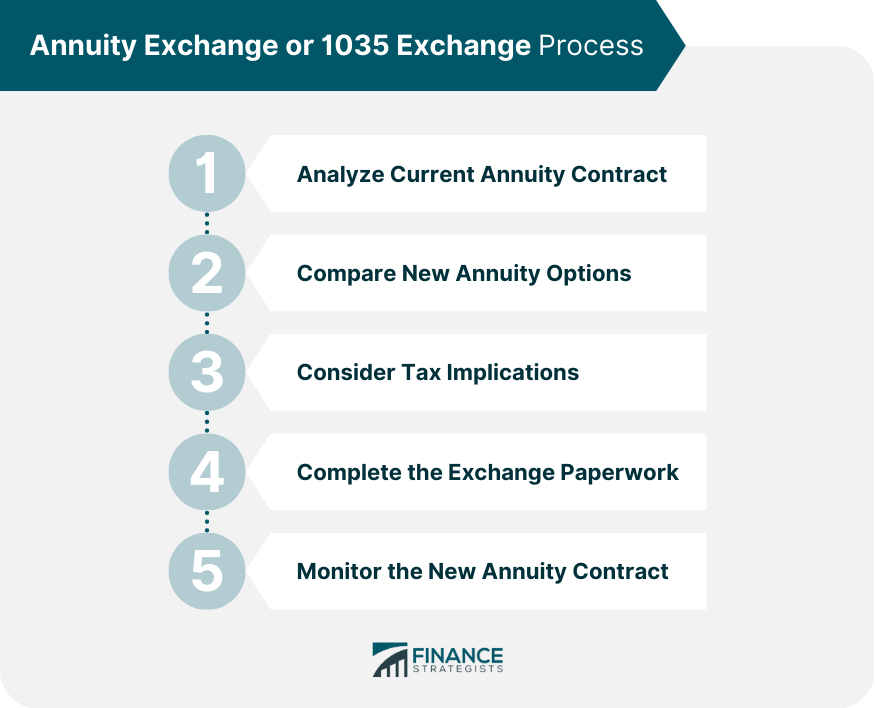

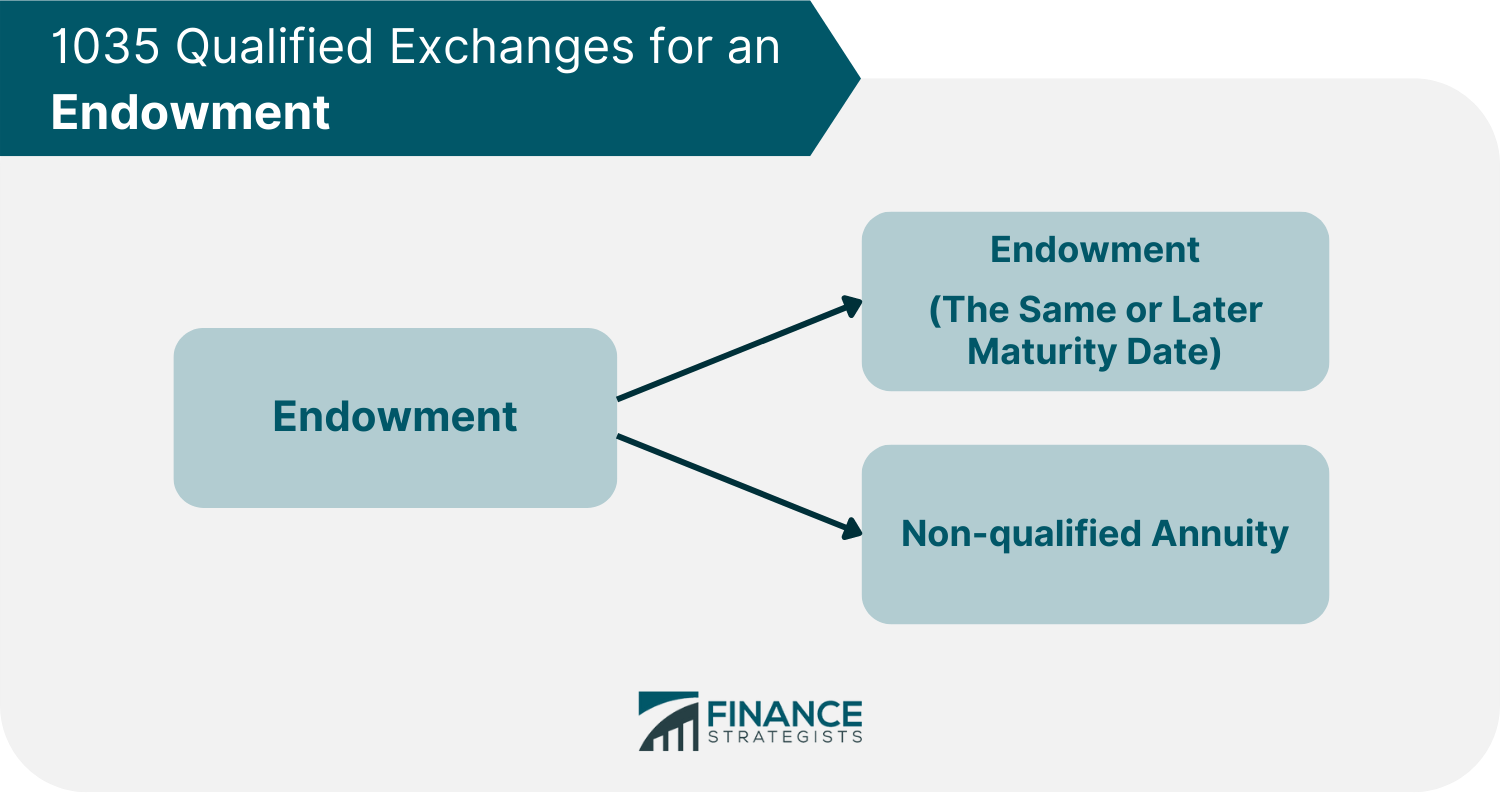

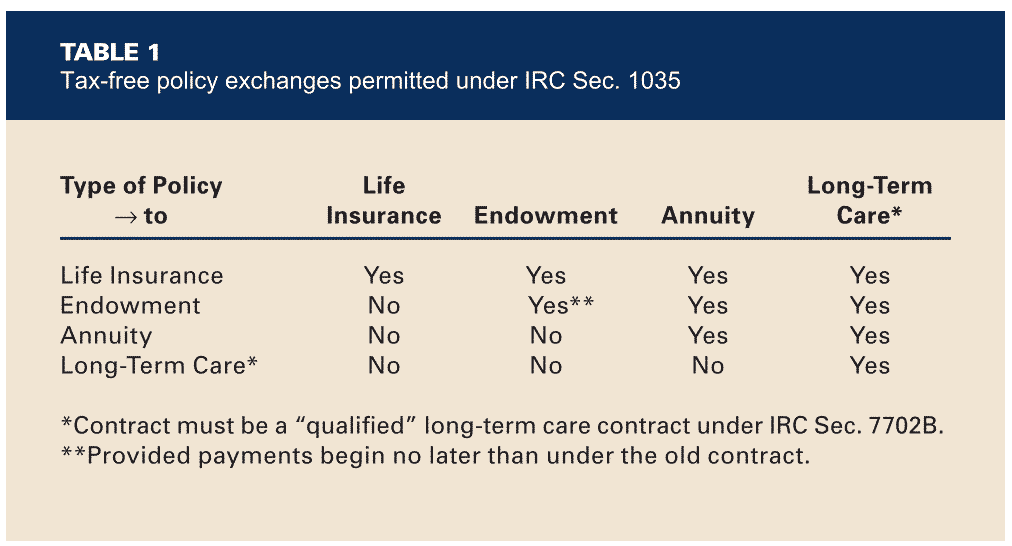

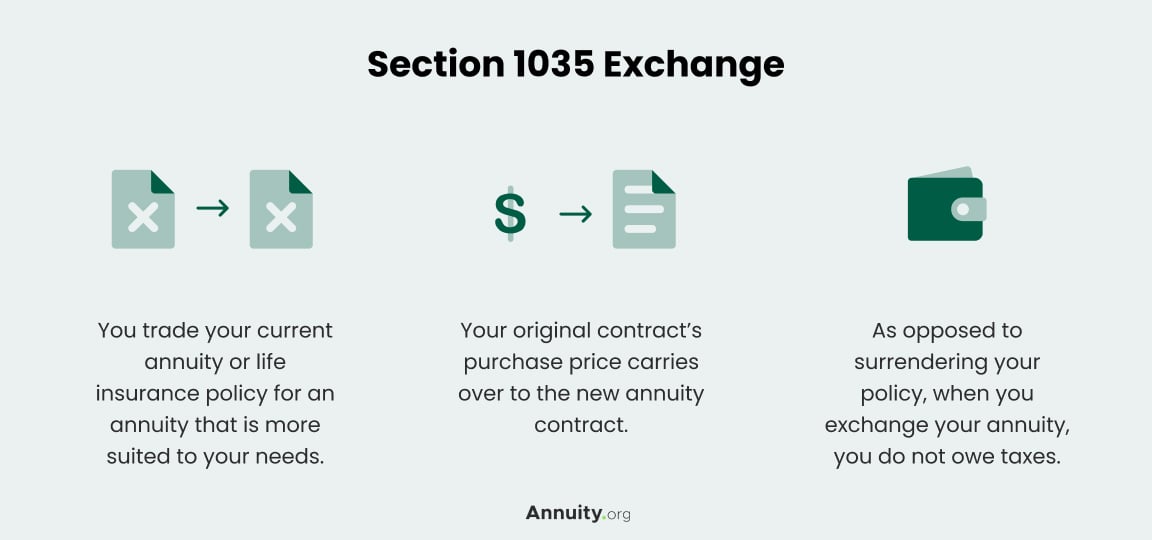

1035 Exchange Chart - When you take distributions from the contract, you will pay income taxes only on the gain. A tax professional should be. Learn all about 1035 exchanges from aafmaa & get your questions answered today. Web a 1035 exchange is from the irs code section1035. Web how a 1035 exchange works. Web what are annuity exchange (1035 exchange) options? An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. Keep in mind that a. Section 1035 says that you can transfer one annuity to another. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the gains earned on the original contract. Web how a 1035 exchange works. The ruling concludes that, pursuant to § 1035, no gain or loss is. Section 1035 says that you can transfer one annuity to another. A tax professional should be. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on. Section 1035 says that you can transfer one annuity to another. Web a second insurance company in exchange for a variable annuity contract issued by the second company. Web what is a section 1035 exchange? If you are bored take some time and read it. An annuity exchange refers to the process of transferring an existing annuity contract or life. Web a 1035 exchange is from the irs code section1035. Section 1035 says that you can transfer one annuity to another. If you are bored take some time and read it. Learn all about 1035 exchanges from aafmaa & get your questions answered today. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own. Keep in mind that a. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. Section 1035 says that you can transfer one annuity to another. Learn all about 1035 exchanges from aafmaa & get your questions answered today. Web what is a section 1035 exchange? When you take distributions from the contract, you will pay income taxes only on the gain. Web both the 1031 and 1035 exchanges provide you, the taxpayer, with the opportunity to exchange into investments that might better align with your goals or. A tax professional should be. Section 1035 says that you can transfer one annuity to another. Web a. Web a second insurance company in exchange for a variable annuity contract issued by the second company. Keep in mind that a. The ruling concludes that, pursuant to § 1035, no gain or loss is. When you take distributions from the contract, you will pay income taxes only on the gain. An annuity exchange refers to the process of transferring. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. Learn all about 1035 exchanges from aafmaa & get your questions answered today. Web what is a section 1035 exchange? Web what are annuity exchange (1035 exchange) options? Web a 1035 exchange provides a means for exchanging an annuity contract or life insurance. The ruling concludes that, pursuant to § 1035, no gain or loss is. Web a 1035 exchange is from the irs code section1035. If you are bored take some time and read it. Web a second insurance company in exchange for a variable annuity contract issued by the second company. Learn all about 1035 exchanges from aafmaa & get your. The ruling concludes that, pursuant to § 1035, no gain or loss is. A tax professional should be. When you take distributions from the contract, you will pay income taxes only on the gain. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. Web both the 1031 and 1035 exchanges provide you, the taxpayer, with the opportunity to exchange into investments that might better align with your goals or. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for. Web what is a section 1035 exchange? Keep in mind that a. Web what are annuity exchange (1035 exchange) options? Section 1035 says that you can transfer one annuity to another. Web how a 1035 exchange works. Web a 1035 exchange provides a means for exchanging an annuity contract or life insurance policy without being treated as if it had been surrendered or sold. Web both the 1031 and 1035 exchanges provide you, the taxpayer, with the opportunity to exchange into investments that might better align with your goals or. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the gains earned on the original contract. Learn all about 1035 exchanges from aafmaa & get your questions answered today. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. A tax professional should be. When you take distributions from the contract, you will pay income taxes only on the gain.

1035 Annuity Exchange A TaxFree Way to Change Annuities

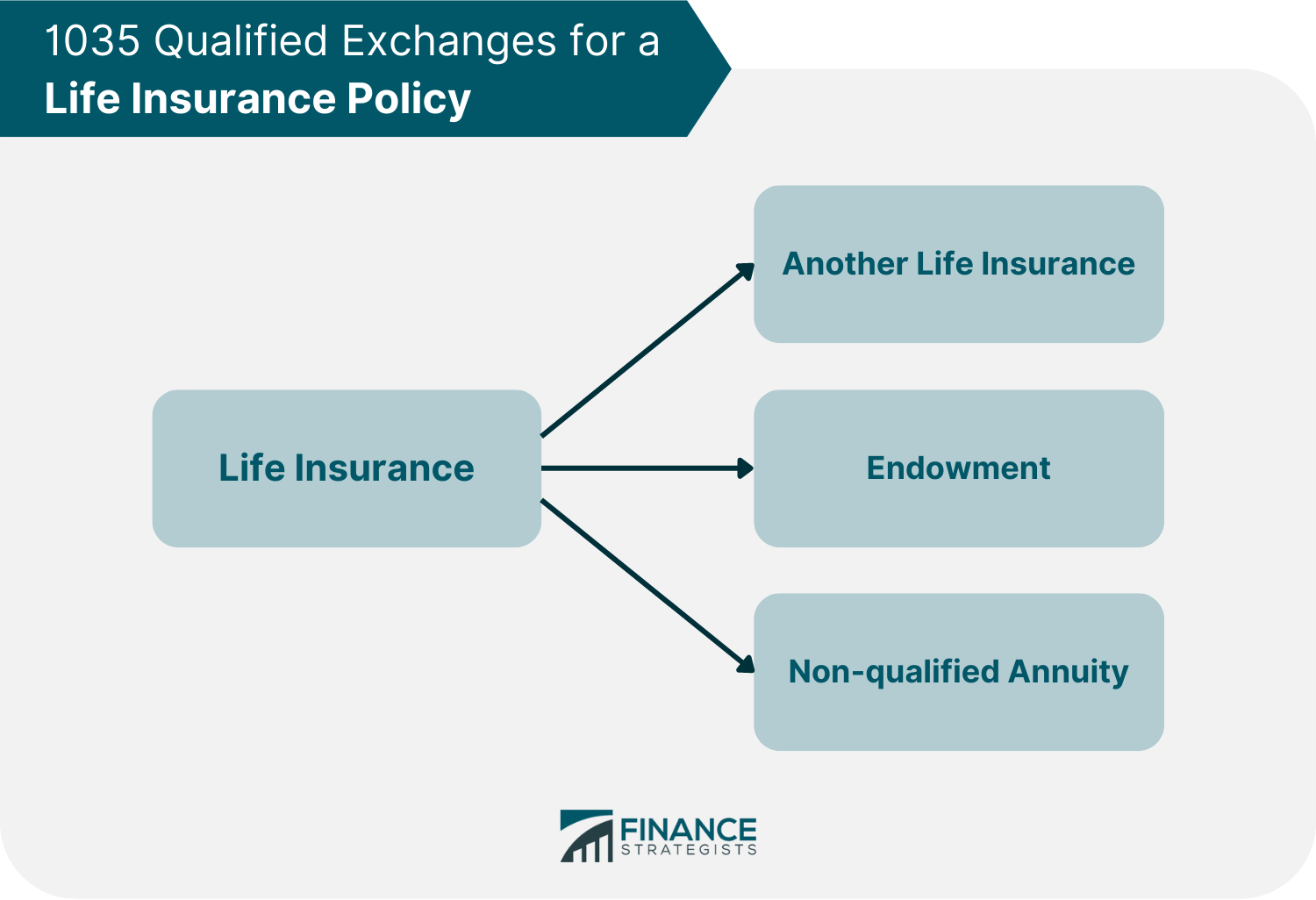

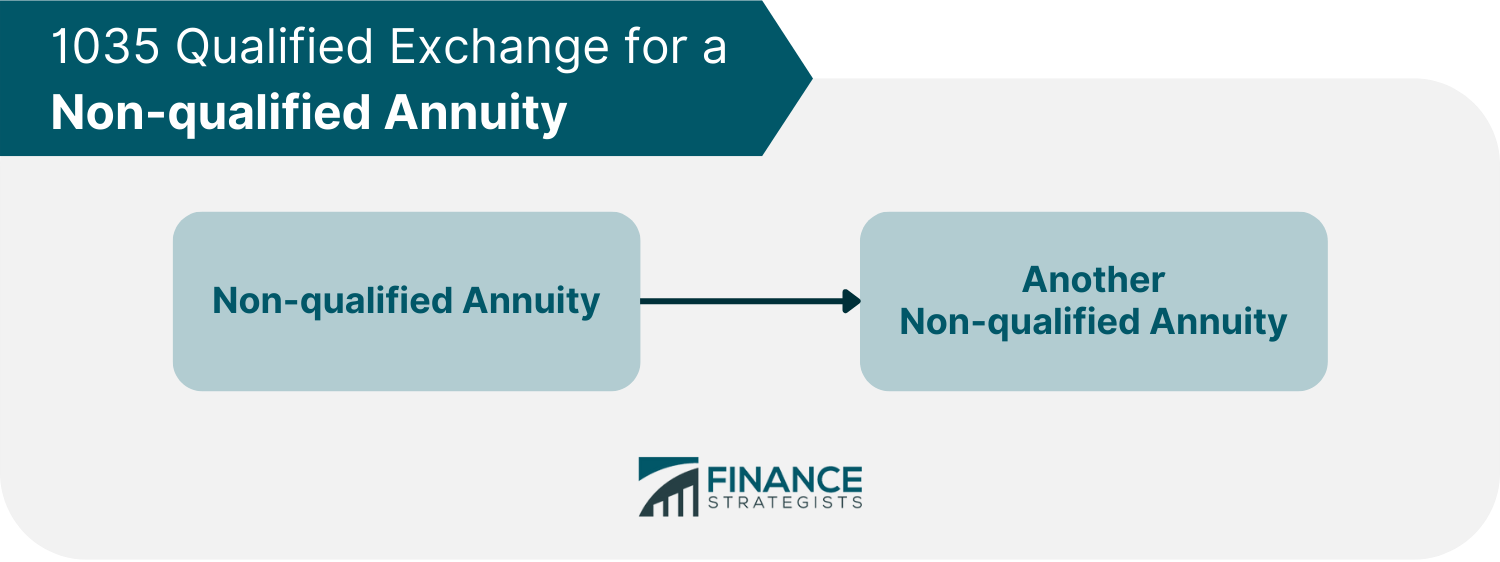

Annuity Exchange (1035 Exchange) Options Meaning & Types

How Does a 1035 Exchange Work for Annuities and Insurance?

1035 Exchange Definition, Qualifications, and What to Consider

Flah & Company

1035 Exchange Definition, Qualifications, and What to Consider

1035 Exchange Definition, Qualifications, and What to Consider

1035 Exchange Rules An Overview Insurance News Magazine

Alternatives to Long Term Care Insurance • My Annuity Store

1035 Annuity Exchange A TaxFree Way to Change Annuities

The Ruling Concludes That, Pursuant To § 1035, No Gain Or Loss Is.

Web A 1035 Exchange Is From The Irs Code Section1035.

If You Are Bored Take Some Time And Read It.

Web A Second Insurance Company In Exchange For A Variable Annuity Contract Issued By The Second Company.

Related Post: