1099 Form Ohio Printable

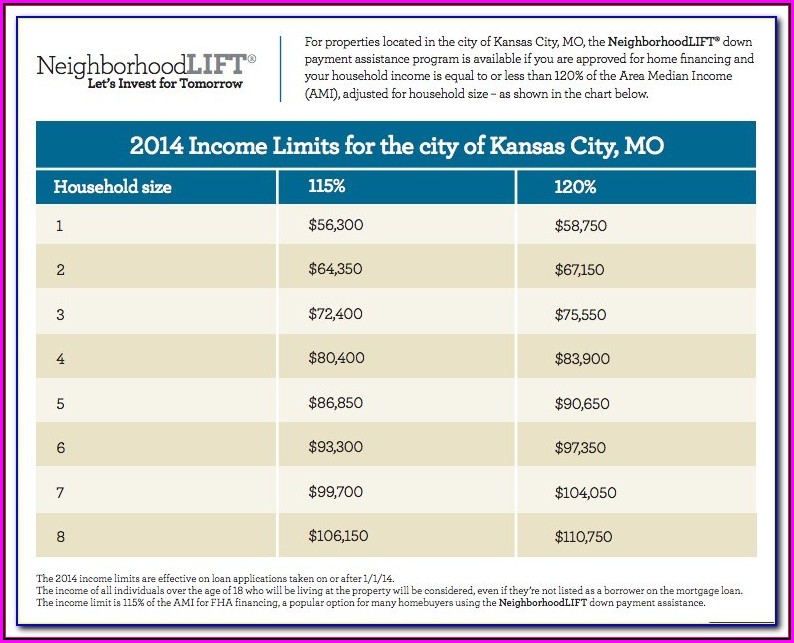

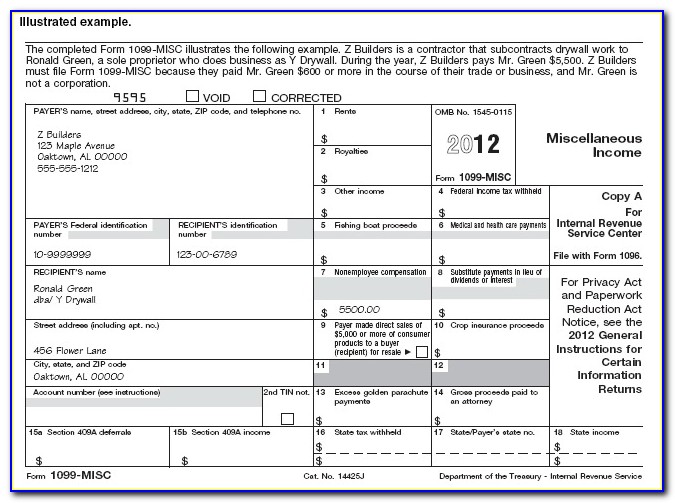

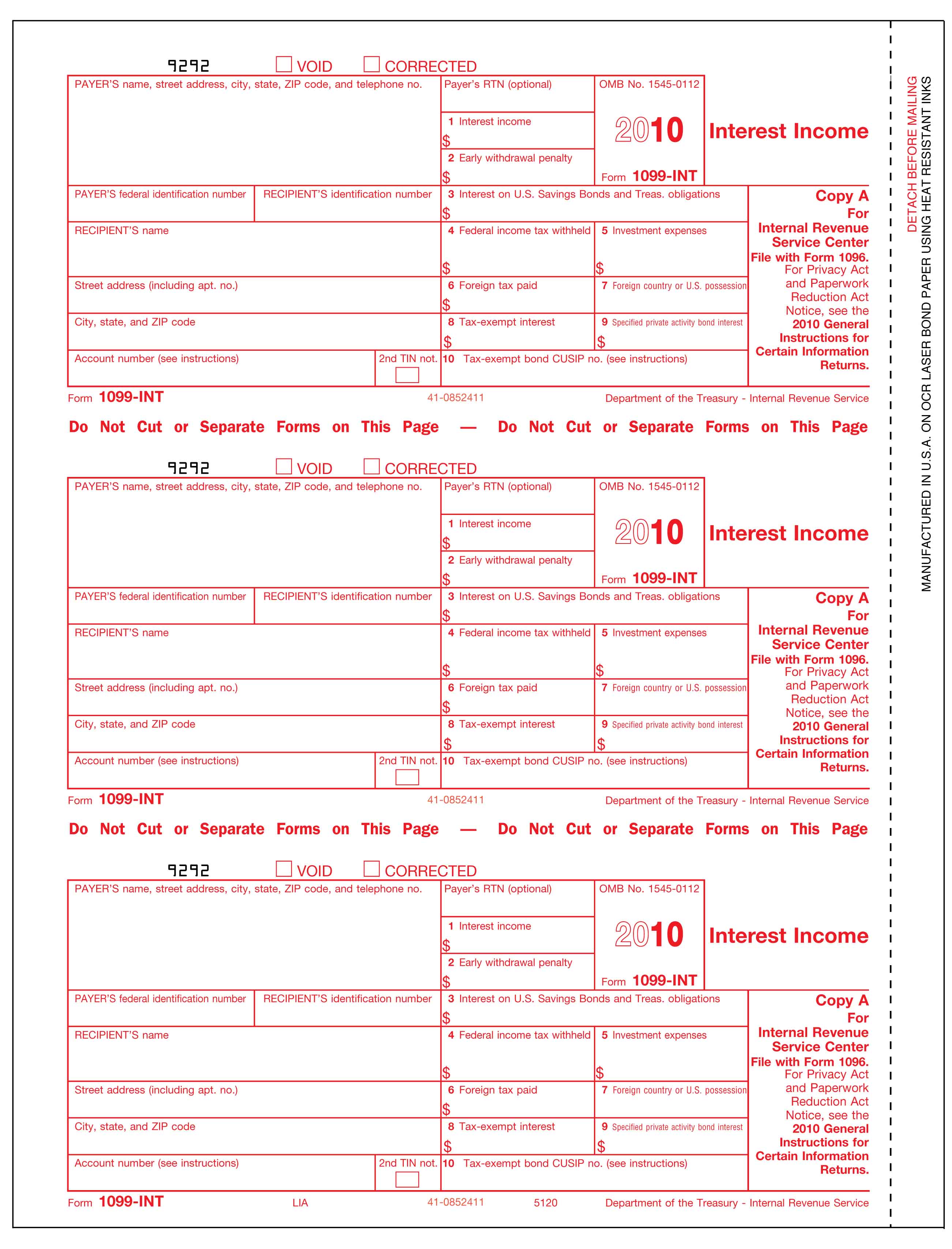

1099 Form Ohio Printable - Find forms to help you file reports and make payments. Submitted in calendar year 2022, are contained in this document. Web to request a waiver online, please visit the source. You can elect to be removed from the next year’s mailing by signing up for email notification. Web independent providers who made more than $600 in 2018 and who are certified under their social security number will be issued an irs form 1099 (report of miscellaneous income) by the office of ohio shared services (oss). However, the payer has reported your complete tin to the irs. Web an official state of ohio site. Agency providers may receive a 1099 depending on the type of contractor as listed in ohio shared services accounting. Submit one file per employee. Ohio department of job and family services. Ohio department of job and family services. Access the forms you need to file taxes or do business in ohio. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. (this information is provided to benefit recipients for tax preparation purposes.) click here to log in or register for an online account. Web all. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Web independent providers who made more than $600 in 2018 and who are certified under their social security number will be issued an irs form 1099 (report of miscellaneous income) by the office of ohio shared services (oss). Access the forms you need to. (this information is provided to benefit recipients for tax preparation purposes.) click here to log in or register for an online account. Lorem ipsum dolor sit amet. Share this expand all sections. After obm shared services has received your form (s) and appropriate documentation, please allow 5 business days for the documents to be processed. Submitted in calendar year 2022,. Are we required to send a copy of our 1099 forms to the state of ohio {} web content viewer. Once users retrieve the correct 1099, they click the appropriate print button at the bottom of the screen to view and/or print the details. Web users select the form type, either int, misc, nec, or g and then the appropriate. After obm shared services has received your form (s) and appropriate documentation, please allow 5 business days for the documents to be processed. Web to request a waiver online, please visit the source. (this information is provided to benefit recipients for tax preparation purposes.) click here to log in or register for an online account. Ohio department of job and. Are we required to send a copy of our 1099 forms to the state of ohio {} web content viewer. Submitted in calendar year 2022, are contained in this document. Once users retrieve the correct 1099, they click the appropriate print button at the bottom of the screen to view and/or print the details. However, the payer has reported your. You can elect to be removed from the next year’s mailing by signing up for email notification. The irs has not authorized using uan for printing these forms to plain paper. Submitted in calendar year 2022, are contained in this document. Web need paper individual or school district income tax forms mailed to you?. Ohio department of job & family. Submit one file per employee. Submitted in calendar year 2023, are contained in this document. However, the payer has reported your complete tin to the irs. Access the forms you need to file taxes or do business in ohio. Web all 1099gs issued by the ohio department of taxation will be mailed by january 31st. Once users retrieve the correct 1099, they click the appropriate print button at the bottom of the screen to view and/or print the details. Share this expand all sections. Web all 1099gs issued by the ohio department of taxation will be mailed by january 31st. Access the forms you need to file taxes or do business in ohio. Web an. Once users retrieve the correct 1099, they click the appropriate print button at the bottom of the screen to view and/or print the details. Submit one file per employee. The irs has not authorized using uan for printing these forms to plain paper. Web an official state of ohio site. Ohio department of job and family services. Access the forms you need to file taxes or do business in ohio. You can elect to be removed from the next year’s mailing by signing up for email notification. Find forms to help you file reports and make payments. Web users select the form type, either int, misc, nec, or g and then the appropriate year. Ohio department of job & family services | 30 e broad st, columbus, oh 43215 | phone: Submitted in calendar year 2023, are contained in this document. Agency providers may receive a 1099 depending on the type of contractor as listed in ohio shared services accounting. Web an official state of ohio site. However, the payer has reported your complete tin to the irs. Once users retrieve the correct 1099, they click the appropriate print button at the bottom of the screen to view and/or print the details. Web to request a waiver online, please visit the source. Web all 1099gs issued by the ohio department of taxation will be mailed by january 31st. After obm shared services has received your form (s) and appropriate documentation, please allow 5 business days for the documents to be processed. (this information is provided to benefit recipients for tax preparation purposes.) click here to log in or register for an online account. Lorem ipsum dolor sit amet. Web an official state of ohio site.

1099 Form Ohio Printable Printable Forms Free Online

1099 Form Ohio Printable Form Resume Examples Ze129Ren8j

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)

1099 Form Ohio Printable

1099 reporting

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

1099 Form Ohio Printable

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

1099 Form Ohio Printable

1099 Form Ohio Printable

1099 Form Ohio Printable

1099Gs Are Available To View And Print Online Through Our Oh|Tax Eservices.

Share This Expand All Sections.

The Ohio Department Of Taxation Provides A Searchable Repository Of Individual Tax Forms For Multiple Purposes.

Are We Required To Send A Copy Of Our 1099 Forms To The State Of Ohio {} Web Content Viewer.

Related Post: