1099 Form Printable Free

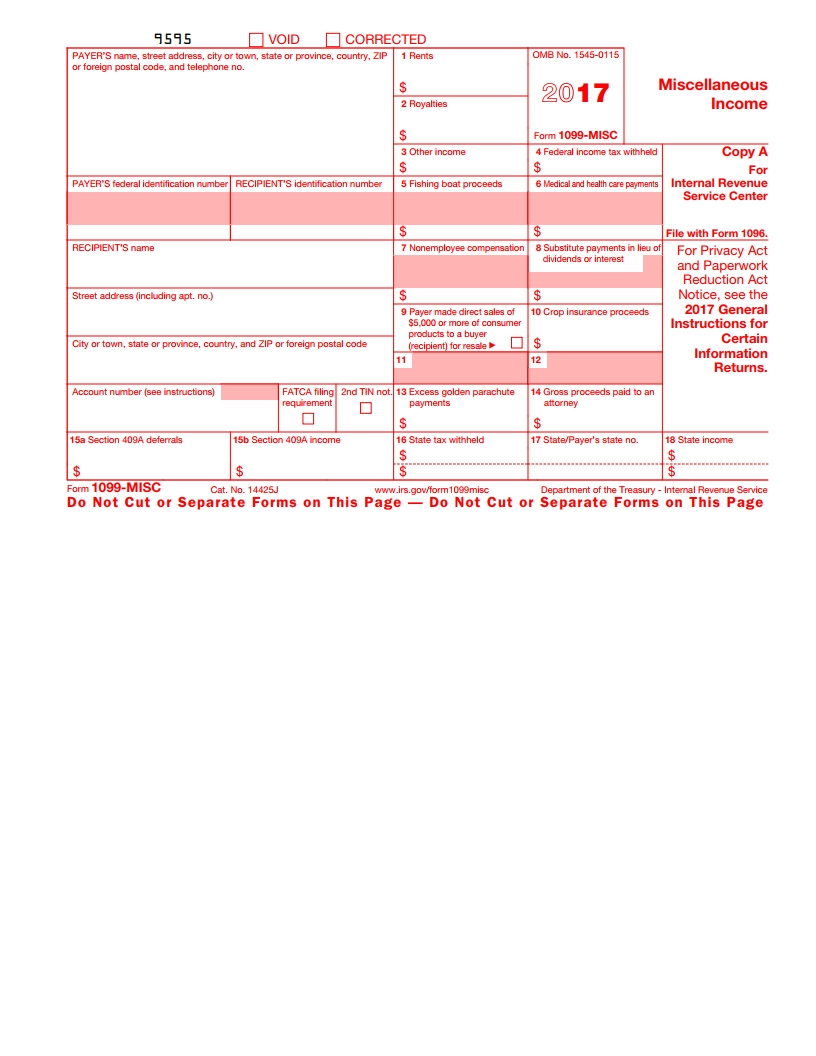

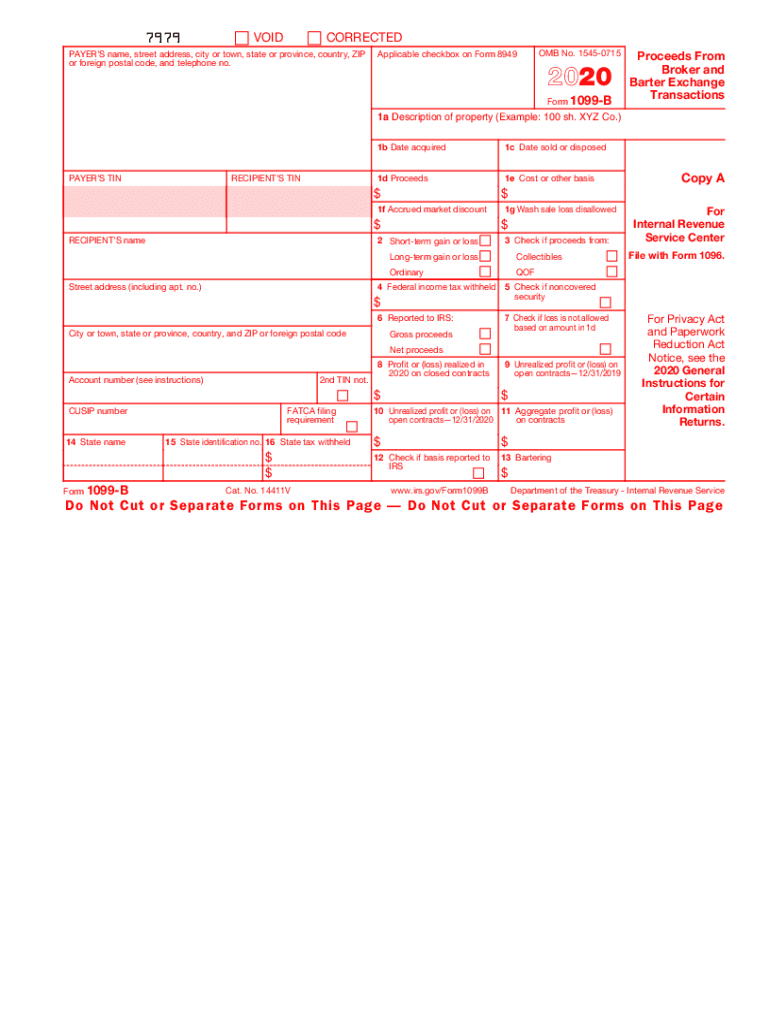

1099 Form Printable Free - 1099s fall into a group of tax documents. All kinds of people can get a 1099 form for different reasons. Make sure you’ve got the right paper in your printer. Web if you need help estimating how income on a form 1099 could affect your tax bill, check out our free tax calculator. If you work as an independent contractor or freelancer, you'll likely have income. You will also have a copy you can send to your state tax department, if required. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Persons with a hearing or speech disability with access to tty/tdd equipment can. Persons with a hearing or speech disability with access to tty/tdd equipment can. Click “print 1099” or “print 1096” if you only want that form. 1099s fall into a group of tax documents. File your 1099 with the irs for free using freetaxusa. You should issue all other payments to the recipient by. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside. You should issue all other payments to the recipient by. You may also have a filing requirement. See your tax return instructions for where to report. Select each contractor you want to print 1099s for. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. List your business’s name and address in the top left section of the form. See your tax return instructions for where to report. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. If you work as an independent contractor or freelancer, you'll likely have income. File your 1099 with the irs. See your tax return instructions for where to report. Post the nonemployee compensation and. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. There are 20 active types of 1099 forms used for various income types. Make sure you’ve got the right paper in your printer. Fill, generate & download or print copies for free. You may also have a filing requirement. See your tax return instructions for where to report. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages,. You may also have a filing requirement. Persons with a hearing or speech disability with access to tty/tdd equipment can. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). You should issue all other payments. Web if you need help estimating how income on a form 1099 could affect your tax bill, check out our free tax calculator. File your 1099 with the irs for free using freetaxusa. Persons with a hearing or speech disability with access to tty/tdd equipment can. However, the issuer has reported your. List your company’s taxpayer identification number (tin) as. You may also have a filing requirement. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Web irs 1099 form. File your 1099 with the irs for free using freetaxusa. You should issue all other payments to the recipient by. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Here you can find everything related to form 1099: All kinds of people can get a 1099 form for different reasons. Irs 1099 forms are a series of tax reporting documents. Fill, generate & download or print copies for free. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other. Get free support and guidance from our experts. 1099 forms can report different types of incomes. Persons with a hearing or speech disability with access to tty/tdd equipment can. File your 1099 with the irs for free using freetaxusa. You will also have a copy you can send to your state tax department, if required. List your company’s taxpayer identification number (tin) as payer’s tin. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web recipient’s taxpayer identification number (tin). Web if you need help estimating how income on a form 1099 could affect your tax bill, check out our free tax calculator. Web get a printable 1099 tax form for the 2023 tax year. Send out these 1099 forms after you review them for accuracy and completeness. However, the issuer has reported your. Free template for print, sample, and filled out example Post the nonemployee compensation and. Web irs 1099 form.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

1099 Form Template. Create A Free 1099 Form Form.

![]()

Printable 1099 Form Pdf Free Printable Download

What is a 1099Misc Form? Financial Strategy Center

1099 Form Independent Contractor Pdf Blank Contractor Agreement

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

2020 Form IRS 1099B Fill Online, Printable, Fillable, Blank pdfFiller

Download Fillable 1099 Form Printable Forms Free Online

1099 Contract Template HQ Printable Documents

What is a 1099R Form Distributions from Pensions & Annuities

For Your Protection, This Form May Show Only The Last Four Digits Of Your Tin (Social Security Number (Ssn), Individual Taxpayer Identification Number (Itin), Adoption Taxpayer Identification Number (Atin), Or Employer Identification Number (Ein)).

Note That The $600 Threshold That Was Enacted.

All Kinds Of People Can Get A 1099 Form For Different Reasons.

You Should Issue All Other Payments To The Recipient By.

Related Post: