1099Misc Printable Form

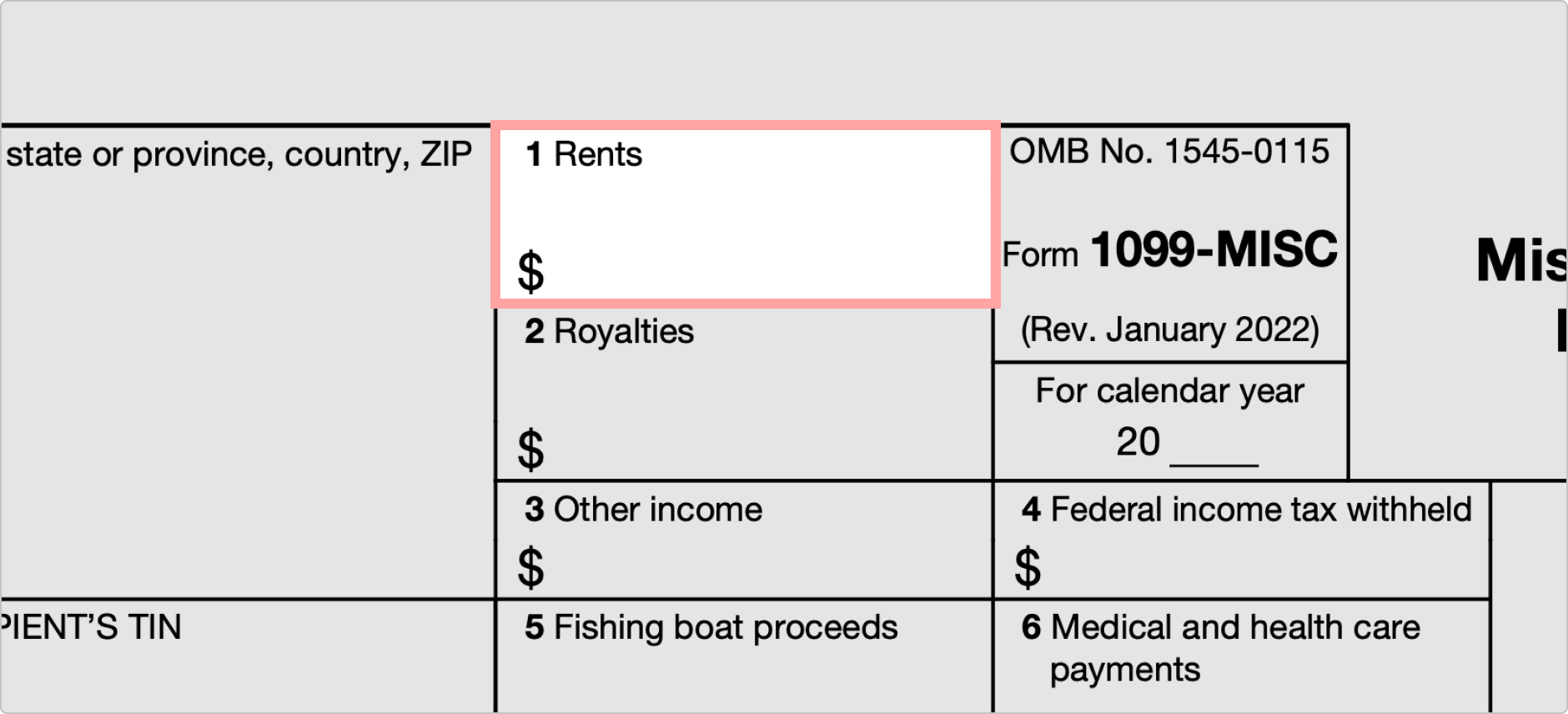

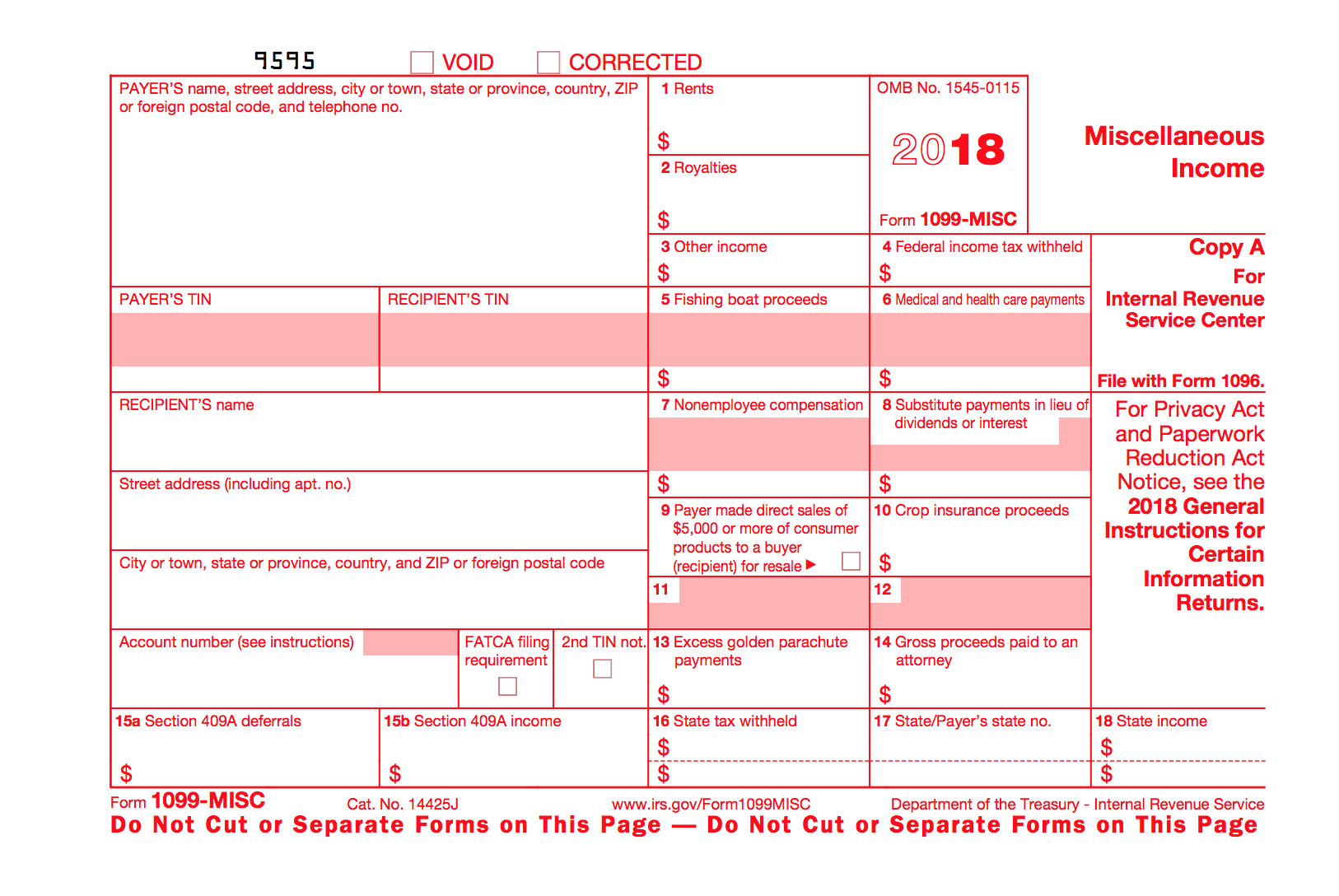

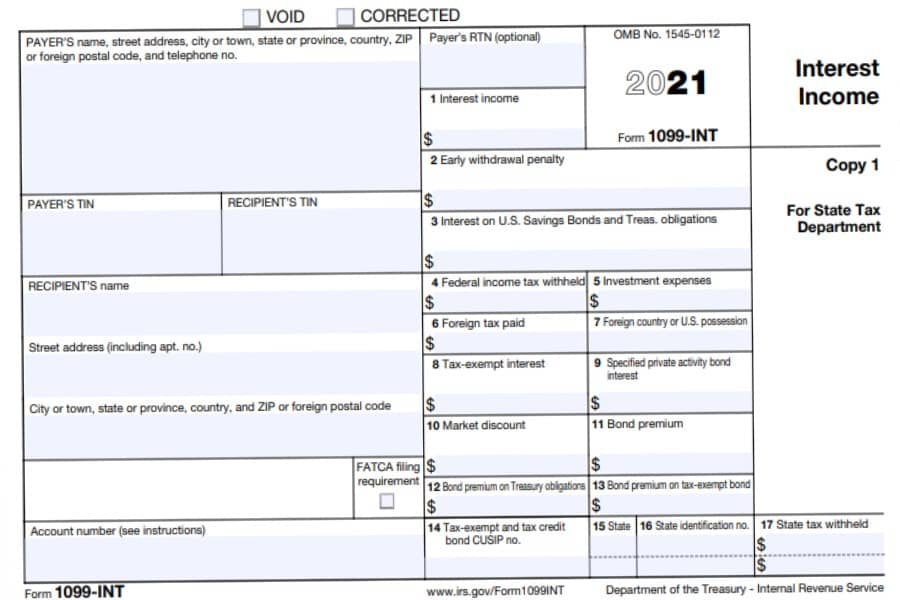

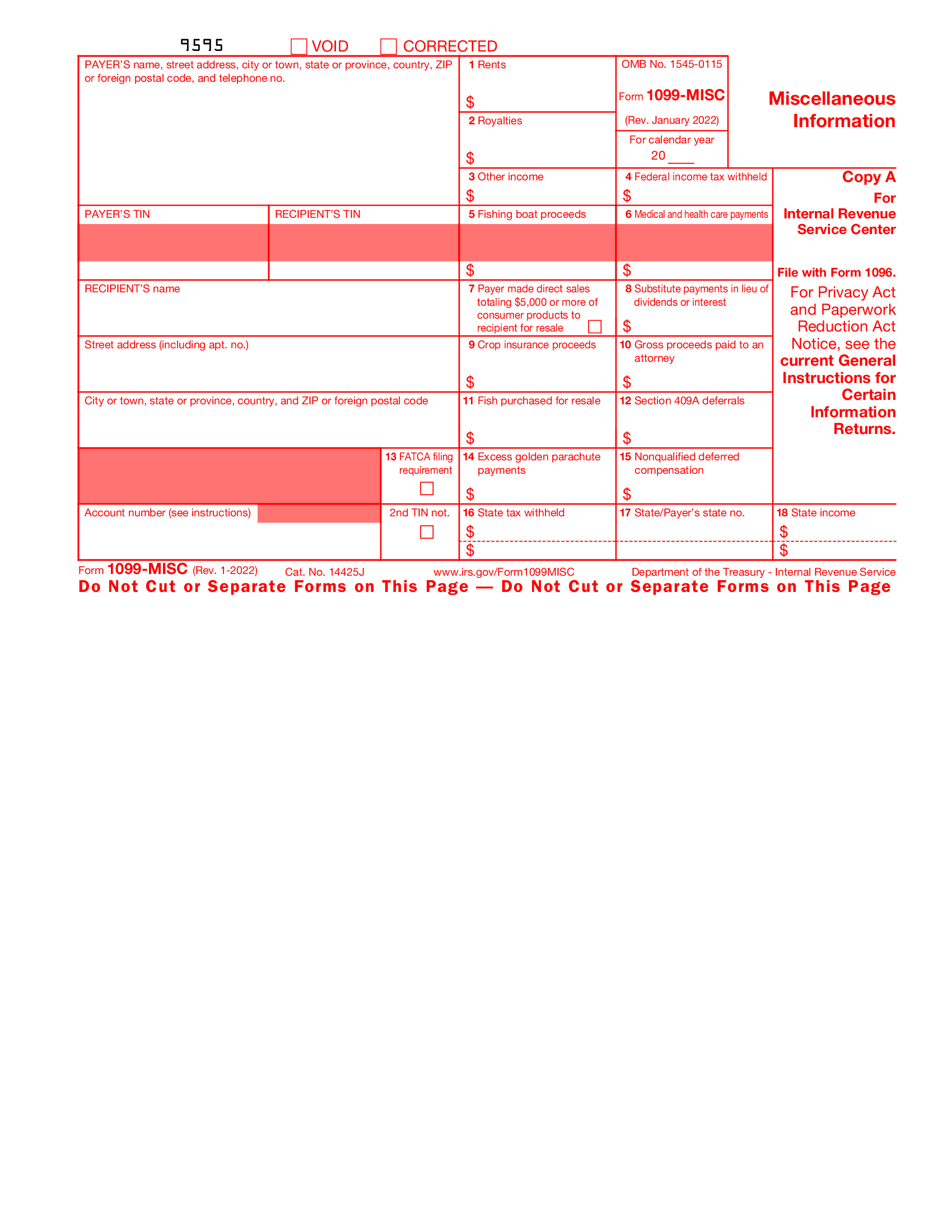

1099Misc Printable Form - To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Copy a of this form is provided for informational purposes only. What it is, how it works. What to do before you print your 1099s. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. Web 10 or more returns: Can you print 1099s on plain paper? Printing 1099s from sage 50. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Can you print 1099s on plain paper? Fill out a 1099 form. However, this form recently changed, and it no longer includes nonemployee compensation the way it. Irs 1099 forms are a series of tax reporting documents used by businesses and. What to do before you print your 1099s. Web must be reported on line 21 of your form 1040. The official printed version of copy a of this irs form is scannable, but the online version of it,. This form is sent by people who pay others for services, rent, or other types of income not connected with salaried employment.. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Web 10 or more returns: The official printed version of copy a of this irs form is scannable, but the online version of it,. However, this form recently changed, and it no longer includes nonemployee compensation. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. However, mileage reimbursements are not considered reportable income. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. The treatment. Copy a appears in red, similar to the official irs form. Fill out a 1099 form. The treatment of amounts reported on this form generally depends upon which box of the form the income is reported in. Corrected for privacy act and paperwork reduction act notice, see the. Web it's just $50. What it is, how it works. This means any juror or prospective juror who serves at least 7 days (with the first day being unpaid) will be issued a form However, mileage reimbursements are not considered reportable income. Web updated march 20, 2024. How to print 1099s from a pdf. Fill out a 1099 form. Where to order printable 1099 forms. The official printed version of copy a of this irs form is scannable, but the online version of it,. Web must be reported on line 21 of your form 1040. When should you print and send your 1099s? Copy a appears in red, similar to the official irs form. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. However, this form recently changed, and it no longer includes nonemployee compensation the way it. How to print 1099s from a pdf. This form is. How it works, who gets one. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Web page last reviewed or updated: To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. How to print. This form is sent by people who pay others for services, rent, or other types of income not connected with salaried employment. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received. Web it's just $50. How to print 1099s from quickbooks. The treatment of amounts reported on this form generally depends upon which box of the form the income is reported in. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Who gets a 1099 form? To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Corrected for privacy act and paperwork reduction act notice, see the. Web must be reported on line 21 of your form 1040. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. The official printed version of copy a of this irs form is scannable, but the online version of it,. What to do before you print your 1099s. For internal revenue service center. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. Web page last reviewed or updated:Tax Form 1099MISC Instructions How to Fill It Out Tipalti

1099MISC Form Fillable, Printable, Download. 2023 Instructions

1099 Misc Form Printable Instructions

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

Printable Form 1099 Misc For 2021 Printable Form 2024

What is a 1099Misc Form? Financial Strategy Center

How to Fill Out and Print 1099 MISC Forms

Fillable 1099 Misc Irs 2022 Fillable Form 2024

![]()

Printable 1099 Form Pdf Free Printable Download

Web Updated March 20, 2024.

Irs 1099 Forms Are A Series Of Tax Reporting Documents Used By Businesses And Individuals To Report Income Received Outside Of Normal Salary Or Wages, Such As Freelance Earnings, Interest, Dividends, And.

Web Irs 1099 Form.

Printing 1099S From Sage 50.

Related Post: