Adverse Action Reasons Chart

Adverse Action Reasons Chart - • generates more consistent scores across the three national credit reporting companies (equifax, experian and transunion), allowing lenders to have Refusing to grant credit in substantially the amount or on substantially the terms requested by the applicant, unless the applicant accepts your counteroffer; The number of reasons should not exceed four because more than four will likely not be meaningful to the applicant. Similarly, there are 93 positive reason code statements. Web indicate as a reason in the other box on the decline notice to the primary applicant: Web as regulation b does not explain what reasons should be secondhand, financial institutions benefit from creating an negative action reasons chart. If you take adverse action against a consumer based on information in a consumer report, you must tell the consumer. Web the noncompliance/adverse action process for reinstatement applicants is diferent than for other certification applicants (see nop 2605). Web adverse action means: Web as regulation b does not explain whats reasons should be used, financial institutions benefit from creating an adverse action reasons chart. Denying credit to an applicant. A denial or revocation of credit. Web as regulation b does not explain what reasons should be secondhand, financial institutions benefit from creating an negative action reasons chart. Witnessing violence in the home or community. Your reasons do not need to be overly specific. When reading about various steps of the adverse action process, it may be helpful to have a picture of where each step falls in relation to the others. If you take adverse action against a consumer based on information in a consumer report, you must tell the consumer. Web indicate as a reason in the other box on the decline. If you take adverse action against a consumer based on information in a consumer report, you must tell the consumer. Web • there are 89 adverse action reason code statements written in “plain english” to facilitate greater. Web indicate as a reason in the other box on the decline notice to the primary applicant: • generates more consistent scores across. Web to promote transparency and fairness in the credit underwriting process, ecoa requires creditors taking adverse action against consumers to provide consumers with a written statement that indicates the specific, principal reason (s) for. Web when sending an adverse action letter for joint applicants with different reasons for denial, can i use two letters (one for each applicant) for all. “technology marketed as artificial intelligence is expanding the data used for lending decisions, and also growing the list of potential reasons for why credit is denied,” said cfpb director rohit. / consumer financial protection circulars. Certifiers are required to continue providing certification services during the mediation and appeal processes. This articles provides a sample adverse action chart that could be. Experiencing violence, abuse, or neglect. Web indicate as a reason in the other box on the decline notice to the primary applicant: Web adverse action means: “technology marketed as artificial intelligence is expanding the data used for lending decisions, and also growing the list of potential reasons for why credit is denied,” said cfpb director rohit. Web when sending an. • generates more consistent scores across the three national credit reporting companies (equifax, experian and transunion), allowing lenders to have Web as regulation b does not explain whats reasons should be used, financial institutions benefit from creating an adverse action reasons chart. This items provides a sample adverse action diagrams that could breathe utilized by. Web the noncompliance/adverse action process. Our bank recently added an equipment finance division and i am wondering if an adverse action notice needs to be sent either to the. Experiencing violence, abuse, or neglect. Web • there are 89 adverse action reason code statements written in “plain english” to facilitate greater. Used in decision) commercial application. Web the noncompliance/adverse action process for reinstatement applicants is. Adverse action notification requirements in connection with credit decisions based on complex algorithms | consumer financial protection bureau. Web an adverse action reasons chart is simply a unitized procedures where a financial institution guaranteed that it consistently uses adverse action reasons from an applicant to the next. Web if adverse action is taken, as defined in the ecoa and regulation. Refusing to grant credit in substantially the amount or on substantially the terms requested by the applicant, unless the applicant accepts your counteroffer; Web indicate as a reason in the other box on the decline notice to the primary applicant: This items provides a sample adverse action diagrams that could breathe utilized by. Our bank recently added an equipment finance. • generates more consistent scores across the three national credit reporting companies (equifax, experian and transunion), allowing lenders to have Web an adverse action reasons chart is simply a unitized procedures where a financial institution guaranteed that it consistently uses adverse action reasons from an applicant to the next. Refusing to grant credit in substantially the amount or on substantially the terms requested by the applicant, unless the applicant accepts your counteroffer; Adverse action is defined in the equal credit opportunity act and the fcra to include: The reasons should alert the applicant to where the problems are but don't have to tell the applicant how to qualify or beat the system in the next application. / consumer financial protection circulars. Certifiers are required to continue providing certification services during the mediation and appeal processes. Web • there are 89 adverse action reason code statements written in “plain english” to facilitate greater. Web when sending an adverse action letter for joint applicants with different reasons for denial, can i use two letters (one for each applicant) for all denial reasons combined? If you take adverse action against a consumer based on information in a consumer report, you must tell the consumer. Web the noncompliance/adverse action process for reinstatement applicants is diferent than for other certification applicants (see nop 2605). When reading about various steps of the adverse action process, it may be helpful to have a picture of where each step falls in relation to the others. Our bank recently added an equipment finance division and i am wondering if an adverse action notice needs to be sent either to the. A denial or revocation of credit. Web if adverse action is taken, as defined in the ecoa and regulation b, the creditor must provide an adverse action notice (aan) disclosing the reasons for taking adverse action, and, if a credit score was used, the key factors adversely affecting the score. Web as regulation b does not explain whats reasons should be used, financial institutions benefit from creating an adverse action reasons chart.

Checklist for Bank Loan DCCI Entrepreneurship & Innovation Expo

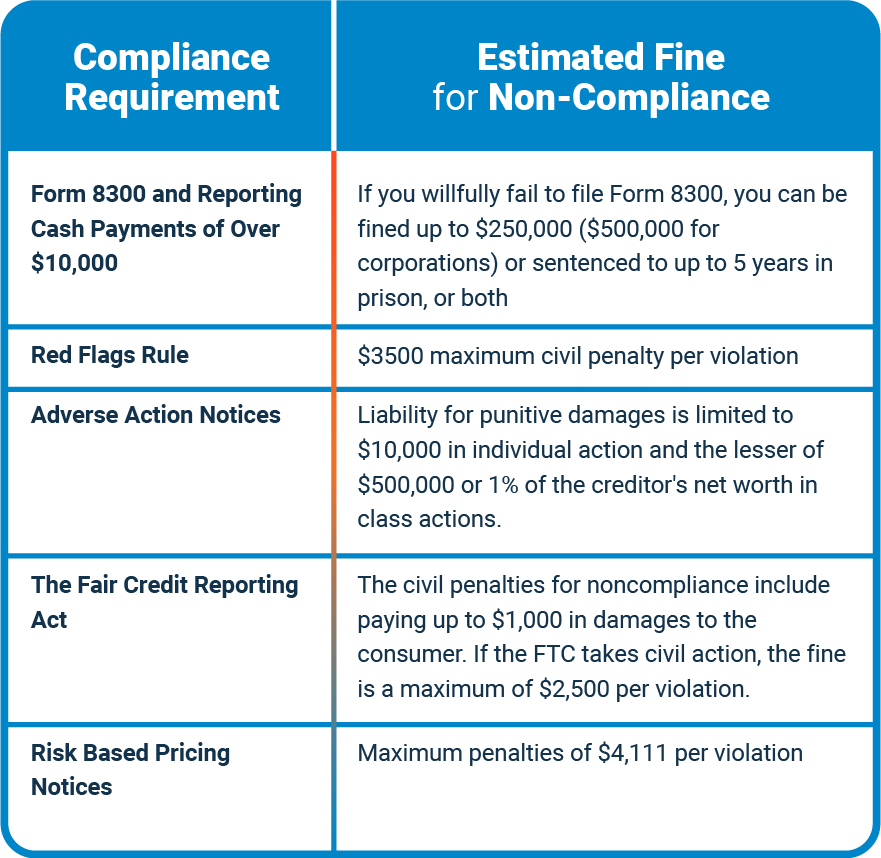

Compliance Training 700 Credit

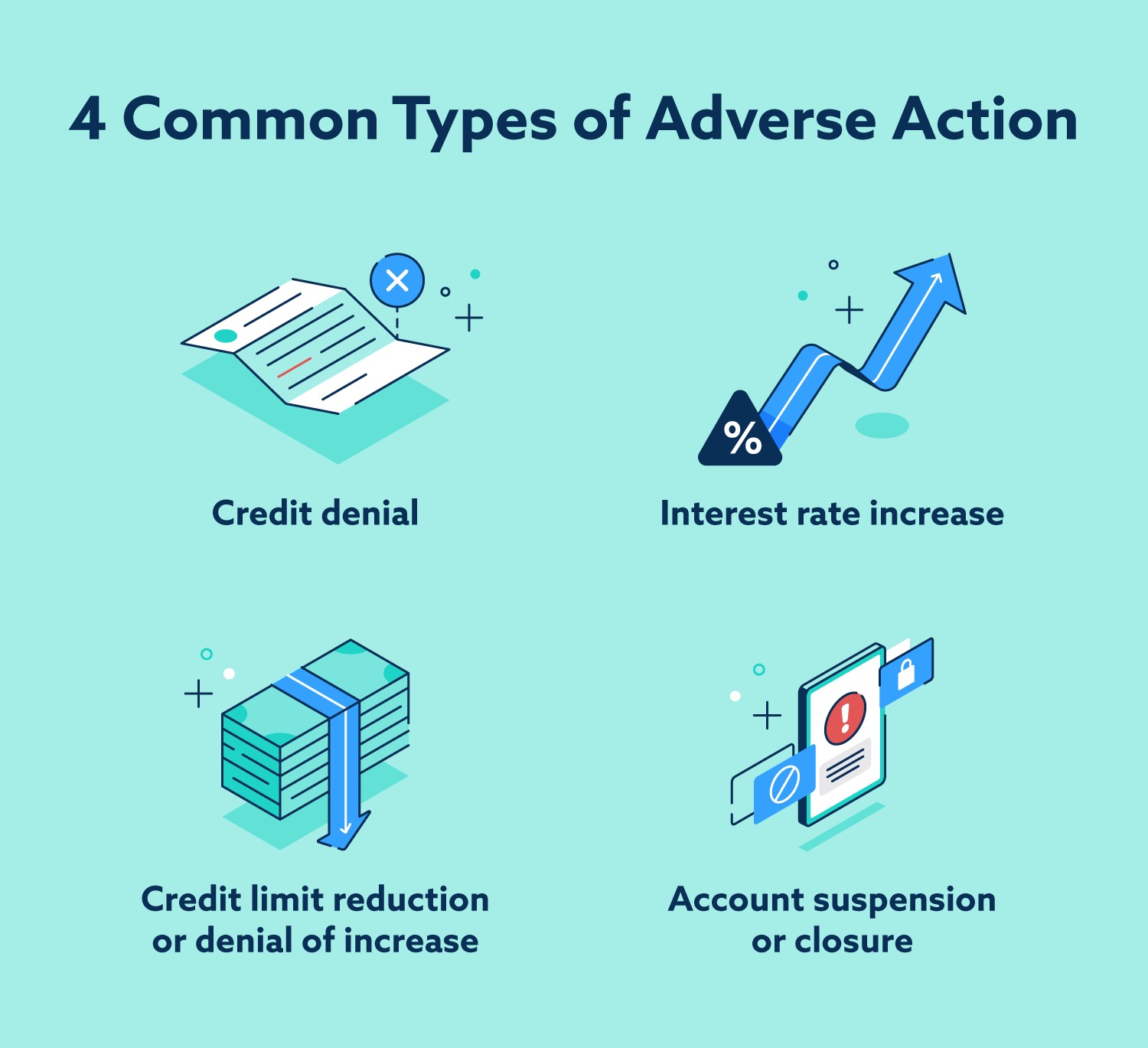

What Is an Adverse Action Notice? Lexington Law

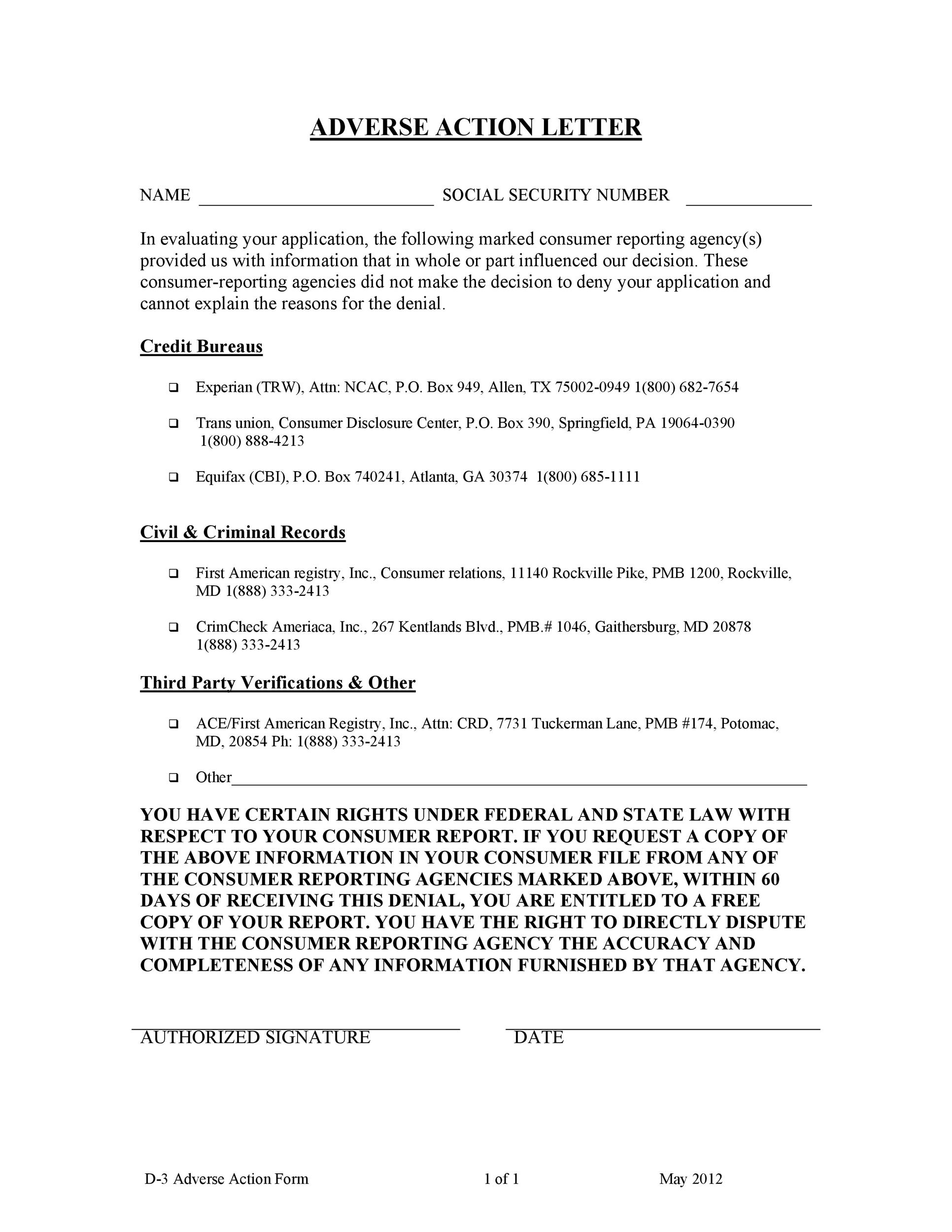

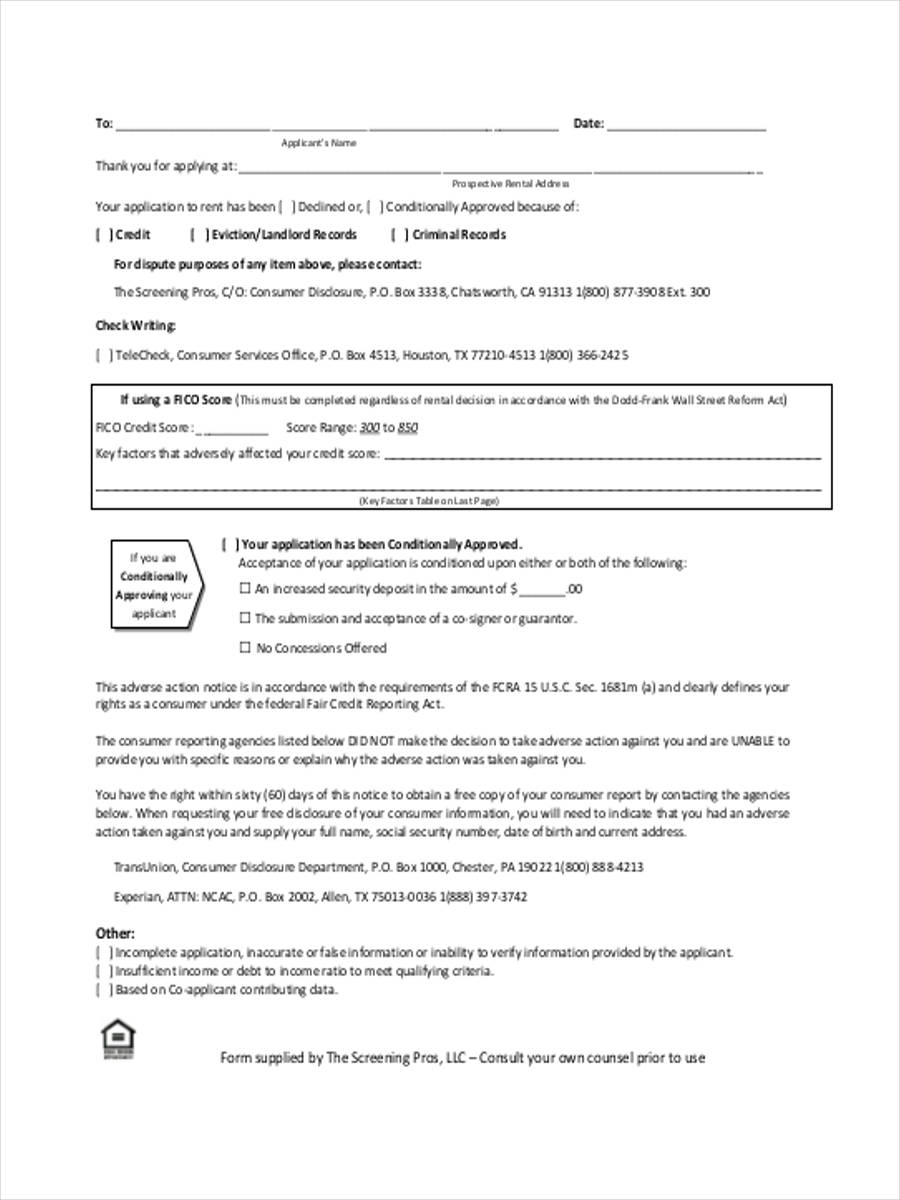

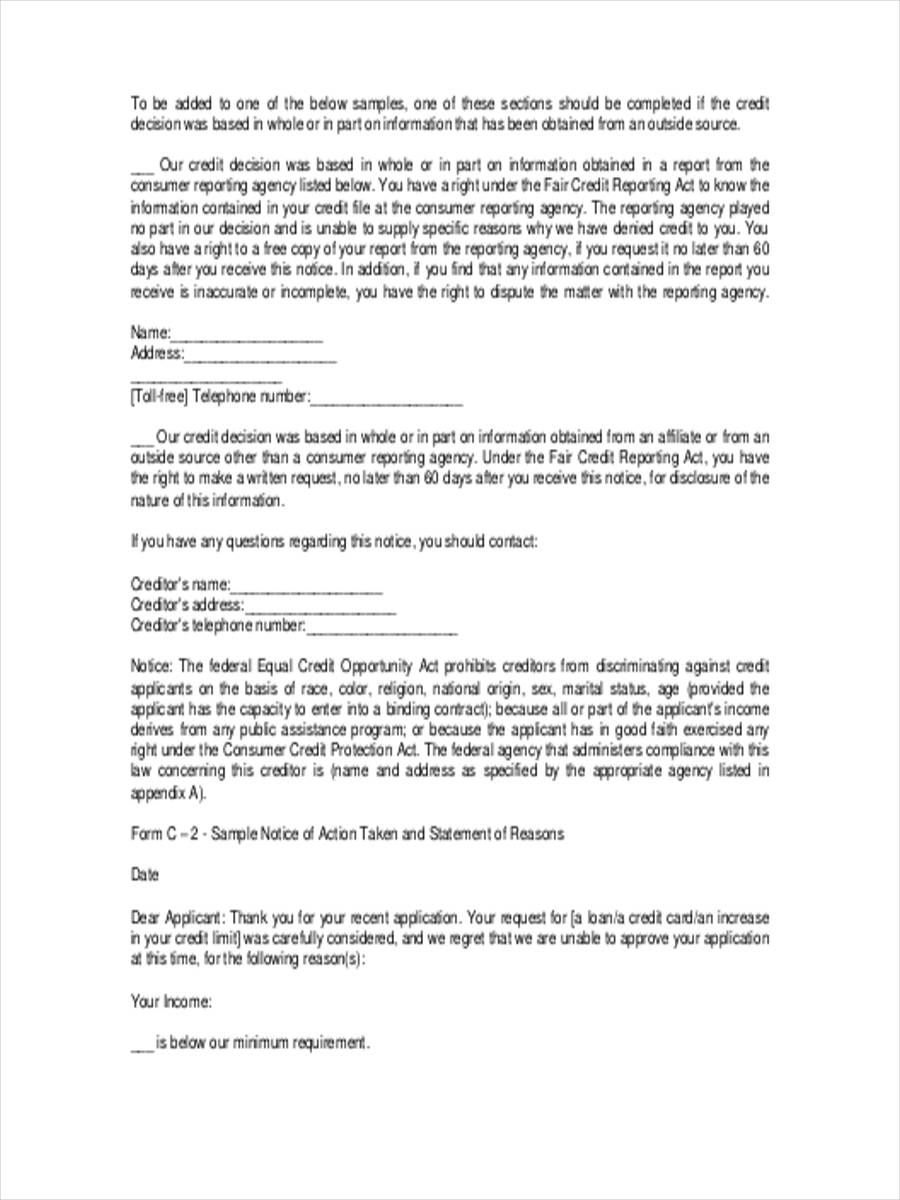

50 Free Adverse Action Notices / Adverse Action Letters ᐅ TemplateLab

Adverse Action Reasons Chart

Adverse Action Reasons Chart

FREE 6+ Adverse Action Forms in PDF Ms Word

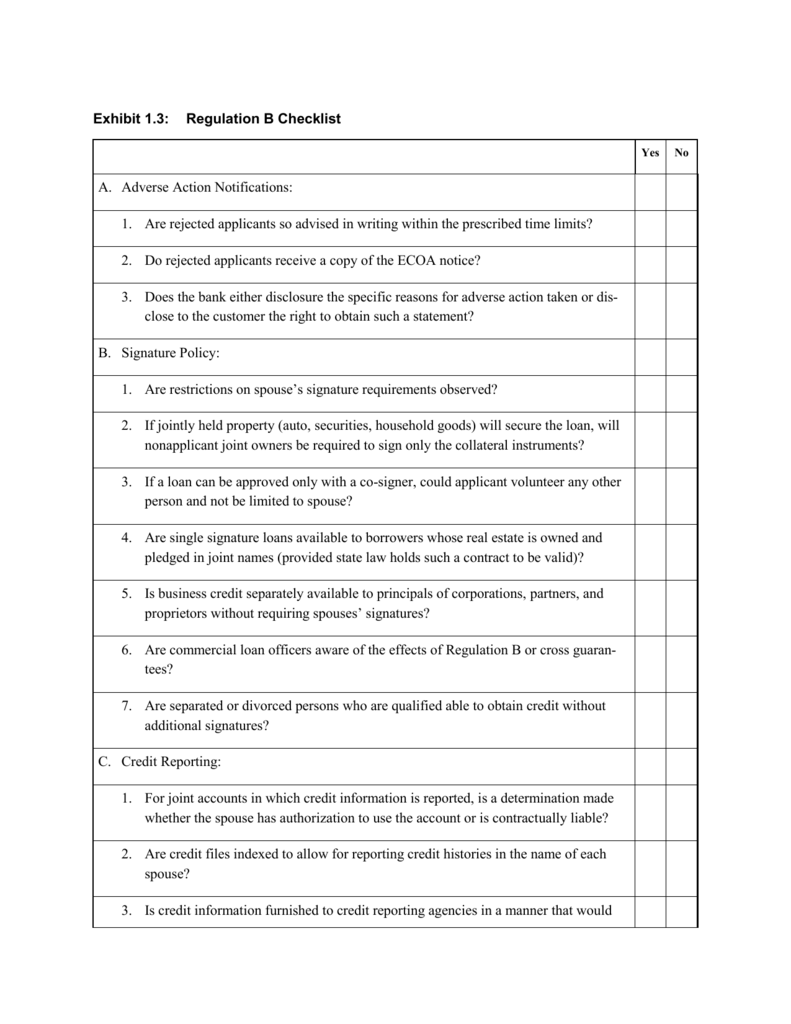

Exhibit 1.3 Regulation B Checklist Yes No A. Adverse Action

Adverse Action Reasons Chart — Compliance Cohort

Your Adverse Action Process Checklist

Web To Promote Transparency And Fairness In The Credit Underwriting Process, Ecoa Requires Creditors Taking Adverse Action Against Consumers To Provide Consumers With A Written Statement That Indicates The Specific, Principal Reason (S) For.

Witnessing Violence In The Home Or Community.

This Articles Provides A Sample Adverse Action Chart That Could Be Used By Financial Institutions.

Any Action Taken Or Determination That Is Adverse To The Interests Of The Consumer (For Example, Unwinding A Spot Delivery)

Related Post: