Ben And Arthur Chart

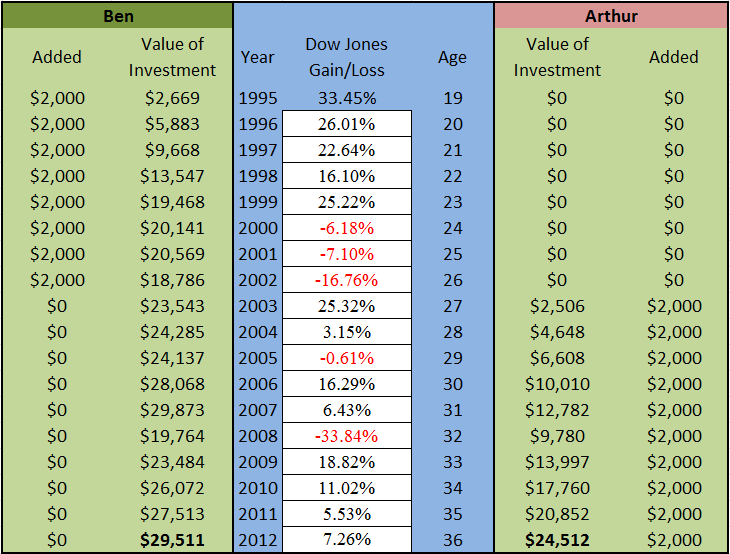

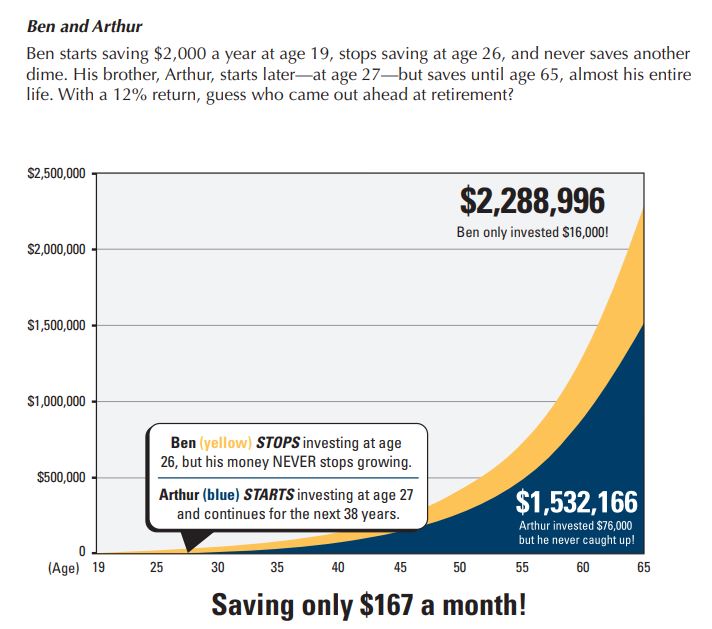

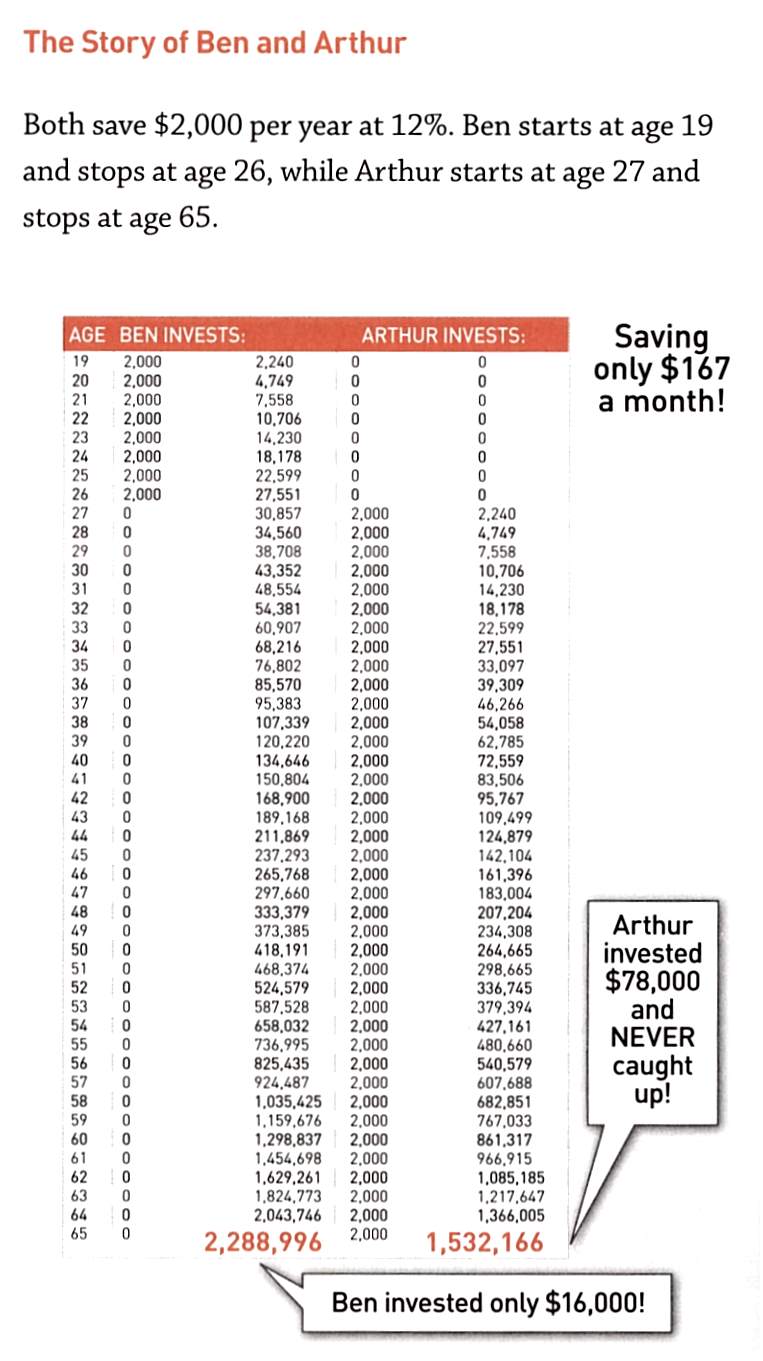

Ben And Arthur Chart - Rated the #884 best film of 2002. His brother, arthur, starts later—at age 27—but saves until age 65, almost his entire life. Sam mraovich, jamie brett gabel. Web you’ve seen the ben and arthur chart, and you are probably eager to start investing as soon as possible. When you’re ready to begin investing, write your investment savings into your budget in the saving category. Ben starts saving $2,000 a year at age 19, stops saving at age 26, and never saves another dime. The reality is none of us are either ben or arthur. Web ben & arthur. Web using the example of ben and arthur, dave shows the incredible power of compound interest over time. A pair of recently married gay men are threatened by the brother of one of the partners, a religious fanatic who plots to murder them after being ostracized by his church. In this web page, you will find a ben and arthur chart, a. Web ben and arthur | dave ramsey | compound interest | #shorts dave ramsey explains wealth building and compound interest. Here’s the story (with my spin on it): A visual reference of charts. Arthur saved $2,000 per year for 39 years, for a total of $78,000, beginning. Web ben and arthur | dave ramsey | compound interest | #shorts dave ramsey explains wealth building and compound interest. Web ben & arthur. The film concerns a recently married gay couple who face opposition from one partner's brother, who plots to murder them after being ostracized by his church. Heck, even i understood it! Dave calls compound interest, “. Web in the blog post how teens can become millionaires, ramsey explores the effects of time and compound interest by showing us how ben, by investing less money earlier in life, will outperform arthur, who invests more money later on in life. Web do a search for ben and arthur. Dave calls compound interest, “ a millionaire’s best friend. Most. Ben starts saving $2,000 a year at age 19, stops saving at age 26, and never saves another dime. He uses an example of two brothers, be. That’s $167 per month for a total of $16,000. A pair of recently married gay men are threatened by the brother of one of the partners, a religious fanatic who plots to murder. In the video above, he tells a story about ben and arthur that helps to dumb down the explanation of compound interest that makes it easy for kids to comprehend. The film concerns a recently married gay couple who face opposition from one partner's brother, who plots to murder them after being ostracized by his church. Web you’ve seen the. Find out how to apply the principles of early and consistent investing, and the criticisms of this approach. Both of them had the same 12% apr interest rate. A pair of recently married gay men are threatened by the brother of one of the partners, a religious fanatic who plots to murder them after being ostracized by his church. Web. He uses an example of two brothers, ben and. Web the ben and arthur chart is an illustration by personal finance guru, dave ramsey. When you’re ready to begin investing, write your investment savings into your budget in the saving category. Web in the blog post how teens can become millionaires, ramsey explores the effects of time and compound interest. Web let's make a difference! Web ben & arthur. It shows how interest rates, not early investing, matter more for retirement outcomes. Web take a look at what happened to ben and arthur. Web ben and arthur chart: Web let's make a difference! Web using the example of ben and arthur, dave shows the incredible power of compound interest over time. (no ties, suits or children) rsvp. Ben and arthur chart is a topic that can benefit from charts. He uses an example of two brothers, ben and arthur, and how each of them end up at age. When that time comes, you’ll write your investment savings into your budget just like all of your other savings goals. When you’re ready to begin investing, write your investment savings into your budget in the saving category. Here’s the story behind the. Interest is the money the prinpical (original amount invested) earns. Web take a look at what happened to. (no ties, suits or children) rsvp. It purportedly shows how important it is to invest early. Ben starts saving $2,000 a year at age 19, stops saving at age 26, and never saves another dime. Web ben & arthur. Web take a look at what happened to ben and arthur. He uses an example of two brothers, be. Here’s the story behind the. 327k views 10 years ago. Sam mraovich, jamie brett gabel. Arthur saved $2,000 per year for 39 years, for a total of $78,000, beginning at age 27. Dave ramsey explains wealth building and compound interest. Dave calls compound interest, “ a millionaire’s best friend. Web explain how compound interest works using the ben and arthur chart as an example. A pair of recently married gay men are threatened by the brother of one of the partners, a religious fanatic who plots to murder them after being ostracized by his church. Web ben and arthur | dave ramsey | compound interest | #shorts dave ramsey explains wealth building and compound interest. When you’re ready to begin investing, write your investment savings into your budget in the saving category.

Why Should I Start Investing Sooner Than Later? — Bridge Financial

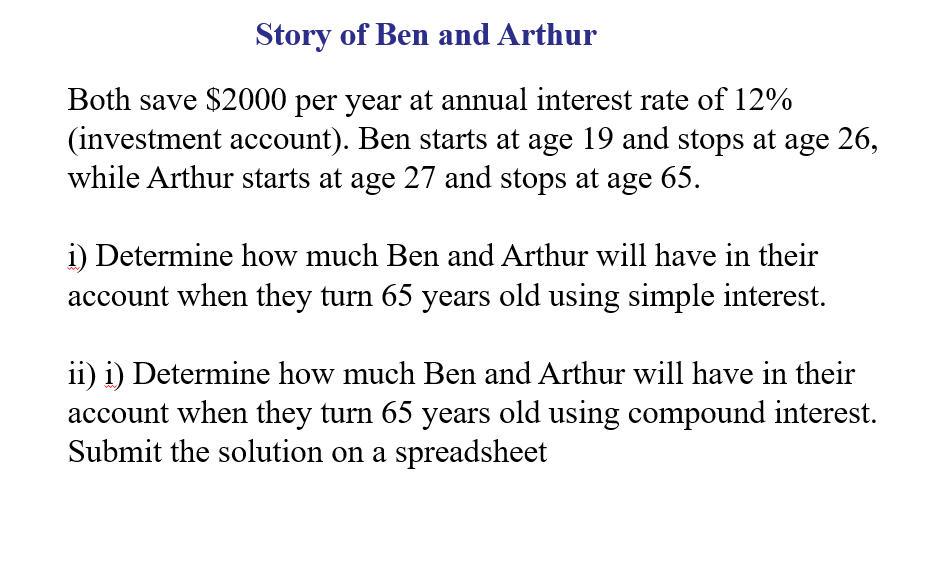

Solved Story of Ben and Arthur Both save 2000 per year at

Ben and Arthur Military PDF PDF

Pin by Kay Lee on Advice even gma would approve of Pinterest

Ben And Arthur Chart

Compound Interest the most misunderstood financial concept Exposing

15 LIFE LESSONS TO SHARE WITH MY 20 YEAR OLD SELF The Debt Free Journey

Debunking Ben & Arthur How to win at investing even if you start later

The Myth of Ben and Arthur

How to Teach Your Kids to Invest

Heck, Even I Understood It!

Web Let's Make A Difference!

Find Out How To Apply The Principles Of Early And Consistent Investing, And The Criticisms Of This Approach.

Rated The #884 Best Film Of 2002.

Related Post: