Chart Patterns For Scalping

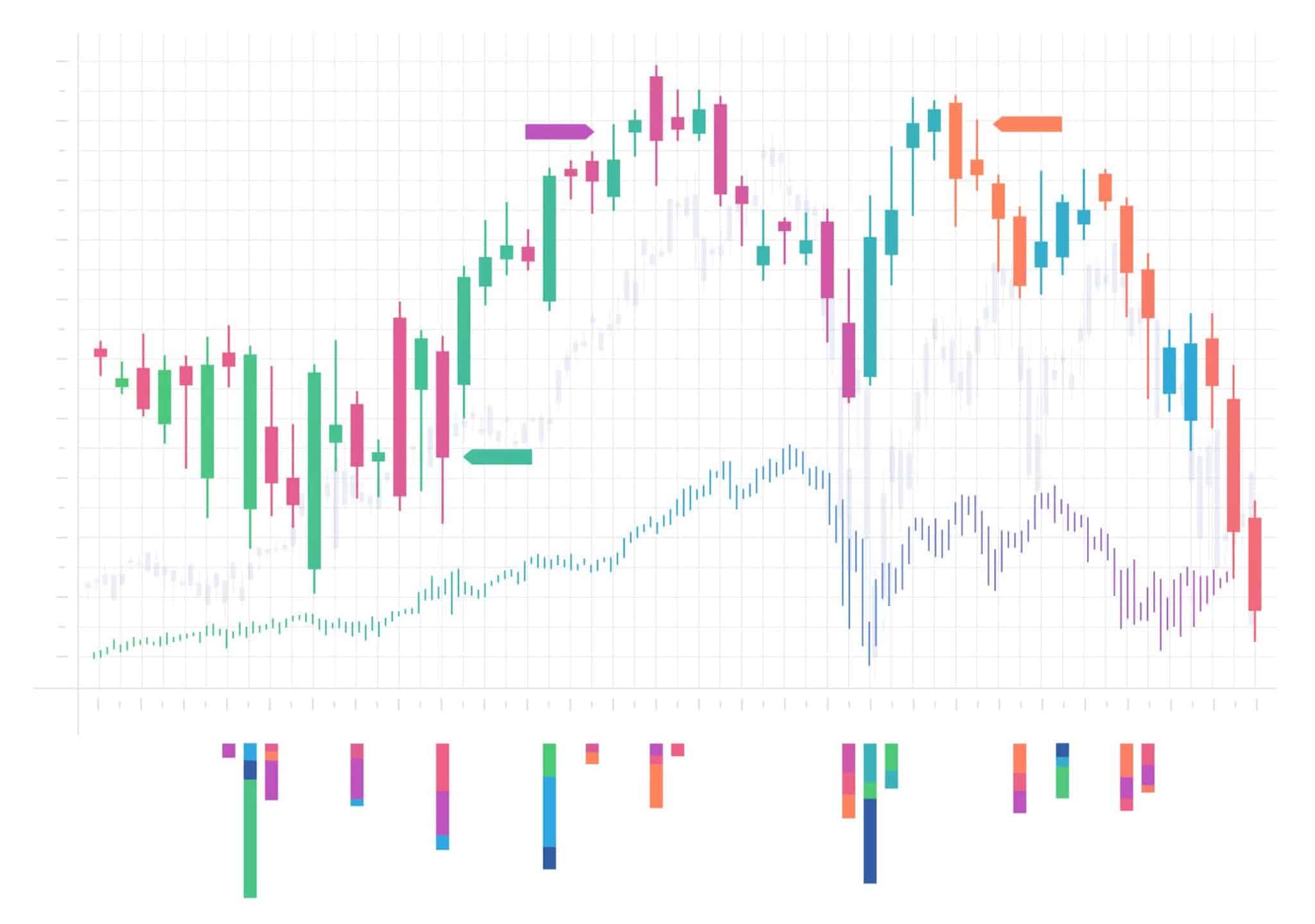

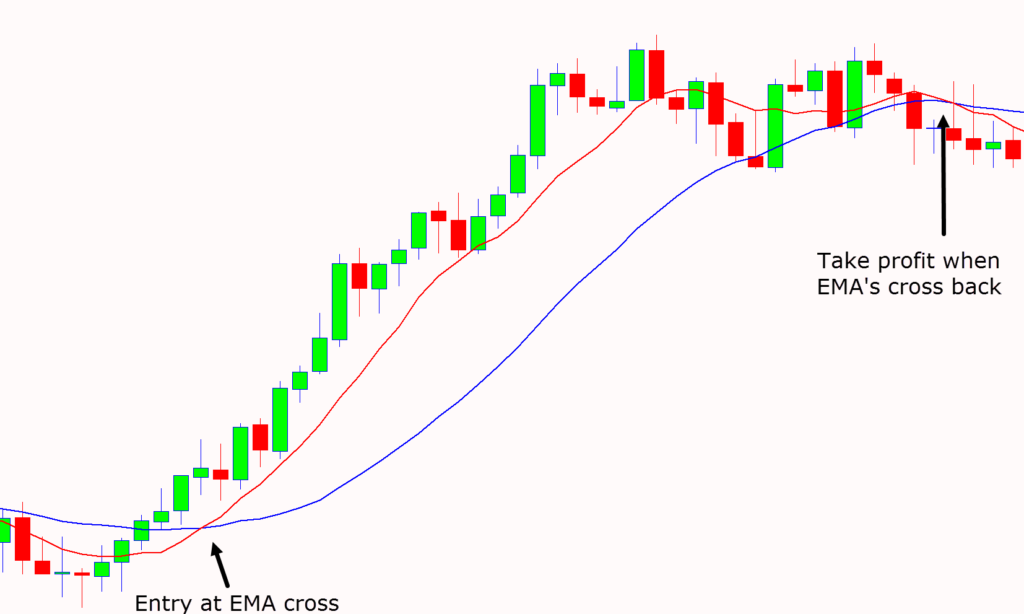

Chart Patterns For Scalping - The strategy differs from others where traders hold trades for hours, days, or even weeks. For starters, there are two main types of charts in day trading: Web here are some key chart patterns frequently used in scalping strategies: The method involves profiting from the volume of trades placed instead of attempting to gain the most on each individual trade. This strategy is particularly popular in highly liquid markets, such as forex and stocks. In this blog post, we will look at some of the best indicators for scalping trading strategies, discussing their value and how to apply them successfully. Web our forex experts take a look at various patterns for scalping forex including chart patterns, candlestick patterns, and breakout patterns. Chart patterns come in all shapes and sizes. They focus on capturing small price fluctuations and capitalizing on market volatility to generate profits. Web chart patterns are powerful tools designed to analyse price movements in trading. Web our forex experts take a look at various patterns for scalping forex including chart patterns, candlestick patterns, and breakout patterns. It indicates a potential trend reversal, with the neckline acting as a crucial support or resistance level. The macd, ema, schaff trend cycle, rsi, parabolic sar, vwap, and bollinger bands are some of. Web 5 chart patterns that are. It indicates a potential trend reversal, with the price likely to move downward after the formation of the right shoulder. This pattern consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). Web chart patterns are powerful tools designed to analyse price movements in trading. It requires a keen eye for spotting. This strategy is particularly popular in highly liquid markets, such as forex and stocks. These are marked with an arrow. Web using chart patterns in scalping is a relatively simple process. It indicates a potential trend reversal, with the price likely to move downward after the formation of the right shoulder. This pattern consists of three peaks, with the middle. This pattern consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). It requires a keen eye for spotting opportunities and executing trades swiftly. Web these indicators enable scalpers to make quick decisions based on probable price patterns. Web scalping is a popular trading strategy that involves buying or shorting assets and. It requires a keen eye for spotting opportunities and executing trades swiftly. Web scalping, in the realm of trading, refers to a strategy where traders aim to profit from small price movements by entering and exiting trades within short timeframes. Web our forex experts take a look at various patterns for scalping forex including chart patterns, candlestick patterns, and breakout. The macd, ema, schaff trend cycle, rsi, parabolic sar, vwap, and bollinger bands are some of. For starters, there are two main types of charts in day trading: It requires a keen eye for spotting opportunities and executing trades swiftly. Web scalping, in the realm of trading, refers to a strategy where traders aim to profit from small price movements. Image by sabrina jiang © investopedia 2020. It requires a keen eye for spotting opportunities and executing trades swiftly. Web our forex experts take a look at various patterns for scalping forex including chart patterns, candlestick patterns, and breakout patterns. The method involves profiting from the volume of trades placed instead of attempting to gain the most on each individual. The basics of forex market Moving average ribbon entry strategy. Web here are some key chart patterns frequently used in scalping strategies: Web scalping is a trading style in which the trader elects to take small profits quickly as they become available within the marketplace. Web here are some of the most common chart patterns used in scalping: Web scalping, in the realm of trading, refers to a strategy where traders aim to profit from small price movements by entering and exiting trades within short timeframes. The method involves profiting from the volume of trades placed instead of attempting to gain the most on each individual trade. In this comprehensive guide, we will delve deep into the world. Web 5 chart patterns that are great for scalping. This article highlights the 5 best candlestick and chart patterns for scalping. It involves identifying chart patterns and then placing trades accordingly. The basics of forex market The strategy differs from others where traders hold trades for hours, days, or even weeks. This article highlights the 5 best candlestick and chart patterns for scalping. This pattern consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). It indicates a potential trend reversal, with the price likely to move downward after the formation of the right shoulder. In this article, we will explain how scalping works, some of the best strategies to use, and its pros and cons. Web scalping is a trading style in which the trader elects to take small profits quickly as they become available within the marketplace. It involves identifying chart patterns and then placing trades accordingly. Web chart patterns are powerful tools designed to analyse price movements in trading. Yes, it’s a famous book, but the truth is that scalping is indeed a fun and exciting way to trade financial assets. Traders who utilize this strategy are referred to as scalpers. Chart patterns come in all shapes and sizes. Web our forex experts take a look at various patterns for scalping forex including chart patterns, candlestick patterns, and breakout patterns. Web scalping, in the realm of trading, refers to a strategy where traders aim to profit from small price movements by entering and exiting trades within short timeframes. They focus on capturing small price fluctuations and capitalizing on market volatility to generate profits. This pattern consists of three peaks, with the middle peak being the highest (the head) and the other two peaks (the shoulders) being lower. For starters, there are two main types of charts in day trading: The method involves profiting from the volume of trades placed instead of attempting to gain the most on each individual trade.

Forex Cheat Sheet Pattern Fast Scalping Forex Hedge Fund

Chart Patterns Cheat Sheet r/FuturesTrading

Forex Patterns Scalping Forex Master Method Evolution Free Download

Scalping Forex with Chart Patterns Forex Scalping Guide

Which Chart Patterns Are Good for Scalping? Our Top 5 DTTW™

1 Min Easy Forex Scalping Strategy

Scalping Trading Strategies With PDF Free Download

Various Chart Patterns

Scalping Chart Patterns The Forex Geek

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

Forex Charts Fast Scalping Forex Hedge Fund

Web Scalping Trading Strategies And Techniques Revolve Around Using Technical Indicators, And Chart Pattern Recognition In Order To Identify Opportunities.

The Basics Of Forex Market

If You Are Trading An Uptrend, You Should Look For Bullish Chart Patterns;

Is The 1 Minute Time Frame Good For Scalping?

Related Post: