Chart Patterns Hammer

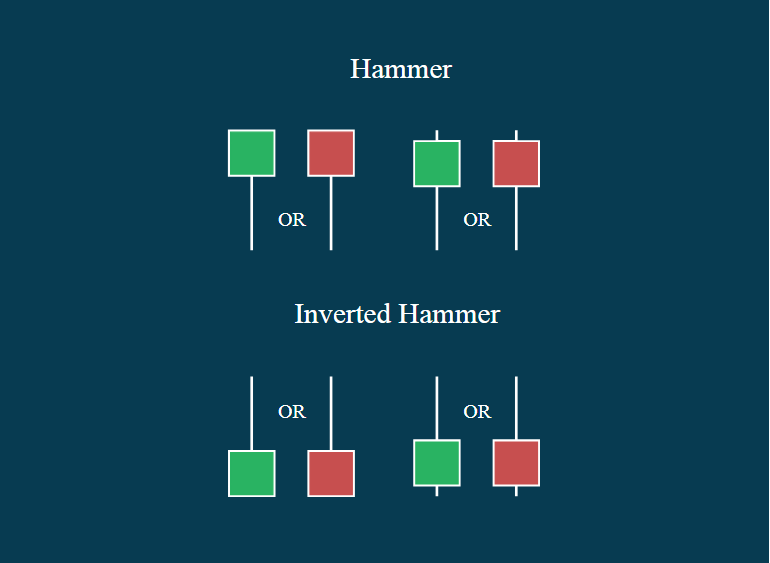

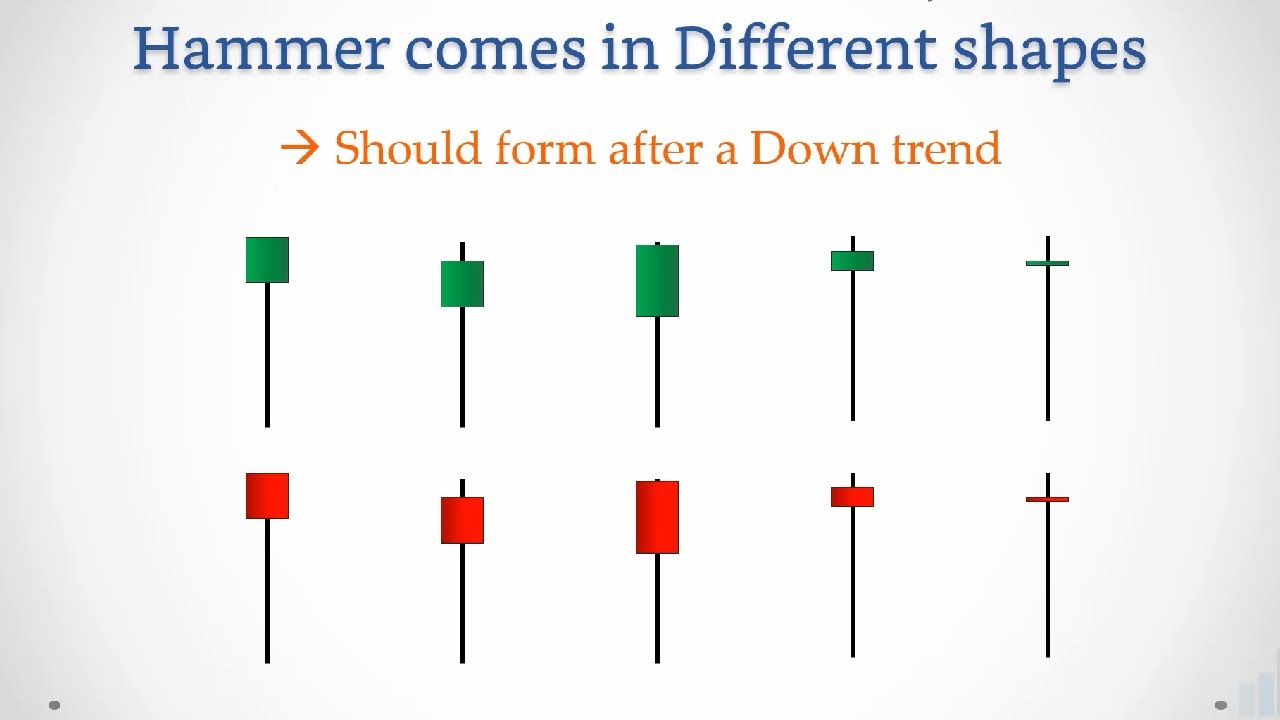

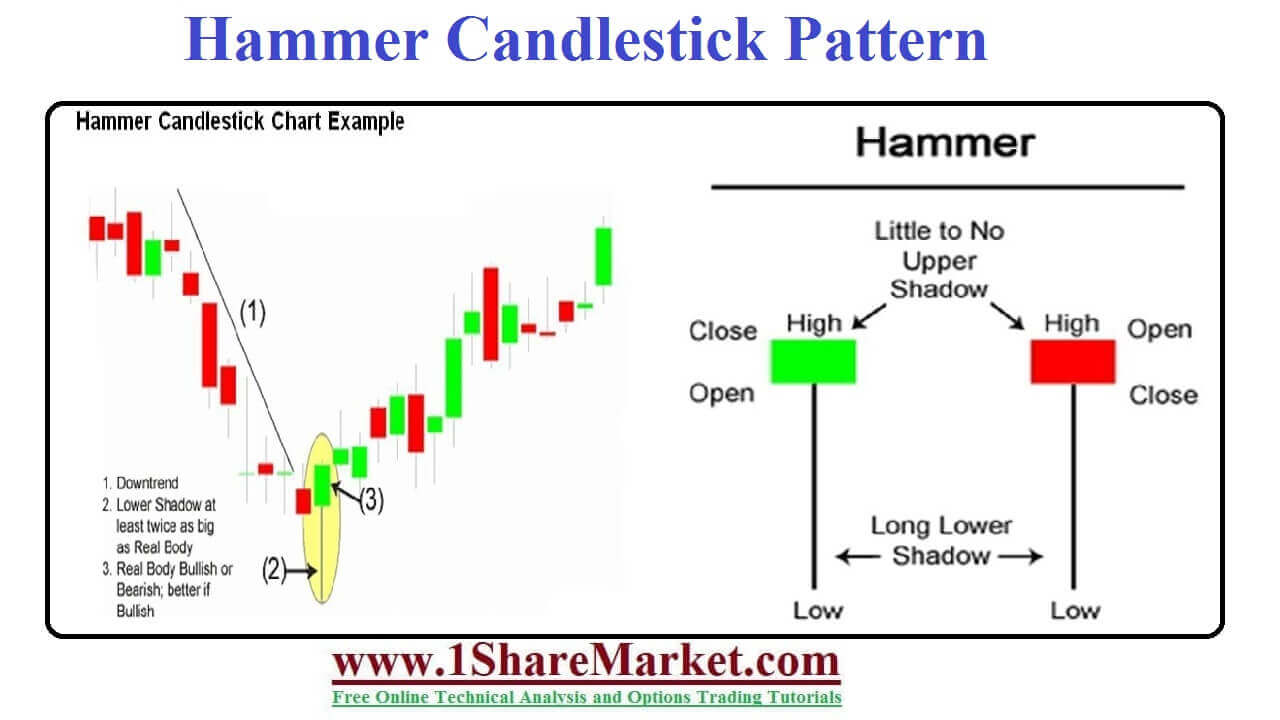

Chart Patterns Hammer - Traders use this pattern as an early indication that the previous is about to reverse and to identify a reliable price level to open a buy trade. Web tellurian (tell) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. Aufbau der hammer candlestick formation. Web a hammer candlestick has a very unique and identifiable shape on a chart. Web bei der hammer formation handelt es sich um ein candlestick patterns der chartanalyse. A candle signals the start of a new bullish rally for a particular instrument. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. Like any other candlestick pattern, it can be particularly useful in tracking price action for the purpose of setting up trades. Lower shadow more than twice the length of the body. Zu beginn dieses artikels klären wir den begriff candlestick. Wir schauen uns an, wie eine kerze aufgebaut ist und wie candlesticks im chart interpretiert werden sollten. Web one of the classic candlestick charting patterns, a hammer is a reversal pattern consisting of a single candle with the appearance of a hammer. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable. Web the hammer is candlestick with a small body and a long lower wick. The real body is small and located at the upper end of the trading range. Like any other candlestick pattern, it can be particularly useful in tracking price action for the purpose of setting up trades. For investors, it’s a glimpse into market dynamics, suggesting that. Zu beginn dieses artikels klären wir den begriff candlestick. Lower shadow more than twice the length of the body. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes.. Learn what it is, how to identify it, and how to use it for intraday trading. Web in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss how to trade on a hammer. Web in his book japanese candlestick. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Web gerade die sogenannten candlestick patterns (kerzenmuster) sind ein zentraler bestandteil der charttechnik und gehören zur technischen analyse von vermögenswerten. In a downtrend, it indicates a buying pressure, followed. The opening price, close, and. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Identifying hammer candlestick patterns can help traders determine potential price reversal areas. Web the hammer candlestick pattern refers to the shape of a candlestick that resembles that of a hammer. We will focus on five bullish candlestick patterns that give the strongest reversal. Aufbau der hammer candlestick formation. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. Web in this guide to understanding the hammer candlestick formation, we’ll show you what. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. Traders use this. Web a hammer candlestick has a very unique and identifiable shape on a chart. Web the aspects of a candlestick pattern. Our guide includes expert trading tips and examples. Die formation weist in der regel auf eine trendumkehr nach oben hin. Identifying hammer candlestick patterns can help traders determine potential price reversal areas. Web there are a great many candlestick patterns that indicate an opportunity to buy. Considered a bearish pattern during an uptrend. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Small candle body with longer lower shadow, resembling a hammer, with. Considered a bearish pattern during an uptrend. Web bei der hammer formation handelt es sich um ein candlestick patterns der chartanalyse. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. Web one of the classic candlestick charting patterns, a hammer is a reversal pattern consisting of a single candle with the appearance of a hammer. Web the hammer is a classic and easily identifiable candlestick chart pattern that often foreshadows a bullish reversal. Zu beginn dieses artikels klären wir den begriff candlestick. Web the hammer candlestick pattern refers to the shape of a candlestick that resembles that of a hammer. Identifying hammer candlestick patterns can help traders determine potential price reversal areas. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. While the stock has lost 5.8% over the past two weeks, it could witness a trend reversal as a hammer chart pattern was formed in its last trading session. Here are the key characteristics: The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web wir zeigen dir, wie du vertrauenswürdige candlestick hammer formationen im chart ausmachst und die entstehende bodenbildung traden kannst. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Lower shadow more than twice the length of the body. Web the hammer is candlestick with a small body and a long lower wick.

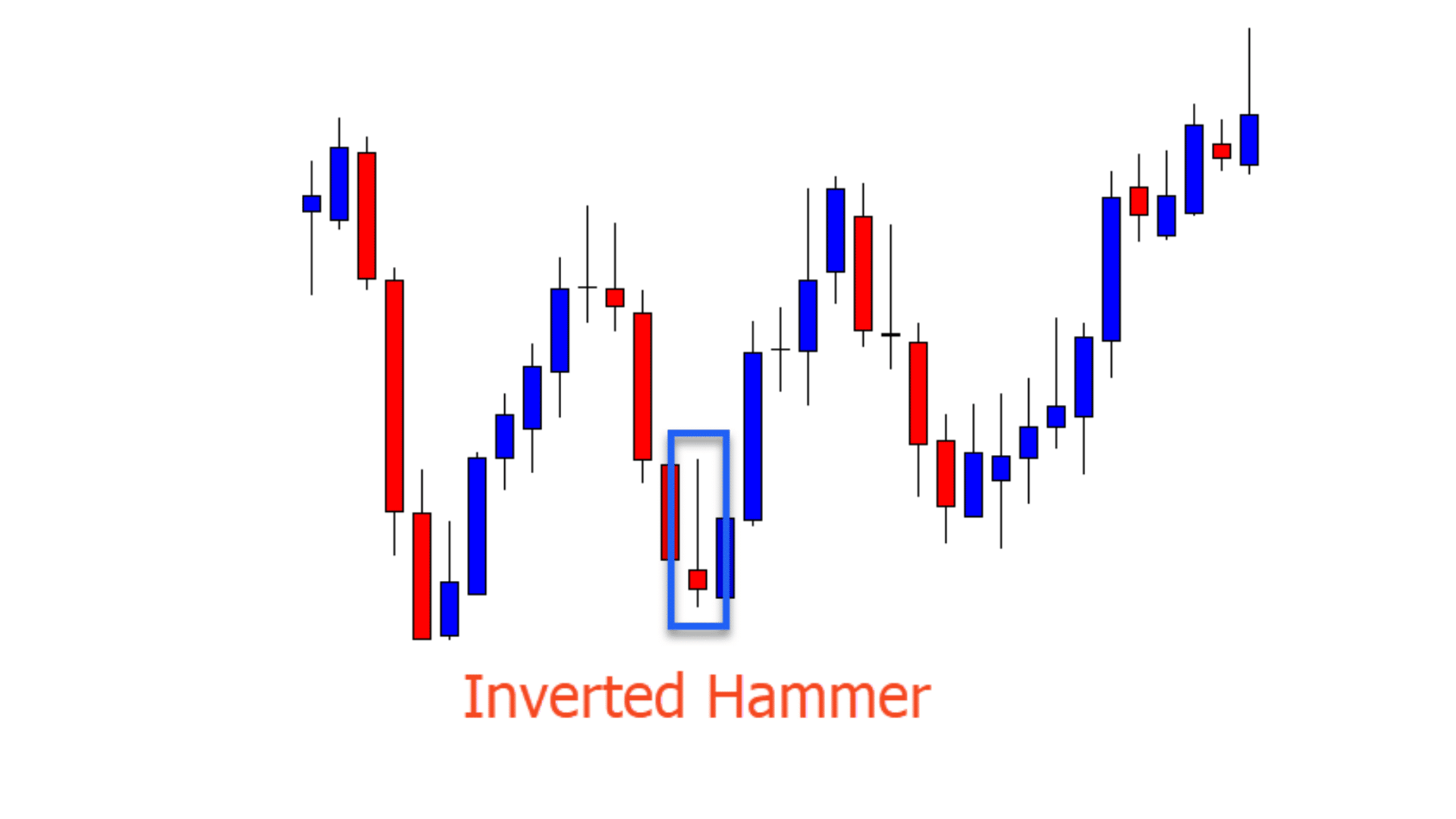

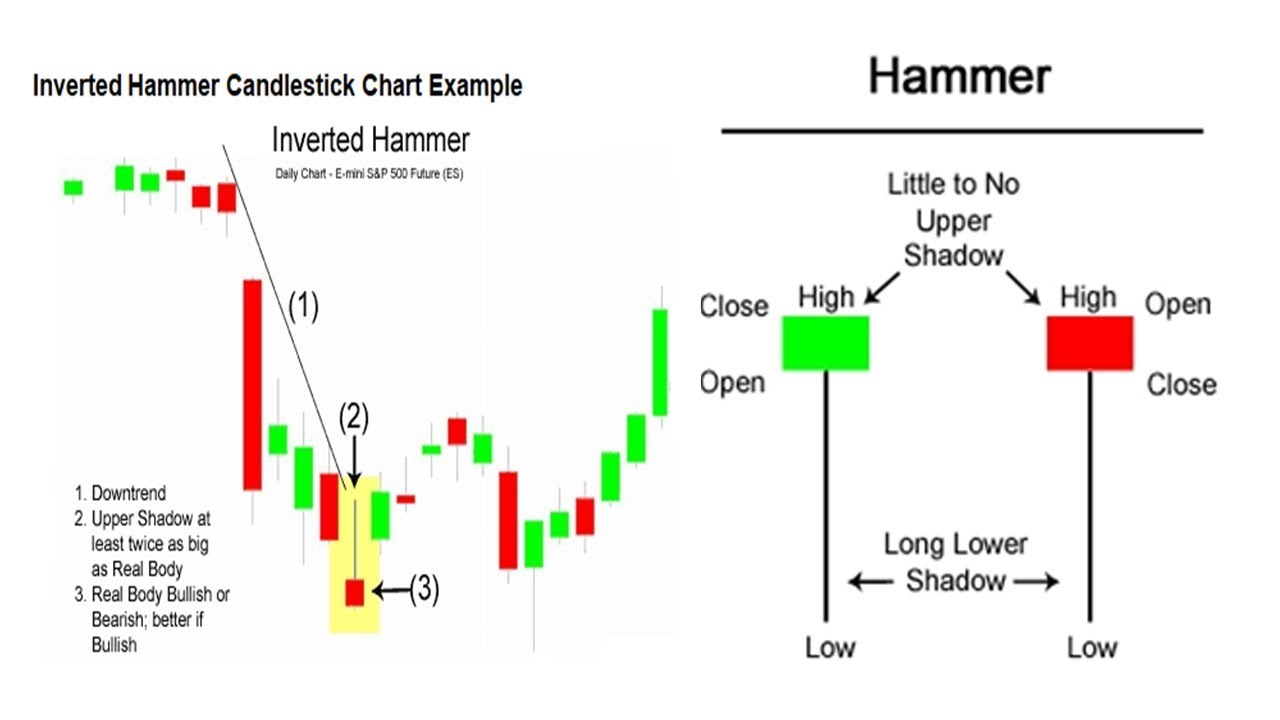

Inverted Hammer Candlestick Pattern Quick Trading Guide

Hammer Chart Pattern

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Hammer Candlestick Pattern Trading Guide

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer candlestick pattern Defination with Advantages and limitation

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Web A Hammer Candlestick Has A Very Unique And Identifiable Shape On A Chart.

Considered A Bearish Pattern In An Uptrend.

Web In This Guide To Understanding The Hammer Candlestick Formation, We’ll Show You What This Chart Looks Like, Explain Its Components, Teach You How To Interpret It With An Example, And Discuss How To Trade On A Hammer.

We Will Focus On Five Bullish Candlestick Patterns That Give The Strongest Reversal Signal.

Related Post: