Clo Rating Chart

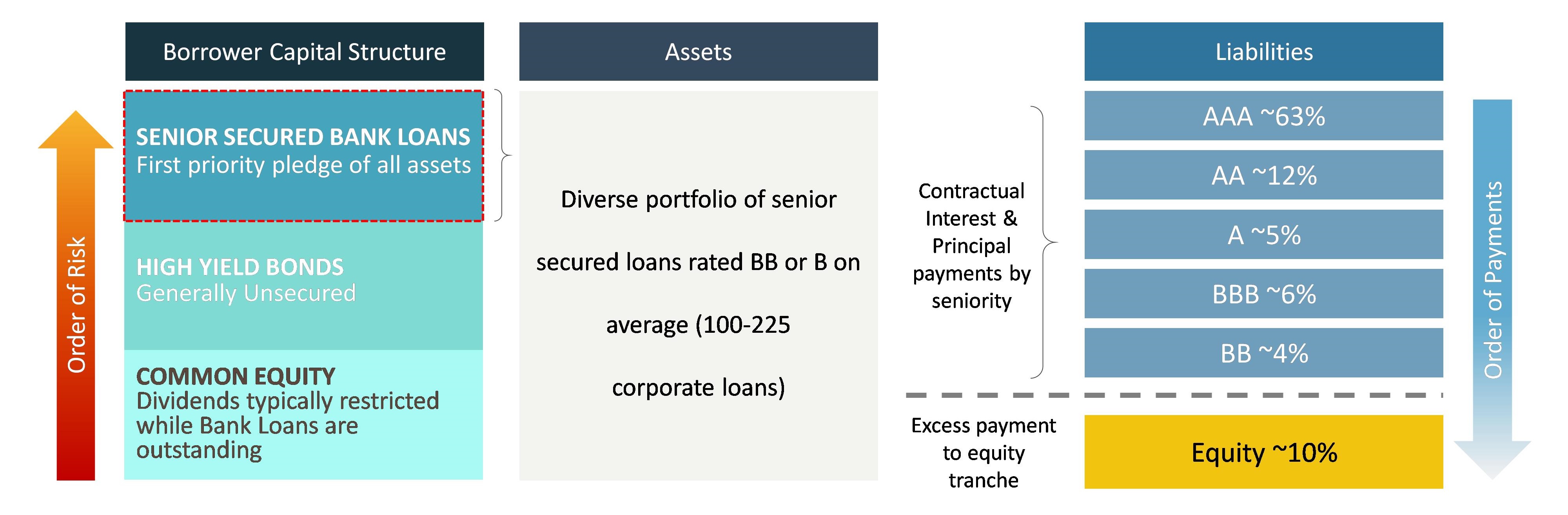

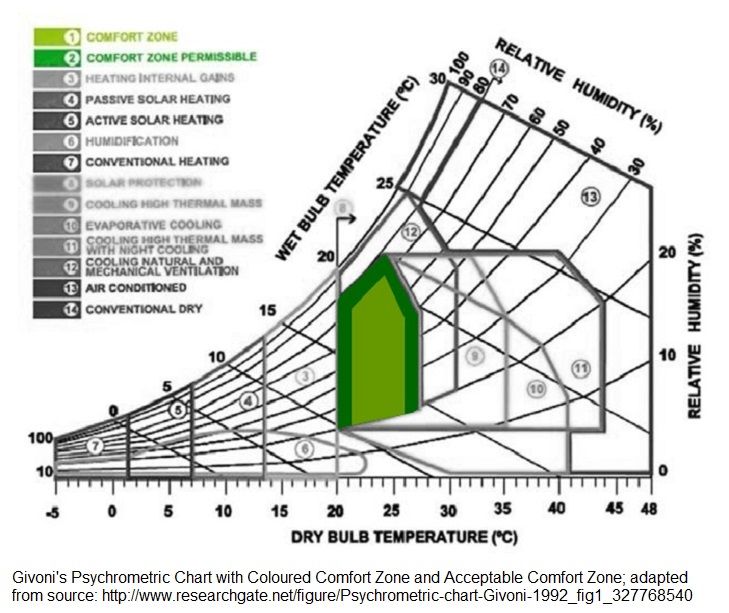

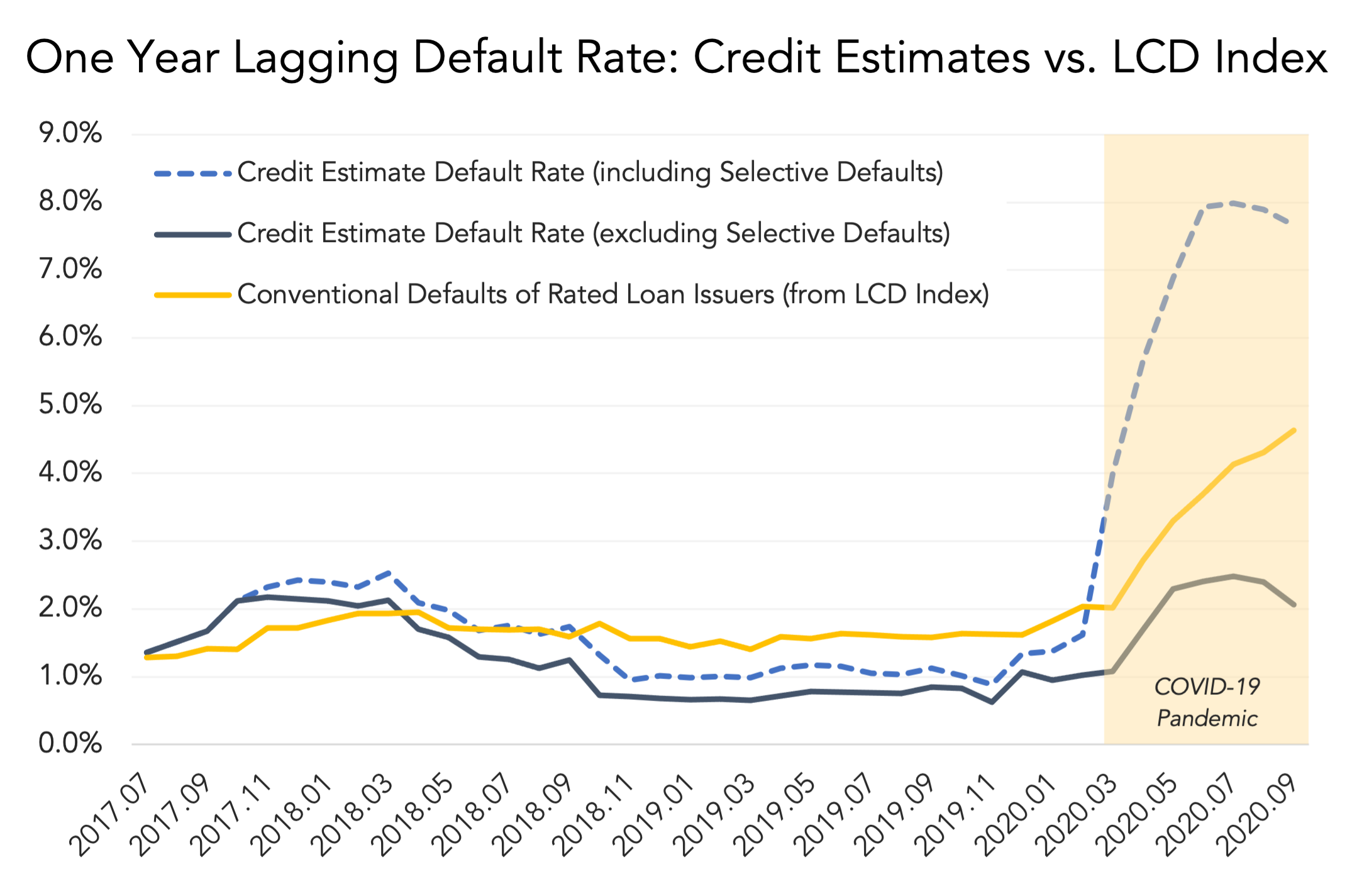

Clo Rating Chart - Metaphorically, like fp * fw value in down jackets…and the higher the value is, the warmer the insulation is. Web s&p global ratings emea collateral managers dashboard provides you with a snapshot view of your clo critical credit risk factors all in one place. Rating clos and cdos of large corporate credit. This can relate each default scenario to the asset and liability side cashflow. Clos and corporate cdos rating criteria. Clo value is an important factor in determining a synthetic jacket’s warmth. Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). The companies that issue the loans in mm clos, like other highly leveraged companies, have felt the impact of rising interest rates and. This should be read together with the counterparty risk methodology. I cl, clo m 2 k/w; Web from 2010 through 2023, s&p global ratings rated 14,204 classes from more than 1,750 u.s. Web clo value is the insulation power of an insulation setting. Overall, there were five clo manager exits versus seven new entrants, representing a net gain of two managers. The important thing here is that unlike fill power, clo is not a characteristic that. Web ejr ratings of clo tranches are based on the estimated losses (el) generated by applying historical default scenarios based on likelihood of occurrence. Pants 1/2 long legs made of wool: Only temperatures, relative humidities, and specific volumes which would allow people to continue wearing clothing are accepted as part of the comfort zone. Web fitch ratings reviews collateralized loan. This report highlights typical clo indenture terms, explains the impact of variances in these terms and notes fitch’s credit perspective on whether such items are positive, neutral or negative. Web s&p global ratings emea collateral managers dashboard provides you with a snapshot view of your clo critical credit risk factors all in one place. Web ejr ratings of clo tranches. Web what is a clo? This should be read together with the counterparty risk methodology. Web this methodology supplements our general structured finance rating methodology for the rating analysis of collateralised loan obligation (clo) transactions, and supersedes it in case of conflict, inconsistency or ambiguity. Fitch ratings has updated its global clo and corporate cdo rating criteria, replacing the existing. Web i a (clo) calm < 1 < 2 < 0.5 > 0.5; Web s&p global ratings emea collateral managers dashboard provides you with a snapshot view of your clo critical credit risk factors all in one place. Web what is a clo? Web our clo rating methodology captures shifting risk conditions in the loan market through its use of. Cash flow assumptions for corporate credit. Overall, there were five clo manager exits versus seven new entrants, representing a net gain of two managers. The estimated loss is then distributed to each tranche using ejr proprietary modeling. I cl, clo m 2 k/w; Web during 2020, s&p global ratings lowered just 1.3% of outstanding mm clo tranche ratings (seven out. I cl, clo m 2 k/w; Synthetic insulators provide more insulation per. This should be read together with the counterparty risk methodology. The estimated loss is then distributed to each tranche using ejr proprietary modeling. Web clo value is the insulation power of an insulation setting. The important thing here is that unlike fill power, clo is not a characteristic that is unique to one ounce of the material. The companies that issue the loans in mm clos, like other highly leveraged companies, have felt the impact of rising interest rates and. Clos and corporate cdos rating criteria. Web what is a clo? Web i a. The important thing here is that unlike fill power, clo is not a characteristic that is unique to one ounce of the material. Web s&p global ratings emea collateral managers dashboard provides you with a snapshot view of your clo critical credit risk factors all in one place. Web as announced on july 23, 2020, any new transactions in u.s.. The update relates primarily to the notching approach for issuer ratings on rating watch negative, which are notched by one sub category. Web fitch ratings reviews collateralized loan obligation (clo) documentation as part of its rating analysis. Clos and corporate cdos rating criteria. Rating clos and cdos of large corporate credit. This should be read together with the counterparty risk. 1 day −2.78% 1 week −0.68% 1 month −31.51% 6 months −73.94% year to date −74.02% 1 year −90.12% 5 years −93.93% all time −97.58% key stats. Clo value is an important factor in determining a synthetic jacket’s warmth. Cash flow assumptions for corporate credit. The companies that issue the loans in mm clos, like other highly leveraged companies, have felt the impact of rising interest rates and. This report highlights typical clo indenture terms, explains the impact of variances in these terms and notes fitch’s credit perspective on whether such items are positive, neutral or negative. Overall, there were five clo manager exits versus seven new entrants, representing a net gain of two managers. Clos and corporate cdos rating criteria. Web ejr ratings of clo tranches are based on the estimated losses (el) generated by applying historical default scenarios based on likelihood of occurrence. Clo asset classes will be rated and monitored by dbrs morningstar using the following dbrs morningstar methodologies (collectively, the dbrs morningstar clo methodologies): Our interactive tool provides clarity to examine, compare and benchmark individual emea s&p global ratings rated clos across a series of key performance indicators to help you. Web s&p global ratings emea collateral managers dashboard provides you with a snapshot view of your clo critical credit risk factors all in one place. Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). Web during 2020, s&p global ratings lowered just 1.3% of outstanding mm clo tranche ratings (seven out of 553 outstanding at the time), compared to about 13% (493 out of 3,786) for bsl clo ratings. The estimated loss is then distributed to each tranche using ejr proprietary modeling. Pants 1/2 long legs made of wool: This can relate each default scenario to the asset and liability side cashflow.

CLOs

The Clo and Thermal Comfort THE environmental ARCHINEER

An Introduction to Collateralized Loan Obligations (2022)

PPT Structured Finance Synthetic ABS PowerPoint Presentation, free

Global Association of Risk Professionals GARP

FAQ

![]()

Fitch Ratings WebBased CLO Tracker LSTA

(PDF) CLO Rating Methodology Scope Ratings DOKUMEN.TIPS

The Lead Left CLOs Revisited Ratings, Risks, and Returns (Last of a

CLO Rating Chart In Powerpoint And Google Slides Cpb

Rating Clos And Cdos Of Large Corporate Credit.

Only Temperatures, Relative Humidities, And Specific Volumes Which Would Allow People To Continue Wearing Clothing Are Accepted As Part Of The Comfort Zone.

Web Fitch Ratings Reviews Collateralized Loan Obligation (Clo) Documentation As Part Of Its Rating Analysis.

Web The Averages In The Chart Reflect A Mix Of Rating Transition Outcomes, Including Ratings That Do Not Experience Any Change, Ratings That Move A Single Notch And Ratings That Move More Than One Notch.

Related Post: