Closing Disclosure 3 Day Rule Chart

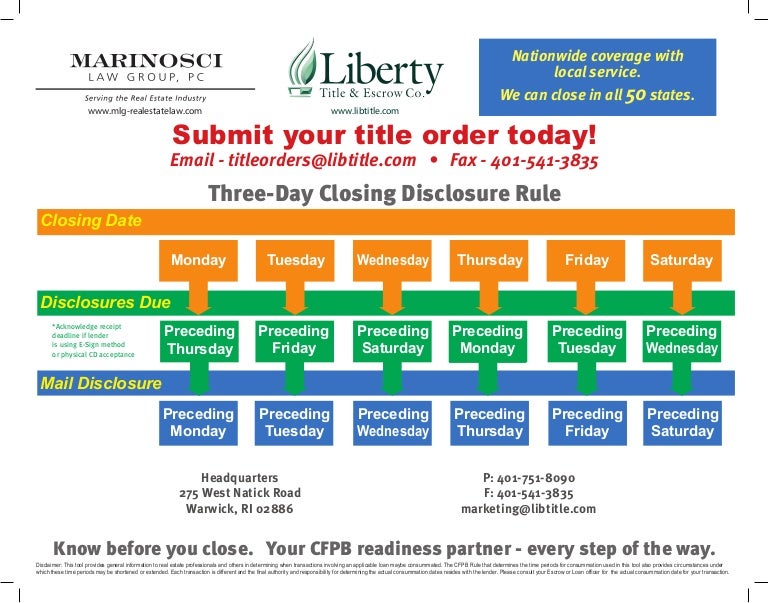

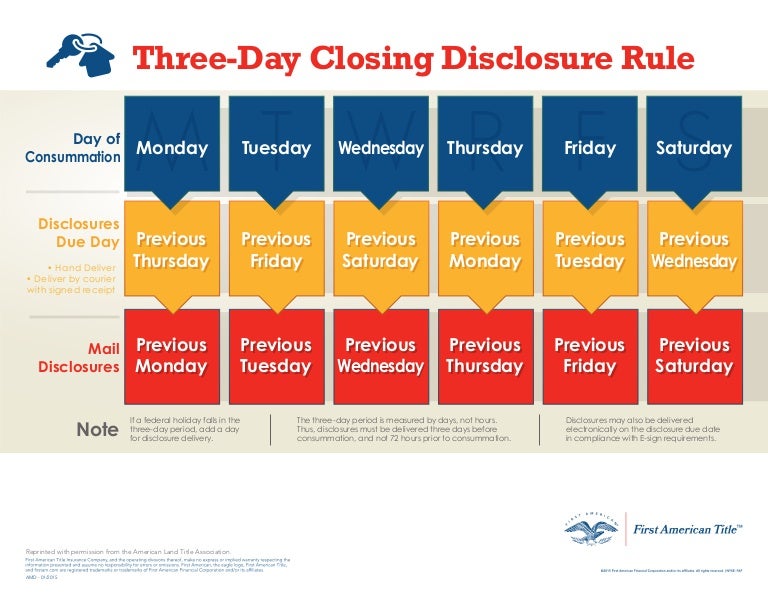

Closing Disclosure 3 Day Rule Chart - This document finalizes the loan terms and closing costs, allowing borrowers to review final details before concluding the mortgage process. Friday would be day #1; Web reference this chart to determine when you need to be sure that the closing disclosure is either electronically received by your borrower or delivered via us mail. Web the closing disclosure form is a pivotal document in real estate transactions, containing key components crucial for both buyers and sellers. In the last national election held on wednesday, may 8, 2019, the final results were announced three days later on. It must be provided to the borrower at least three business days before closing. Web the iec normally begins releasing partial results within hours of polls closing. Web the closing disclosure is presumed to have been received three (3) business days after it is dropped in the mail or sent via email, so the practical result is that most closing disclosures will need to be sent a. With receipt confirmed by consumer after approval to use email method of delivery (if not, assume 3 days to open mail) delivery defined the 3 day closing disclosure rule This enables the consumer to compare the closing disclosure to the loan estimate to ensure that all the charges meet expectations. Disclosures may also be delivered Web reference this chart to determine when you need to be sure that the closing disclosure is either electronically received by your borrower or delivered via us mail. Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Your lender is required by law to give you the standardized. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives it three days prior to consummation of the transaction. Informa on on this handout was obtained from american land title associa on, alta.org/cfpb. This enables the consumer to compare the closing disclosure to the loan estimate to ensure that. This will give you more time to understand your mortgage terms and costs, so that you know before you owe. Web the closing disclosure form is a pivotal document in real estate transactions, containing key components crucial for both buyers and sellers. Web use the chart below to help you determine when the closing disclosure should be sent to ensure. This document finalizes the loan terms and closing costs, allowing borrowers to review final details before concluding the mortgage process. This enables the consumer to compare the closing disclosure to the loan estimate to ensure that all the charges meet expectations. Web the closing disclosure is presumed to have been received three (3) business days after it is dropped in. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date in compliance with e. Web the closing disclosure form is a pivotal document in real estate transactions, containing key components crucial for both buyers and sellers. Contact oct today for more informaon. Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Contact oct today for more informaon on trid and f or all your tle needs7. Web south africa's ruling party, the african national congress (anc), is on course to lose its majority in parliament for the first time since it came to power 30. Informa on on this handout was obtained from american land title associa on, alta.org/cfpb. Generally, if changes occur between the time the closing disclosure form is given and the closing, the consumer must be provided a new form. Web receipt 3 days after placed in mail overnight delivery: Web use the chart below to help you determine when the closing. The precise definition of business day is used here. And monday would be day #3 (borrower can sign on day #3). The table below sets out the acknowledgment and earliest possible signing days. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives it three days prior to consummation. Contact oct today for more informaon on trid and f or all your tle needs7. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. This comprehensive breakdown includes a closing disclosure sample showcasing loan. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on. Web because the closing disclosure must be provided to the consumer no later than three business days before consummation (see section 10.2 below), this means the consumer must receive a revised loan estimate no later than four business days prior to consummation. Web however, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business. Web the closing disclosure is presumed to have been received three (3) business days after it is dropped in the mail or sent via email, so the practical result is that most closing disclosures will need to be sent a. It must be provided to the borrower at least three business days before closing. Generally, if changes occur between the time the closing disclosure form is given and the closing, the consumer must be provided a new form. This document finalizes the loan terms and closing costs, allowing borrowers to review final details before concluding the mortgage process. This enables the consumer to compare the closing disclosure to the loan estimate to ensure that all the charges meet expectations. The customer must receive a final closing disclosure at least 3 business days prior to consummation. Disclosures may also be delivered Your lender is required by law to give you the standardized closing disclosure at least 3 business days before closing. Informa on on this handout was obtained from american land title associa on, alta.org/cfpb. Web however, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days before consummation of the transaction if: Web the iec normally begins releasing partial results within hours of polls closing. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives it three days prior to consummation of the transaction. Or (3) if a prepayment. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date in compliance with e. Web the closing disclosure form is a pivotal document in real estate transactions, containing key components crucial for both buyers and sellers. To ensure you have enough time to review all of the numbers before signing your final paperwork, lenders are required by law to provide you with a closing disclosure.

Resources Integrity Land Title

NEW LOAN ESTIMATE AND CLOSING DISCLOSURE FORMS Village Settlements, Inc.

Three day closing disclosure rule TRID October 2015 from Liberty Titl…

3 day closing disclosure rule.

Sellers Apex Title & Closing Services, LLC.

ThreeDay Closing Disclosure Rule Infographic

3day closing disclosure rule chart Calendar, How to make notes

The Fund The 3Day Closing Disclosure Rule

Closing Disclosure 3 Day Rule Calendar Graphics Calendar examples

The 3 Day Closing Disclosure Rule Twin City Title

Web If The Closing Disclosure Is Acknowledged On A Thursday, For Example, The Borrower Can Sign Loan Docs On The Following Monday;

The Table Below Sets Out The Acknowledgment And Earliest Possible Signing Days.

The Precise Definition Of Business Day Is Used Here.

And Monday Would Be Day #3 (Borrower Can Sign On Day #3).

Related Post: