Construction Loan Draw Procedures

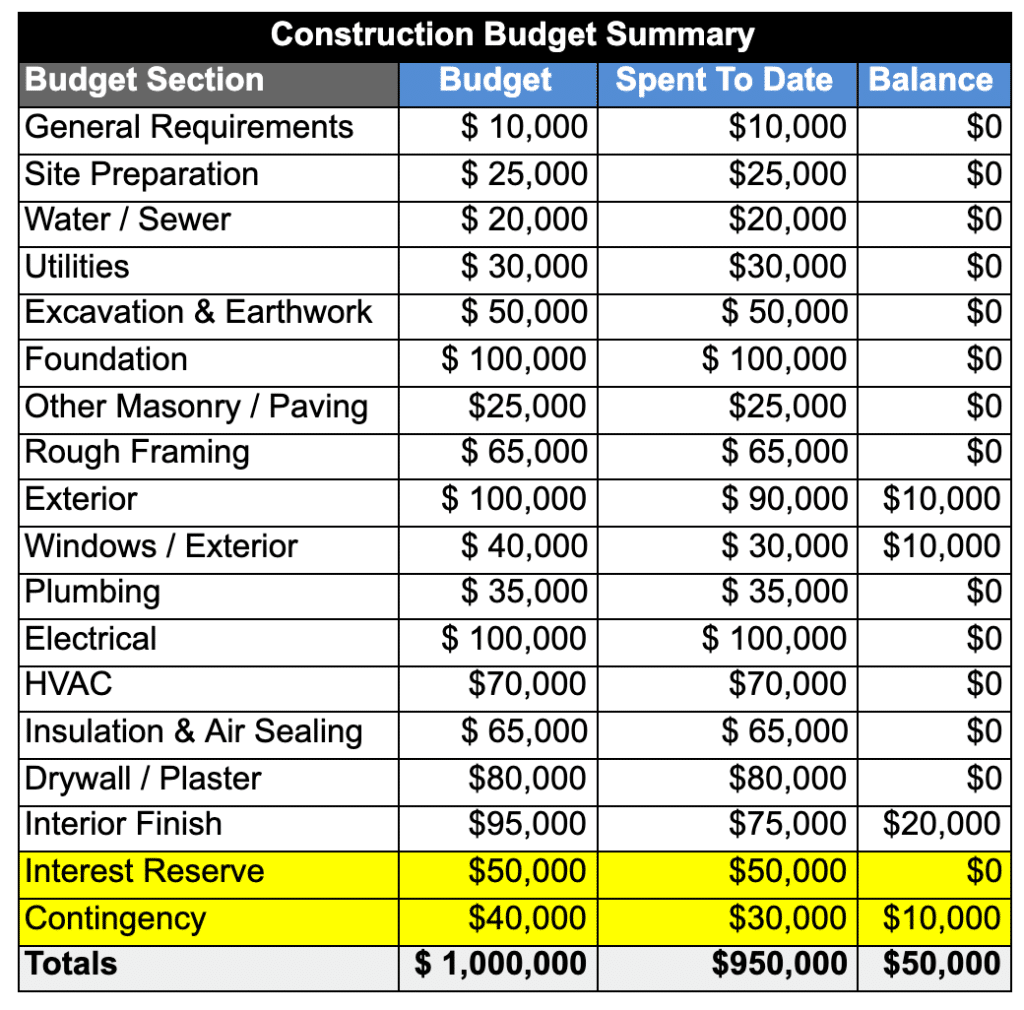

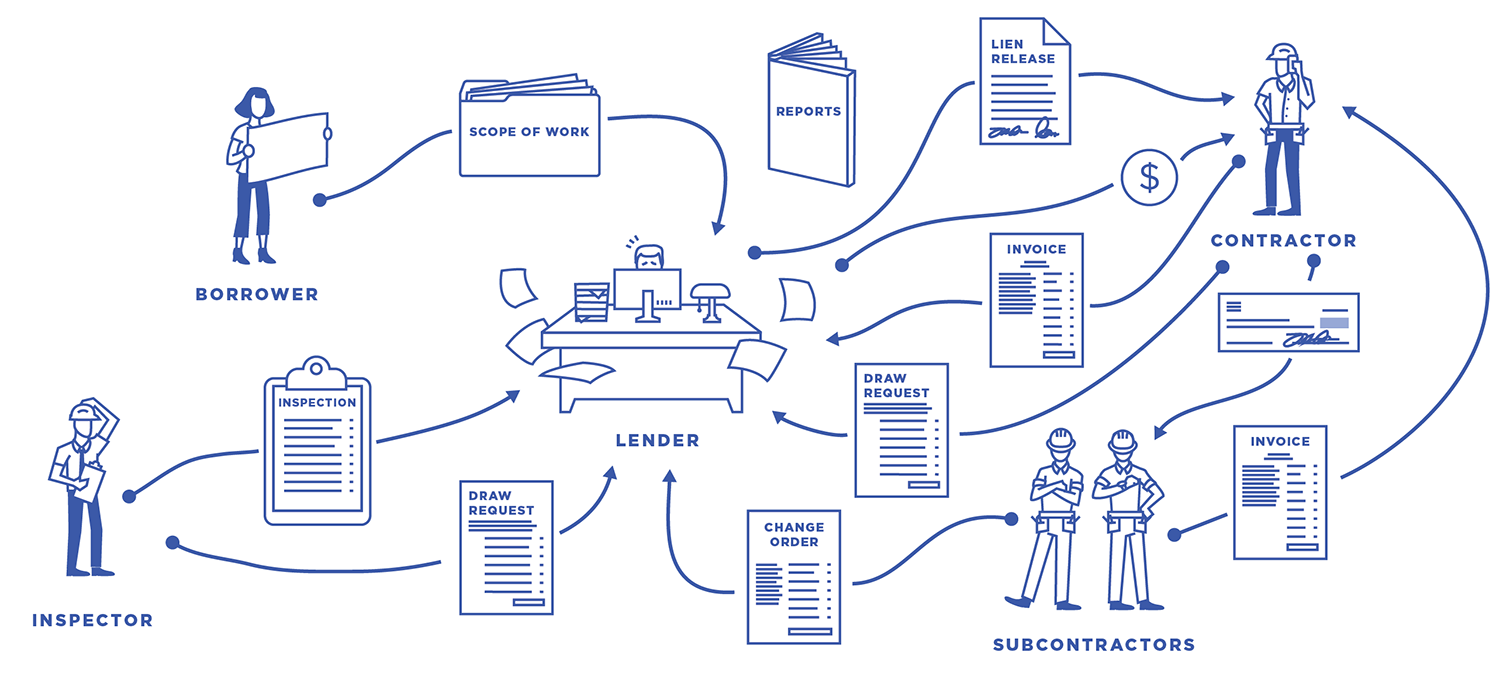

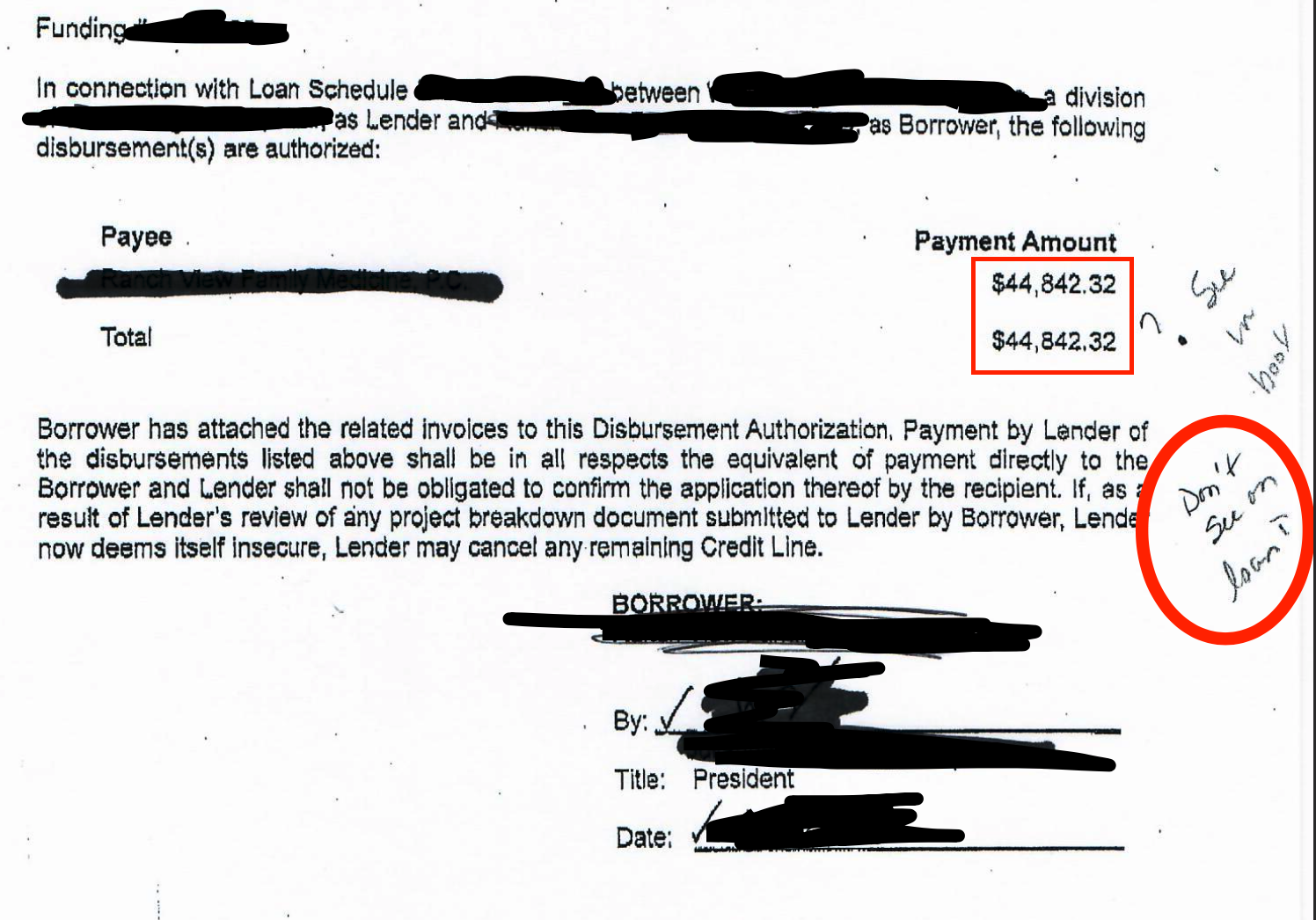

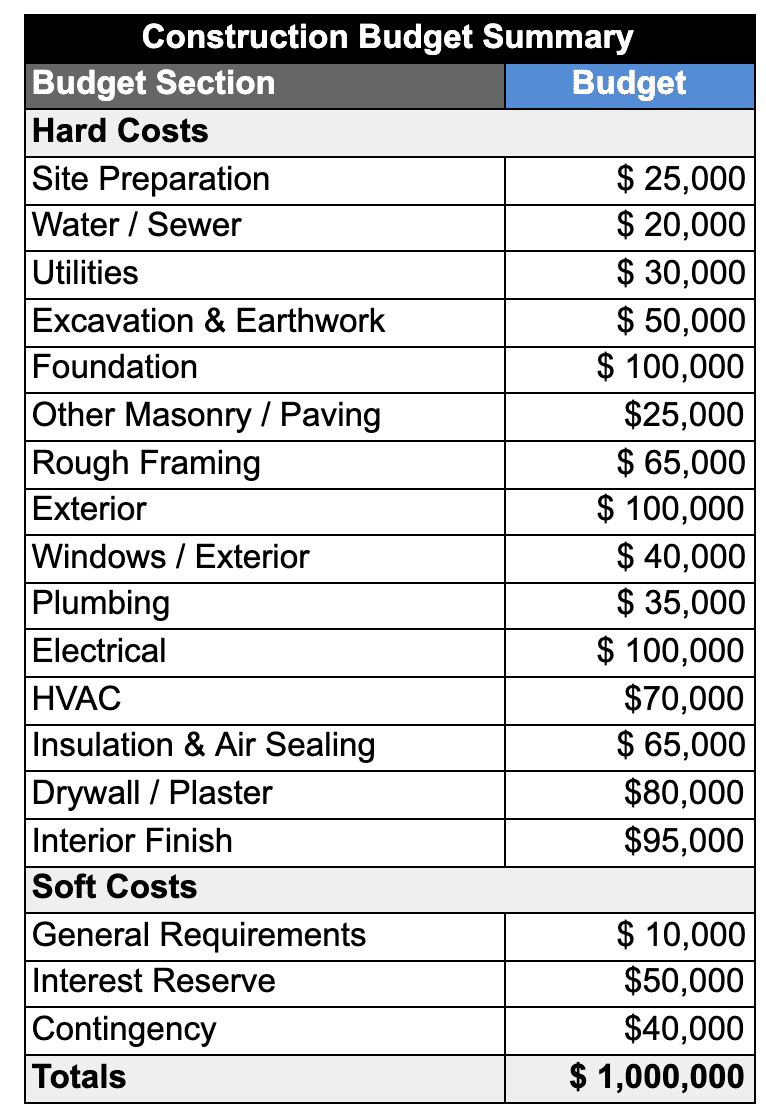

Construction Loan Draw Procedures - Begin draw process (see construction loan information document that is included in your initial disclosure package for further details.) membership eligibility required. Web construction loan draw inspections are guaranteed 5 day turnaround. You must indicate any changes in cost from estimated costs and reflect them on the sworn statement. For each property, there a flat fee of $395 for the first inspection, and $295 for subsequent inspections. Some construction loans can be converted to mortgages after your home is finished. Web construction lending done right requires a streamlined draw inspection process that is dependable, intuitive, and flexible. This form helps you assess the borrower’s financial needs and ensures consistency in the draw request process. Web quickdraw fund control employs trained inspectors to investigate and report on the progress of a construction project. Web what is a construction draw schedule? Web what is a construction draw loan? This type of loan requires more than a few pieces of paper to be signed. Construction loans may cover the costs of buying land. This form helps you assess the borrower’s financial needs and ensures consistency in the draw request process. Web draw requests refer to the bundle documents submitted to the lender in order to draw payment for work. Web read on to explore the key features of the typical construction loan draw schedule as well the components of the draw request process. You must indicate any changes in cost from estimated costs and reflect them on the sworn statement. Web understanding the construction loan draw process. Web the construction draw process is simply a method of paying the. 48 hour rush orders are available for an added fee of $100. The goal is to make progress payments to. Draw requests are usually made by an owner or project manager, made up of any number of pay apps and other supporting documents collected by the prime contractor (s). Web construction lending done right requires a streamlined draw inspection process. Photo by daniel mccullough on unsplash Web the construction draw process is simply a method of paying the contractor in installments, or draws, from the construction project funds. Web quickdraw fund control employs trained inspectors to investigate and report on the progress of a construction project. Discover strategies and best practices for creating an effective construction loan draw schedule and. The sworn statement is a legal document that Review signed loan document for funding approval. Web draws are based on the greater of (a) original cost to construct (i.e., building agreement/cost breakdown); What is a draw schedule for construction projects? Web here’s how construction loan software fast tracks the construction draw process. Web the draw process refers to the method of releasing funds in stages during construction. A construction draw loan is a unique type of loan that is typically provided by banks used to pay for construction supplies and materials. Read on to learn more about how draw schedules for construction loans can help projects run smoothly and efficiently. Construction loans. Begin draw process (see construction loan information document that is included in your initial disclosure package for further details.) membership eligibility required. This system safeguards the lender by ensuring their money is used appropriately and offers borrowers a structured way to finance the build. Web read on to explore the key features of the typical construction loan draw schedule as. What is a draw schedule for construction projects? A standardized form that captures essential project details, budget breakdown, and the amount requested for disbursement. The construction draw schedule determines how and when construction loan funds are distributed. Pieces of a draw request. This system safeguards the lender by ensuring their money is used appropriately and offers borrowers a structured way. The construction loan draw process consists of three major parts: Discover strategies and best practices for creating an effective construction loan draw schedule and learn its importance for managing cash flow and financial health over a project’s life. The construction draw schedule determines how and when construction loan funds are distributed. Pieces of a draw request. You must indicate any. Review signed loan document for funding approval. Web construction loan draw inspections are guaranteed 5 day turnaround. The construction loan draw process consists of three major parts: Discover strategies and best practices for creating an effective construction loan draw schedule and learn its importance for managing cash flow and financial health over a project’s life. Web quickdraw fund control employs. Draw requests are usually made by an owner or project manager, made up of any number of pay apps and other supporting documents collected by the prime contractor (s). 48 hour rush orders are available for an added fee of $100. Photo by daniel mccullough on unsplash Web the draw process refers to the method of releasing funds in stages during construction. Instead of being paid in one lump sum, these funds are paid out during the progression of the project to reimburse the contractor for labor and materials. However, in order to fully understand the construction draw schedule, it is first necessary to understand several concepts related to construction lending. You must indicate any changes in cost from estimated costs and reflect them on the sworn statement. Review signed loan document for funding approval. Web construction lending done right requires a streamlined draw inspection process that is dependable, intuitive, and flexible. Web draw requests refer to the bundle documents submitted to the lender in order to draw payment for work performed. Web the construction draw process is simply a method of paying the contractor in installments, or draws, from the construction project funds. For each property, there a flat fee of $395 for the first inspection, and $295 for subsequent inspections. Tedious administration, onerous requirements, varying project types, and changes to the original plan can compound to make a consistent construction loan management process feel out of reach. Web understanding the construction loan draw process. Web build the home of your dreams. Discover strategies and best practices for creating an effective construction loan draw schedule and learn its importance for managing cash flow and financial health over a project’s life.

Construction Loans and Draw Schedules Timeline Infographic

Guide To Building Your Home In The Shenandoah Valley, Virginia

The Construction Loan Draw Request Process, Explained

Construction Loans 101 Everything You Need To Know

Understanding The Construction Loan Draw Process YouTube

Understanding the Construction Draw Schedule PropertyMetrics

How Construction Loan Software Fast Tracks the Construction Draw

Case Study Manual Construction Loan Process Leads to Undocumented Draw

Construction Draw Schedule How Construction Draws are Funded YouTube

Understanding the Construction Draw Schedule PropertyMetrics

Web Construction Loan Draw Inspections Are Guaranteed 5 Day Turnaround.

Begin Draw Process (See Construction Loan Information Document That Is Included In Your Initial Disclosure Package For Further Details.) Membership Eligibility Required.

Construction Loans May Cover The Costs Of Buying Land.

Web Read On To Explore The Key Features Of The Typical Construction Loan Draw Schedule As Well The Components Of The Draw Request Process.

Related Post: