Construction Loan Draw Process

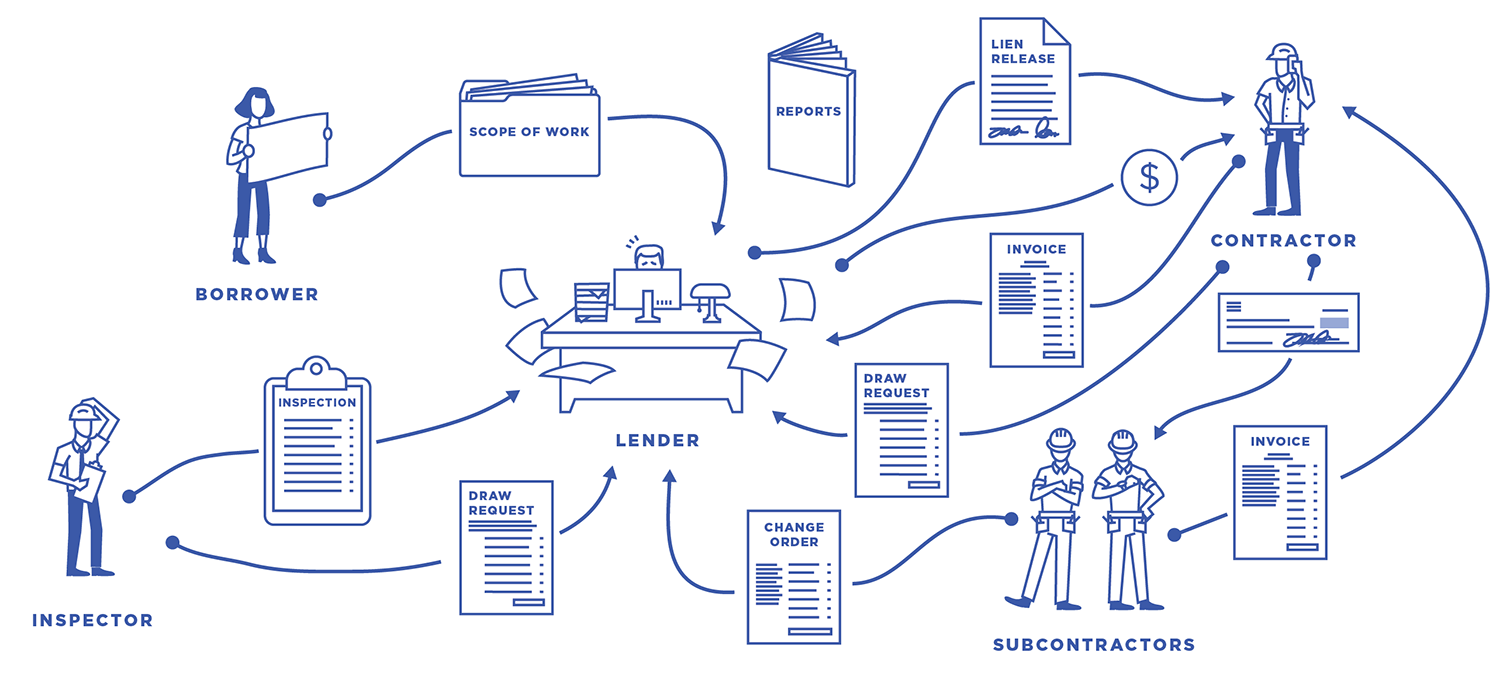

Construction Loan Draw Process - A construction draw loan is a unique type of loan that is typically provided by banks used to pay for construction supplies and materials. Common types are a standalone. To make a draw request, you will present documents that show the work completed and the costs. A standardized form that captures essential project details, budget breakdown, and the amount requested for disbursement. Web understanding the construction loan draw process. If a bank is financing the project, the draw schedule determines when the bank will disburse funds to you and the contractor. This packet of documents outlines the. Discover strategies and best practices for creating an effective construction loan draw schedule and learn its importance for managing cash flow and financial health over a project’s life. A form board survey must be performed by a licensed land surveyor, before the. Web a construction draw schedule is an agreement between the lender, builder, and borrower that outlines when the builder will be paid for their work. Web how does the construction draw process work? That’s the total gross amount. Then we know that there are deductions. Web what is a construction draw schedule? Begin draw process (see construction loan information document that is included in your initial disclosure package for further details.) membership eligibility required. Web draws are scheduled based on the construction timeline, and your lender likely will send an inspector to evaluate the status of construction prior to each payment. As each stage of work is completed, the builder will submit a draw request to the lender to pay those costs. Construction lenders do not typically disburse the entire amount of a construction. Contractor draw request process let’s take a step back. For both builders and homeowners, grasping the draw process is vital. Web let’s assume that you have a $750,000 construction loan approved from your construction lender. It ensures a smooth flow of funds and timely project completion. Review signed loan document for funding approval. This packet of documents outlines the. Then we know that there are deductions. For both builders and homeowners, grasping the draw process is vital. A standardized form that captures essential project details, budget breakdown, and the amount requested for disbursement. That’s the total gross amount. Web draws are scheduled based on the construction timeline, and your lender likely will send an inspector to evaluate the status of construction prior to each payment. Web the draw process works to ensure the builder is using your funds solely for your project and not paying for materials or labor on other projects or diverting them for personal use.. Contractor draw request process let’s take a step back. Web read on to explore the key features of the typical construction loan draw schedule as well the components of the draw request process. In this video i talk about the steps we go through when the builder request a draw on a construction loan. Construction lenders do not typically disburse. Common types are a standalone. Begin draw process (see construction loan information document that is included in your initial disclosure package for further details.) membership eligibility required. Review signed loan document for funding approval. These are typically split up into various milestones or phases of the overall project. Web the portions are known as “draws.” your contractor, for example, may. Pieces of a draw request. In this video i talk about the steps we go through when the builder request a draw on a construction loan. Web let’s assume that you have a $750,000 construction loan approved from your construction lender. This packet of documents outlines the. Common types are a standalone. Web draws are based on the greater of (a) original cost to construct (i.e., building agreement/cost breakdown); In this video i talk about the steps we go through when the builder request a draw on a construction loan. So there’s right off the top, the 10% construction lien holdback which gets. During the construction period, borrowers are usually responsible only. Web the portions are known as “draws.” your contractor, for example, may get the first draw to start the foundation and the second upon completion of it. Review signed loan document for funding approval. And is it really complete when the lender approves. So 31% of $750,000 is 232,500. Web draws are scheduled based on the construction timeline, and your. This packet of documents outlines the. Web what is a construction draw loan? (c) current cost to construct per sworn statement(s). Web here’s how construction loan software fast tracks the construction draw process. Web let’s assume that you have a $750,000 construction loan approved from your construction lender. This form helps you assess the borrower’s financial needs and ensures consistency in the draw request process. Both the property owner and builder are required to sign each draw request. This type of loan requires more than a few pieces of paper to be signed. The construction draw schedule and schedule of values. To make a draw request, you will present documents that show the work completed and the costs. Discover strategies and best practices for creating an effective construction loan draw schedule and learn its importance for managing cash flow and financial health over a project’s life. The lender may inspect the progress before the next draw. Web what is a construction draw schedule? For both builders and homeowners, grasping the draw process is vital. So there’s right off the top, the 10% construction lien holdback which gets. Review signed loan document for funding approval.

VA Construction loan process for Privates OTC loan explained YouTube

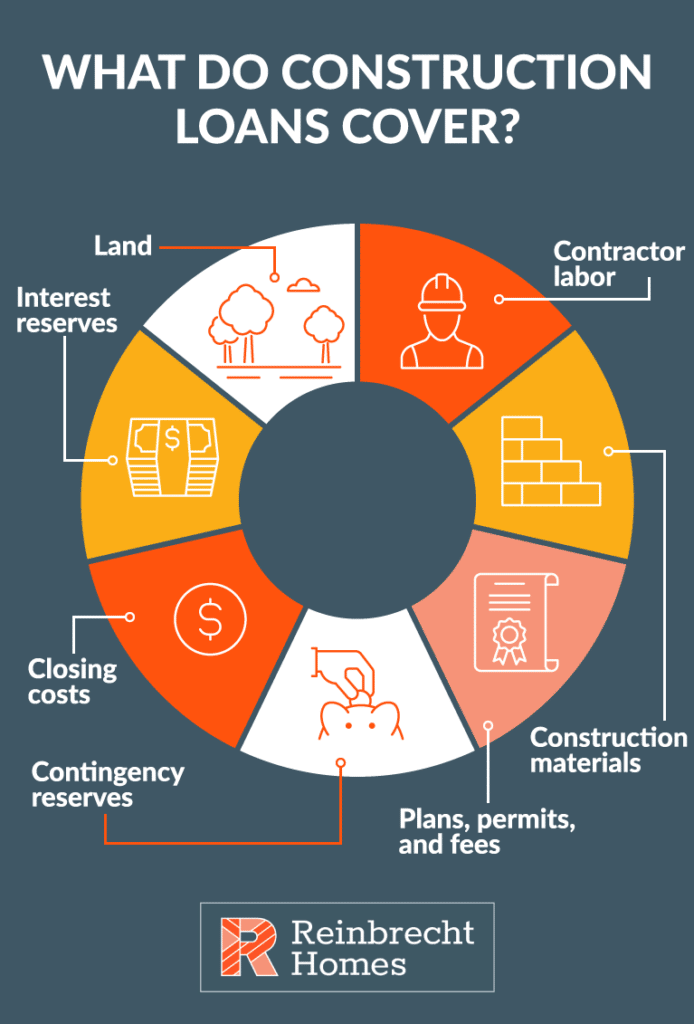

Construction Loans 101 Everything You Need To Know

How Does the Construction Loan Process Work?

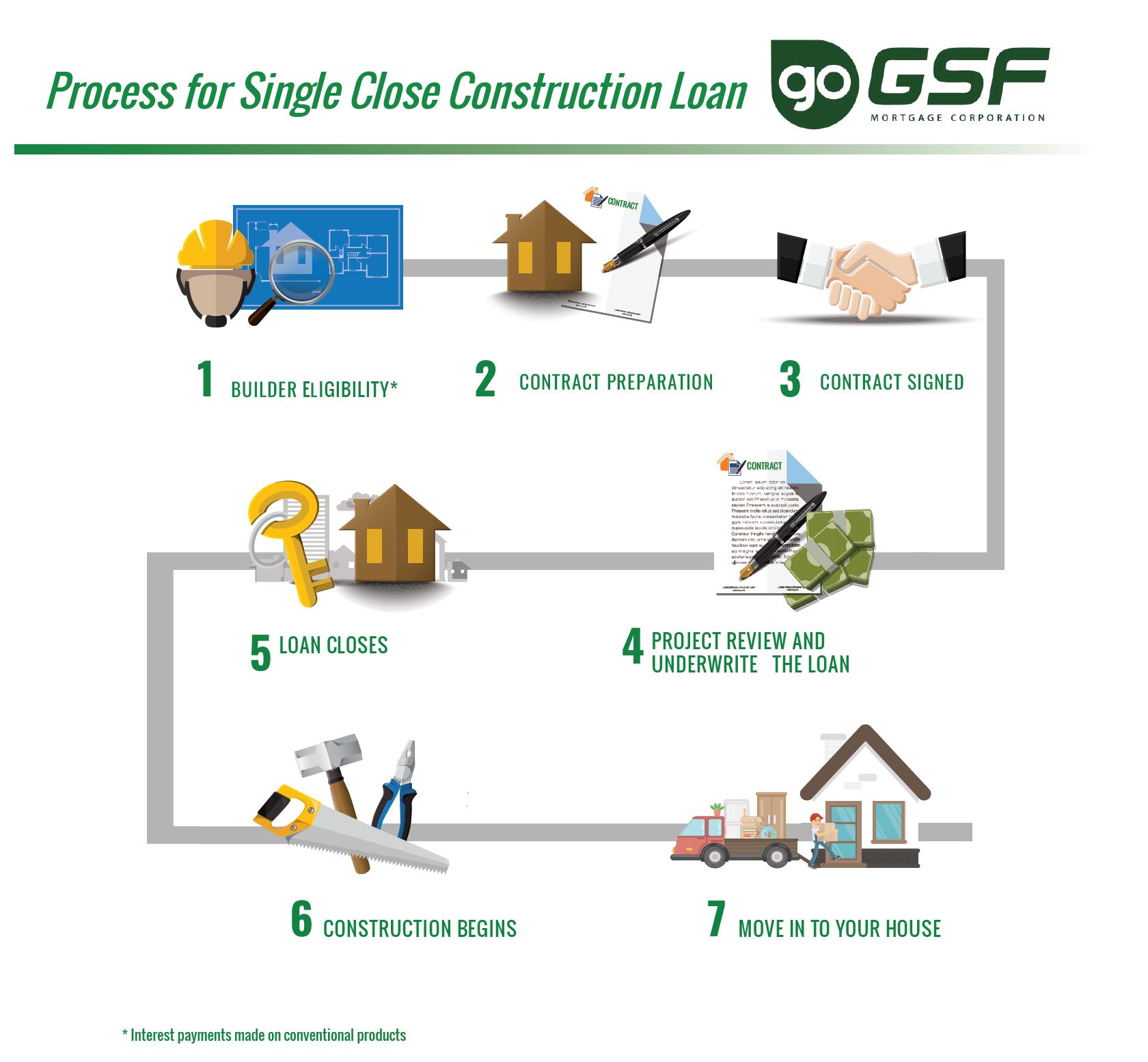

How Does a Single Close Construction Loan Work?

Construction Loans 101 Everything You Need To Know (2023)

Guide To Building Your Home In The Shenandoah Valley, Virginia

How Construction Loan Software Fast Tracks the Construction Draw

Construction Loan Process American Savings Bank Hawaii

The Construction Loan Draw Request Process, Explained

Understanding The Construction Loan Draw Process YouTube

A Construction Draw Loan Is A Unique Type Of Loan That Is Typically Provided By Banks Used To Pay For Construction Supplies And Materials.

The Construction Draw Schedule Determines How And When Construction Loan Funds Are Distributed.

And Is It Really Complete When The Lender Approves.

If A Bank Is Financing The Project, The Draw Schedule Determines When The Bank Will Disburse Funds To You And The Contractor.

Related Post: