Credit Union Record Retention Chart

Credit Union Record Retention Chart - Where specific requirements are not specified in a regulation, guidance is given based on best practices. Josh shapiro is a different kind of leader, and he has been a different kind of governor. (a) charter, bylaws, and amendments; Web records inventory, appraisal, retention schedules & disposition. Certificates or licenses to operate under programs of various government agencies, such as a certificate to act as issuing agent for the sale of u.s. § 707.9 enforcement and record retention. Key operational records that should be retained. A credit report is a record of the borrower's credit history from a number of sources, including banks, credit card companies, collection agencies, and governments. Nafcu is now america’s credit unions. Determine that the credit union retains for two years records to show compliance with this section of the regulation. (b) certificates or licenses to operate under programs of various government agencies, such as a certificate to act as issuing agent for the sale of u.s. (a) charter, bylaws, and amendments. (b) certificates or licenses to operate under programs of various government agencies, such as a certificate to act as. Web records inventory, appraisal, retention schedules & disposition. Where specific. A core element of any records and information program is the records retention schedule (or rrs). For example, there is a three year record retention requirement for information relating to loan originator compensation and the ability to repay/qualified mortgage rule. (a) charter, bylaws, and amendments; Web what records should be retained permanently? Official records of the credit union: Web cuna asked the ncua to revisit the permanent records detailed in appendix a to the regulation, which provides guidance concerning how long credit unions should retain certain records. Web most federal consumer protection laws and regulations require providers of financial products and services to retain records of compliance for a specified period. Web at least quarterly, a federal credit. Web at least quarterly, a federal credit union's senior executive officers must deliver a comprehensive derivatives report, as described in paragraph (c) of this section to the federal credit. Communicate with governor josh shaprio. What format should the credit union use for retaining records? Web records inventory, appraisal, retention schedules & disposition. Web record retention guidelines revised june 2013. Official records of the credit union: The following record retention and disposal guidelines are provided by the kansas department of credit unions to assist credit unions in determining minimum retention periods for certain types of books and records. Web records inventory, appraisal, retention schedules & disposition. Nafcu is now america’s credit unions. Web at least quarterly, a federal credit union's. (a) charter, bylaws, and amendments. Ncua does not recommend a particular format for record retention. Web monetary instruments record reg # retention time. Web a creditor shall retain evidence of compliance with this part (other than advertising requirements under §§ 1026.16 and 1026.24, and other than the requirements under § 1026.19 (e) and (f)) for two years after the date. Web cuna asked the ncua to revisit the permanent records detailed in appendix a to the regulation, which provides guidance concerning how long credit unions should retain certain records. Web section 1026.25 of regulation z indicates that credit unions must retain evidence of compliance for two years. This is a document that lists what records are in your credit union. Deposits and investments remain the largest component of credit union assets, accounting for 74 per cent of assets at 30 september 2020 at €14.29 billion. Web records retention guidance for federally insured credit unions is provided in appendix a to part 749 in ncua’s regulations and it specifically addresses the question of formats credit unions can use for retaining records. (b) certificates or licenses to operate under programs of various government agencies, such as a certificate to act as. (a) charter, bylaws, and amendments. Ncua does not recommend a particular format for record retention. Web most federal consumer protection laws and regulations require providers of financial products and services to retain records of compliance for a specified period. Here is. Where specific requirements are not specified in a regulation, guidance is given based on best practices. Communicate with governor josh shaprio. Josh shapiro is a different kind of leader, and he has been a different kind of governor. Official records of the credit union: Determine that the credit union retains for two years records to show compliance with this section. Web at least quarterly, a federal credit union's senior executive officers must deliver a comprehensive derivatives report, as described in paragraph (c) of this section to the federal credit. Official records of the credit union: A borrower's credit score is the result of a mathematical algorithm applied to a credit report and other sources of. Web record retention guidelines revised june 2013. Section 270 of tisa (12 u.s. (b) certificates or licenses to operate under programs of various government agencies, such as a certificate to act as. Deposits and investments remain the largest component of credit union assets, accounting for 74 per cent of assets at 30 september 2020 at €14.29 billion. (a) charter, bylaws, and amendments. For example, there is a three year record retention requirement for information relating to loan originator compensation and the ability to repay/qualified mortgage rule. A credit report is a record of the borrower's credit history from a number of sources, including banks, credit card companies, collection agencies, and governments. Web the rule contains a general 2 year record retention requirement, with some longer retention periods for other specific documents. This is a document that lists what records are in your credit union and how long your credit union intends to keep them. Web cuna asked the ncua to revisit the permanent records detailed in appendix a to the regulation, which provides guidance concerning how long credit unions should retain certain records. Web records inventory, appraisal, retention schedules & disposition. Certificates or licenses to operate under programs of various government agencies, such as a certificate to act as issuing agent for the sale of u.s. This record retention schedule created by affirmx was designed to provide a summary of record retention requirements of various regulations.

Retention Schedule Template

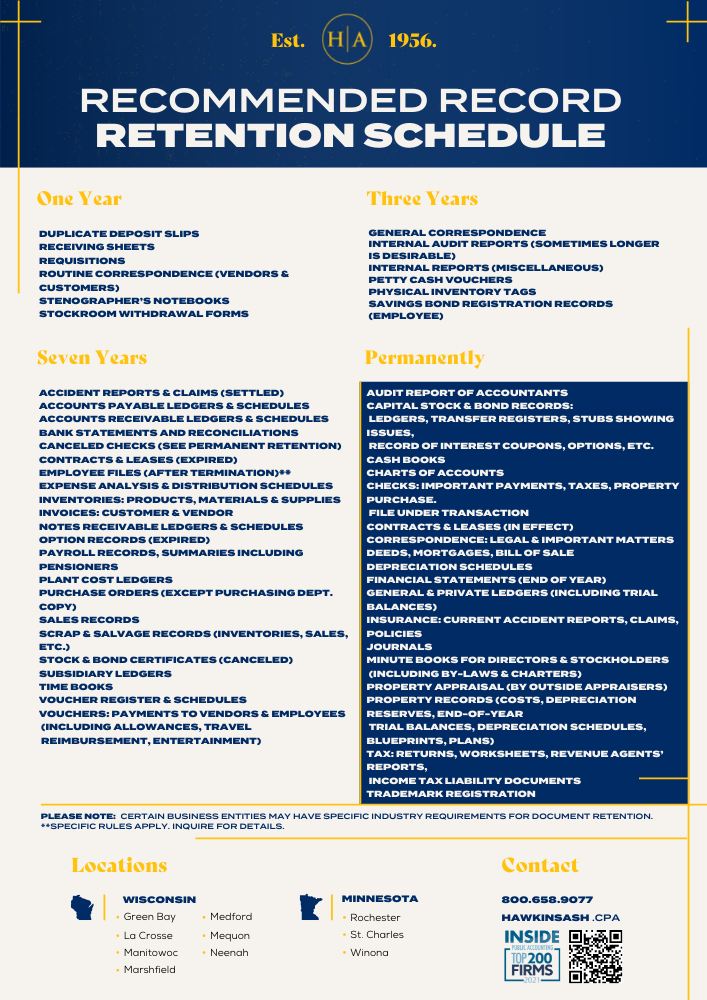

Record Retention Schedule Hawkins Ash CPAs

Record Retention Schedule Templates 11+ Free Docs, Xlsx & PDF Free

Records Retention Schedule Template MS Excel Templates

Record Retention Guidelines Banks Employment

Records Retention Schedule Surety Bond Debits And Credits

Credit Union Record Retention Requirements

How Long To Retain Your Records Shred Nations

Record Retention Schedule Templates 11+ Free Docs, Xlsx & PDF Formats

Records Retention 101

Requirements For Select Federal Consumer Protection Laws And Regulations.

Determine That The Credit Union Retains For Two Years Records To Show Compliance With This Section Of The Regulation.

Official Records Of The Credit Union That Should Be Retained Permanently Are:

(A) Charter, Bylaws, And Amendments.

Related Post: