Dark Cloud Cover Chart Pattern

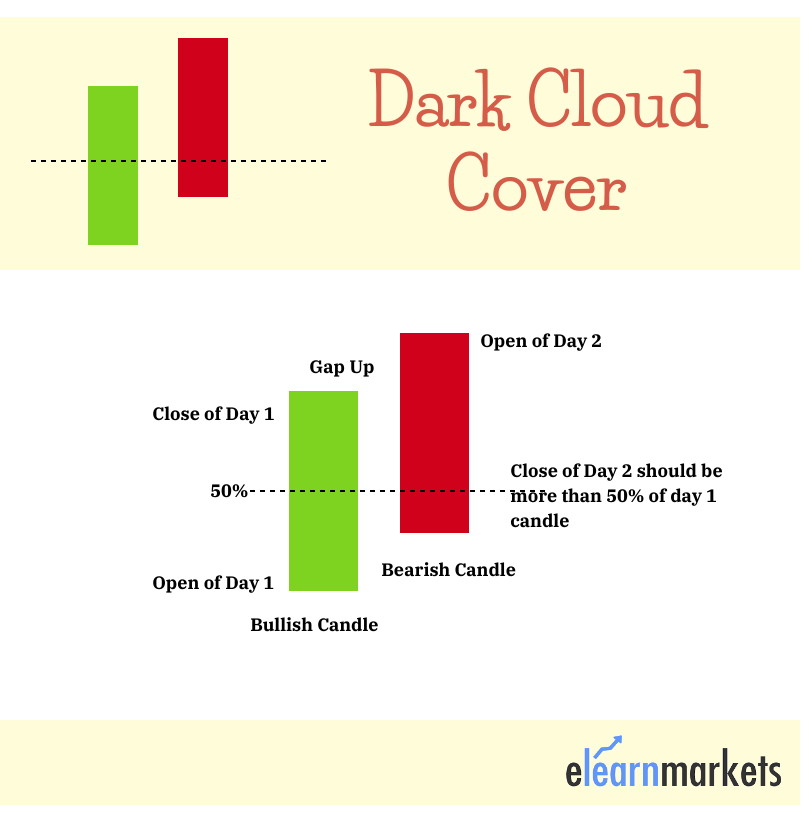

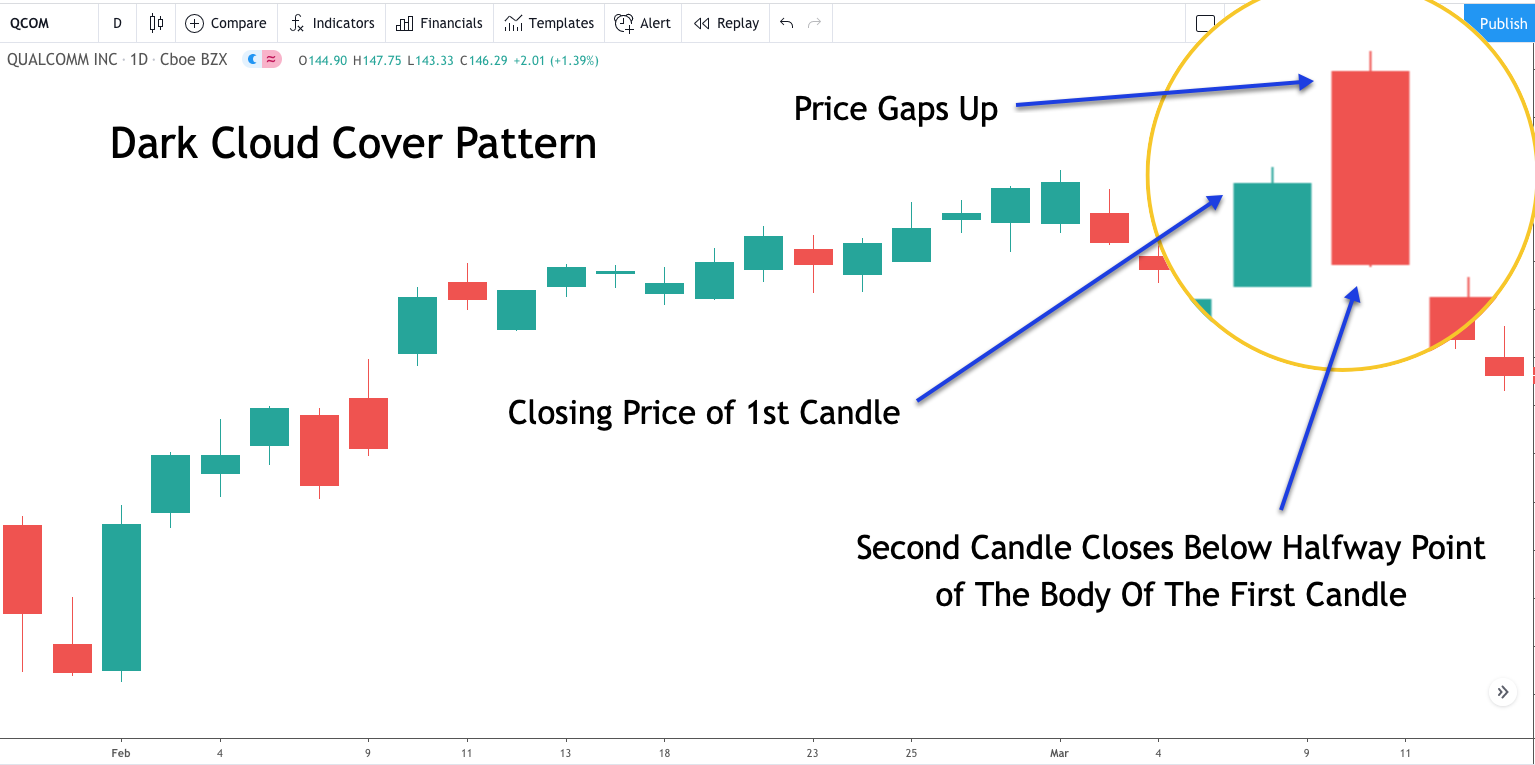

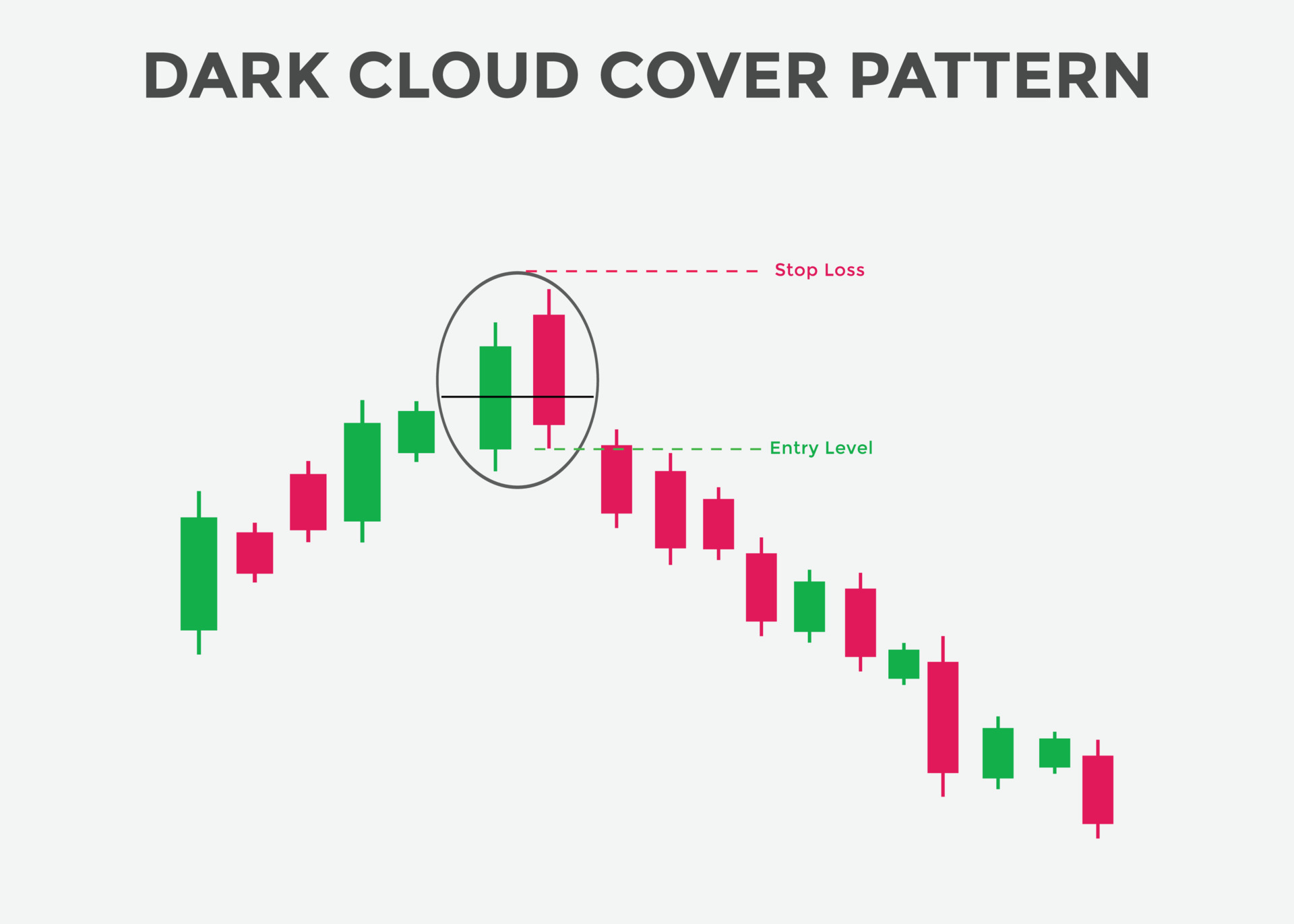

Dark Cloud Cover Chart Pattern - Web the dark cloud cover is a bearish reversal candlestick pattern that occurs after an uptrend. It is a double candlestick pattern that warns of a potential bearish trend reversal, making it a top reversal pattern that can appear in an established uptrend. This pattern’s significance lies in its ability to alert traders to a shift in market sentiment, from bullish optimism to bearish pessimism. The chart example above shows a dark cloud cover forex pattern (marked by the yellow square) that formed at the end of a bullish phase before a. Beim dark cloud cover ist die erste kerze eine grüne kerze mit langem körper. Web table of contents show. However, as we’ll soon see, this candlestick isn’t so scary. Web dark cloud cover, circled in a, appears on the daily scale. Dark cloud cover is a stock market event that intricately studies the prices. The term ideally means that the tumbling prices resemble dark clouds. Web dark cloud cover, circled in a, appears on the daily scale. It forms when a bearish candlestick follows a bullish candlestick, where the bearish candlestick opens above the previous bullish candlestick’s closing price but closes below its midpoint. Web the dark cloud cover is a crucial bearish reversal pattern in technical analysis, known for its ability to signal a. This pattern’s significance lies in its ability to alert traders to a shift in market sentiment, from bullish optimism to bearish pessimism. Web dark cloud cover patterns explained. How to trade using the dark cloud cover; They show a particular security’s opening, closing, and. Last updated on 10 february, 2024 by trading system. Web the dark cloud cover is a crucial bearish reversal pattern in technical analysis, known for its ability to signal a potential downturn in an uptrend. It forms when a bearish candlestick follows a bullish candlestick, where the bearish candlestick opens above the previous bullish candlestick’s closing price but closes below its midpoint. There are many candlesticks to choose from,. Image for illustration purposes only. The next day, the clouds move in forming a black candle that begins the day with a higher open but closes below the middle of. Web the dark cloud cover is a candlestick pattern that signals a momentum shift to bearish. How to identify a dark cloud on forex charts; Web the dark cloud cover. A piercing line is a bullish reversal pattern that forms at the end of a downtrend. Web a dark cloud cover is a bearish candlestick pattern visible at the end of an uptrend. How to identify a dark cloud on forex charts; The chart example above shows a dark cloud cover forex pattern (marked by the yellow square) that formed. Web what does the dark cloud cover forex pattern mean? Web the dark cloud cover gets its name from the ominous second black candlestick. Web the dark cloud cover candlestick pattern is a type of bearish reversal candlestick pattern used by traders to analyse the price movement of securities. The chart example above shows a dark cloud cover forex pattern. Usually, it appears after a price move to the upside and shows rejection from higher prices. The next day, the clouds move in forming a black candle that begins the day with a higher open but closes below the middle of. Look for price action to fall below the second candlestick and hold to confirm bearish continuation. Web the dark. How to trade the dark cloud cover chart pattern. Learn from this blog about its formation, features and how to use it for trading with examples. Usually, it appears after a price move to the upside and shows rejection from higher prices. The chart example above shows a dark cloud cover forex pattern (marked by the yellow square) that formed. Web the dark cloud cover is a candlestick pattern that signals a momentum shift to bearish. Web dark cloud cover is a bearish reversal candlestick pattern where a down candle opens higher but closes below the midpoint of the prior up candlestick. The dark cloud cover is a japanese candlestick pattern. Web a dark cloud cover is a bearish candlestick. Web dark cloud cover patterns are two candlestick patterns found at the top of uptrends or near resistance levels and signal a reversal to the downside. The second bearish candle covers up to half of the first bullish candle. It starts with a bullish (green) candle followed by a bearish (red) candle that yields a new high. Web dark cloud. This pattern’s significance lies in its ability to alert traders to a shift in market sentiment, from bullish optimism to bearish pessimism. Web learn the significance for traders of the dark cloud cover candlestick pattern, a bearish indicator closely related to the bearish engulfing pattern. Web dark cloud cover is a bearish reversal candlestick pattern where a down candle opens higher but closes below the midpoint of the prior up candlestick. Web dark cloud cover und piercing pattern sind beides umkehrsignale im kerzenchart ( candlestick chart ). But before we cover the best dark cloud cover trading strategies, let’s learn how to identify this pattern on our candlestick charts. The second bearish candle covers up to half of the first bullish candle. Web the dark cloud cover is a candlestick pattern that signals a momentum shift to bearish. It starts with a bullish (green) candle followed by a bearish (red) candle that yields a new high. It usually comes about at the peak of an uptrend. A piercing line is a bullish reversal pattern that forms at the end of a downtrend. However, as we’ll soon see, this candlestick isn’t so scary. Web dark cloud cover, circled in a, appears on the daily scale. Web the dark cloud cover pattern is known in japanese as kabuse, which means 'to get covered' or 'to hang over'. Candlestick charts have come to attract many traders since their introduction to the western world in the late ’80s. This pattern’s significance lies in its ability to alert traders to a shift in market sentiment, from bullish optimism to bearish pessimism. Web dark cloud cover patterns are two candlestick patterns found at the top of uptrends or near resistance levels and signal a reversal to the downside.:max_bytes(150000):strip_icc()/DarkCloudCover-2c6f2d7b211942019a87dbe632fb3d2b.png)

Dark Cloud Cover Definition and Example

Dark Cloud Cover How to trade with this powerful candlestick Pattern2022

How to Trade the Dark Cloud Cover Candlestick

Overview Of The Dark Cloud Cover Candlestick Pattern Forex Training Group

Dark Cloud Cover Candlestick Chart Pattern A Special Number 1

What Is Dark Cloud Cover Candlestick Pattern? How To Trade Blog

Dark Cloud Cover Definition and Example

Tutorial on Dark Cloud Cover Candlestick Pattern YouTube

Dark cloud candlestick chart pattern. Japanese candlesticks pattern

How To Trade Blog What Is A Dark Cloud Cover Candlestick? Meaning And

Learn From This Blog About Its Formation, Features And How To Use It For Trading With Examples.

Web The Dark Cloud Cover Is A Bearish Reversal Candlestick Pattern That Occurs After An Uptrend.

In The Case Of The Piercing Line, The First Candle Is Bearish.

Web Table Of Contents Show.

Related Post: