Debt Snowball Free Printable

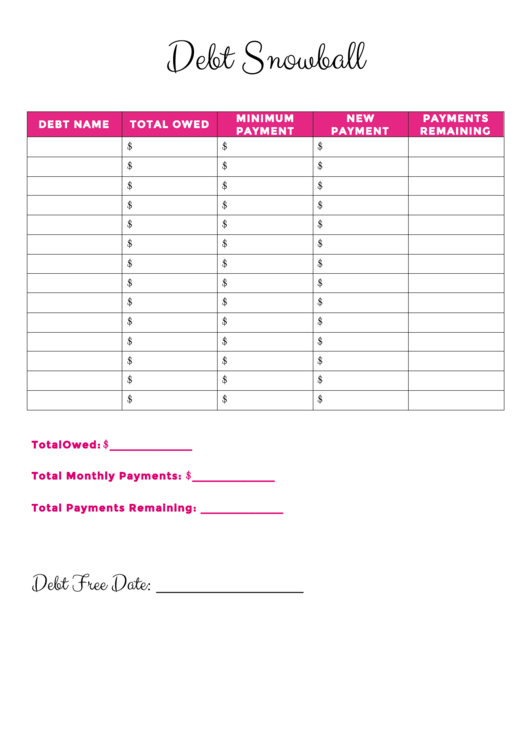

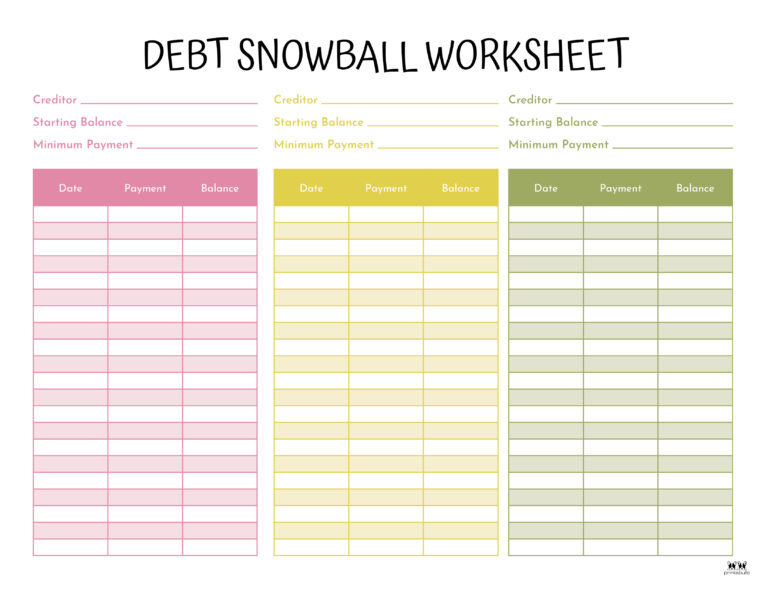

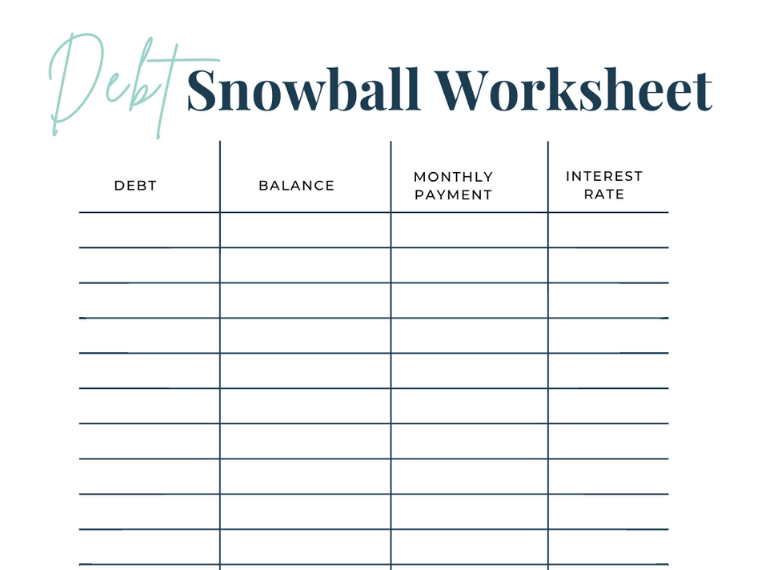

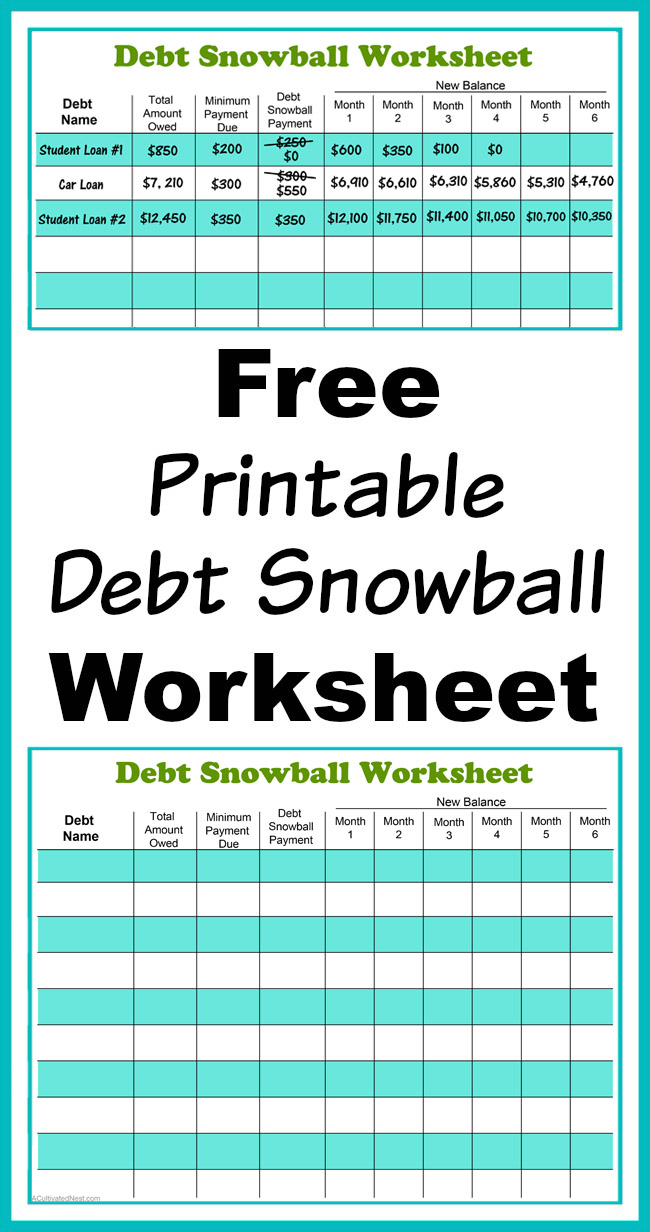

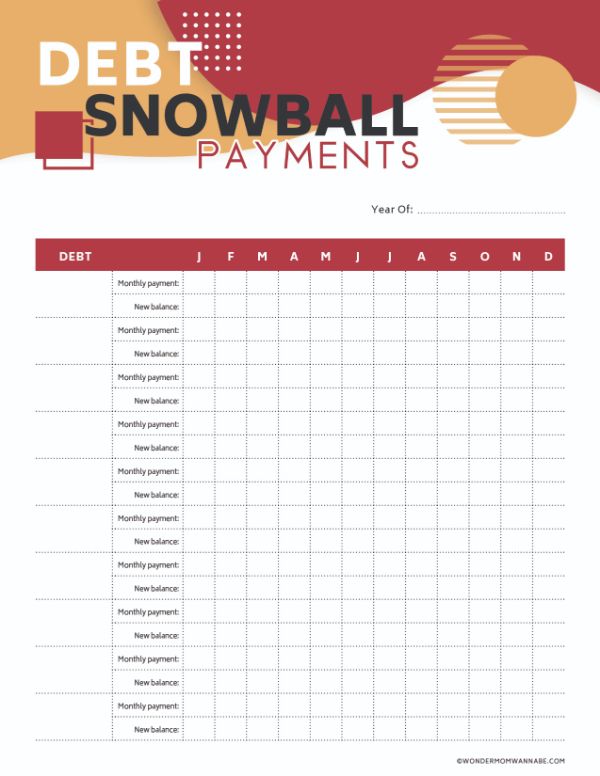

Debt Snowball Free Printable - All pages are 100% free. The debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small. Get your debt snowball rolling. 4.1 🖥️ download the printables. Free printable debt snowball worksheet; Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. The approach involves paying off your debts from smallest to largest (in terms of the balance owed), without regard to the interest rates of the debts. These worksheets make it easy to pay off debt quickly and visibly see your progress using the dave ramsey debt snowball method. Web 1.1 💰 example: 3 🏦 snowball debt vs debt avalanche methods. The debt snowball is one of the best ways to make a big dent in your outstanding debts. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. These worksheets make it easy to pay off debt quickly and visibly see. How to use the debt snowball method with free debt snowball worksheet. Web using a debt snowball worksheet helps you prioritize your debts and figure out your debt payoff plan (you can download ours below). Pay the minimum payment for all your debts except for the smallest one. Web debt snowball worksheets. Free printable debt snowball worksheet; Web free debt snowball spreadsheets for excel & google sheets. Web one of my favorite ways to tackle debt is with dave ramsey’s debt snowball method because it’s proven to work well when you have debt from multiple sources. Web debt snowball illustration & free printable debt payoff worksheet pdf. List all of your debts smallest to largest, and use. Get your debt snowball rolling. Get your debt snowball rolling. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. Debt snowball spreadsheet in google docs/excel; Web this is the ultimate guide to debt snowball method! Do the same for the second smallest debt untill that one is paid off as well. To make it easier for you to start your debt snowball, i created a. Web one of my favorite ways to tackle debt is with dave ramsey’s debt snowball method because it’s proven to work well when you have debt from multiple sources. .paying. Next, to snowball your debt, enter the additional amount you want to pay above the minimum required payment. If you’re not familiar with the debt snowball, it is a debt payoff approach that has been popularized by dave ramsey. 4 💸 four steps to start. Web below are 10 debt snowball worksheets that you can download for free to use. If you’re not familiar with the debt snowball, it is a debt payoff approach that has been popularized by dave ramsey. 3 🏦 snowball debt vs debt avalanche methods. The debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small. Web that’s why i’m giving you this free printable. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. List all of your debts smallest to largest, and use this sheet to. Web how to use the debt snowball w/ free debt snowball worksheet. 2 💵 how to use. Next, to snowball your debt, enter the additional amount you want to pay. Web debt snowball worksheets. For beginners, we will also provide you with a simple, free debt tracker spreadsheet template to use. 5 💵 20 ways to cut your budget. Free printable debt snowball worksheet; Web this is the ultimate guide to debt snowball method! Put any extra dollar amount into your smallest debt until it is paid off. Debt snowball spreadsheet in google docs/excel; Web what is the debt snowball? How fast can you pay off debt with the snowball method? To make it easier for you to start your debt snowball, i created a. The debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small. See our review of our top picks of debt snowball spreadsheets to help you get your debt under control. .paying off debt doesn't have to be so hard. 2 💵 how to use. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Debt snowball spreadsheet in google docs/excel; Debt 'n' credit / by lyca. Do the same for the second smallest debt untill that one is paid off as well. Free printable debt snowball worksheet; Get your debt snowball rolling. The approach involves paying off your debts from smallest to largest (in terms of the balance owed), without regard to the interest rates of the debts. Debt payoff template from medium for google sheets. Web free debt snowball spreadsheets for excel & google sheets. If you’re not familiar with the debt snowball, it is a debt payoff approach that has been popularized by dave ramsey. Get your debt snowball rolling. 4.1 🖥️ download the printables.![]()

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Free Printable Snowball Debt Spreadsheet Printable World Holiday

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Israel

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff

Free Printable Debt Snowball Worksheet To Payoff Debt In 2022

Free Printable Debt Snowball Worksheet Pay Down Your Debt!

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Free Printable Debt Snowball Worksheet FREE PRINTABLE TEMPLATES

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-snowball-excel.jpg?gid=443)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Web My Free Debt Snowball Worksheet Is A Handy Tool For Listing And Prioritizing Your Debts, Crunching Numbers To Calculate Payoff Dates, And Keeping Track Of Your Progress Along The Way.

Web How To Use The Debt Snowball W/ Free Debt Snowball Worksheet.

Web One Of My Favorite Ways To Tackle Debt Is With Dave Ramsey’s Debt Snowball Method Because It’s Proven To Work Well When You Have Debt From Multiple Sources.

Working The Debt Snowball Method?

Related Post: