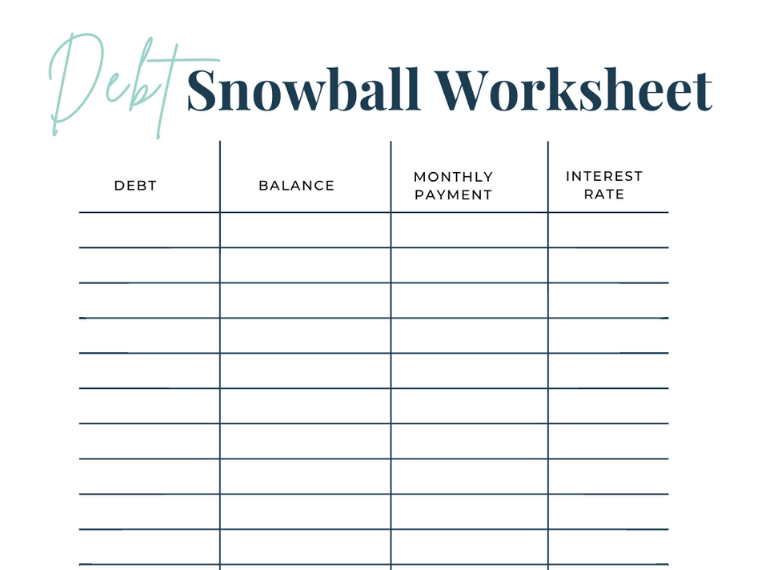

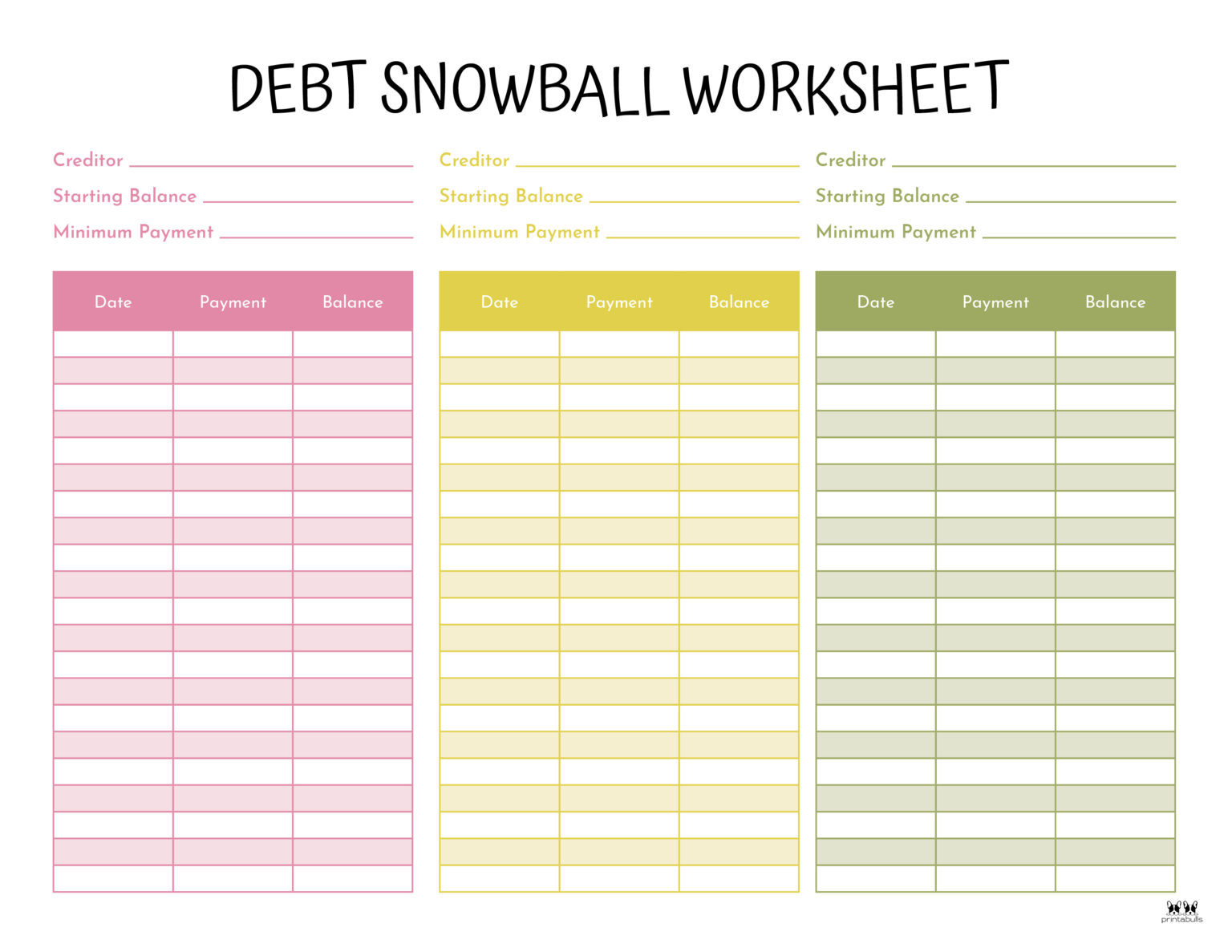

Debt Snowball Worksheet Printable

Debt Snowball Worksheet Printable - Make sure you list all your debts except for your mortgage. Do the same for the second smallest debt untill that one is paid off as well. List all your debts and prioritize them from smallest to largest balance. Especially considering the fact that my husband and i weren’t making a ton of money at the time. This includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). Monthly household income (optional) $ additional payment. Web debt snowball illustration & free printable debt payoff worksheet pdf. Web debt snowball worksheet explained. The debt snowball is one of the best ways to make a big dent in your outstanding debts. Free printable debt snowball worksheet; Web creditor starting balance minimum payment date payment balance creditor starting balance minimum payment date payment balance creditor starting balance Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. These worksheets make it easy to pay off debt quickly and visibly see your progress using the dave ramsey debt snowball method. $. Especially considering the fact that my husband and i weren’t making a ton of money at the time. This includes the $50 you borrowed from your friend for the concert ticket and the $50,000 student loan. Debt snowball form by well kept wallet; Pay as much money as possible to the smallest debt. Get your debt snowball rolling. The debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the smallest amount owed to the largest amount outstanding with the goal of giving you a good idea as to when your debts will be paid off in full. Pay the minimum payment on every. Work your way from top to bottom, paying off your smallest debt first. Sugar spice and glitter’s debt repayment tracker; This includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). Pay the minimum payment on every debt except the smallest. After a debt is paid off, you apply that money towards the next. Web one of my favorite ways to tackle debt is with dave ramsey’s debt snowball method because it’s proven to work well when you have debt from multiple sources. This free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. The debt snowball method is as simple as writing down all of your. Monthly household income (optional) $ additional payment. Managing debt is a normal part of the modern financial. Web click the image to download this worksheet! List all your debts and prioritize them from smallest to largest balance. Web debt snowball worksheet explained. The debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the smallest amount owed to the largest amount outstanding with the goal of giving you a good idea as to when your debts will be paid off in full. Frugal fanatic’s debt paydown worksheet; Web. List all your debts and prioritize them from smallest to largest balance. Frugal fanatic’s debt paydown worksheet; First, you have to list every single debt that you have. Make sure you list all your debts except for your mortgage. Do the same for the second smallest debt untill that one is paid off as well. Monthly household income (optional) $ additional payment. Fill out your debts from smallest to largest. Web debt snowball illustration & free printable debt payoff worksheet pdf. Web free printable debt snowball worksheet to payoff debt in 2024. Put any extra dollar amount into your smallest debt until it is paid off. Sugar spice and glitter’s debt repayment tracker; Pay as much money as possible to the smallest debt. Frugal fanatic’s debt paydown worksheet; $ account name (optional) add debt. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. Work your way from top to bottom, paying off your smallest debt first. This includes the $50 you borrowed from your friend for the concert ticket and the $50,000 student loan. Web account name month 1 month 2 month 3 month 4 total owed minimum monthly payment snowball payment month 5 month 6 new balance debt snowball worksheet How to use the snowball method to pay off debt. Get your debt snowball rolling. Pay the minimum payment for all your debts except for the smallest one. If you don’t have a surplus, then you need to find a way to reduce your expenses or increase your income. When i first started paying off debt, i had no clue what i was doing or how i’d actually reach my big, scary goal of becoming debt free. First, you have to list every single debt that you have. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. Web creditor starting balance minimum payment date payment balance creditor starting balance minimum payment date payment balance creditor starting balance Web designed by template lab. Web debt snowball illustration & free printable debt payoff worksheet pdf. After a debt is paid off, you apply that money towards the next item. Web debt snowball worksheets. It helps a person who owes multiple accounts pay off the smallest balances first while paying the minimum payment on larger debts.

Free Debt Snowball Worksheet Printable Vital Dollar

Printable Debt Snowball Worksheet Debt Snowball Planner Etsy

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/excel-debt-snowball-template.jpg?gid=443)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Israel

Free Printable Debt Snowball Worksheet To Payoff Debt In 2022

![]()

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Snowball Worksheet Worksheets For Kindergarten

Pay The Minimum Payment On Every Debt Except The Smallest.

Available As Printable Pdf Or Google Docs Sheet.

Web Acultivated Nest’s Debt Snowball Worksheet;

Managing Debt Is A Normal Part Of The Modern Financial.

Related Post: