Dp1 Dp2 Dp3 Insurance Comparison Chart

Dp1 Dp2 Dp3 Insurance Comparison Chart - Web the premium difference between a dp1 and dp3 policy can vary significantly based on the insured property's value, location, age, and other risk factors. What it is and how it works. Also known as coverage a, this portion of your policy covers the main structure of a home as well as any attached structures. Of course, if the duplex or townhome in question is also your residence, you’re going to want to look into an ho3 homeowners policy. It is a named peril policy, and it only covers the actual cash value of damages resulting from a covered peril. What is a dwelling fire policy? Notably, water damage from appliances or pipes isn’t covered, and that can be a potentially big gap in your coverage. One of the most important parts of a homeowners insurance policy is dwelling coverage. The key differences between these policies are the types of coverage offered, the number of perils covered, and how they settle claims. Web here’s a simple breakdown of dp3 vs ho3: For instance, if the insurance company says that they do not cover risks from political unrest, it will not compensate you for any damages from such peril. One of the most important parts of a homeowners insurance policy is dwelling coverage. If an incident not listed happens, it’s not covered. Also known as coverage a, this portion of your policy. Web compare the differences between dp1, dp2, and dp3 to determine which you need. Of course, if the duplex or townhome in question is also your residence, you’re going to want to look into an ho3 homeowners policy. What is a dwelling fire policy? Web the main difference between dp1 and dp2 is that dp2 covers more risks, eighteen in. If one of these incidents occurs at your property, it’s covered. Web 4 min read. Web the main difference between dp1 and dp2 is that dp2 covers more risks, eighteen in number, while dp1 covers nine. One of the most important parts of a homeowners insurance policy is dwelling coverage. What is the difference between dp1, dp2, and dp3 vessels? A dp3 policy is a type of dwelling fire insurance intended for rented residential homes (not commercial rentals). The key differences between these policies are the types of coverage offered, the number of perils covered, and how they settle claims. When you need a dp3 policy. One of the most important parts of a homeowners insurance policy is dwelling coverage.. Web the three most common rental insurance policies are the dp1, dp2, and dp3. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. Dp 1 is the most basic form of coverage of the three. Web a dp1 policy is a basic form of insurance for vacant homes and rental properties that is more. What is a dwelling fire policy? Dp1, dp2, and dp3 policies are commonly referred to as dwelling fire policies. You’re not alone if you find yourself scratching your head, wondering what exactly sets these two policies apart. If one of these incidents occurs at your property, it’s covered. The dp3 is the most extensive landlord insurance policy, providing the broadest. Both dp1 and dp3 policies can be used to cover homes used as primary residences or as investment properties. What is a dwelling fire policy? Web ellieb / check the difference. One of the most important parts of a homeowners insurance policy is dwelling coverage. To start your quote, enter your address below. Web here’s a simple breakdown of dp3 vs ho3: Also known as coverage a, this portion of your policy covers the main structure of a home as well as any attached structures. The key differences between these policies are the types of coverage offered, the number of perils covered, and how they settle claims. Web compare the differences between dp1,. An open perils policy simply means insurance. Notably, water damage from appliances or pipes isn’t covered, and that can be a potentially big gap in your coverage. Dp 1 is the most basic form of coverage of the three. Web the premium difference between a dp1 and dp3 policy can vary significantly based on the insured property's value, location, age,. The key differences between these policies are the types of coverage offered, the number of perils covered, and how they settle claims. What is a dp3 policy? Web a dp1 policy is a basic form of insurance for vacant homes and rental properties that is more limited than dp2 and dp3 policies. It’s fun fact friday and today we’ll take. Of course, if the duplex or townhome in question is also your residence, you’re going to want to look into an ho3 homeowners policy. Web the three most common rental insurance policies are the dp1, dp2, and dp3. What is the difference between dp1, dp2, and dp3 vessels? Web compare the differences between dp1, dp2, and dp3 to determine which you need. To start your quote, enter your address below. Web a dp3 policy is one of the three policies under dwelling fire insurance policies. You’re not alone if you find yourself scratching your head, wondering what exactly sets these two policies apart. Also known as coverage a, this portion of your policy covers the main structure of a home as well as any attached structures. It is a named peril policy, and it only covers the actual cash value of damages resulting from a covered peril. One of the most important parts of a homeowners insurance policy is dwelling coverage. Web ellieb / check the difference. Dp3 policy guide to landlord insurance. Web what’s the difference between a dp1 and a dp3 policy? The key differences between these policies are the types of coverage offered, the number of perils covered, and how they settle claims. Notably, water damage from appliances or pipes isn’t covered, and that can be a potentially big gap in your coverage. Web the answer really depends on your situation.

Dp1 Dp2 Dp3 Insurance Comparison Chart Best Picture Of Chart

Dp1 Dp2 Dp3 Insurance Parison Charts Reviews Of Chart

Homeowners Insurance Comparison Chart Hot Sex Picture

Resources Ricci Insurance Group

.png)

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

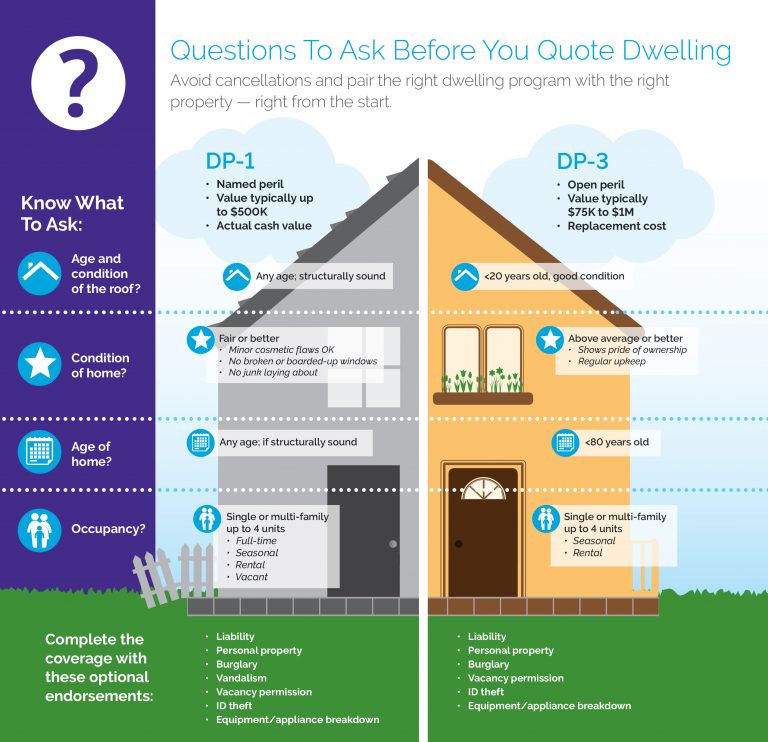

DP1 and DP3 comparison chart American Modern Insurance Agents

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

HO1,2,3,4,5,6,8 Home Insurance Policies YouTube

Michelle Ferrigno, Insurance Agent Coverages Explained 'Landlord

Kingstone Landlord Insurance A Complete Guide

Obie Offers Quotes For All Three And Can Help You Secure The Right Coverage.

Dp1, Dp2, And Dp3 Policies Are Commonly Referred To As Dwelling Fire Policies.

Web The Premium Difference Between A Dp1 And Dp3 Policy Can Vary Significantly Based On The Insured Property's Value, Location, Age, And Other Risk Factors.

It Is An Open Peril Policy, Covering All Perils Unless The Insurer Has Stated Specific Exclusions.

Related Post: