Fhlb Rate History Chart

Fhlb Rate History Chart - Web historic fixed rate advance information. Millions of dollars, not seasonally adjusted. Capital bank, na fhlb 1 yr fixed rate data. Web #rate set at and available until 3:00 pm; Web the federal home loan bank (fhlb) system was created by the federal home loan bank act of 1932 as a government sponsored enterprise to support mortgage lending and. Web today's advance rates as of 5/23/2024 8:00 am (cst) a 2 bps surcharge will be applied to symmetrical prepay advances. Web 521 economic data series with tag: Fhlb advances (qbpbstlkfhlb) from q1 1984 to q4 2023 about advances,. The values shown are daily data published by the federal reserve board based on the average yield of a. This screen does not constitute an offer to sell or a solicitation of an offer to. 30 years 4.94% 5.04% 4.89% 4.83% 4.93% 4.77% 4.77% 4.87% 4.71% 4.72% 4.82% 4.66% 4.70% 4.80% 4.64% 4.65% 4.75% 4.59% 4.62%. We offer members competitive rates on advances so they can make intelligent borrowing decisions. Visit our solutions page on fhlbc.com for terms and conditions. All results will be downloaded in excel. We are happy to make a select sample. 30 years 4.94% 5.04% 4.89% 4.83% 4.93% 4.77% 4.77% 4.87% 4.71% 4.72% 4.82% 4.66% 4.70% 4.80% 4.64% 4.65% 4.75% 4.59% 4.62%. The values shown are daily data published by the federal reserve board based on the average yield of a. Web mortgage partnership finance, mpf, mpf xtra and empf are registered trademarks of the federal home loan bank of chicago.. Web the information provided on this screen is subject to the disclaimer on our home page. Web the federal home loan bank (fhlb) system was created by the federal home loan bank act of 1932 as a government sponsored enterprise to support mortgage lending and. Call 844.fhl.bank (844.345.2265) or click the button below to connect with an fhlb dallas. We. Web 521 economic data series with tag: This screen does not constitute an offer to sell or a solicitation of an offer to. A member services associate is ready to serve you. Web #rate set at and available until 3:00 pm; Web utilize our rate history search tool to download historical advance rate data from 2012 to present. Web in q1 2024, “unrealized losses” on securities held by commercial banks increased by $39 billion (or by 8.1%) from q4, to a cumulative loss of $517 billion. This screen does not constitute an offer to sell or a solicitation of an offer to. 1y | 5y | 10y | max. (may 22, 2024) — mortgage applications increased 1.9 percent. A member services associate is ready to serve you. 30 years 4.94% 5.04% 4.89% 4.83% 4.93% 4.77% 4.77% 4.87% 4.71% 4.72% 4.82% 4.66% 4.70% 4.80% 4.64% 4.65% 4.75% 4.59% 4.62%. The values shown are daily data published by the federal reserve board based on the average yield of a. Web 521 economic data series with tag: (may 22, 2024) —. Web view a comprehensive chart on the term, interest rate, interest rate day count and availability for the different types of short term advances. Check out today’s rates and historical advance. Call 844.fhl.bank (844.345.2265) or click the button below to connect with an fhlb dallas. Fhlb advances (qbpbstlkfhlb) from q1 1984 to q4 2023 about advances,. Millions of dollars, not. Call 844.fhl.bank (844.345.2265) or click the button below to connect with an fhlb dallas. Web 521 economic data series with tag: We offer members competitive rates on advances so they can make intelligent borrowing decisions. 1y | 5y | 10y | max. The values shown are daily data published by the federal reserve board based on the average yield of. The values shown are daily data published by the federal reserve board based on the average yield of a. All results will be downloaded in excel. Downloadable data is available in excel and pdf. Web 521 economic data series with tag: Web #rate set at and available until 3:00 pm; Simply follow the instructions provided for each step and select a specific date range, product type and term(s). Web utilize our rate history search tool to download historical advance rate data from 2012 to present. Web historic fixed rate advance information. Web #rate set at and available until 3:00 pm; A member services associate is ready to serve you. Simply follow the instructions provided for each step and select a specific date range, product type and term(s). Capital bank, na fhlb 1 yr fixed rate data. Downloadable data is available in excel and pdf. Call 844.fhl.bank (844.345.2265) or click the button below to connect with an fhlb dallas. Download, graph, and track economic data. (may 22, 2024) — mortgage applications increased 1.9 percent from one week earlier, according to data. The values shown are daily data published by the federal reserve board based on the average yield of a. Regular dividend adjusted rate * cia; Fhlb advances (qbpbstlkfhlb) from q1 1984 to q4 2023 about advances,. Mar 7, 2024 3:33 pm cst. Web the federal home loan bank (fhlb) system was created by the federal home loan bank act of 1932 as a government sponsored enterprise to support mortgage lending and. Web graph and download economic data for balance sheet: Web today's advance rates as of 5/23/2024 8:00 am (cst) a 2 bps surcharge will be applied to symmetrical prepay advances. Web historic fixed rate advance information. All results will be downloaded in excel. Web mortgage partnership finance, mpf, mpf xtra and empf are registered trademarks of the federal home loan bank of chicago.

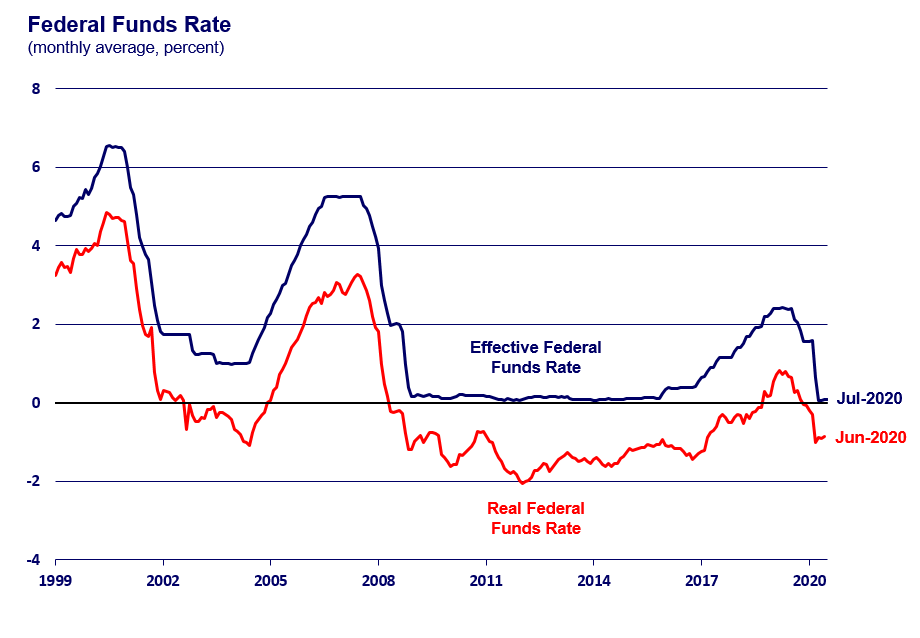

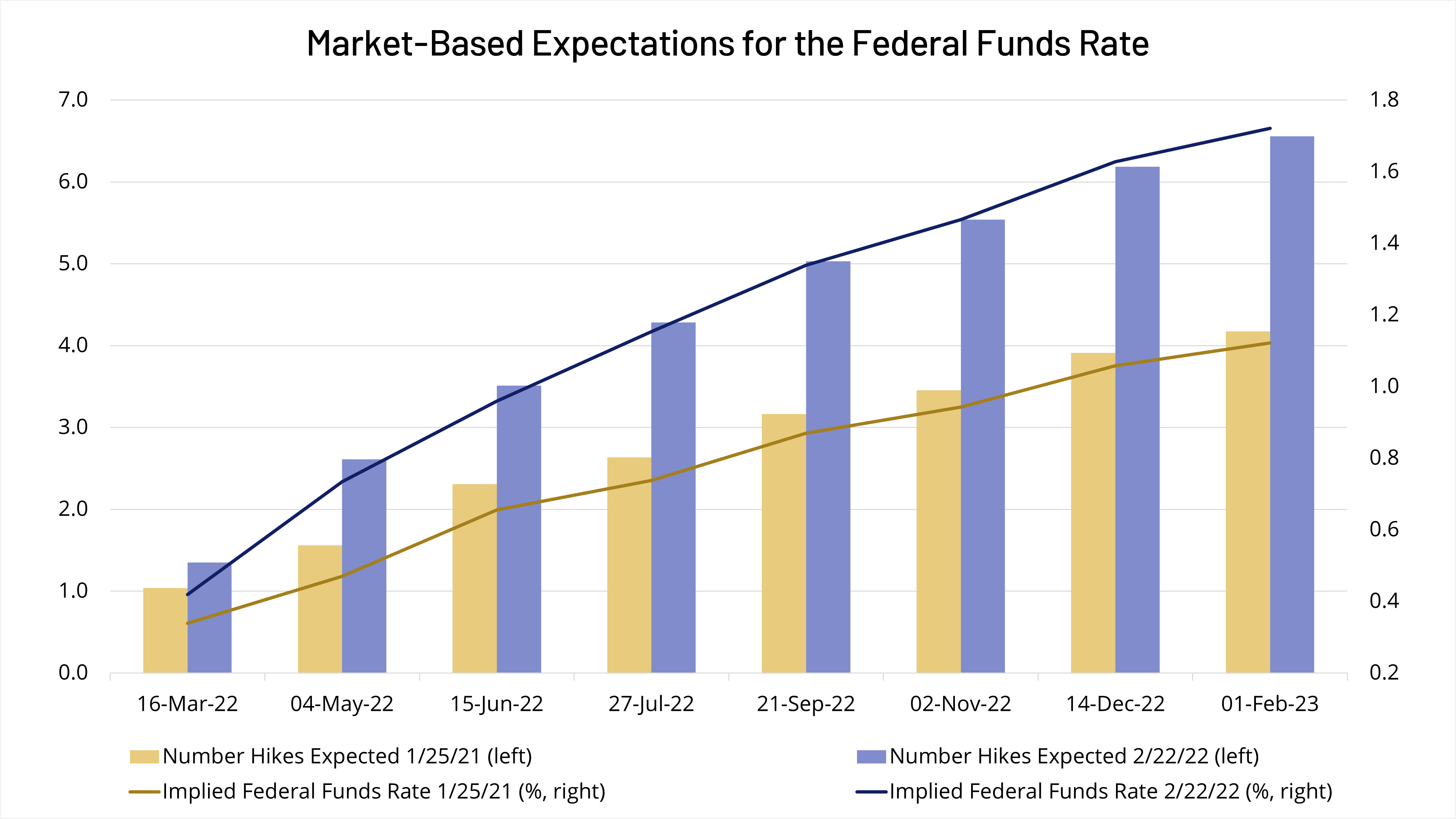

The Federal Funds Rate Federal Reserve Bank of Chicago

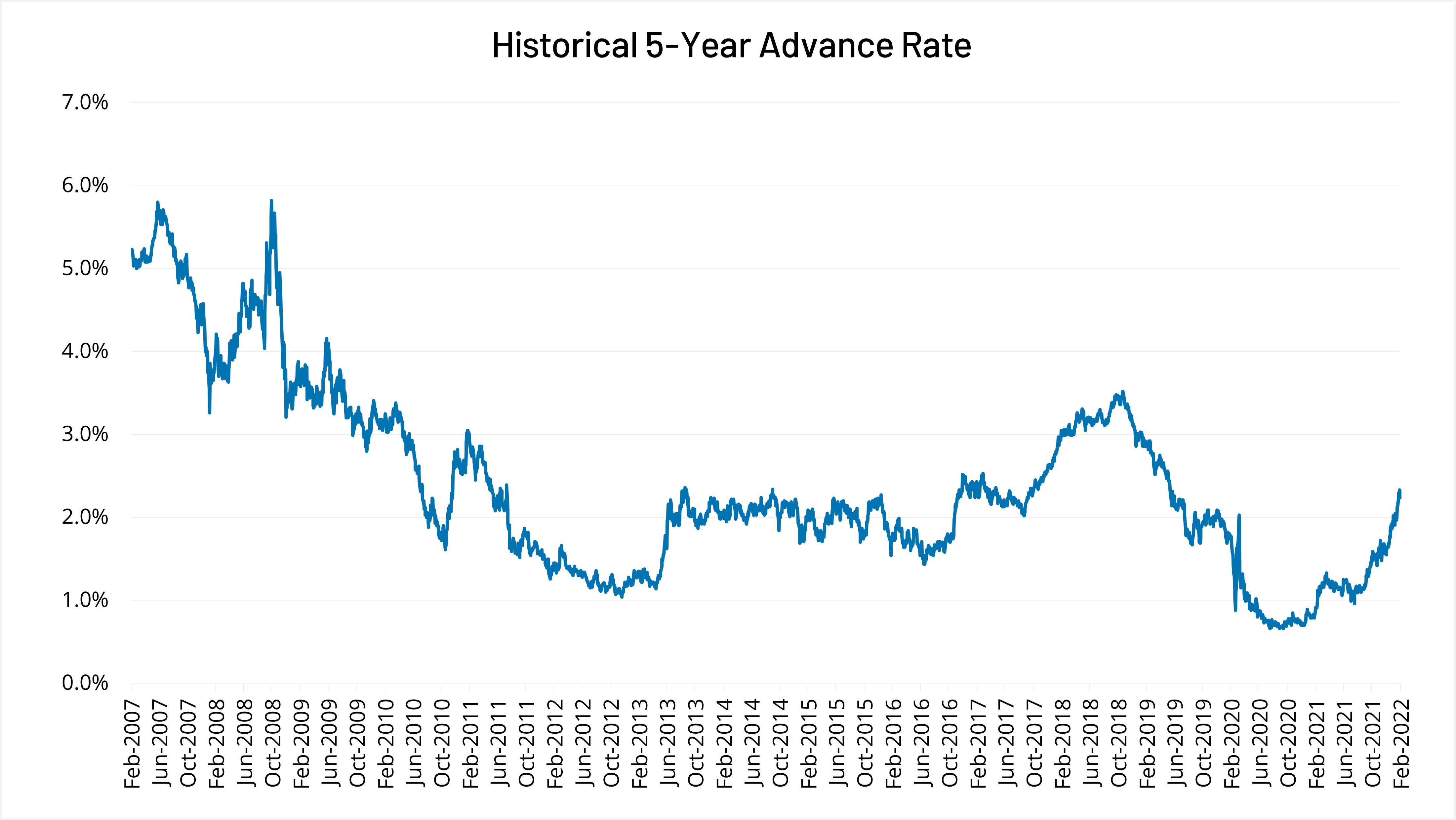

Be Prepared for a New Point in the Interest Rate Cycle Federal Home

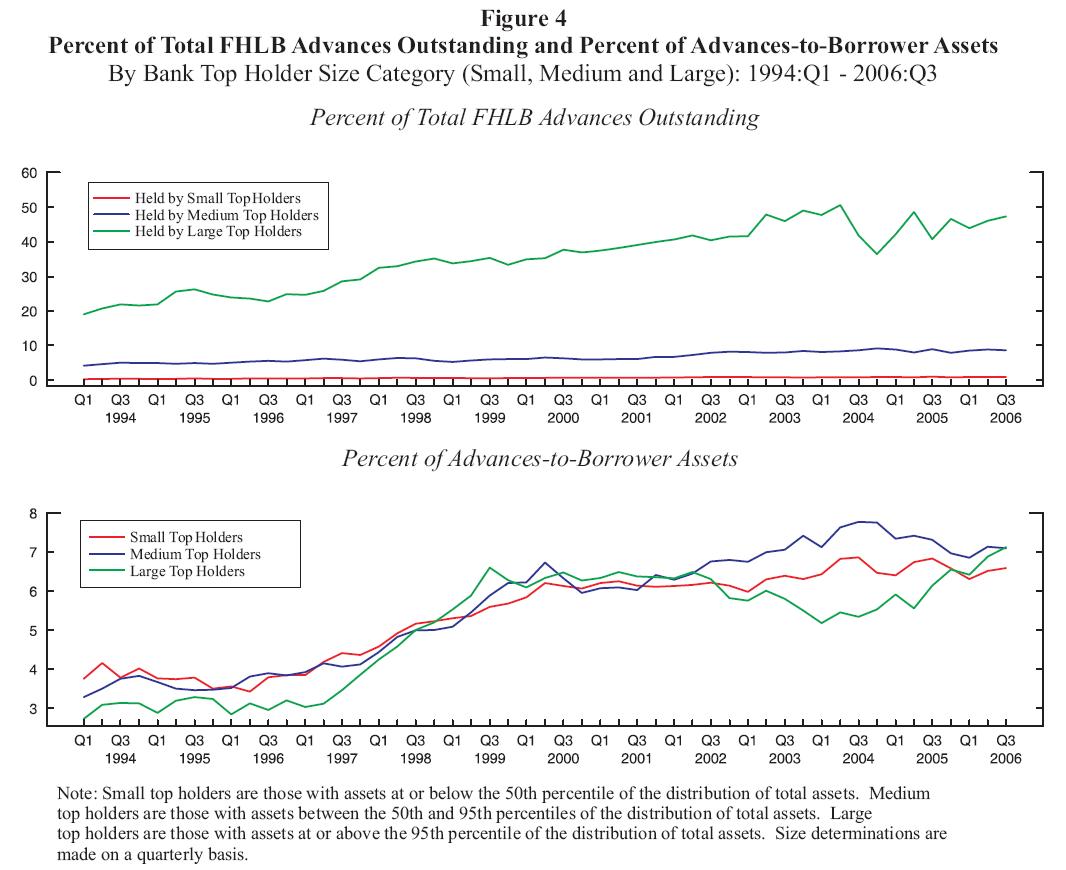

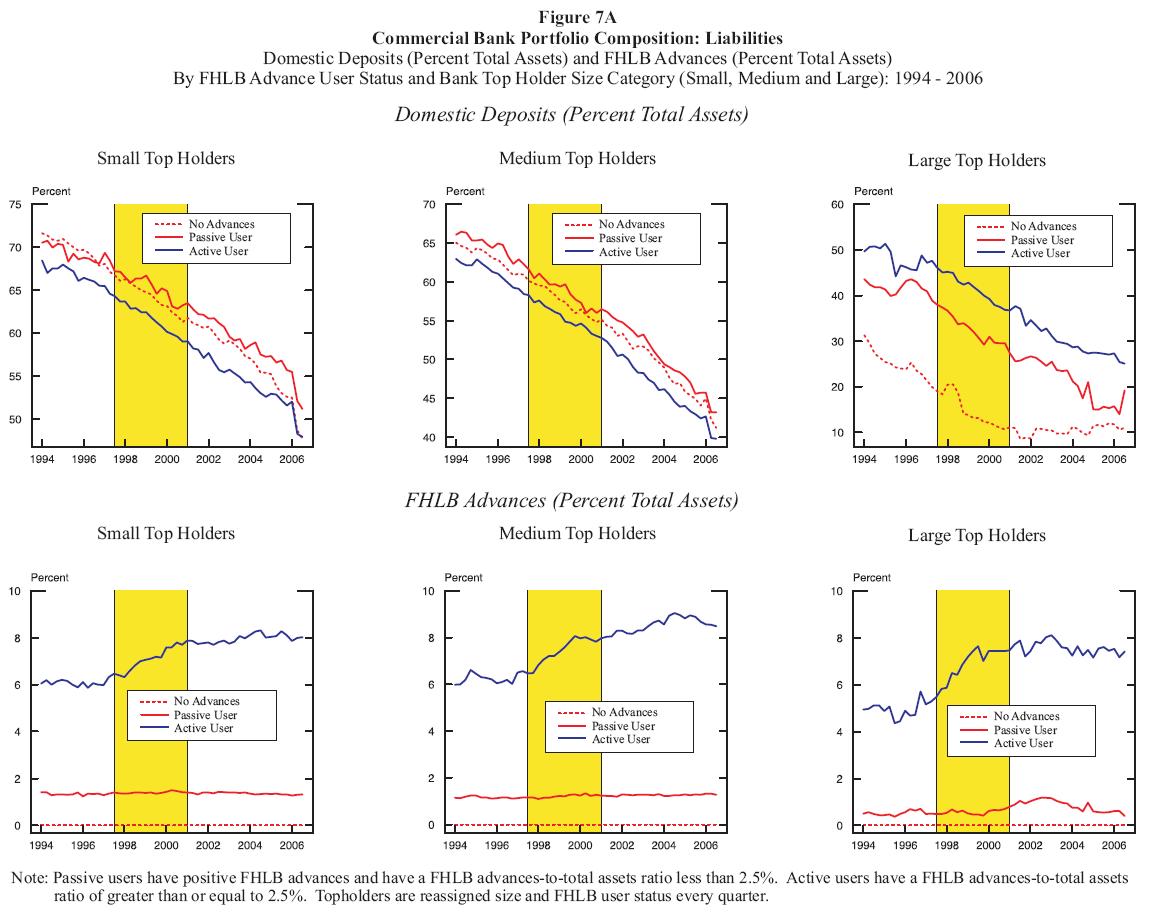

FRB Finance and Economics Discussion Series Screen Reader Version

Financing Gas Stations

Be Prepared for a New Point in the Interest Rate Cycle Federal Home

Fhlb Rate History Chart

FRB Finance and Economics Discussion Series Screen Reader Version

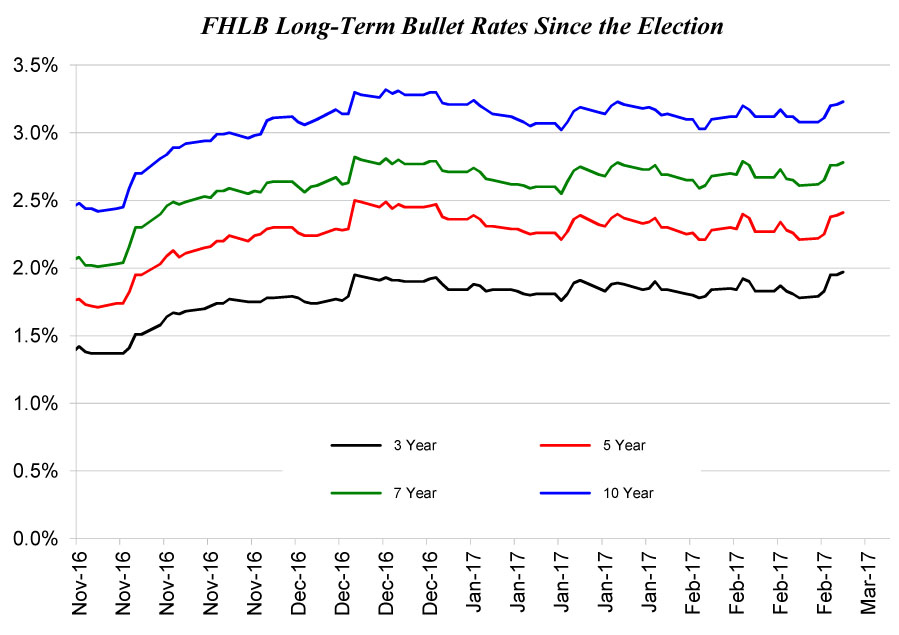

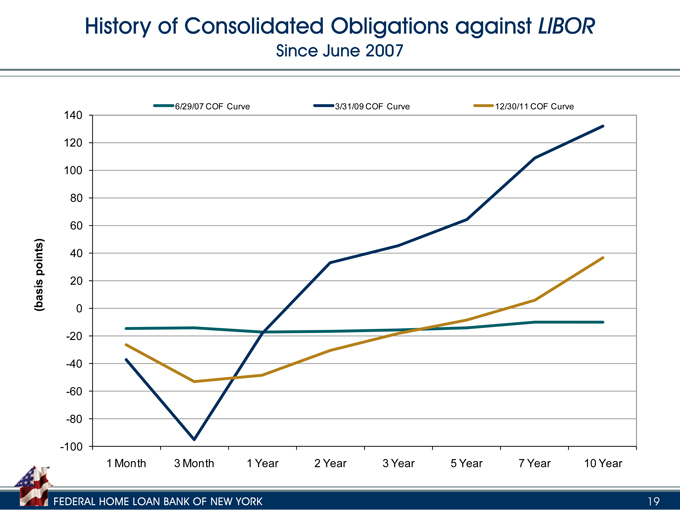

Federal Home Loan Bank of New York FORM 8K EX99.2 FHLBNY MEMBER

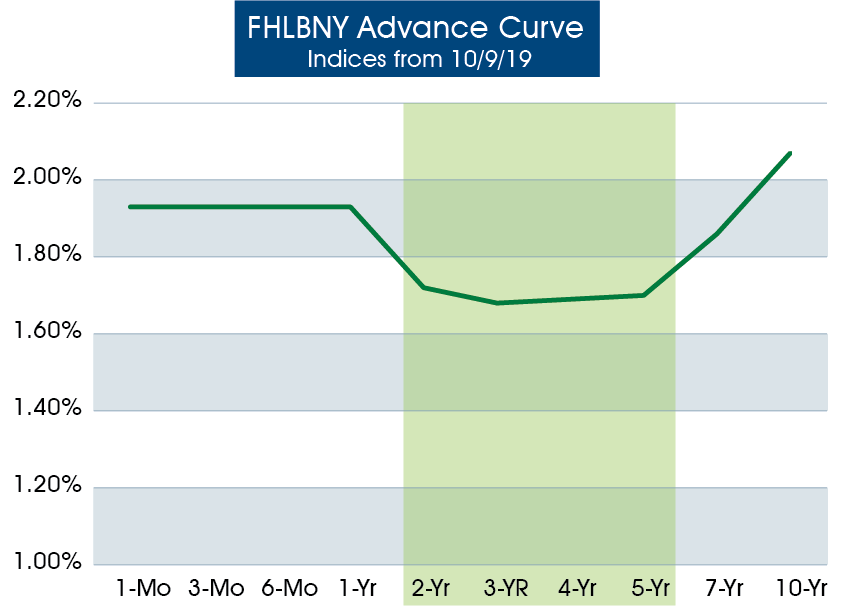

Member Advantage Federal Home Loan Bank of New York

Chứng khoán Mỹ đang tăng sau khi dữ liệu lạm phát thúc đẩy lên hy vọng

Visit Our Solutions Page On Fhlbc.com For Terms And Conditions.

Millions Of Dollars, Not Seasonally Adjusted.

Web In Q1 2024, “Unrealized Losses” On Securities Held By Commercial Banks Increased By $39 Billion (Or By 8.1%) From Q4, To A Cumulative Loss Of $517 Billion.

We Offer Members Competitive Rates On Advances So They Can Make Intelligent Borrowing Decisions.

Related Post: