Flsa Exemption Test Flow Chart

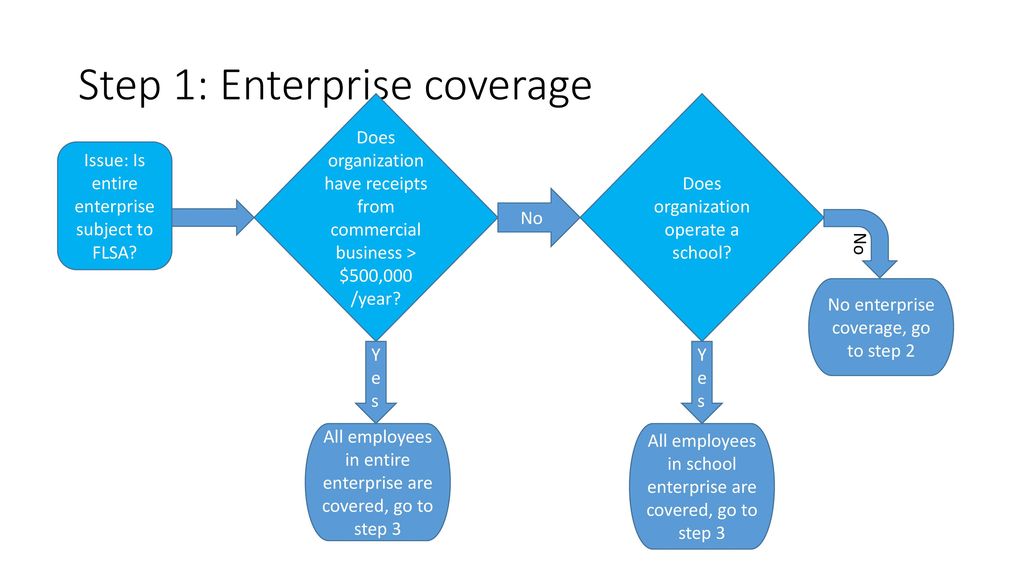

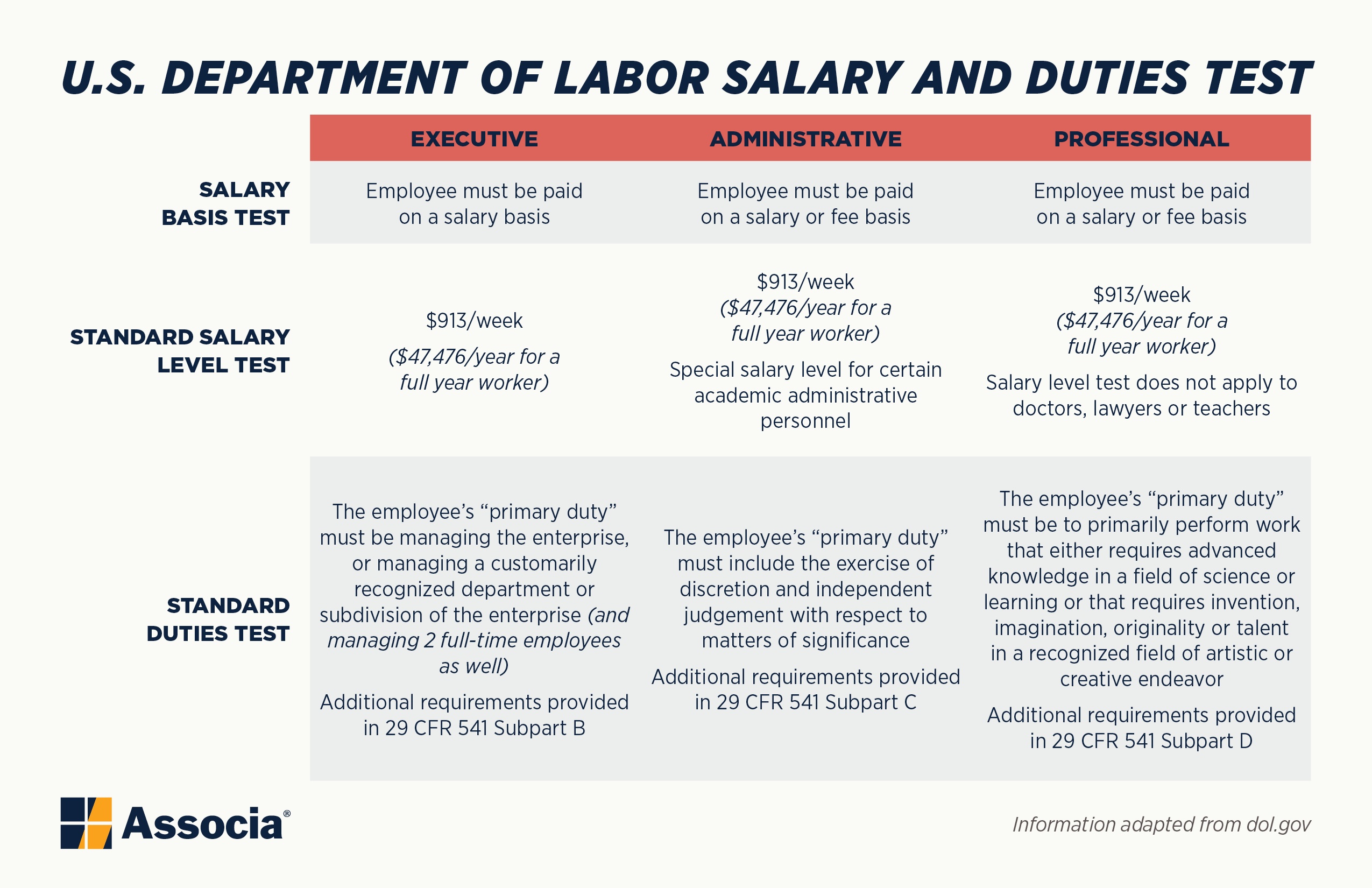

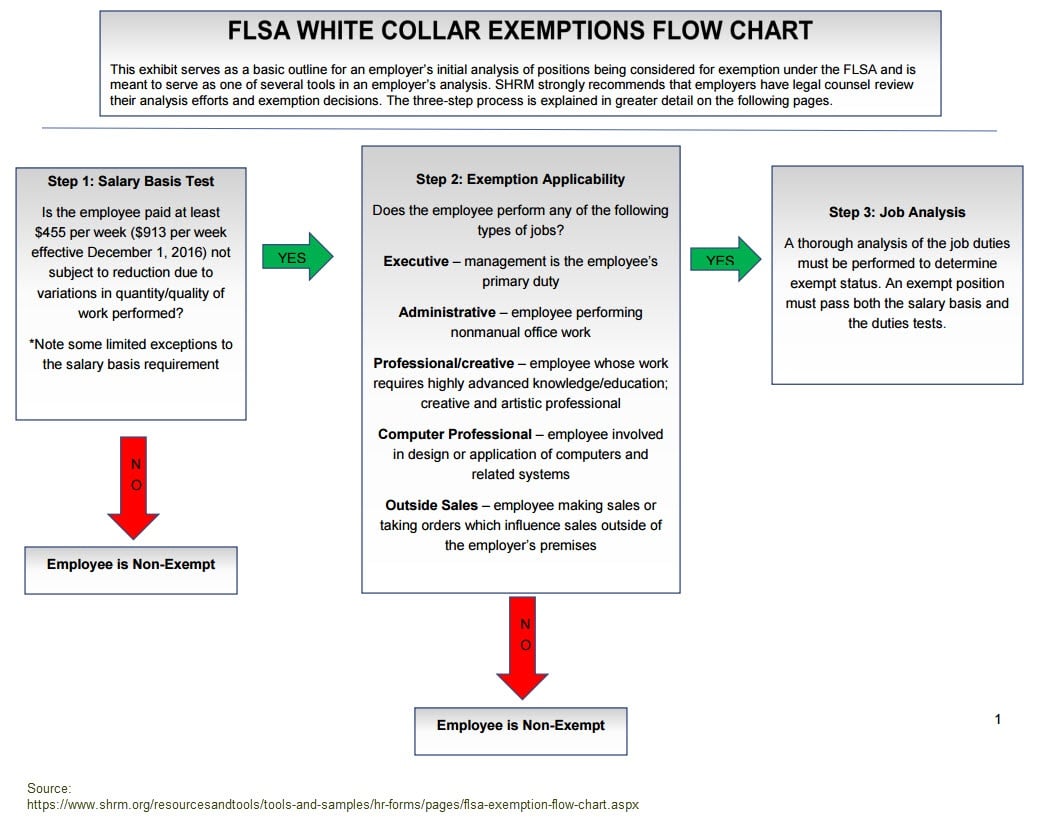

Flsa Exemption Test Flow Chart - Web employer's flsa exemption guide. For positions that are currently exempt and whose salary will be less than $35,568 on january 1, 2020, evaluate hours. Click on this button to download/view the. This simplified chart is neither a definitive guide nor legal advice. Please consult with an attorney regarding your specific. Web a basic outline for an employer's initial analysis of positions being considered for exemption under the flsa. The employee must be compensated on a salary basis (as defined in. Does the employee earn a salary of at least $455.00 per week? This guide explains those exemptions and includes a flow chart to help. Work from left to right, following the arrows to help determine. Flowchart—determining exemption status under the flsa’s final regulations. This simplified chart is neither a definitive guide nor legal advice. Click on this button to download/view the. Web employer's flsa exemption guide. Please consult with an attorney regarding your specific. Web an exempt position must pass both the salary basis and the duties tests. Please consult with an attorney regarding your specific. Executive, teaching, professional, administrative, and computer exemption tests. Web this flow chart provides general information on the exemption from minimum wage and overtime pay provided by section 13(a)(1) of the fair labor standards act as defined by. If. To qualify for the executive employee exemption, all of the following tests must be met: Executive, teaching, professional, administrative, and computer exemption tests. Federal law provides that certain employees may be. Web flow chart for professional exemption: Does the employee earn at least $455 per week paid on a salary. Web use this flow chart to walk through the steps for determining exemption status under the current flsa regulations. For positions that are currently exempt and whose salary will be less than $35,568 on january 1, 2020, evaluate hours. Work from left to right, following the arrows to help determine. 1, 2025, the total compensation threshold will increase to $151,164,. Web a basic outline for an employer's initial analysis of positions being considered for exemption under the flsa. If no, then employee is not exempt and is subject to. 1, 2025, the total compensation threshold will increase to $151,164, which includes at least $1,128 per week paid on a salary basis. Employees must be paid a predetermined and. Generally recognized. Executive, teaching, professional, administrative, and computer exemption tests. 1, 2025, the total compensation threshold will increase to $151,164, which includes at least $1,128 per week paid on a salary basis. Web flow chart for professional exemption: Work from left to right, following the arrows to determine if the. Web answered yes to all questions, and should be marked as exempt. 1, 2025, the total compensation threshold will increase to $151,164, which includes at least $1,128 per week paid on a salary basis. Federal law provides that certain employees may be. Generally recognized fields of artistic or creative endeavor include positions within music, writing and acting. Web use this flow chart to walk through the steps for determining exemption status under. Web flsa exemption test worksheet. Flowchart—determining exemption status under the flsa’s final regulations. The employee must be compensated on a salary basis (as defined in. The computer professional exemption has a salary basis test of $455 per week or $27.63 per hour. Federal law provides that certain employees may be. Does the employee earn a salary of at least $455.00 per week? Web an exempt position must pass both the salary basis and the duties tests. 1, 2025, the total compensation threshold will increase to $151,164, which includes at least $1,128 per week paid on a salary basis. This guide explains those exemptions and includes a flow chart to help.. Fair labor standards act (flsa) type: Web use this flow chart to walk through the steps for determining exemption status under the current flsa regulations. If you answered no to any of the questions, then the employee does not meet the definition for the. Web flsa exemption test worksheet. Please consult with an attorney regarding your specific. Refer to this section of 5 cfr when addressing. Web however, section 13(a)(1) of the flsa provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative,. Web an exempt position must pass both the salary basis and the duties tests. Web flow chart for professional exemption: Does the employee earn at least $455 per week paid on a salary. Web use this flow chart to walk through the steps for determining exemption status under the current flsa regulations. Web answered yes to all questions, and should be marked as exempt. If you answered no to any of the questions, then the employee does not meet the definition for the. The employee must be compensated on a salary basis (as defined in. Web employee qualifying for exemption performs minimal routine work. The burden of proof is on the employer, as all work is. Web flow chart for flsa coverage and exemption analysis. The flsa determines when overtime must be paid to an employee. Generally recognized fields of artistic or creative endeavor include positions within music, writing and acting. Work from left to right, following the arrows to help determine. Web this flow chart provides general information on the exemption from minimum wage and overtime pay provided by section 13(a)(1) of the fair labor standards act as defined by.

Flow Chart for FLSA Coverage and Exemption Analysis ppt download

Flsa Flow Chart Exemption Status

Flsa Exemption Test Flow Chart

Flow Chart for FLSA Coverage and Exemption Analysis ppt download

Exempt vs. Nonexempt Employees What’s the Difference?

What Is FLSA Status? AIHR HR Glossary

FLSA Overtime Fact Sheet HR Guide to Exemptions

FLSA Exemption Determination Checklist Learned Professional Exemption

FLSA Exemptions Update Commission Salespeople, Executives & Overtime

FLSA EXEMPTIONS FLOW CHART PDF Free Download

Flowchart—Determining Exemption Status Under The Flsa’s Final Regulations.

Does The Employee Earn A Salary Of At Least $455.00 Per Week?

Work From Left To Right, Following The Arrows To Determine If The.

Web Flsa Exemptions Flow Chart.

Related Post: