Free Macd Charts

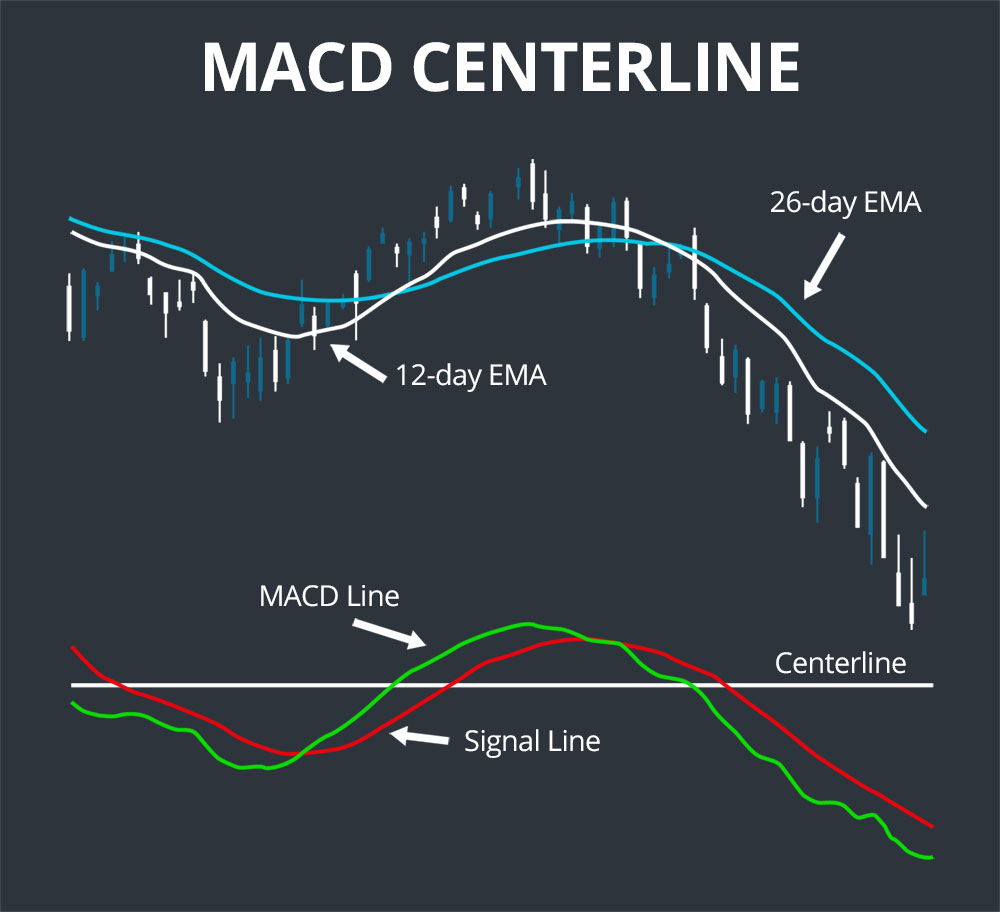

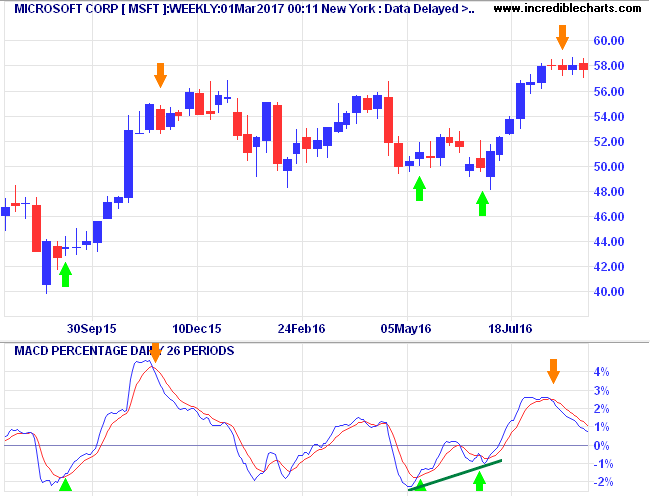

Free Macd Charts - The macd or “moving average convergence divergence” oscillator assists in indicating. It helps to predict potential shifts in the. Web create advanced interactive price charts for free, with a wide variety of chart types, technical indicators, overlays, and annotation tools. On this week's edition of stock talk with joe rabil, joe shows a specific macd pattern that, when it develops on the monthly chart, can give a great. Are you an indicator trader? Moving average convergence / divergence (macd) the macd is an extremely popular indicator used in technical analysis. It can be used to identify aspects of a. It is based on a macd line calculated by subtracting the. Although it is an oscillator, it is not typically used. We conducted 606,422 test trades to find the best settings and trading strategies. It calculates the rsi on a. It is based on a macd line calculated by subtracting the. Web the macd indicator was developed by gerald appel in the late 70s and is used to indicate both trends and momentum. Web the macd on rsi indicator combines elements of the moving average convergence divergence (macd) and the relative strength index (rsi).. It helps to predict potential shifts in the. It can be used to identify aspects of a. Watch to learn how the macd indicator can help you measure a stock's momentum and identify potential buy and sell signals. This method is computed by taking two moving. Web the macd indicator was developed by gerald appel in the late 70s and. The macd or “moving average convergence divergence” oscillator assists in indicating. Web create advanced interactive price charts for free, with a wide variety of chart types, technical indicators, overlays, and annotation tools. Web the macd indicator was developed by gerald appel in the late 70s and is used to indicate both trends and momentum. Moving average convergence / divergence (macd). We conducted 606,422 test trades to find the best settings and trading strategies. Web create advanced interactive price charts for free, with a wide variety of chart types, technical indicators, overlays, and annotation tools. Are you an indicator trader? This method is computed by taking two moving. It calculates the rsi on a. On this week's edition of stock talk with joe rabil, joe shows a specific macd pattern that, when it develops on the monthly chart, can give a great. It is based on a macd line calculated by subtracting the. Although it is an oscillator, it is not typically used. The moving average convergence/divergence indicator is a momentum oscillator primarily used. Web the moving average convergence/divergence (macd), is used to indicated swings in the price of various stocks in the future. Web the macd indicator was developed by gerald appel in the late 70s and is used to indicate both trends and momentum. The macd or “moving average convergence divergence” oscillator assists in indicating. Web january 10, 2023 beginner. Moving average. Moving average convergence / divergence (macd) the macd is an extremely popular indicator used in technical analysis. Web the macd indicator was developed by gerald appel in the late 70s and is used to indicate both trends and momentum. On this week's edition of stock talk with joe rabil, joe shows a specific macd pattern that, when it develops on. Web the macd on rsi indicator combines elements of the moving average convergence divergence (macd) and the relative strength index (rsi). Web create advanced interactive price charts for free, with a wide variety of chart types, technical indicators, overlays, and annotation tools. It can be used to identify aspects of a. It calculates the rsi on a. Moving average convergence. Web the moving average convergence/divergence (macd), is used to indicated swings in the price of various stocks in the future. It is based on a macd line calculated by subtracting the. It can be used to identify aspects of a. Web the macd on rsi indicator combines elements of the moving average convergence divergence (macd) and the relative strength index. It is based on a macd line calculated by subtracting the. It helps to predict potential shifts in the. This method is computed by taking two moving. Are you an indicator trader? We conducted 606,422 test trades to find the best settings and trading strategies. It can be used to identify aspects of a. Watch to learn how the macd indicator can help you measure a stock's momentum and identify potential buy and sell signals. Moving average convergence / divergence (macd) the macd is an extremely popular indicator used in technical analysis. This method is computed by taking two moving. Are you an indicator trader? On this week's edition of stock talk with joe rabil, joe shows a specific macd pattern that, when it develops on the monthly chart, can give a great. We conducted 606,422 test trades to find the best settings and trading strategies. Web the moving average convergence/divergence (macd), is used to indicated swings in the price of various stocks in the future. The macd or “moving average convergence divergence” oscillator assists in indicating. Web the macd indicator was developed by gerald appel in the late 70s and is used to indicate both trends and momentum. It helps to predict potential shifts in the. It calculates the rsi on a. Although it is an oscillator, it is not typically used. Web create advanced interactive price charts for free, with a wide variety of chart types, technical indicators, overlays, and annotation tools.![MACD Divergence Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/macd-divergence-cheat-sheet-860x608.png)

MACD Divergence Cheat Sheet [FREE Download] HowToTrade

MACD (Moving Average Convegence Divergence) Guide for Traders

The MACD Works/ Charts inside.

Intraday Trading Guide MACD indicator Meaning And Calculation Formula

Macd Stock Charts DSEBD

MACD on Chart Indicator For MT4 Download Best Forex Indicator

Best MACD Settings For 1 Minute Chart and Scalping

MACD Moving Average Convergence Divergence Free PDF Guide

MACD Moving Average Convergence Divergence Free PDF Guide

How to use the MACD Indicator Effectively Pro Trading School

The Moving Average Convergence/Divergence Indicator Is A Momentum Oscillator Primarily Used To Trade Trends.

It Is Based On A Macd Line Calculated By Subtracting The.

Web The Macd On Rsi Indicator Combines Elements Of The Moving Average Convergence Divergence (Macd) And The Relative Strength Index (Rsi).

Web January 10, 2023 Beginner.

Related Post: