Illinois Workers Compensation Rate Chart

Illinois Workers Compensation Rate Chart - Web the current state average weekly wage, as of january 15, 2023, is $1,386.15. The saww sets the maximum and minimum. Web every six months, the illinois department of employment security publishes the statewide average weekly wage (saww). State average wage (saww) & wage differential max after 2/1/06. Web the ttd rate is equal to 100% of employee’s aww or the above minimum, whichever is less. The saww sets the maximum and minimum weekly benefit levels for workers' compensation. Web for your convenience, we have created a table that details the temporary total disability (ttd) and death benefits rates, as well as permanent partial disability. Disability, man as a whole disfigurement thumb first (index) finger second (middle) finger third (ring) finger fourth (little) finger great toe each other toe hand arm arm, amputation above elbow arm, amputation at shoulder joint foot leg leg, amputation above knee leg, amputation at hip joint eye eye, enucleation of. Insurance companies may be able to apply discounts and policy credits on workers' comp coverage. Web welcome to the illinois workers' compensation commission. How much do workers’ compensation claims cost? By comparison, that’s approximately $350 higher than the maximum from 2019. To calculate the saww, total wages are divided. Web learn what workers’ compensation benefits you might be entitled to receive and what your 2024 illinois workers’ comp settlement could be worth. Web for your convenience, we have created a table that details. Rate cards view all > reference guides view all > seminar books view all > webinars view all > rate cards. The saww sets the maximum and minimum. Ttd minimums will increase annually as state minimum wage increases up to $15.00 by 1/1/2025. The illinois minimum wage increased to $13.00 on january 1, 2023. Insurance companies may be able to. Rate cards view all > reference guides view all > seminar books view all > webinars view all > rate cards. Handbook on workers' compensation and occupational diseases. How much do workers’ compensation claims cost? Web the current state mileage rate is: Workers’ compensation benefit rates are adjusted each year. Handbook on workers' compensation and occupational diseases. Effective 2/1/06, the maximum 8(d)1 (wage differential) award is equal to the saww, and the minimums are the same as the ttd minimums. Web 2021 illinois rate chart. Web learn what workers’ compensation benefits you might be entitled to receive and what your 2024 illinois workers’ comp settlement could be worth. To calculate. Employee controls subject to 820 ilc305/1, section 8(a). Web learn what workers’ compensation benefits you might be entitled to receive and what your 2024 illinois workers’ comp settlement could be worth. Wage differential awards capped at 67 years old or 5 years, whichever is greater. The saww sets the maximum and minimum. Web the ttd rate is equal to 100%. State average wage (saww) & wage differential max after 2/1/06. Effective 2/1/06, the maximum 8(d)1 (wage differential) award is equal to the saww, and the minimums are the same as the ttd minimums. Current state minimum wage is $11.00 an hour for 2021. Total compensation cannot exceed $500,000.00 or 25 years of benefits, whichever is greater. Web in illinois, there. For ppd, the current maximum was set july 1, 2022 and is valid for accidents through june 30,. Disability, man as a whole disfigurement thumb first (index) finger second (middle) finger third (ring) finger fourth (little) finger great toe each other toe hand arm arm, amputation above elbow arm, amputation at shoulder joint foot leg leg, amputation above knee leg,. Pracowniczych ubezpieczeń odszkodowawczych oraz chorób zawodowych. Web nearly every employer in illinois is required to carry workers’ compensation insurance in the event that an employee becomes hurt on the job. State average wage (saww) & wage differential max after 2/1/06. Workers’ compensation benefit rates are adjusted each year. That means that the ttd maximum rate for accidents on or after. Rate cards view all > reference guides view all > seminar books view all > webinars view all > rate cards. The saww sets the maximum and minimum. Chicago 10 south lasalle street suite 900 Employee controls subject to 820 ilc305/1, section 8(a). Web the current state average weekly wage, as of january 15, 2023, is $1,386.15. To calculate the saww, total wages are divided. Web 2021 illinois rate chart. Illinois rates are regulated by the illinois department of inssurance. Pracowniczych ubezpieczeń odszkodowawczych oraz chorób zawodowych. Web every six months, the illinois department of employment security publishes the statewide average weekly wage (saww). For ppd, the current maximum was set july 1, 2022 and is valid for accidents through june 30,. Web nearly every employer in illinois is required to carry workers’ compensation insurance in the event that an employee becomes hurt on the job. The illinois minimum wage increased to $13.00 on january 1, 2023. Web every six months, the illinois department of employment security publishes the statewide average weekly wage (saww). Workers' comp claim calculations depend on medical costs, lost income, and disability, capped by average weekly wages, injury severity, and earnings. Insurance companies may be able to apply discounts and policy credits on workers' comp coverage. Disability, man as a whole disfigurement thumb first (index) finger second (middle) finger third (ring) finger fourth (little) finger great toe each other toe hand arm arm, amputation above elbow arm, amputation at shoulder joint foot leg leg, amputation above knee leg, amputation at hip joint eye eye, enucleation of. Web the current state mileage rate is: Illinois rates are regulated by the illinois department of inssurance. Pracowniczych ubezpieczeń odszkodowawczych oraz chorób zawodowych. Web the illinois minimum wage increased to $14.00 on january 1, 2024. Medical care to treat the injury or illness. The saww sets the maximum and minimum. Web in illinois, there are several types of workers compensation benefits available including: To calculate the saww, total wages are divided. Handbook on workers' compensation and occupational diseases.

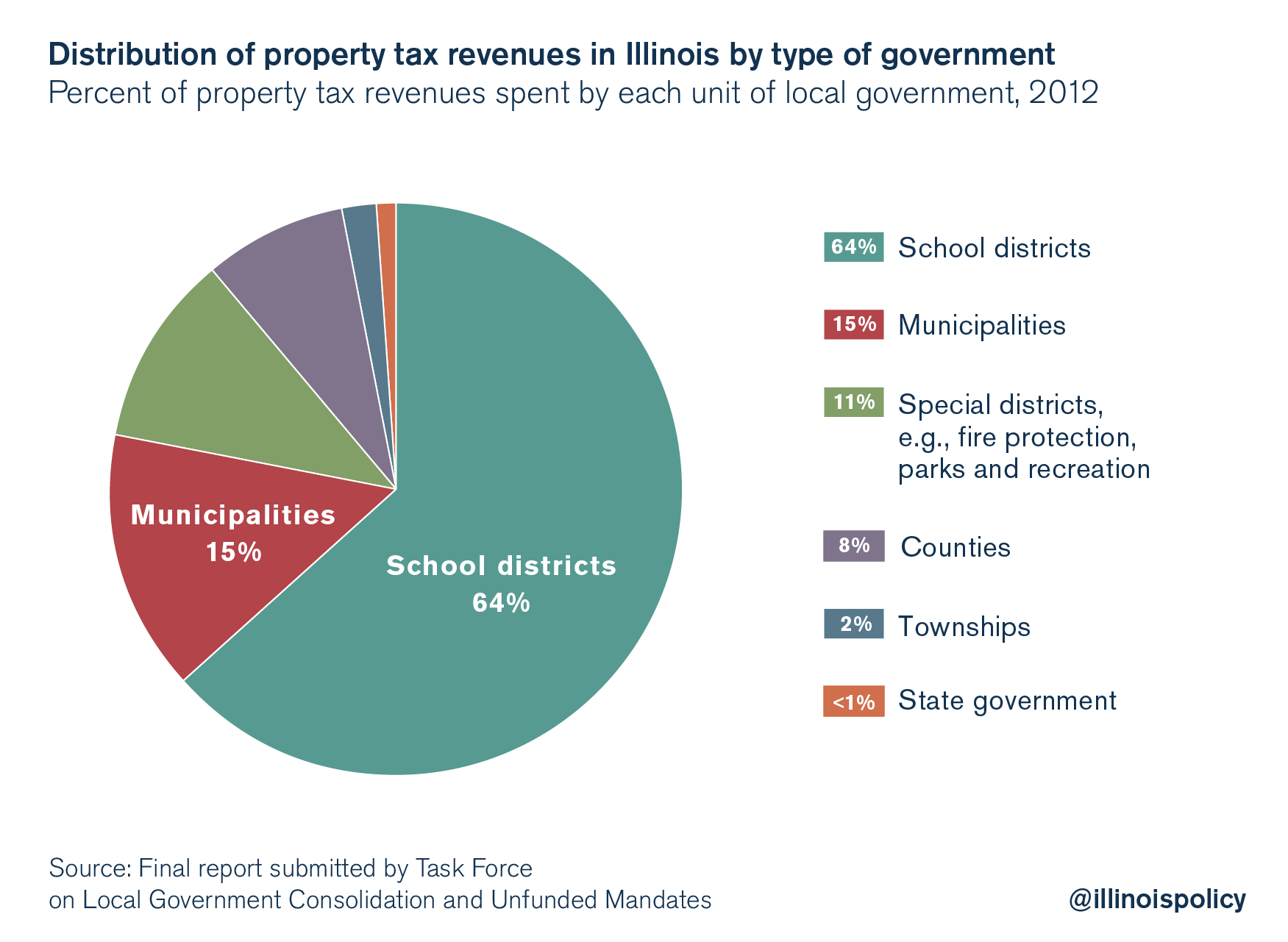

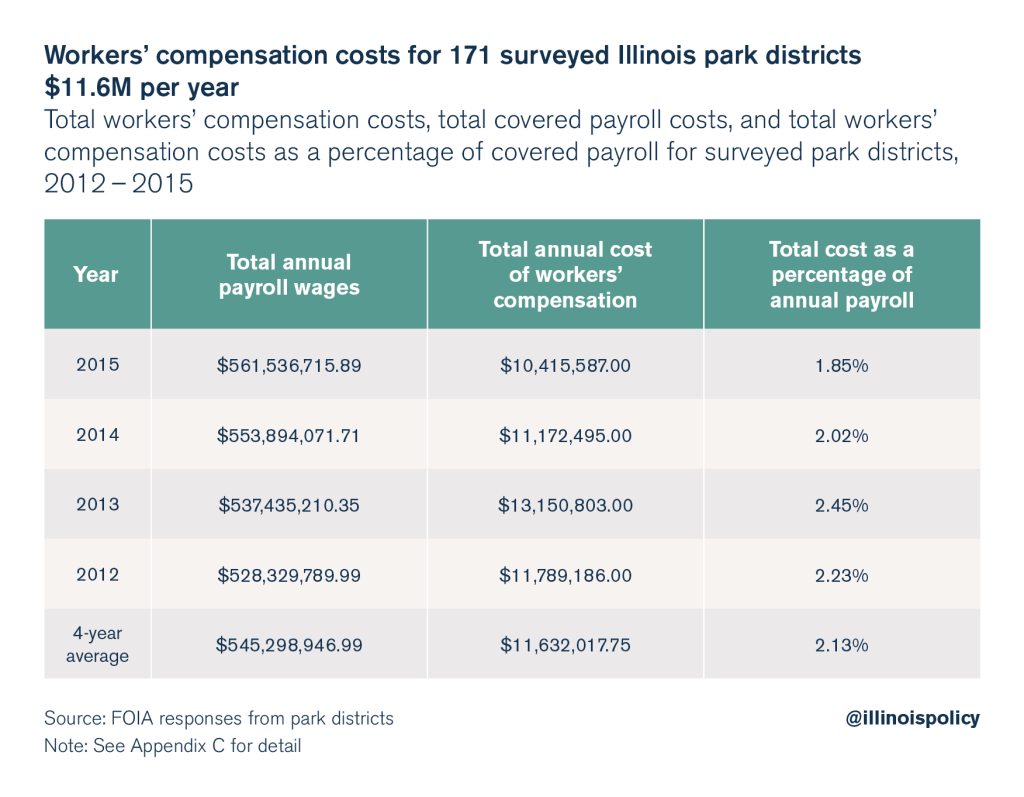

Workers’ compensation estimated to cost Illinois taxpayers nearly 1

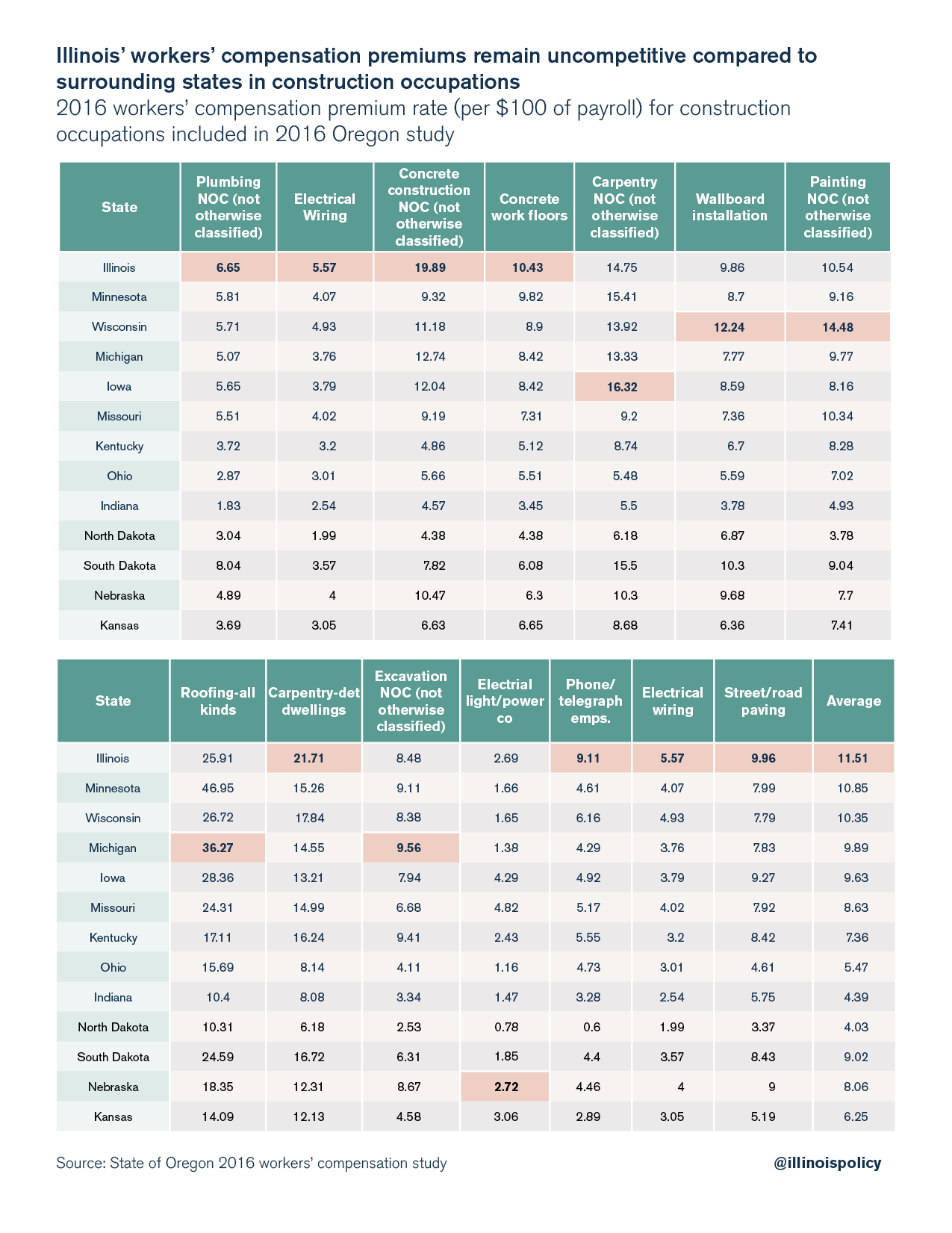

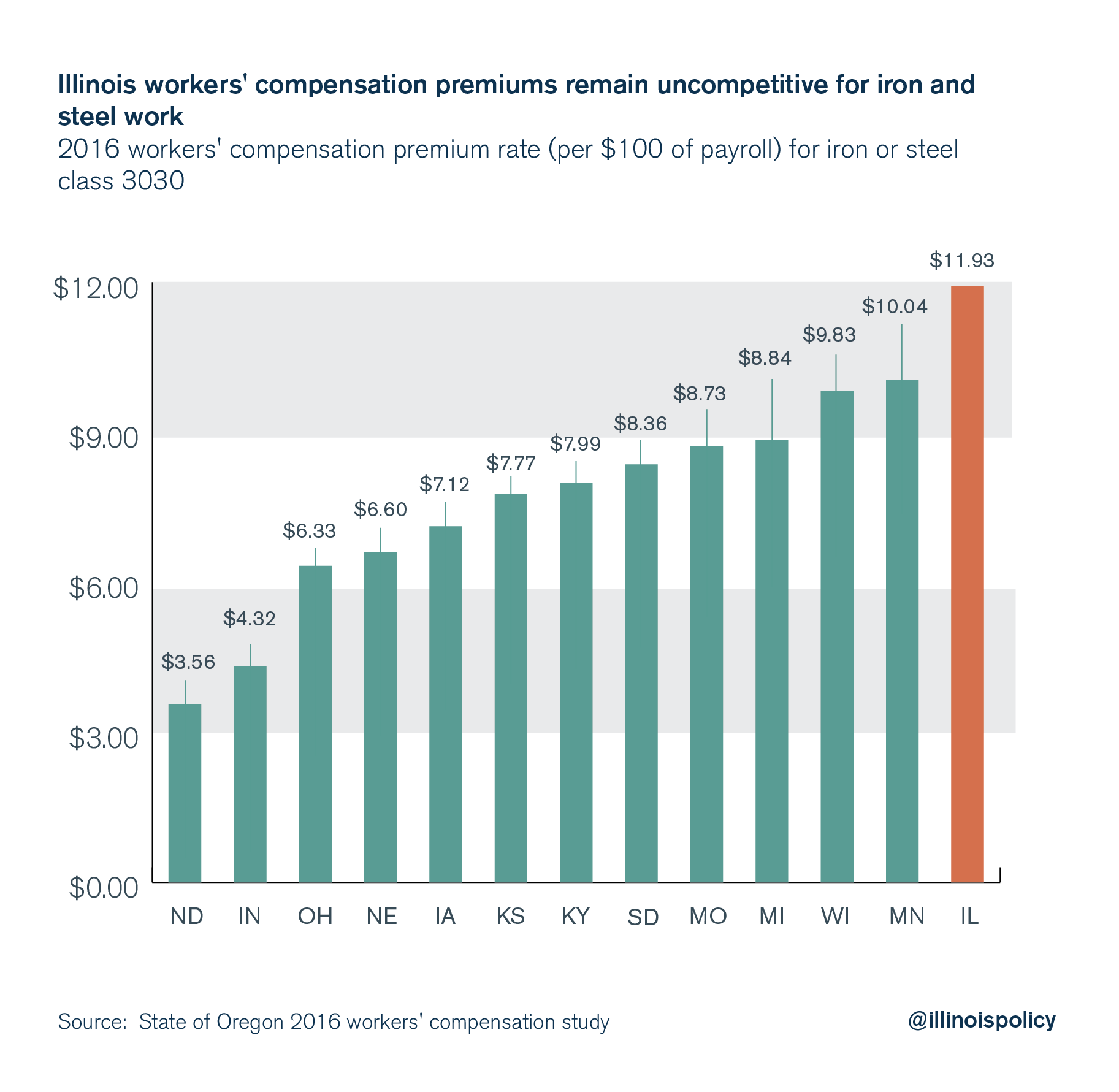

Illinois remains after 2011 workers’ compensation changes

Illinois remains after 2011 workers’ compensation changes

Illinois Workers' Compensation Body Chart

Illinois Workers' Compensation Body Chart

Workers’ compensation estimated to cost Illinois taxpayers nearly 1

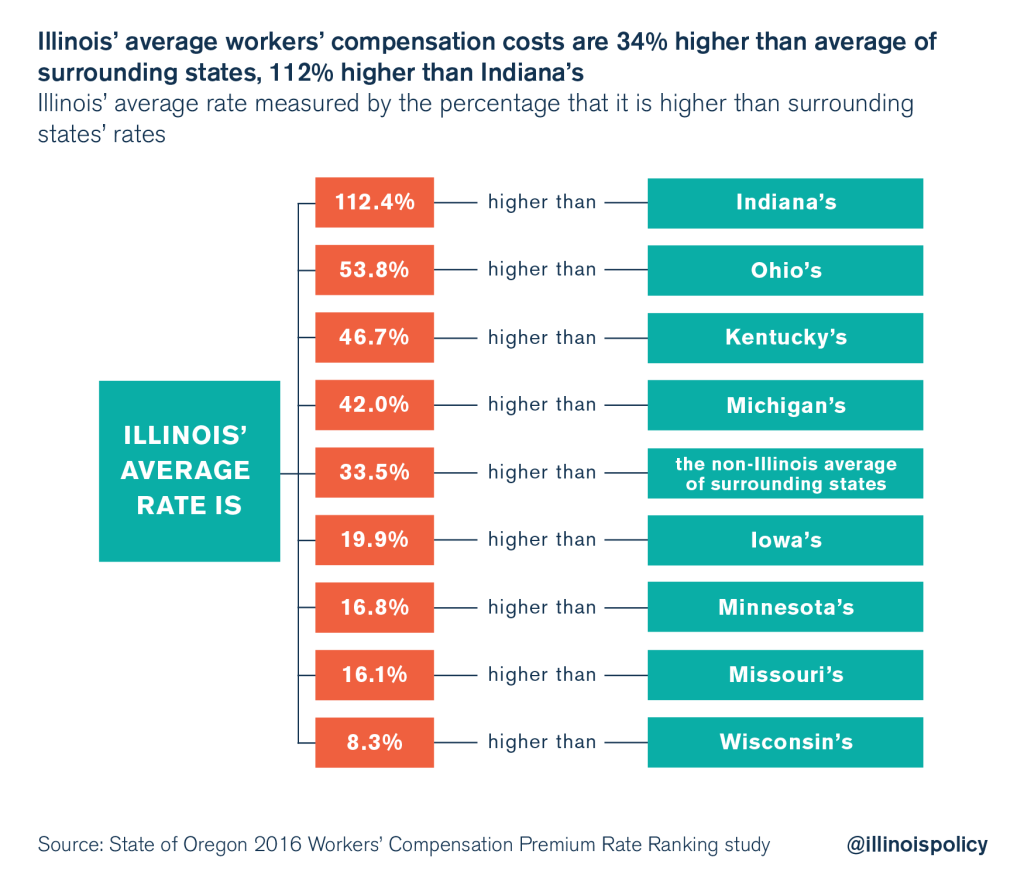

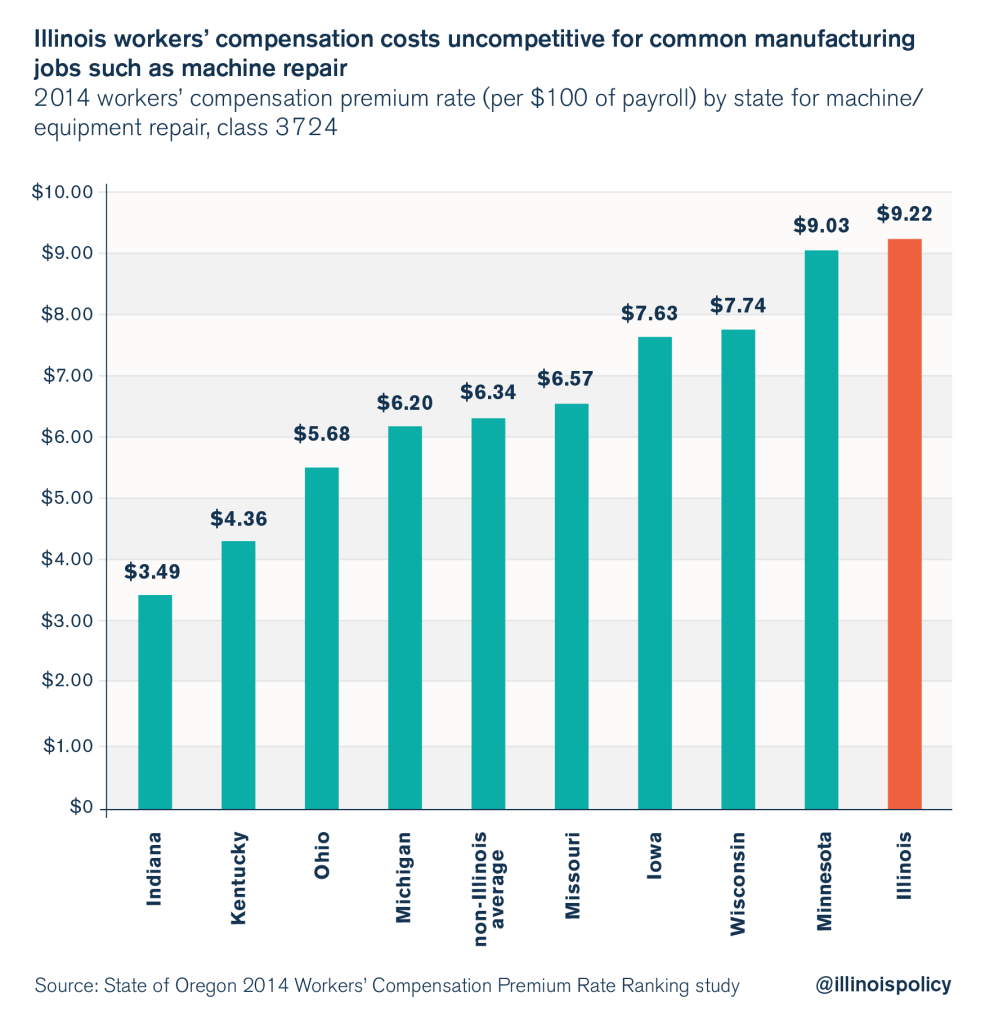

Illinois remains most expensive state in Midwest for workers

Illinois remains most expensive state in Midwest for workers

Workers comp and the value of limbs in Illinois, Indiana Crain's

Illinois Workers Compensation Body Chart

Ttd, Total & Permanent, Amputation.

The Saww Sets The Maximum And Minimum Weekly Benefit Levels For Workers' Compensation.

We Make It Our Priority To Keep Our Clients Apprised Of Changes In The Law.

By Comparison, That’s Approximately $350 Higher Than The Maximum From 2019.

Related Post: