Loan Constant Chart

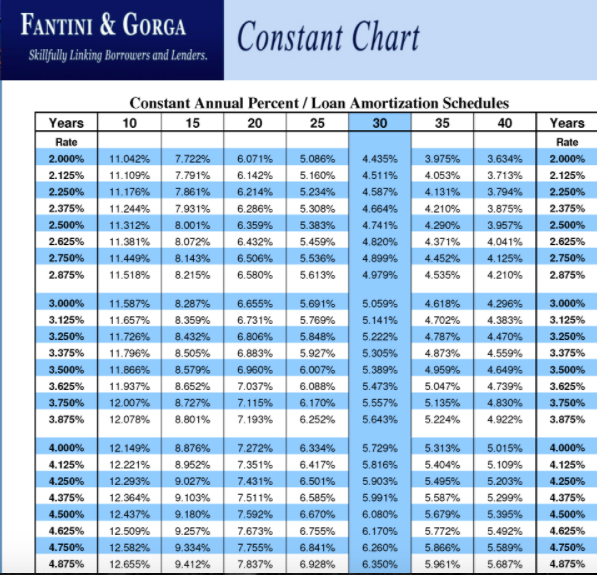

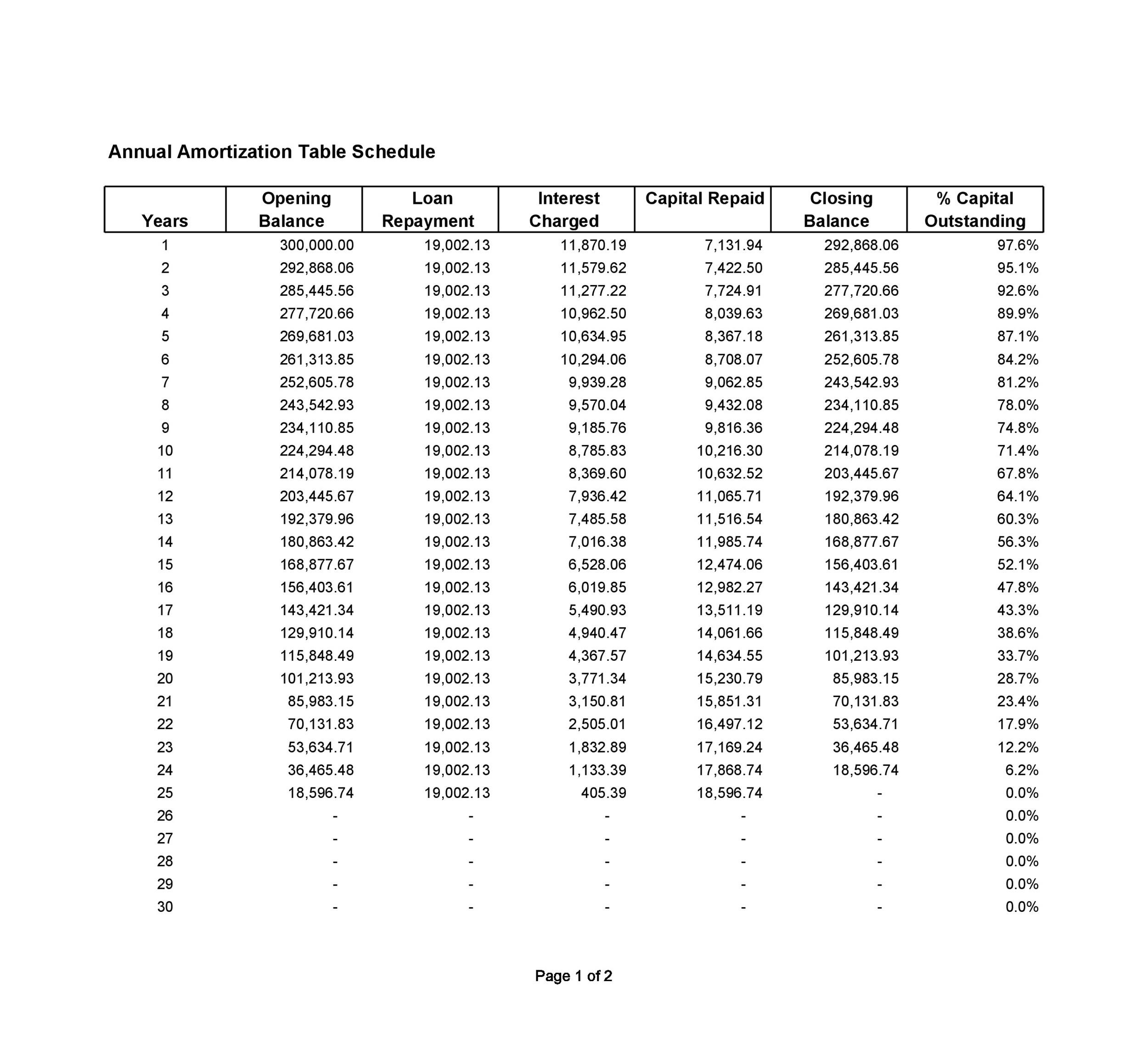

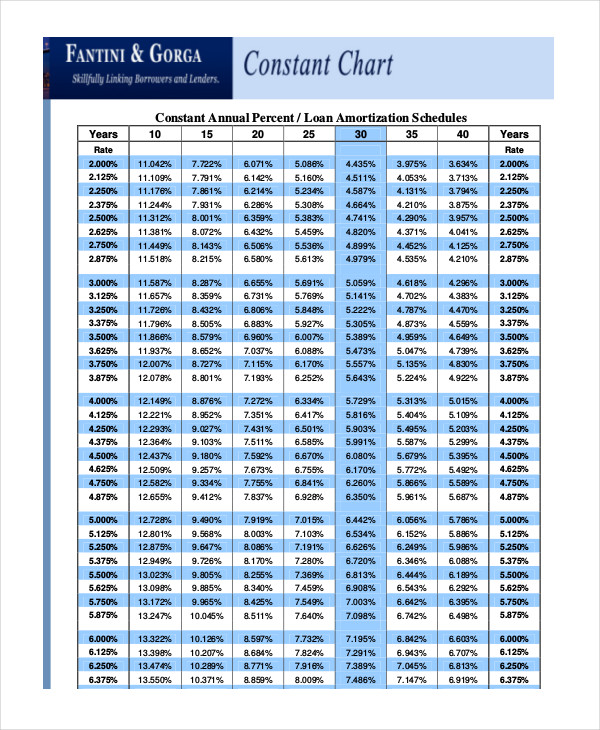

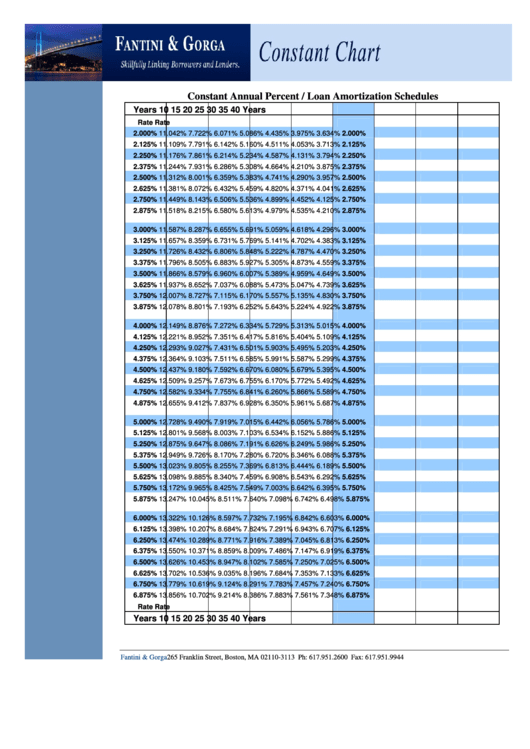

Loan Constant Chart - Web loan amortization table calculator. The alternative to using the debt constant formula is to use the present value of an annuity tables. It meant no longer needing to write out numbers and mathematical formulas or manually entering numbers on a calculator. The interest rate must be constant throughout the term of the loan and must be for the length of one period. To use the table, identify the interest rate and amortizing loan period that matches your mortgage and locate the cell where the two variables intersect. Web a loan constant, also known as a mortgage constant, is a percentage which compares the entire amount of a loan by its annual debt service. A loan constant is the percentage of cash paid to the lender compared with the outstanding loan balance. Web a loan constant, also known as the mortgage constant or debt constant, is a financial metric that represents the percentage of the original loan amount (the principal) paid on an annual basis. In this example, the loan constant is 0.1059 or 10.59%. In other words, the mortgage constant is the annual debt service amount per dollar of loan, and it includes both principal and interest payments. Web the debt constant or loan constant is calculated using the formula as follows: Web learn what a mortgage constant is, how to calculate it and how to use it for real estate investments and loan analysis. In addition to dscr, ltv, and debt yield, a loan constant is an important metric that lenders use to determine a property’s suitability. It meant no longer needing to write out numbers and mathematical formulas or manually entering numbers on a calculator. A loan constant is a percentage that shows the annual debt service on a loan compared to its total principal. Web most loan constant charts include the mortgage term length on one axis and the fixed interest rate on another. Web. Web loan constant = annual debt service / total loan amount. $ interest rate (current rates) % term. Web updated november 29, 2020. Figuring out whether a mortgage is a good deal takes a lot of time and number crunching. Web a loan constant table makes determining a mortgage constant simple by providing a straightforward and visual way to find. In this example, the loan constant is 0.1059 or 10.59%. Web the mortgage constant, also known as the loan constant or the debt constant, is defined as annual debt service divided by the loan amount. In addition to dscr, ltv, and debt yield, a loan constant is an important metric that lenders use to determine a property’s suitability for a. The alternative to using the debt constant formula is to use the present value of an annuity tables. Mortgage constant compares the annual debt service of a prospective commercial real estate loan to the entire loan amount. The interest rate must be constant throughout the term of the loan and must be for the length of one period. In addition. $ interest rate (current rates) % term. In other words, the mortgage constant is the annual debt service amount per dollar of loan, and it includes both principal and interest payments. This means that each year, approximately 10.59% of the original loan amount will be repaid. A loan constant is the percentage of cash paid to the lender compared with. Web the loan constant formula is: Loan constant is an essential tool for borrowers and lenders as it helps them compare different loan options and choose the best one. Web updated november 29, 2020. You can use this figure to decide whether you can afford a home, to compare various loan options, and to work out the total amount of. Web a loan constant, also known as the mortgage constant or debt constant, is a financial metric that represents the percentage of the original loan amount (the principal) paid on an annual basis. A mortgage constant is the percentage of money paid each year to service a debt compared to the total loan value. Learn how to calculate your loan. Web most loan constant charts include the mortgage term length on one axis and the fixed interest rate on another. A loan constant is a percentage that shows the annual debt service on a loan compared to its total principal. In addition to dscr, ltv, and debt yield, a loan constant is an important metric that lenders use to determine. Web the mortgage constant is a figure that represents how much of the loan is being paid off on an annual basis over the entire course of the loan. Learn how to calculate your loan constant and why it matters. The interest rate must be constant throughout the term of the loan and must be for the length of one. In addition to dscr, ltv, and debt yield, a loan constant is an important metric that lenders use to determine a property’s suitability for a commercial or multifamily loan. Web a loan constant, also known as a mortgage constant, is a percentage which compares the entire amount of a loan by its annual debt service. Web learn what a mortgage constant is, how to calculate it and how to use it for real estate investments and loan analysis. Learn how to calculate your loan constant and why it matters. Loan payment = principal amount + interest amount. A loan constant is a percentage that shows the annual debt service on a loan compared to its total principal. Constant annual percent / loan amortization schedules. That’s compared to the average of 6.71% at this time last week. Web the mortgage constant, also known as the loan constant or the debt constant, is defined as annual debt service divided by the loan amount. Use this amortization schedule calculator to create a printable table for a loan or mortgage with fixed principal payments. Web the mortgage constant is a figure that represents how much of the loan is being paid off on an annual basis over the entire course of the loan. You can use this figure to decide whether you can afford a home, to compare various loan options, and to work out the total amount of debt you’re servicing annually. Web this amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. This means that each year, approximately 10.59% of the original loan amount will be repaid. Loan constant is an essential tool for borrowers and lenders as it helps them compare different loan options and choose the best one. To use the table, identify the interest rate and amortizing loan period that matches your mortgage and locate the cell where the two variables intersect.

How to Calculate Loan Constant YouTube

28 Tables to Calculate Loan Amortization Schedule (Excel) ᐅ TemplateLab

Constant Chart PDF Loans Interest

Loan Amortization Schedule 7+ Free Excel, PDF Documents Download

Loan Constant Chart A Visual Reference of Charts Chart Master

What Is a Loan Constant and How Does It Work?

FREE 8+ Sample Mortgage Amortization Calculator Templates in PDF

Constant Annual Percent / Loan Amortization Schedules printable pdf

Solved FANTINI & Skillfully Linking Borrowers and

Loan Constant Tables Double Entry Bookkeeping

Web Loan Constant = Annual Debt Service / Total Loan Amount.

In This Example, The Loan Constant Is 0.1059 Or 10.59%.

The Alternative To Using The Debt Constant Formula Is To Use The Present Value Of An Annuity Tables.

The Interest Rate Must Be Constant Throughout The Term Of The Loan And Must Be For The Length Of One Period.

Related Post: