Nebraska Sales Tax Exemption Chart

Nebraska Sales Tax Exemption Chart - Web types of exemptions. Web what is exempt from sales taxes in nebraska? Web this table lists a number of additional categories of goods and services that are exempt from nebraska's sales tax. C contractor (complete section c.). Web i hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason: Web find out which sales are exempt from nebraska sales tax and how to document them. Nebraska resale or exempt sale exemption certificate. Web are services subject to sales tax? Web our free online guide for business owners covers nebraska sales tax registration, collecting, filing, due dates, nexus obligations, and more. $100,000 in annual sales or 200 separate sales transactions. Web nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. C contractor (complete section c.). $100,000 in annual sales or 200 separate sales transactions. Web are services subject to sales tax? Web types of exemptions. Web are services subject to sales tax? For a list that also shows taxable items, see the list of. A sales tax exemption certificate can. Nebraska resale or exempt sale exemption certificate. C contractor (complete section c.). It helps reduce costs by avoiding unnecessary tax payments, thus. Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales. Web a sales tax exemption certificate is a valuable tool for eligible businesses and organizations. Web to determine the 2024 ne sales tax rate, start with. Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales. Nebraska resale or exempt sale exemption certificate. Web nebraska has a state sales tax of 5.5 percent for retail sales. Additionally, city and county governments can impose local sales and use tax rates of up to. See the list of exemptions by category, such as business across state lines, commercial agriculture, and industrial machinery. Web this table lists a number of additional categories of goods and services that are exempt from nebraska's sales tax. Web nebraska has a 5.5% statewide sales tax rate , but also has 343 local tax jurisdictions (including cities, towns, counties, and. Web what is exempt from sales taxes in nebraska? Web i hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason: Web types of exemptions. Use our calculator to determine your exact sales tax rate. Web nebraska has a state sales tax of 5.5 percent for retail. Web a sales tax exemption certificate is a valuable tool for eligible businesses and organizations. Web nebraska has a 5.5% statewide sales tax rate , but also has 343 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales. Nebraska resale or exempt sale exemption certificate. Web find out which sales are exempt from. Web find out which sales are exempt from nebraska sales tax and how to document them. $100,000 in annual sales or 200 separate sales transactions. Then, identify the local sales tax rates, varying across counties, cities, and districts. Web i hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for. Additionally, city and county governments can impose local sales and use tax rates of up to 2 percent. Web our free online guide for business owners covers nebraska sales tax registration, collecting, filing, due dates, nexus obligations, and more. Web are services subject to sales tax? Nebraska resale or exempt sale exemption certificate. Prescription drugs, insulin, newspapers, magazines, and journals,. Web what is exempt from sales taxes in nebraska? Additionally, city and county governments can impose local sales and use tax rates of up to 2 percent. Web nebraska has a 5.5% statewide sales tax rate , but also has 343 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales. Web find out. Web generally, the sales tax base in nebraska is any retail sale of tangible personal property, unless exempted, and selected, listed, retail sales of services. $100,000 in annual sales or 200 separate sales transactions. Web types of exemptions. Web this table lists a number of additional categories of goods and services that are exempt from nebraska's sales tax. Web what is exempt from sales taxes in nebraska? Web 5.5% local taxes: It helps reduce costs by avoiding unnecessary tax payments, thus. Additionally, city and county governments can impose local sales and use tax rates of up to 2 percent. Web i hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason: Prescription drugs, insulin, newspapers, magazines, and journals, occasional sales, sales for resale. Web nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. C contractor (complete section c.). See the list of exemptions by category, such as business across state lines, commercial agriculture, and industrial machinery. Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales. Web nebraska has a state sales tax of 5.5 percent for retail sales. Use our calculator to determine your exact sales tax rate.

Nebraska Sales Tax Guide for Businesses

Homestead Exemption Nebraska Debt and Bankruptcy Blog

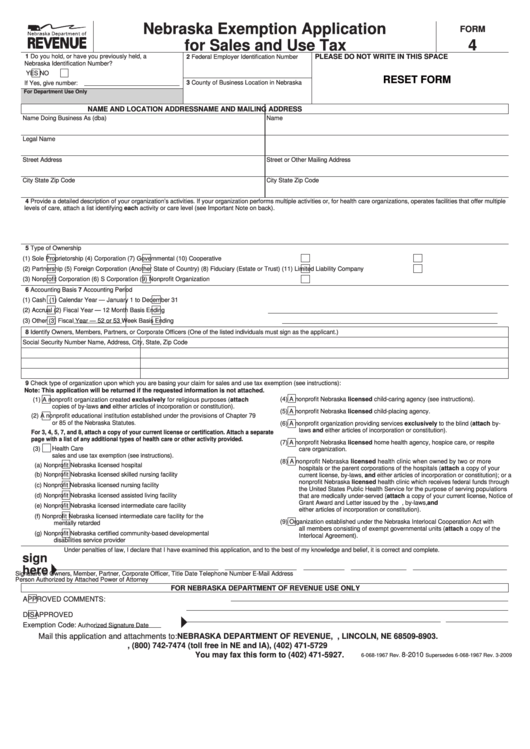

Fillable Form 4 Nebraska Exemption Application For Sales And Use Tax

FREE 10 Sample Tax Exemption Forms In PDF

Filing Exempt On Taxes For 6 Months How To Do This

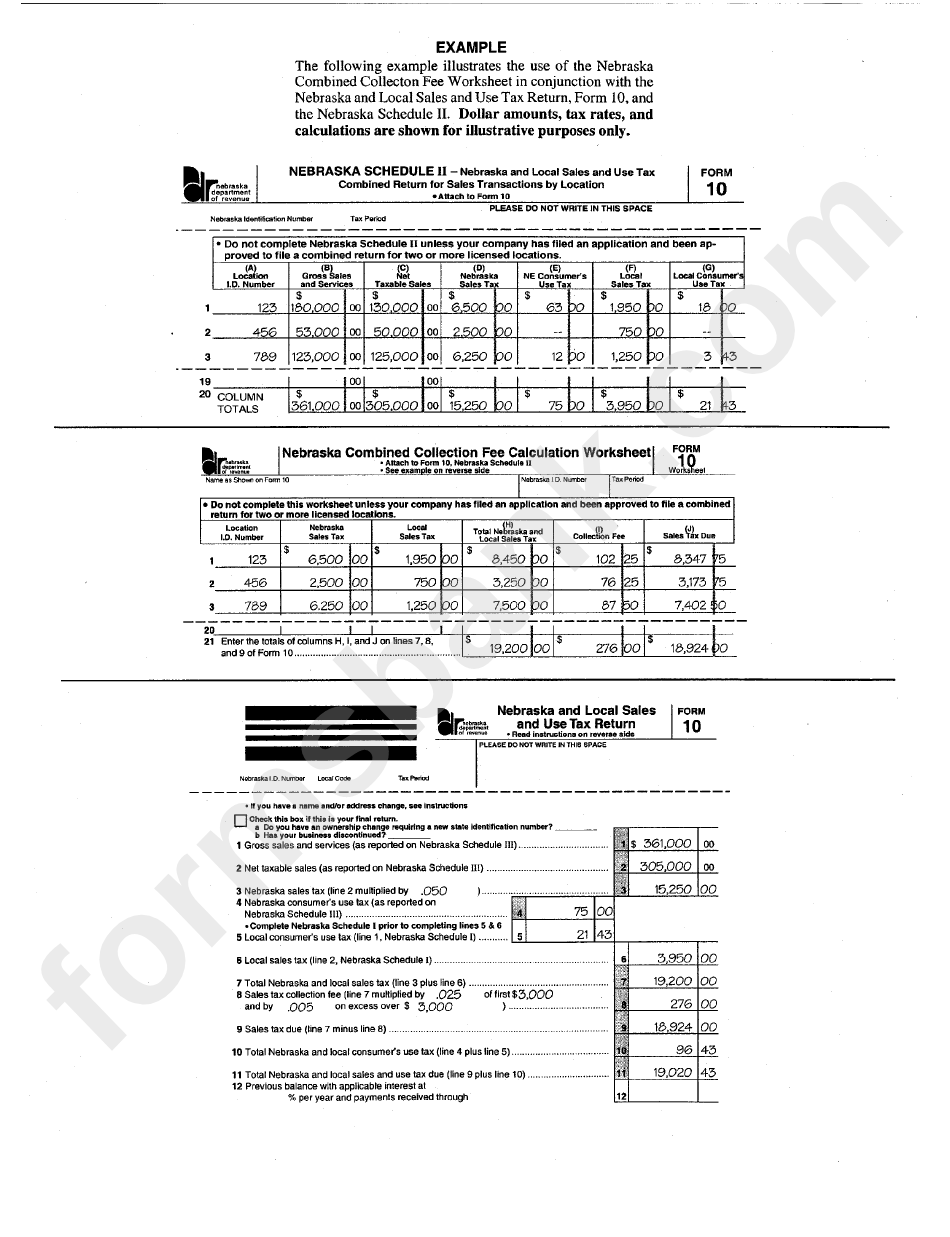

Form 10 Nebraska And Local Sales And Use Tax Return Example printable

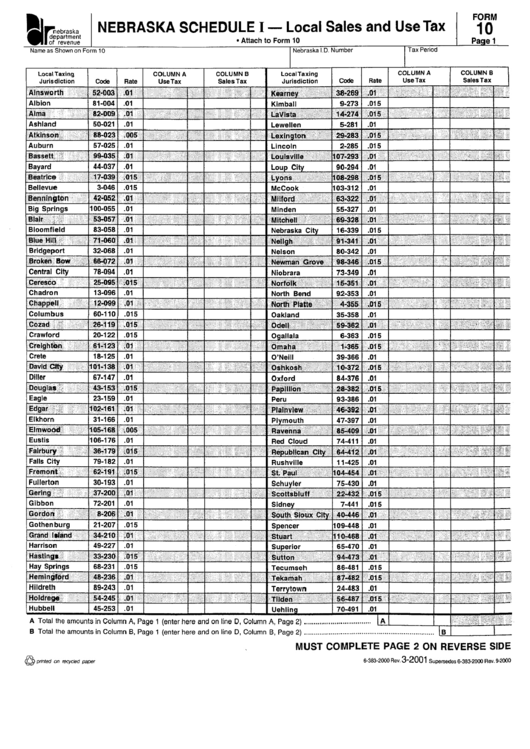

Form 10 Nebraska Schedule I Local Sales And Use Tax 2000

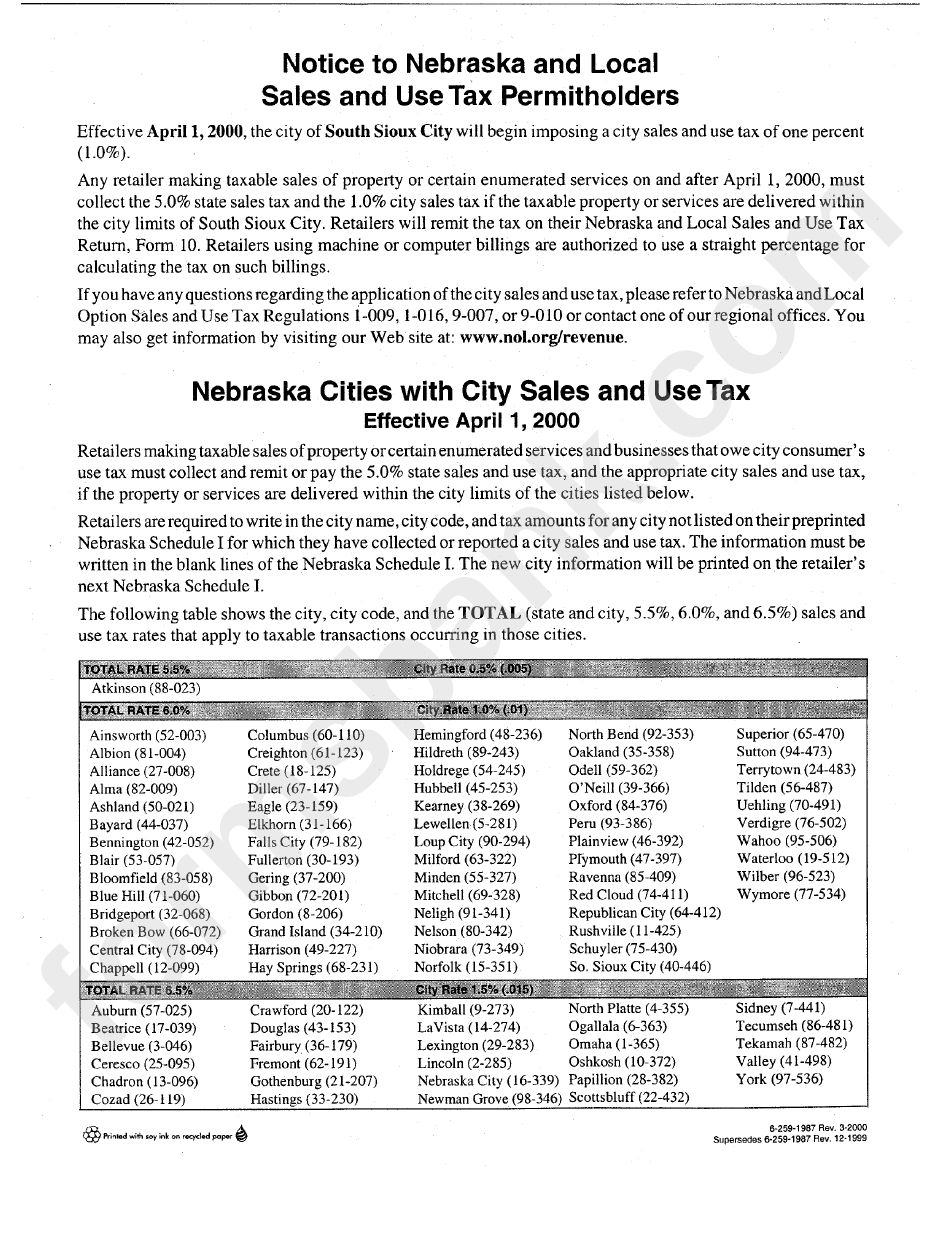

Notice To Nebraska And Local Sales And Use Tax Permitholders printable

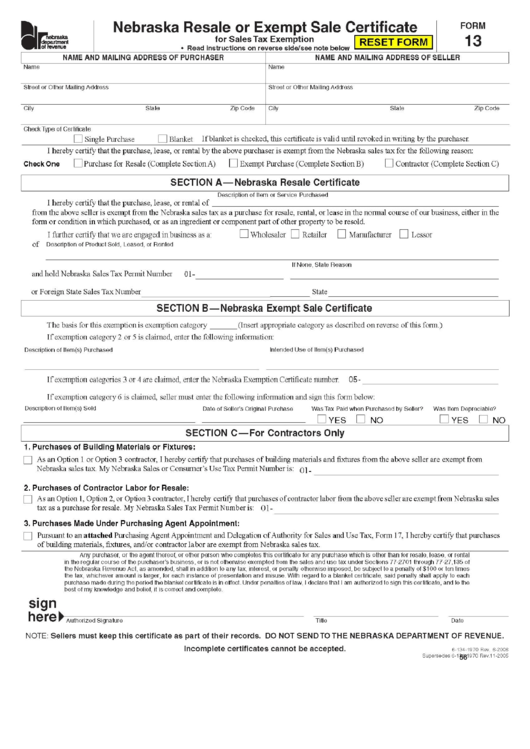

Nebraska Resale Or Exempt Sale Certificate printable pdf download

Free Printable Sales Tax Chart Printable World Holiday

While Nebraska's Sales Tax Generally Applies To Most Transactions, Certain Items Have Special Treatment In Many States When It Comes To Sales.

Nebraska Resale Or Exempt Sale Exemption Certificate.

Web A Sales Tax Exemption Certificate Is A Valuable Tool For Eligible Businesses And Organizations.

Web Nebraska Has A 5.5% Statewide Sales Tax Rate , But Also Has 343 Local Tax Jurisdictions (Including Cities, Towns, Counties, And Special Districts) That Collect An Average Local Sales.

Related Post: