Nonprofit Chart Of Accounts Template

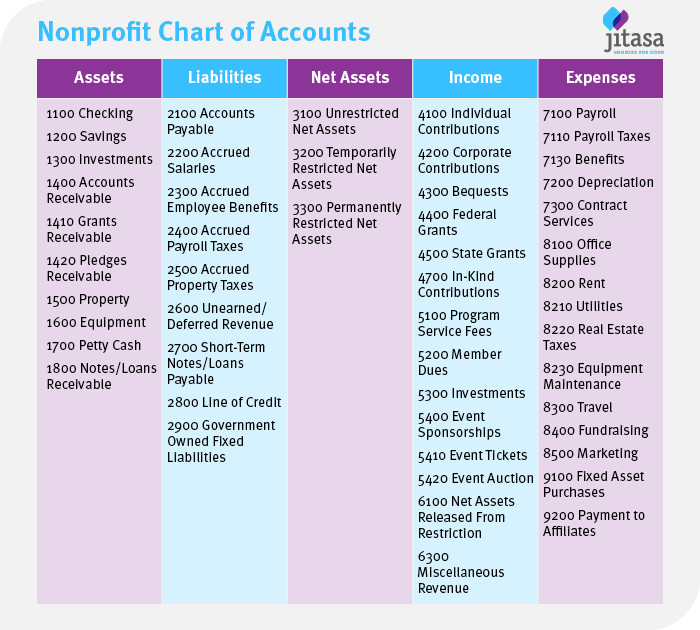

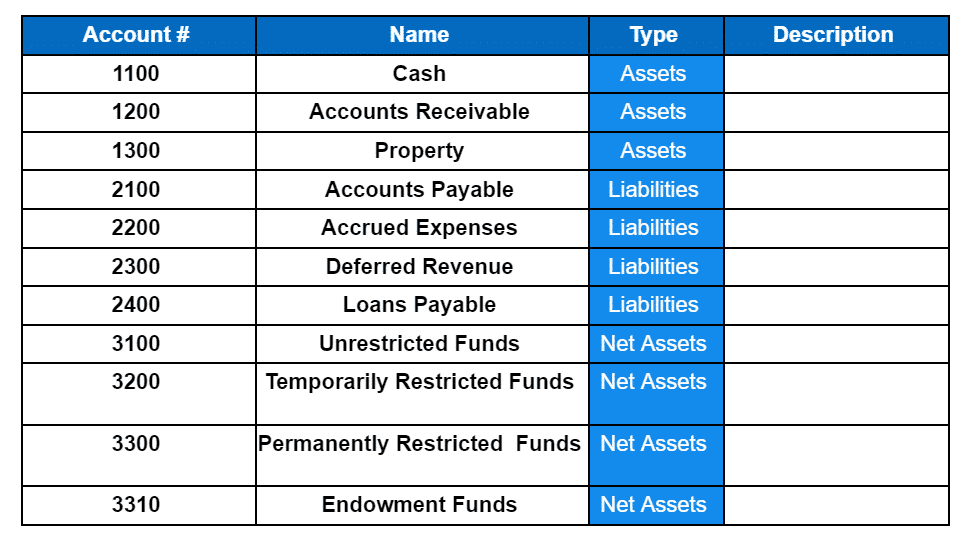

Nonprofit Chart Of Accounts Template - What is a nonprofit chart of accounts? But why should it matter to your nonprofit, and how will you create and maintain one? Web cyndi meuchel march 7, 2022. Now, let’s put each of those 5 required categories together to get a full look at a nonprofit chart of accounts. It defines classes of items your accounting system will use to aggregate transactions into your organization’s financial reporting. • credit card expenditures are recorded per purchase. Web our nonprofit chart of accounts template is here to help! Purpose of the nonprofit chart of accounts; Web creating a chart of accounts for your nonprofit organization + template & sample. It’s a series of line items, or accounts, that allows you to organize your accounting data. This table is a directory of your nonprofit’s financial records, helping you organize important information about your finances. • credit card expenditures are recorded per purchase. Web in this guide, we’ll explore the basics of the nonprofit chart of accounts, including: It is typically divided into five categories: Web a chart of accounts can provide your nonprofit with the information. Your organization will only have one chart of accounts, so make sure to create one that makes sense for your operations. A chart of accounts is a listing of all the accounts in a business and the debits and credits to each account. Your coa should align with the specific needs of the organization and reflect its unique financial activities.. Web creating a chart of accounts for your nonprofit organization + template & sample. Bills are entered as payable when the expense is incurred. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). Tips for maintaining your chart of accounts; Web the account numbers, account number ranges,. A chart of accounts is the foundation of a solid nonprofit group. Web creating a chart of accounts for your nonprofit organization + template & sample. Your coa should align with the specific needs of the organization and reflect its unique financial activities. Analyze your organization’s needs and objectives. This template organizes your transactions similarly to your annual form 990. Web the chart of accounts (coa) tracks your various ledgers and everything your nonprofit does financially. Web cyndi meuchel march 7, 2022. The balance is reduced as payments are made. But why should it matter to your nonprofit, and how will you create and maintain one? Web download the nonprofit chart of accounts template! However, when creating a chart of accounts, there are common mistakes to avoid. It’s a series of line items, or accounts, that allows you to organize your accounting data. • accounts payable are the bills your organization must pay. It defines classes of items your accounting system will use to aggregate transactions into your organization’s financial reporting. Web you can. Web in this guide, we’ll explore the basics of the nonprofit chart of accounts, including: Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if you don’t fully understand its usefulness.” visit the guide and example. A coa categorizes an expense or revenue as either “revenue” or. Web the account numbers, account number ranges, account names, breakdowns of each account category, and account descriptions will vary based on the nonprofit's structure and needs. Structuring a chart of accounts for nonprofit organizations; This table is a directory of your nonprofit’s financial records, helping you organize important information about your finances. This template organizes your transactions similarly to your. Analyze your organization’s needs and objectives. Web creating a chart of accounts for your nonprofit organization + template & sample. The chart of accounts is a foundational part of your financial management system. Structuring a chart of accounts for nonprofit organizations; What is a nonprofit chart of accounts? A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501 (c) (3) status to account for the money they receive and spend. Why is a chart of accounts important for nonprofit organizations? Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. Web. This template organizes your transactions similarly to your annual form 990 so that information transfers easily between the two documents. Web a chart of accounts can provide your nonprofit with the information you need to make accurate and informed business decisions. A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501 (c) (3) status to account for the money they receive and spend. Web the chart of accounts (coa) tracks your various ledgers and everything your nonprofit does financially. For example, a nonprofit that relies heavily on grant funding may need to create specific accounts to track grant income and expenses. It’s part of your accounting architecture. The chart of accounts is a foundational part of your financial management system. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if you don’t fully understand its usefulness.” visit the guide and example. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Web download the nonprofit chart of accounts template! These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). Web in this guide, we’ll cover the basics of the nonprofit chart of accounts, including: The following chart of accounts can provide you with a basic example that you can use to structure your own. Bills are entered as payable when the expense is incurred.

Nonprofit Chart Of Accounts Template

Chart Of Accounts For Nonprofit Sample

Chart Of Accounts Examples For Nonprofits

sample nonprofit chart of accounts

Sample Nonprofit Chart Of Accounts

Nonprofit Chart of Accounts How to Get Started + Example

The Beginner’s Guide to Nonprofit Chart of Accounts

Sample Chart Of Accounts For Nonprofit Excel Template And Google Sheets

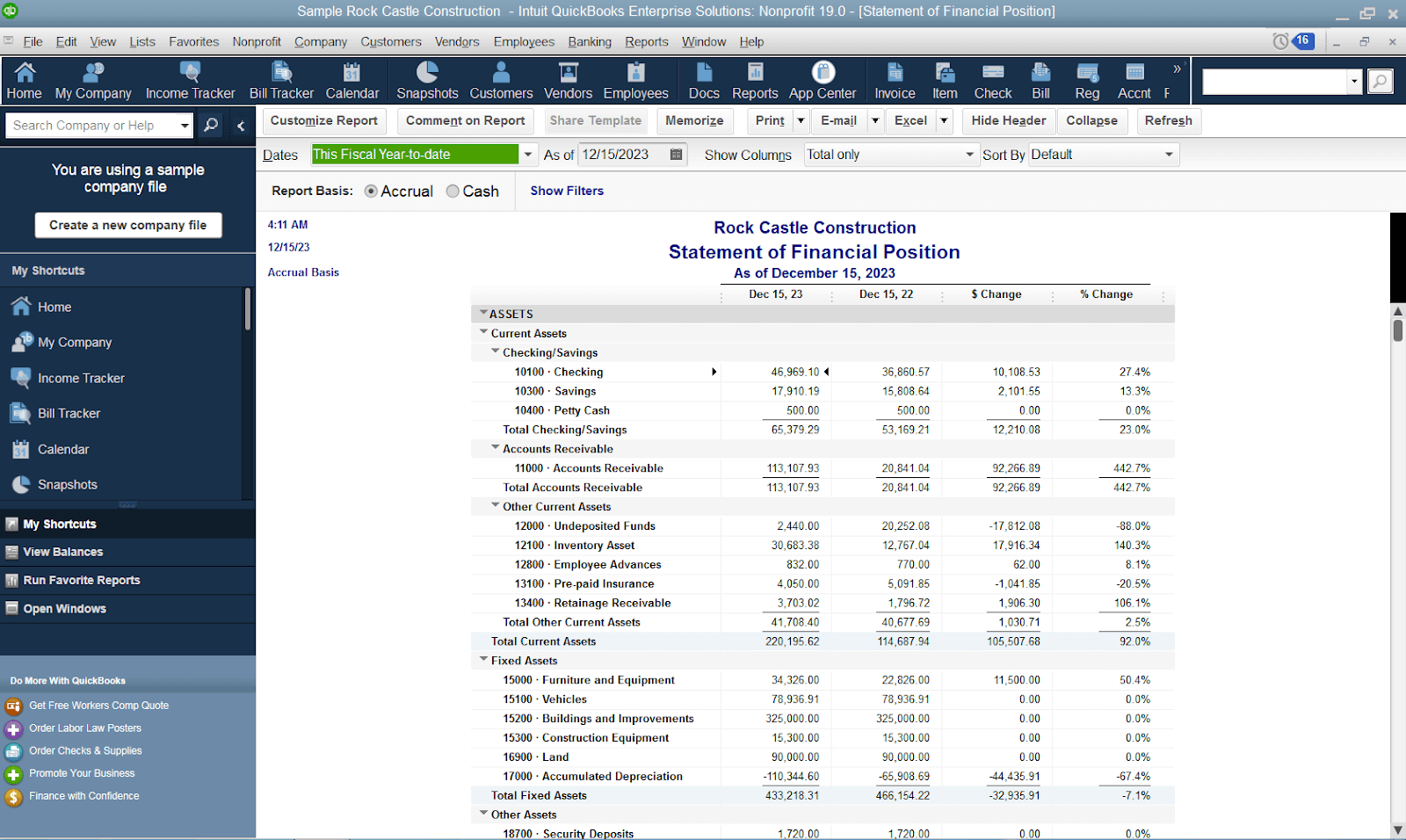

Sample Nonprofit Chart Of Accounts Quickbooks

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

Web To Get Started With Creating Your Nonprofit’s Chart Of Accounts, There Is A Standardized Template You Could Use Known As The Unified Chart Of Accounts (Ucoa).

Web In This Guide, We’ll Explore The Basics Of The Nonprofit Chart Of Accounts, Including:

It Is Typically Divided Into Five Categories:

Web A Chart Of Accounts (Coa) Is A List Of Financial Accounts That Helps Nonprofits Keep Track Of Their Transactions.

Related Post: