Ohio County Sales Tax Chart

Ohio County Sales Tax Chart - Web this interactive sales tax map map of ohio shows how local sales tax rates vary across ohio's 88 counties. Then, identify the local sales tax rates, varying across counties, cities, and districts. During fiscal year 2009, the tax generated about $7.33 billion in revenue for state govern ment. Ohio sales tax rates by county, sstp rate database table, county rate table by zip code csv, or county rate table by zip plus 4 csv. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. The state's sales and use tax rate is currently 5.75% * municipalities whose boundaries extend both within and beyond franklin county assess a transit rate of 0.50% in addition to the posted state and county sales tax rate. Find the sales and use tax rate in your county. Web the current state sales and use tax rate, 5.5 percent, was established on july 1, 2005. Web state and permissive sales tax rates, by county, july 2023. Map of current sales tax rates. Web to determine the 2024 oh sales tax rate, start with the statewide sales tax rate of 5.75%. Web download tax rates and geographic information systems (gis) boundary data. Ohio sales tax rates by county, sstp rate database table, county rate table by zip code csv, or county rate table by zip plus 4 csv. Web there were no sales. Williams 7.25% fulton 7.25% lucas 7.75% ottawa 7.00% defiance 6.75% henry 7.25% cuyahoga 8.00% wood ** 6.75% sandusky 7.25% erie 6.75% lorain 6.50% paulding 7.25% seneca 7.25% huron 7.25% summit 6.75%. Then, identify the local sales tax rates, varying across counties, cities, and districts. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. A. For more information about the sales and use tax, look at the options below. Then, identify the local sales tax rates, varying across counties, cities, and districts. Web our free online ohio sales tax calculator calculates exact sales tax by state, county, city, or zip code. The ohio department of taxation offers the following ways to file sales or. Web. There are a total of 576 local tax jurisdictions across the state, collecting an average local tax of 1.502%. Web the tax data is broken down by zip code, and additional locality information (location, population, etc) is also included. For more information about the sales and use tax, look at the options below. Key sales & use tax resources. The. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. The balance was distrib uted to the public library fund. Find the sales and use tax rate in your county. The state sales tax rate in ohio is 5.75%, but you can customize this table as needed to. Web look up 2024 ohio sales tax. Web 1148 rows ohio has state sales tax of 5.75% , and allows local governments to collect a local option sales tax of up to 2.25%. The state sales tax rate in ohio is 5.75%, but you can customize this table as needed to. Web the state sales and use tax rate is 5.75 percent. Click here for a larger. Find the sales and use tax rate in your county. The ohio department of taxation offers the following ways to file sales or. Ohio sales tax rates by county, sstp rate database table, county rate table by zip code csv, or county rate table by zip plus 4 csv. Web ohio’s tax collection schedule sales and use tax for state,. Web the state sales and use tax rate is 5.75 percent. Web zip county rate zip county rate zip county rate zip county rate county rate table by zip code may 2024 43001 licking 7.25% 43002 franklin 7.50% 43003 * delaware 7.00% 43003* morrow 7.25% 43004* franklin 7.50% 43004 * licking 7.25% 43005 knox 7.25% 43006* coshocton 7.75% 43006 *. Ohio levies a sales and use tax on the retail sale, lease, and rental of personal property and the sale of selected services. Find the sales and use tax rate in your county. Web there were no sales and use tax county rate changes effective april 1, 2024. Ohio has state sales tax of 5.75%, and allows local governments to. In addition, ohio counties and local transit authorities may levy additional sales and use taxes. Web our free online ohio sales tax calculator calculates exact sales tax by state, county, city, or zip code. Counties and regional transit authorities may levy additional sales and use taxes. You can download the ohio sales tax rates database from our partners at salestaxhandbook.. Click on any county for detailed sales tax rates, or see a full list of ohio counties here. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. There are a total of 576 local tax jurisdictions across the state, collecting an average local tax of 1.502%. Web sales and use tax electronic filing | department of taxation. Web july 2024 sales tax rates color. Web look up 2024 ohio sales tax rates in an easy to navigate table listed by county and city. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Ohio has 1,424 cities, counties, and special districts that collect a local sales tax in addition to the ohio state sales tax. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. Web to determine the 2024 oh sales tax rate, start with the statewide sales tax rate of 5.75%. Ohio levies a sales and use tax on the retail sale, lease, and rental of personal property and the sale of selected services. Ohio sales tax rates by county, sstp rate database table, county rate table by zip code csv, or county rate table by zip plus 4 csv. The state sales tax rate in ohio is 5.75%, but you can customize this table as needed to. Williams 7.25% fulton 7.25% lucas 7.75% ottawa 7.00% defiance 6.75% henry 7.25% cuyahoga 8.00% wood ** 6.75% sandusky 7.25% erie 6.75% lorain 6.50% paulding 7.25% seneca 7.25% huron 7.25% summit 6.75%. Web our free online ohio sales tax calculator calculates exact sales tax by state, county, city, or zip code. Notifications of ohio sales tax rates and changes or boundary changes.

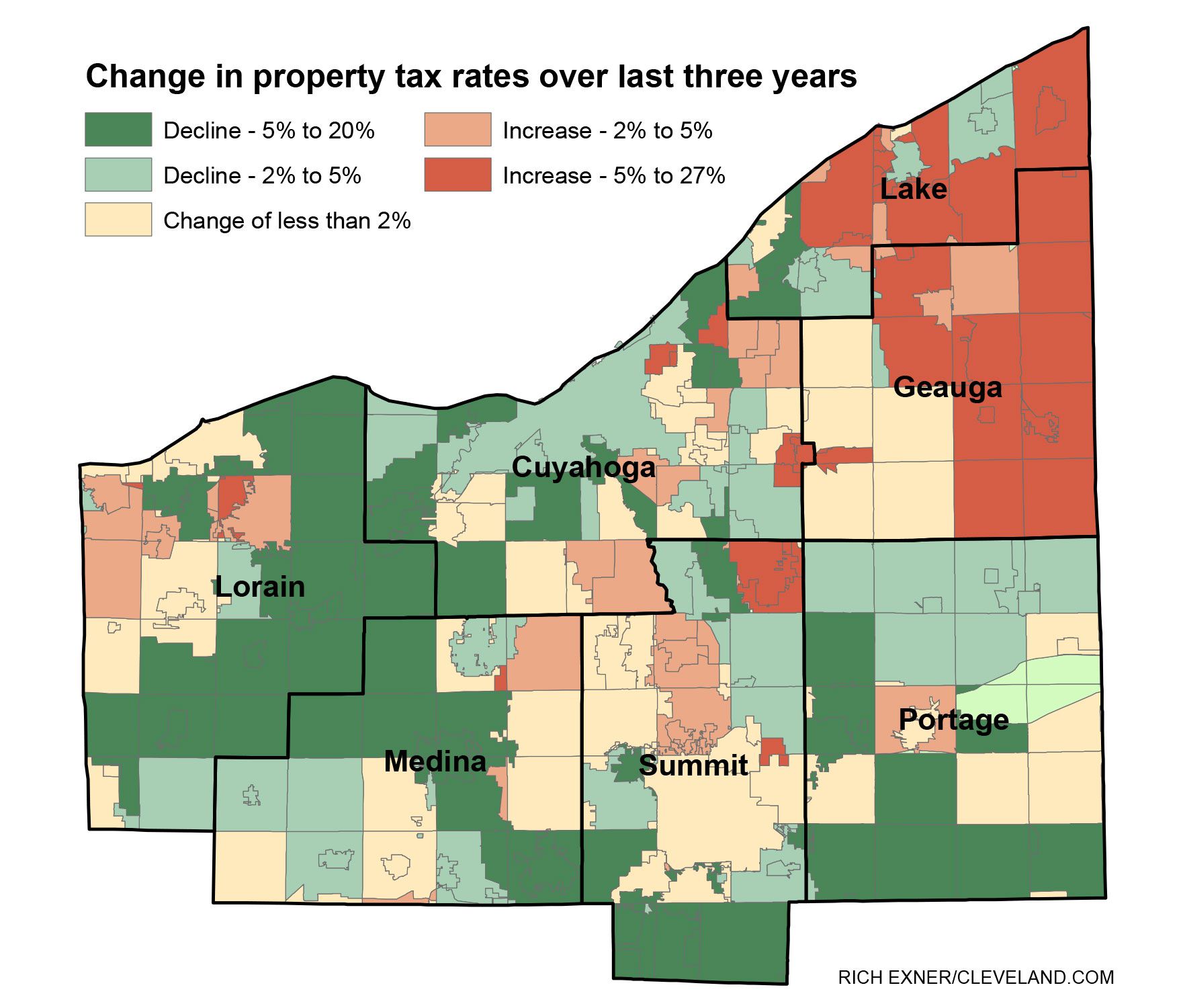

Ohio Sales Tax Rate Map New River Kayaking Map

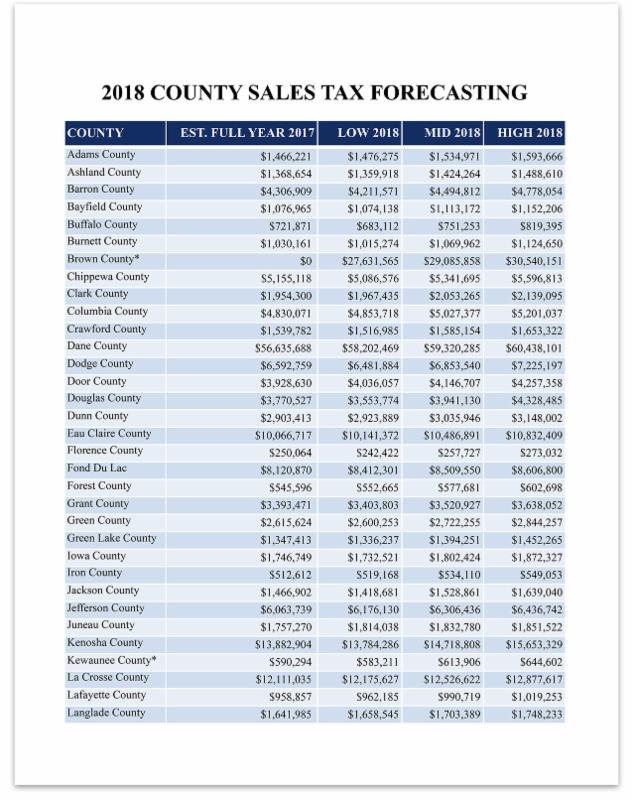

COUNTY SALES TAX FORECASTING

Ohioans are spending more money on taxable things this year, including

When is Ohio's tax free weekend for school clothes, supplies?

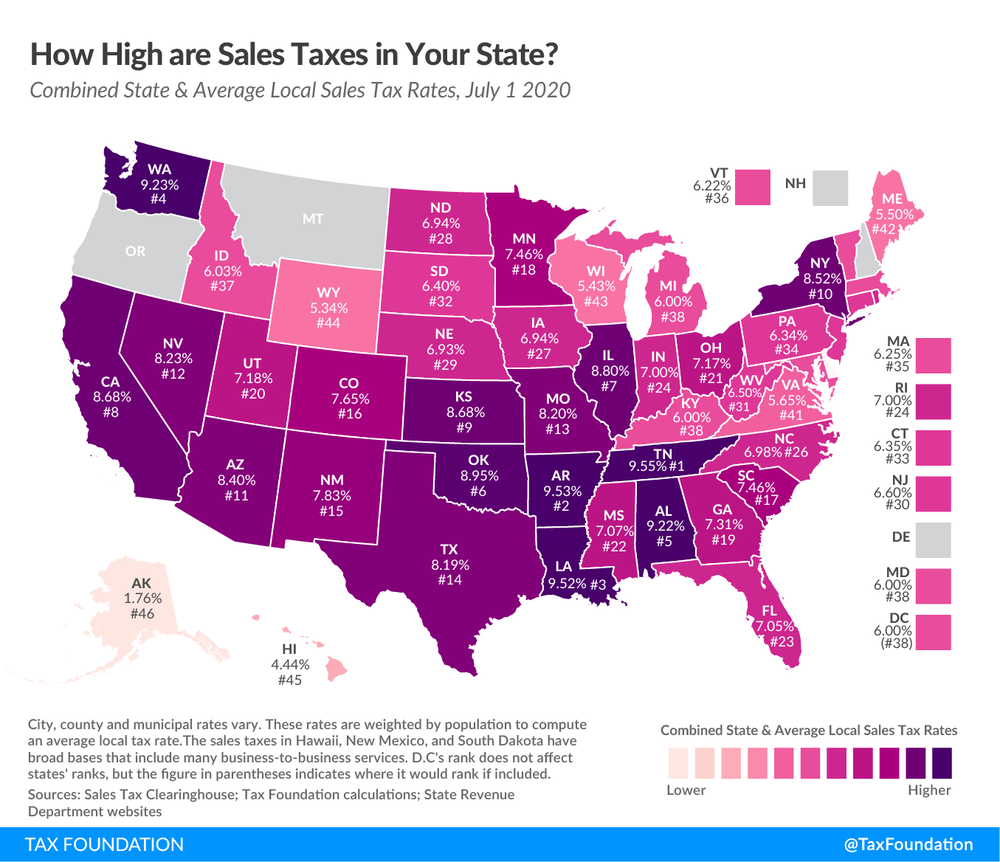

![U.S. Sales Tax by State [1484x1419] MapPorn](https://external-preview.redd.it/t9sLze7hV6ZUinIl1h1wA8Vg4oASGxodMFiNWhYfjYE.png?auto=webp&s=08cfd4239c6068d48a2557b63d1d8404215a5da7)

U.S. Sales Tax by State [1484x1419] MapPorn

eBay Sales Tax Guide

Ohio Sales Tax Rate Map New River Kayaking Map

Ohio County Tax Map secretmuseum

WKSU News Noon headlines, July 2, 2012 Storms, schools, sales taxes

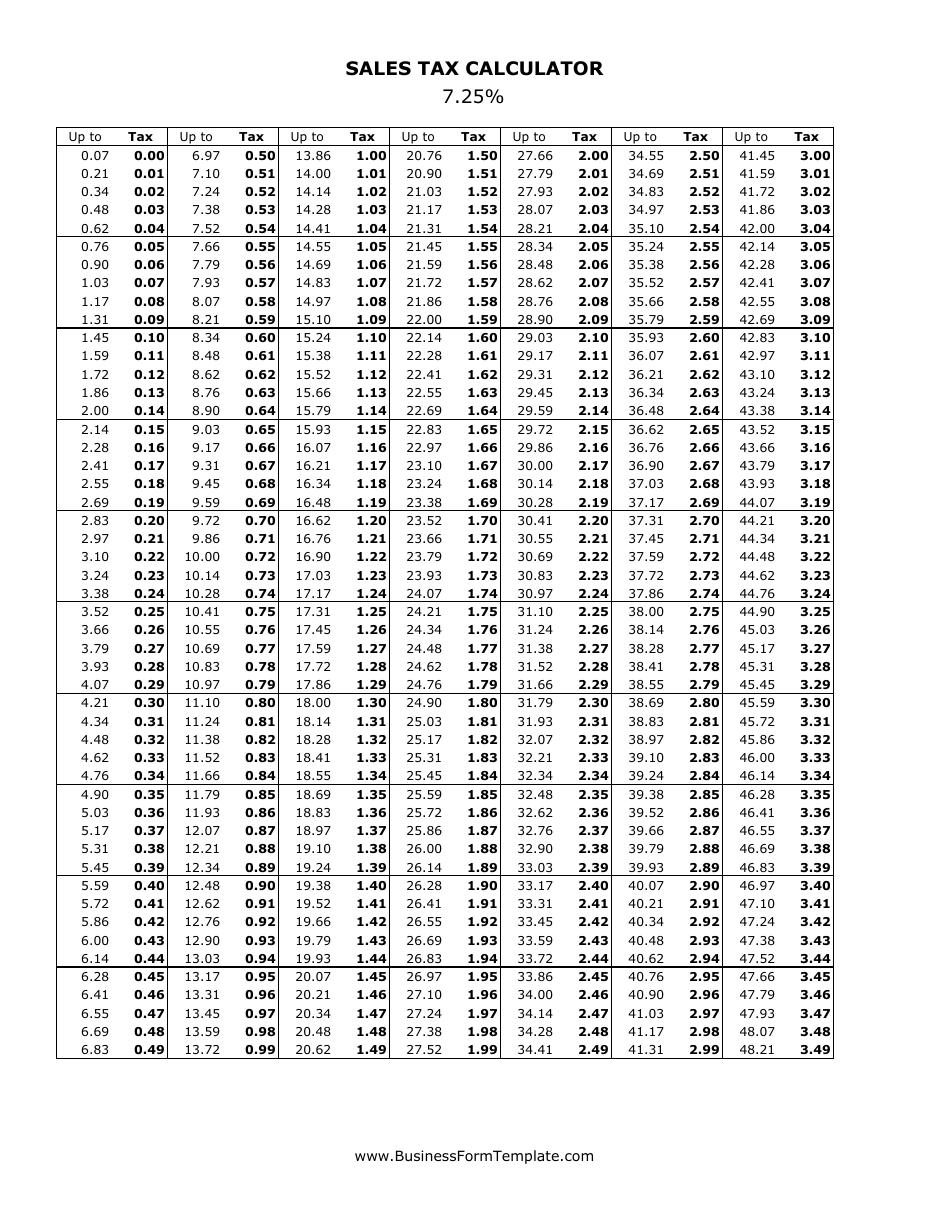

7.25 Sales Tax Chart Printable Printable Word Searches

Web Ohio’s Tax Collection Schedule Sales And Use Tax For State, County And/Or Transit Tax.

For More Information About The Sales And Use Tax, Look At The Options Below.

The Balance Was Distrib Uted To The Public Library Fund.

Web There Were No Sales And Use Tax County Rate Changes Effective April 1, 2024.

Related Post: