Ohio Police And Fire Pension Percentage Chart

Ohio Police And Fire Pension Percentage Chart - Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2021 2021 actual employer employer allocation employer code. Web ohio police & fire. If you have service with the ohio police and fire pension fund (op&f), highway patrol retirement system (hprs) or the cincinnati retirement. The next, you’re off to a call. Web includes 2.5 percent of final average salary (fas), multiplied by the first 25 years of service, plus 2.1 percent of fas for each year of service thereafter. Web this calculator has been designed to provide you with an estimate of your service retirement benefits. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2022 2022 actual employer employer allocation employer code. The following results are estimates only and will vary by member. You’re having a nice, calm day one minute; Web the state’s rate for municipalities’ contributions to firefighters’ pensions is currently set at 24%. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2022 2022 actual employer employer allocation employer code. Web the 6.00 percent results are shown to illustrate this sensitivity. Web includes 2.5 percent of final average salary (fas), multiplied by the first 25 years of service, plus 2.1 percent of. Web the table below shows the amount a monthly benefit is reduced for each $1,000 of lump sum payment. If you have service with the ohio police and fire pension fund (op&f), highway patrol retirement system (hprs) or the cincinnati retirement. This report presents the results of the annual actuarial valuation of the assets and liabilities of op&f as of. Web the ohio police & fire pension fund (op&f). Now, let’s take on your election worker question. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2021 2021 actual employer employer allocation employer code. Web the 6.00 percent results are shown to illustrate this sensitivity. If you have service. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2021 2021 actual employer employer allocation employer code. Web the 6.00 percent results are shown to illustrate this sensitivity. If you have service with the ohio police and fire pension fund (op&f), highway patrol retirement system (hprs) or the cincinnati. The bill would have raised both police and fire employer. Web includes 2.5 percent of final average salary (fas), multiplied by the first 25 years of service, plus 2.1 percent of fas for each year of service thereafter. Projection of op&f disbursements and sources of money. Web this calculator has been designed to provide you with an estimate of your. The following results are estimates only and will vary by member. Web the state’s rate for municipalities’ contributions to firefighters’ pensions is currently set at 24%. Now, let’s take on your election worker question. Web the ohio police & fire pension fund (op&f). Web ohio police & fire pension (op&f) being a first responder means constantly dealing with the unexpected. The next, you’re off to a call. Web the state’s rate for municipalities’ contributions to firefighters’ pensions is currently set at 24%. Now, let’s take on your election worker question. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2021 2021 actual employer employer allocation employer code. You’re having. The health care stabilization fund principal will be. Now, let’s take on your election worker question. Web the table below shows the amount a monthly benefit is reduced for each $1,000 of lump sum payment. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2022 2022 actual employer employer. You’re having a nice, calm day one minute; Web the ohio police & fire pension fund (op&f). Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2022 2022 actual employer employer allocation employer code. Web the state’s rate for municipalities’ contributions to firefighters’ pensions is currently set at 24%.. For example, a defined benefit plan participant who retires at age 57 and. Projection of op&f disbursements and sources of money. The next, you’re off to a call. This report presents the results of the annual actuarial valuation of the assets and liabilities of op&f as of january 1, 2023,. Web the table below shows the amount a monthly benefit. If you have service with the ohio police and fire pension fund (op&f), highway patrol retirement system (hprs) or the cincinnati retirement. Web ohio police & fire pension (op&f) being a first responder means constantly dealing with the unexpected. Web the state’s rate for municipalities’ contributions to firefighters’ pensions is currently set at 24%. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2022 2022 actual employer employer allocation employer code. This report presents the results of the annual actuarial valuation of the assets and liabilities of op&f as of january 1, 2023,. Web ohio police & fire pension fund schedule of employer allocations as of and for the year ended december 31, 2021 2021 actual employer employer allocation employer code. Web the bill increases contribution rates for employers of police officers and firefighters (i.e., the employer’s share of the contribution) that must be paid to the ohio police and fire. The bill would have raised both police and fire employer. Projection of op&f disbursements and sources of money. Web the table below shows the amount a monthly benefit is reduced for each $1,000 of lump sum payment. The health care stabilization fund principal will be. Web ohio police & fire. Web the 6.00 percent results are shown to illustrate this sensitivity. Now, let’s take on your election worker question. For example, a defined benefit plan participant who retires at age 57 and. Web clay cozart, a member of the akron police department, was the successful candidate for this spring’s election for a seat on the op&f board of trustees.

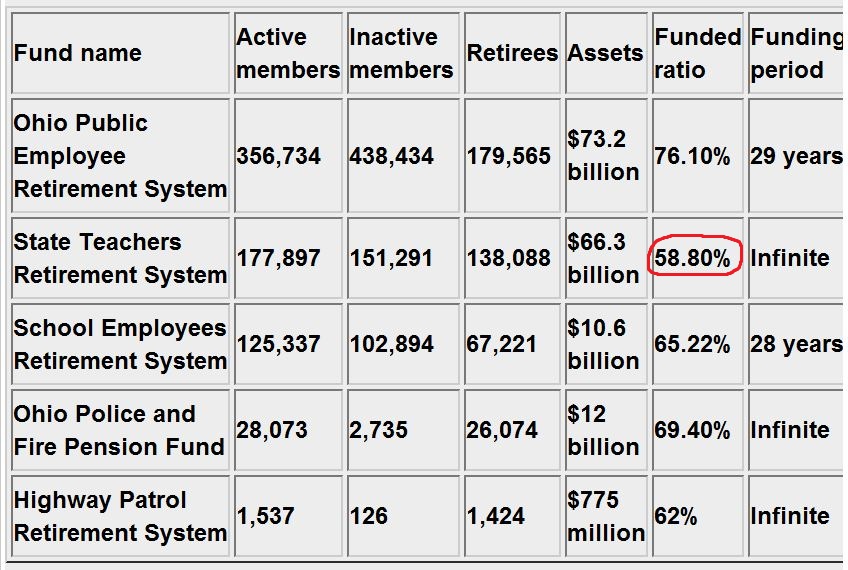

Kathie Bracy's Blog Bob Buerkle An open letter to all STRS members

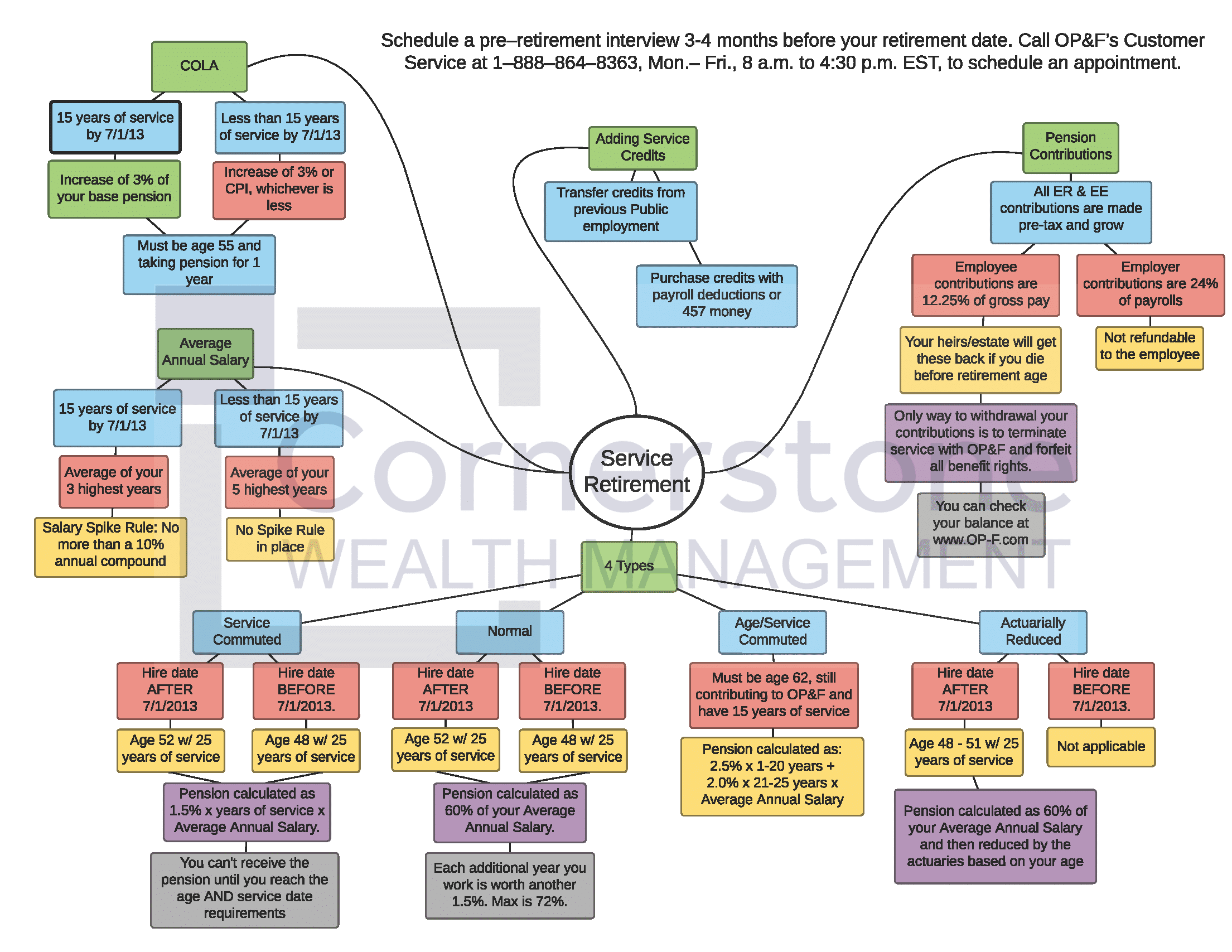

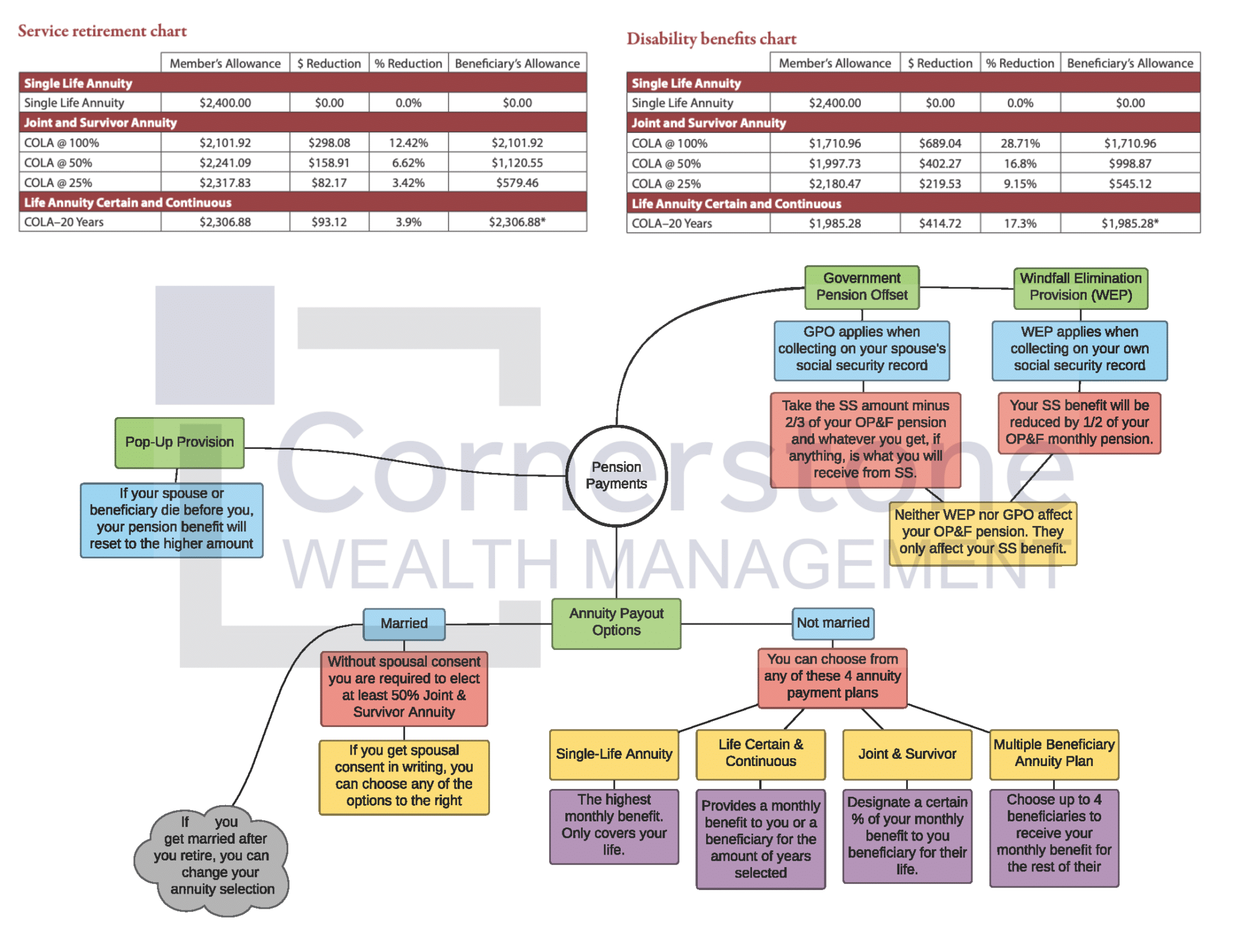

Ohio Police & Fire (OP&F) Michael Kelley, CFP

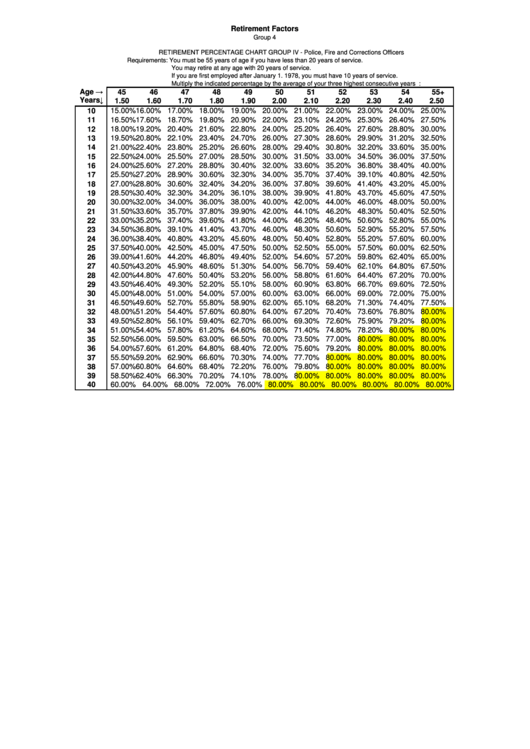

Retirement Percentage Chart (Group Iv) Police, Fire And Corrections

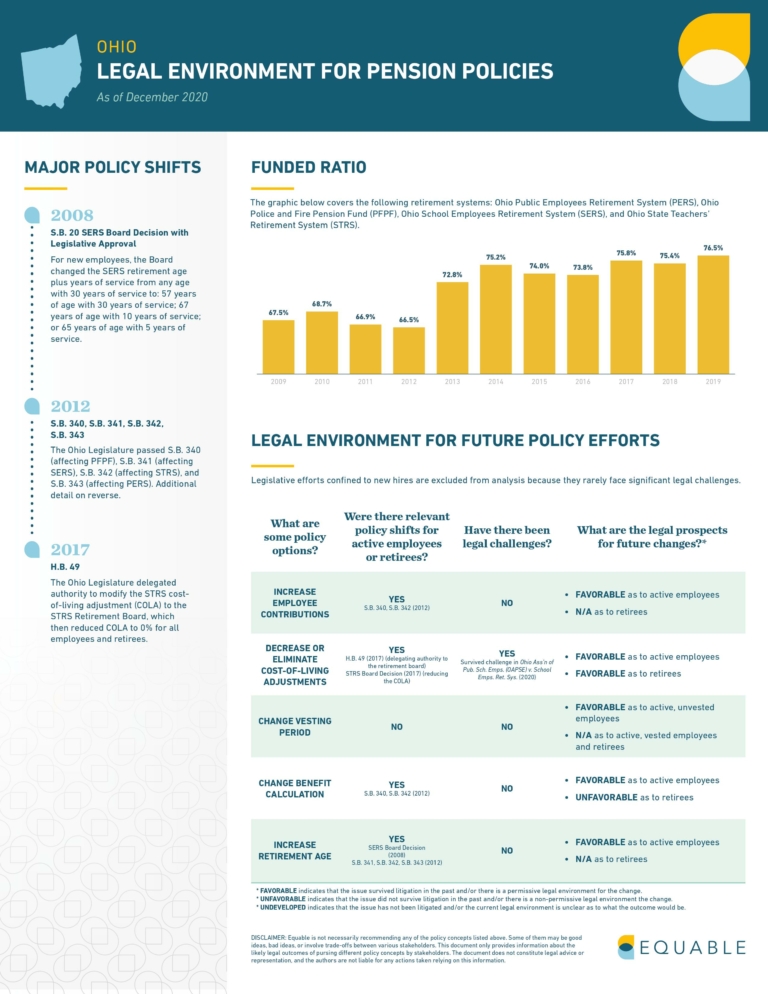

Infographic The Protections for Ohio’s Public Pensions

Ohio Police & Fire (OP&F) Michael Kelley, CFP

Ohio lawmakers propose increasing taxpayers’ share for police and fire

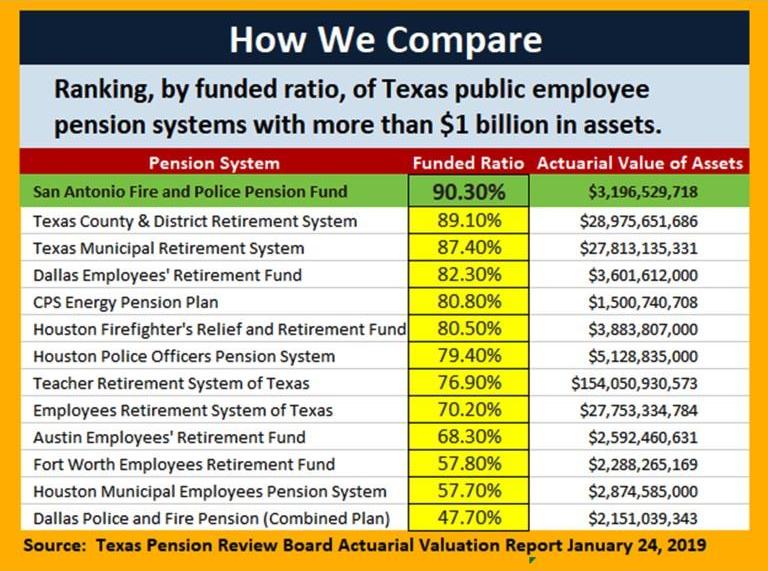

Fire & Police Pension Fund,San Antonio

Ohio Police And Fire Pension Percentage Chart policejullle

OH Police, FFs Uneasy on Pension Healthcare Firehouse

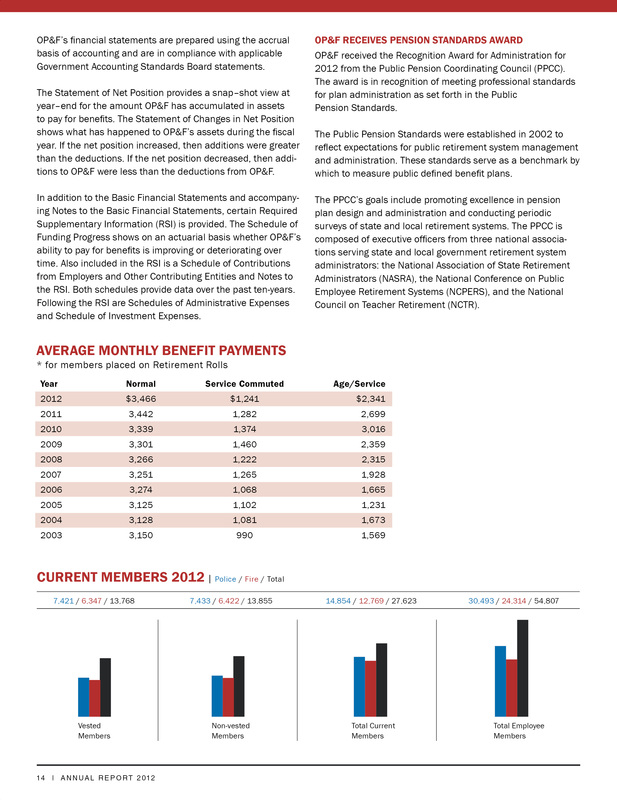

2012 Annual Report Ohio Police & Fire Pension Fund ADAM HENSLEY

Web The Ohio Police & Fire Pension Fund (Op&F).

The Next, You’re Off To A Call.

The Following Results Are Estimates Only And Will Vary By Member.

Web Includes 2.5 Percent Of Final Average Salary (Fas), Multiplied By The First 25 Years Of Service, Plus 2.1 Percent Of Fas For Each Year Of Service Thereafter.

Related Post: