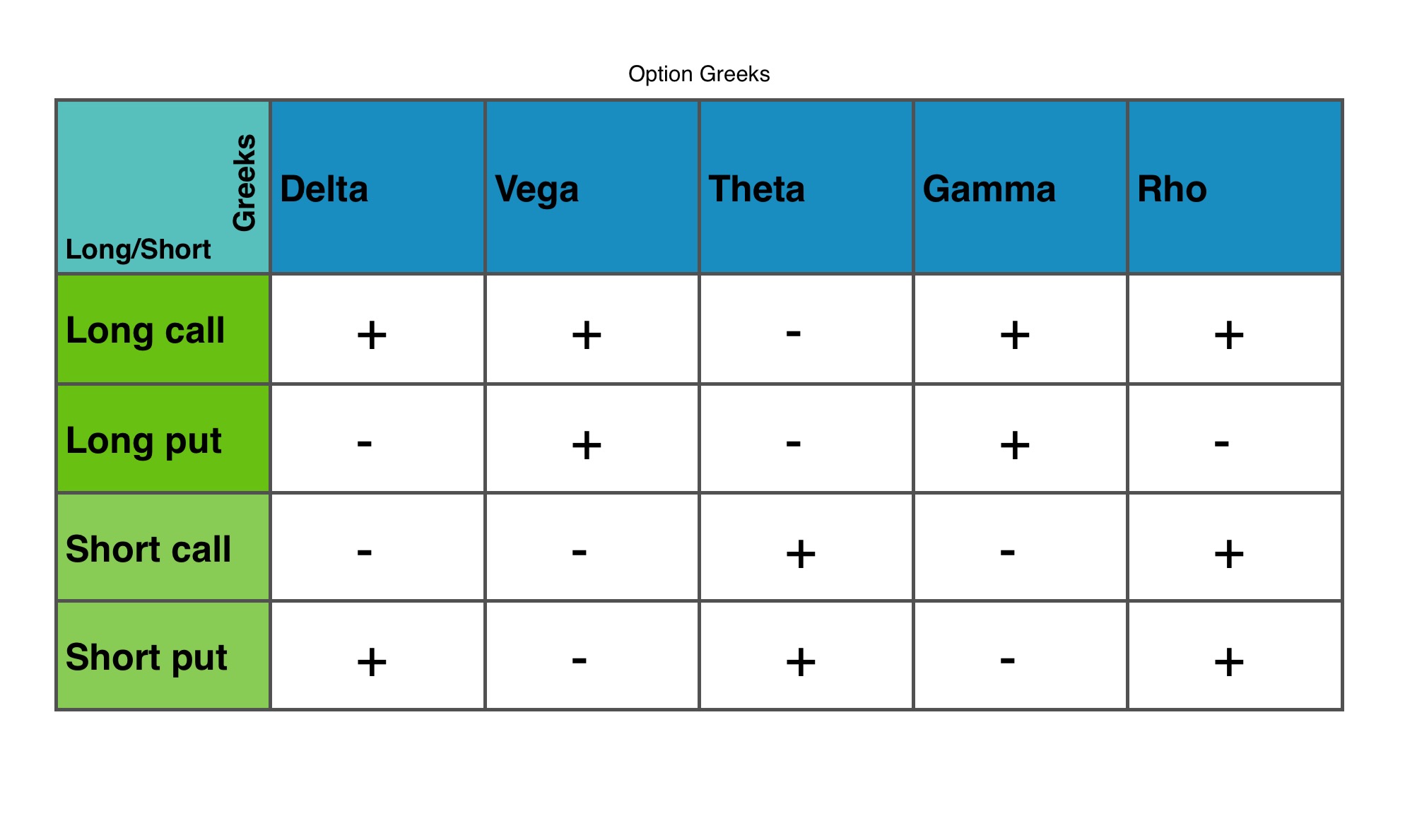

Option Greeks Chart

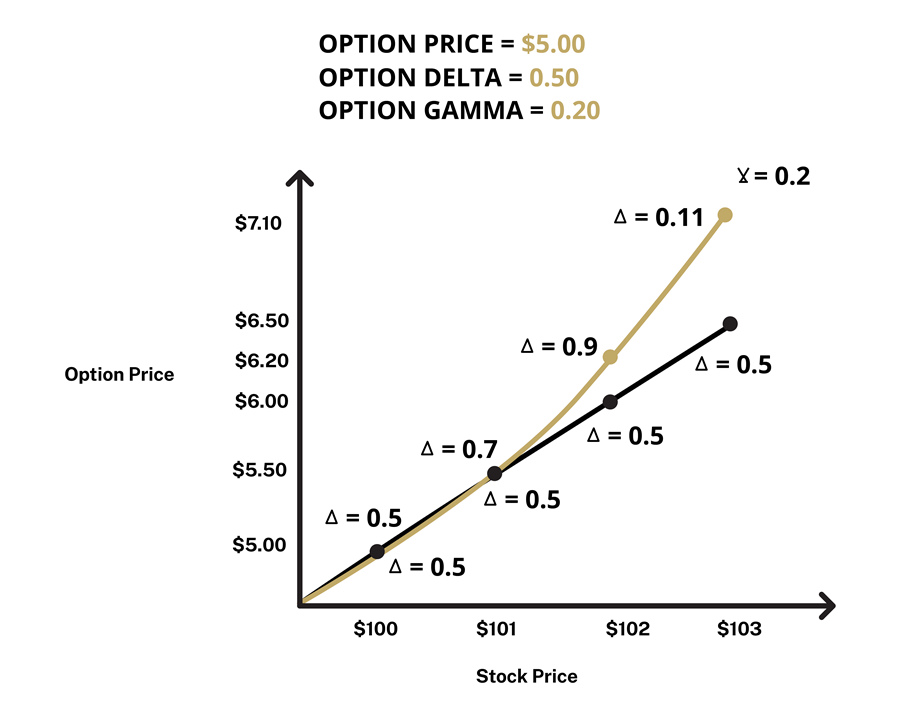

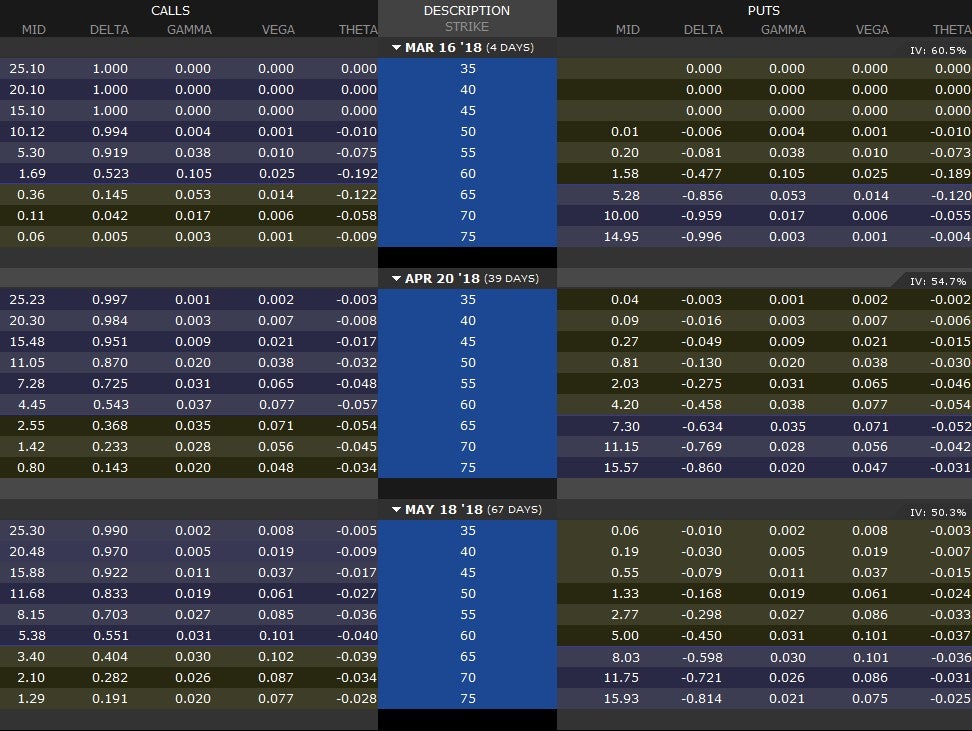

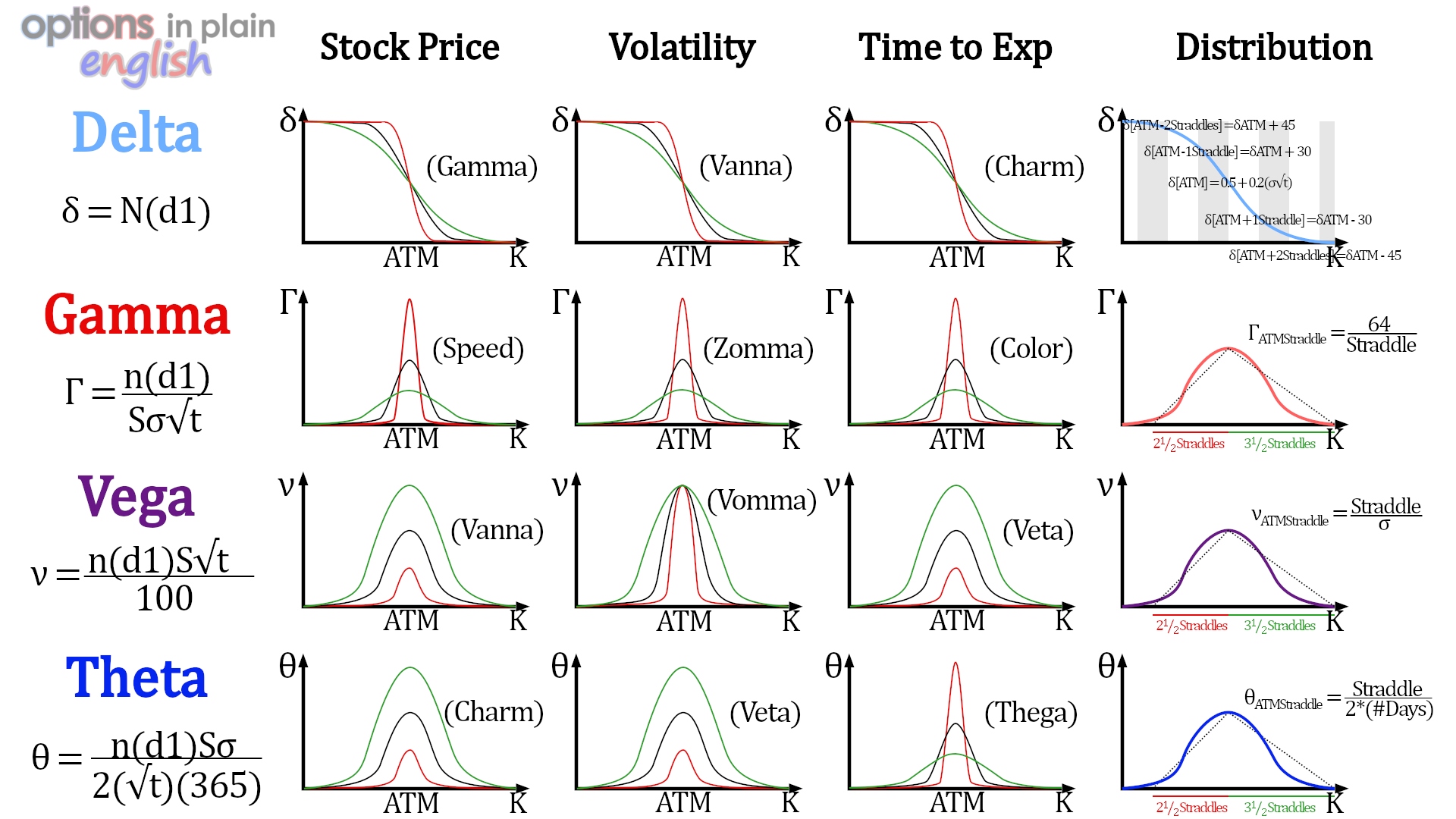

Option Greeks Chart - Greek letters delta, gamma, theta, and vega represent those variables. Web in simple terms, options greeks are financial calculations that measure the sensitivity of the derivative instrument’s price (the options contract) to the underlying asset. Beginning option traders sometimes assume that when a stock moves $1, the price of options based on that stock will move more than $1. Just ask and chatgpt can help with writing, learning, brainstorming and more. S&p 500 index options charts for volume, open interest, implied volatility, and max pain by expiration date. Delta, gamma, theta, and vega. Delta measures how much the options premium will change, theoretically, with a $1 move in the underlying price. Web discover how options greeks such as theta, vega, and delta, and more can help you evaluate the risks and rewards of trading options. The volatility & greeks view presents theoretical information based on and calculated using the binomial option pricing model. Web these four primary greek risk measures are known as an option's delta, gamma, theta, and vega. Use oic calculators to estimate option value changes and risks. Web in a nutshell, options greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. The calculator uses the latest price for the underlying symbol. Though you don’t necessarily need to use the greeks in order to trade options, they can be very. Web in options trading, there are four major greeks: These primary option greeks have a greater impact on the sensitivity of options premium than the secondary option greeks. Just ask and chatgpt can help with writing, learning, brainstorming and more. The measures are considered essential by many investors for making informed decisions in options trading. Web in simple terms, options. Delta, gamma, theta, and vega. Let’s go through each of them one by one. These primary option greeks have a greater impact on the sensitivity of options premium than the secondary option greeks. What is delta and how is it used? That’s a little silly when you really think about it. Web option greeks (chart cheat sheet) to measure the value of change, multiply the greek by 100. Though you don’t necessarily need to use the greeks in order to trade options, they can be very helpful in measuring and understanding certain risks. S&p 500 index options charts for volume, open interest, implied volatility, and max pain by expiration date. The. Beginning option traders sometimes assume that when a stock moves $1, the price of options based on that stock will move more than $1. How much will the option price change for every unit of change in the price of the underlying? Let’s go through each of them one by one. That’s what delta tells you. Though you don’t necessarily. The measures are considered essential by many investors for making informed decisions in options trading. That’s a little silly when you really think about it. Web in options trading, there are four major greeks: S&p 500 index options charts for volume, open interest, implied volatility, and max pain by expiration date. How much will the option price change for every. Web in options trading, there are four major greeks: Web in simple terms, options greeks are financial calculations that measure the sensitivity of the derivative instrument’s price (the options contract) to the underlying asset. Beginning option traders sometimes assume that when a stock moves $1, the price of options based on that stock will move more than $1. If you're. The greek charts display delta, gamma, theta, and vega for calls and puts across all strikes. Take a deeper look at the greek letters used to represent variables in futures and options trading. Web discover how options greeks such as theta, vega, and delta, and more can help you evaluate the risks and rewards of trading options. How much will. Delta measures how much the options premium will change, theoretically, with a $1 move in the underlying price. Delta, gamma, vega, theta, and rho are the key option greeks. Web discover how options greeks such as theta, vega, and delta, and more can help you evaluate the risks and rewards of trading options. What is delta and how is it. Web the options greeks chart page is a tool for displaying the values of options greek letters, including delta, gamma, theta, vega, and rho. This tool can help users better understand the risk and return characteristics of options, thereby better formulating investment strategies. Greek letters delta, gamma, theta, and vega represent those variables. Beginning option traders sometimes assume that when. Just ask and chatgpt can help with writing, learning, brainstorming and more. Web understand options trading with the greeks: Web the greeks are utilized in the analysis of an options portfolio and in sensitivity analysis of an option or portfolio of options. Web discover how options greeks such as theta, vega, and delta, and more can help you evaluate the risks and rewards of trading options. The volatility & greeks view presents theoretical information based on and calculated using the binomial option pricing model. The measures are considered essential by many investors for making informed decisions in options trading. In short, the greeks refer to a set of calculations you can use to measure different factors that might affect the price of an options contract. Web option greeks (chart cheat sheet) to measure the value of change, multiply the greek by 100. Delta measures how much the options premium will change, theoretically, with a $1 move in the underlying price. Delta, gamma, theta, and vega. Delta, gamma, theta, and vega. Web options traders often invoke the greeks. what are they, and more importantly, what can they do for you? This tool can help users better understand the risk and return characteristics of options, thereby better formulating investment strategies. Web in options trading, there are four major greeks: Beginning option traders sometimes assume that when a stock moves $1, the price of options based on that stock will move more than $1. Use oic calculators to estimate option value changes and risks.

Introduction to Option Greeks Trading Campus

The greeks option trading risk guide vega, gamma, theta, delta

![Options Greeks Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/options-greeks-cheat-sheet-1024x724.png)

Options Greeks Cheat Sheet [FREE Download] HowToTrade

Options Pricing & Option Greeks Explained Trade Options With Me

What are Option Greeks? Simplify

Using "The Greeks" To Understand Options

Options Greeks Cheat Sheet 4 Greeks Delta, Gamma, Theta, Vega

Option Greeks All Things Stocks Medium

Calculating Greeks on Option Spreads R YouTube

How To Use Option Greeks To Measure Risk Riset

Let’s Go Through Each Of Them One By One.

Take A Deeper Look At The Greek Letters Used To Represent Variables In Futures And Options Trading.

Web The Greeks Help To Provide Important Measurements Of An Option Position's Risks And Potential Rewards.

Why Should You Be Able To Reap Even More Benefit Than If You Owned The Stock?

Related Post: