Owners Draw Tax Rate

Owners Draw Tax Rate - In this post, we’ll look at a few. Web in simple terms, an owner’s draw is withdrawing money from your business and using it for personal use. Web 7 min read as a small business owner, paying your own salary may come at the end of a very long list of expenses. Salary business owners or shareholders can pay themselves in various ways, but the two most common. Web may 27, 2023 we'll show you our 117 tax planning strategies save a minimum of $10k in taxes.guaranteed! It is an equity account from which the money gets deducted. But is your current approach the best one? Web in its most simple terms, an owner’s draw is a way for owners to with draw (get it?) money from their business for their own personal use. Web the procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect. Web if an individual invests $30,000 into a business entity and their share of profit is $18,000, then their owner’s equity is at $48,000. Understandably, you might take less money out. Web conclusion frequently asked questions owner’s draw vs. Web in simple terms, an owner’s draw is withdrawing money from your business and using it for personal use. Web the procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect.. But when it comes to paying yourself, what do you do? Suppose the owner draws $20,000,. Web in 2022, the federal corporate income tax rate is 21%, with many states adding their own taxes on top of that. Web 7 min read as a small business owner, paying your own salary may come at the end of a very long. But when it comes to paying yourself, what do you do? Web how does an owner’s draw work? Web in 2022, the federal corporate income tax rate is 21%, with many states adding their own taxes on top of that. Understandably, you might take less money out. Web if an individual invests $30,000 into a business entity and their share. Web how does an owner’s draw work? Easy and accuratemaximum refund guaranteedaudit support guarantee Web the procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect. S corporations are popular business organizations for small. Understandably, you might take less money out. Web if an individual invests $30,000 into a business entity and their share of profit is $18,000, then their owner’s equity is at $48,000. Suppose the owner draws $20,000,. Web according to porter, “states will tax an llc relative to the amount of sales, payroll, or assets that are owned in that state. Understandably, you might take less money out.. This will allow you to deduct the salary from your. Web according to porter, “states will tax an llc relative to the amount of sales, payroll, or assets that are owned in that state. Web the procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect.. Web in 2022, the federal corporate income tax rate is 21%, with many states adding their own taxes on top of that. S corporations are popular business organizations for small. Salary business owners or shareholders can pay themselves in various ways, but the two most common. Web if an individual invests $30,000 into a business entity and their share of. Web 7 min read as a small business owner, paying your own salary may come at the end of a very long list of expenses. Web in its most simple terms, an owner’s draw is a way for owners to with draw (get it?) money from their business for their own personal use. 04, 2022 tax 304 when you first. Web in 2022, the federal corporate income tax rate is 21%, with many states adding their own taxes on top of that. 04, 2022 tax 304 when you first launch your own business or small startup, it can be confusing knowing how to do all the fine print properly. Web 7 min read as a small business owner, paying your. Web 7 min read as a small business owner, paying your own salary may come at the end of a very long list of expenses. It is an equity account from which the money gets deducted. In this post, we’ll look at a few. But when it comes to paying yourself, what do you do? In other words, if federal. Salary business owners or shareholders can pay themselves in various ways, but the two most common. Web according to porter, “states will tax an llc relative to the amount of sales, payroll, or assets that are owned in that state. Understandably, you might take less money out. Learn more about this practice. Web 7 min read as a small business owner, paying your own salary may come at the end of a very long list of expenses. Web how does an owner’s draw work? Web if an individual invests $30,000 into a business entity and their share of profit is $18,000, then their owner’s equity is at $48,000. In other words, if federal income is $100. S corporations are popular business organizations for small. Web in its most simple terms, an owner’s draw is a way for owners to with draw (get it?) money from their business for their own personal use. But is your current approach the best one? Web in 2022, the federal corporate income tax rate is 21%, with many states adding their own taxes on top of that. Web the procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect. Easy and accuratemaximum refund guaranteedaudit support guarantee Web you don’t withhold payroll taxes from an owner’s draw because it’s not immediately taxable. Along with the corporate income tax, any profits or.How to pay invoices using owner's draw?

How to pay invoices using owner's draw? QuickBooks Community

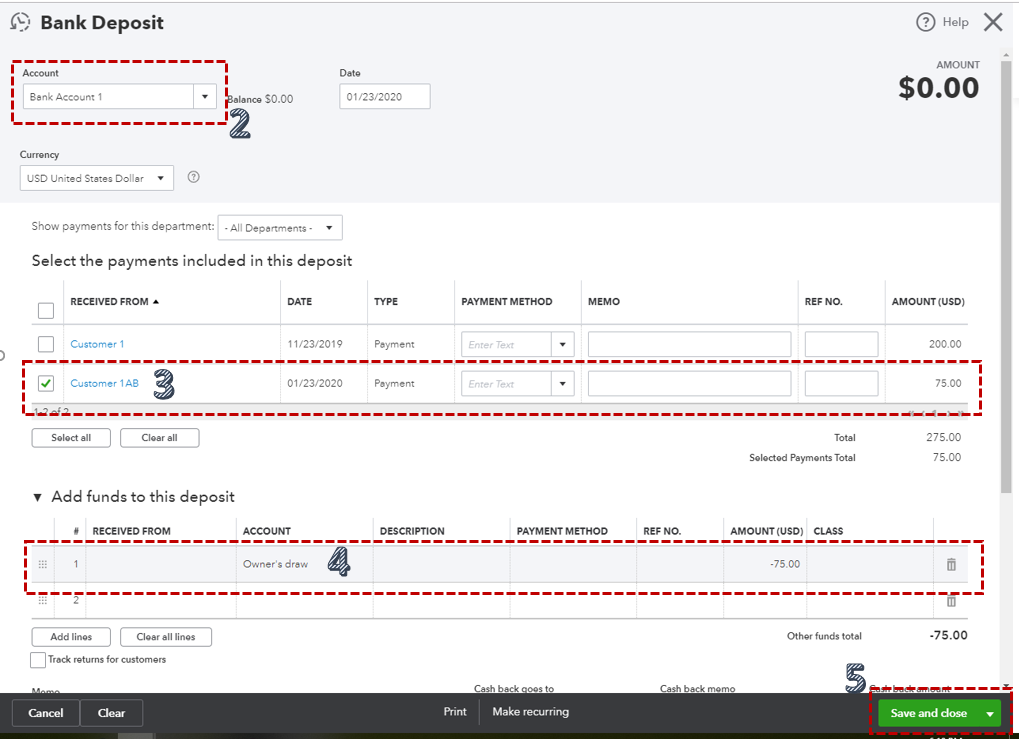

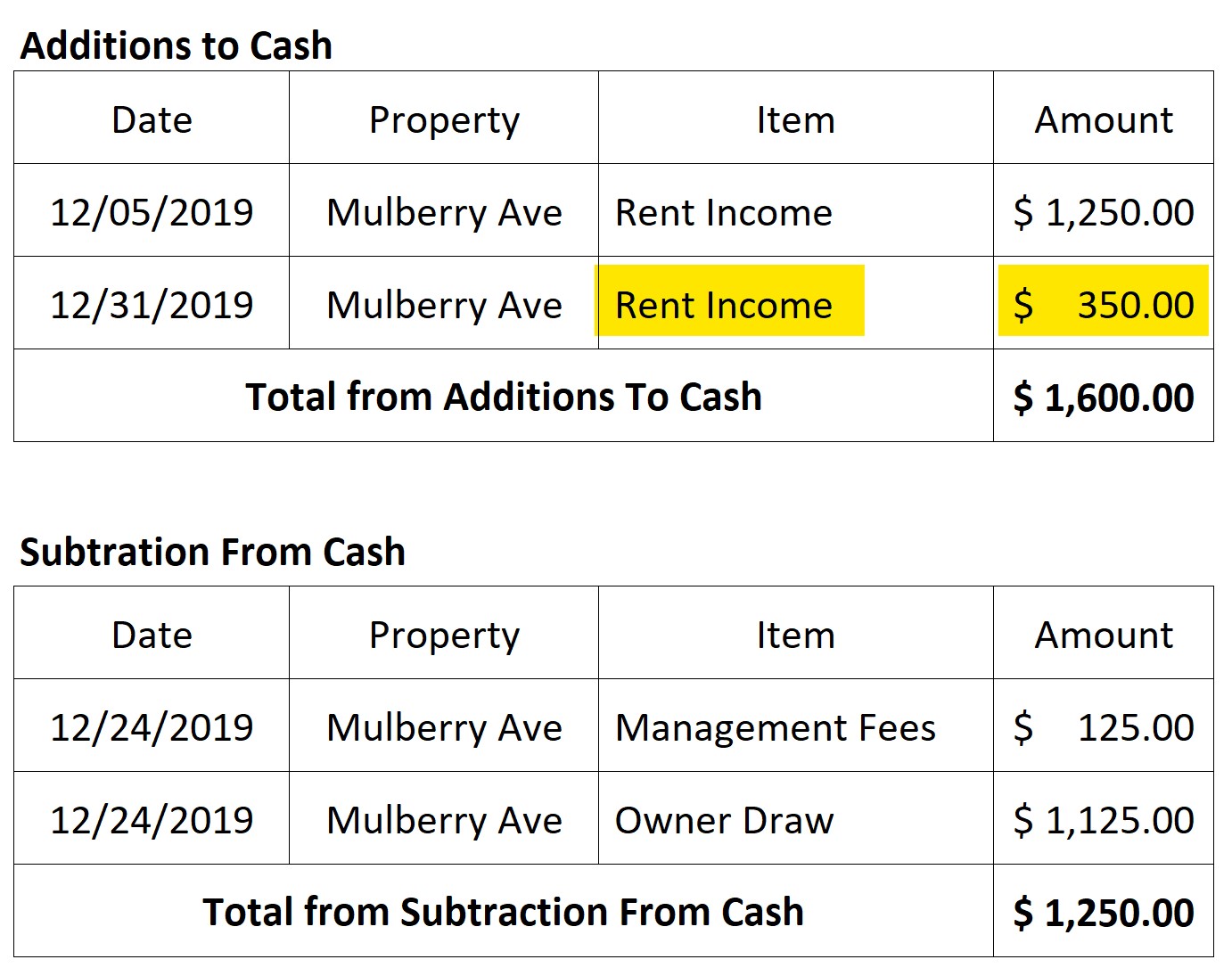

How to enter the payment (owner draw) received from your PM to QuickBooks

Small Business Taxes Are Owner Draws Taxable? YouTube

Small Business Financial Skills Is Owner's Draw Taxable? YouTube

owner's drawing account definition and Business Accounting

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masako Arndt

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

How Much Does A Small Business Get Taxed Business Walls

Web Contact Us Login Let's Get Started An Owner’s Draw Is When A Business Owner Takes Funds Out Of Their Business For Personal Use.

In This Post, We’ll Look At A Few.

Web November 19, 2021 If You're The Owner Of A Company, You’re Probably Getting Paid Somehow.

But When It Comes To Paying Yourself, What Do You Do?

Related Post: