Present And Future Value Charts

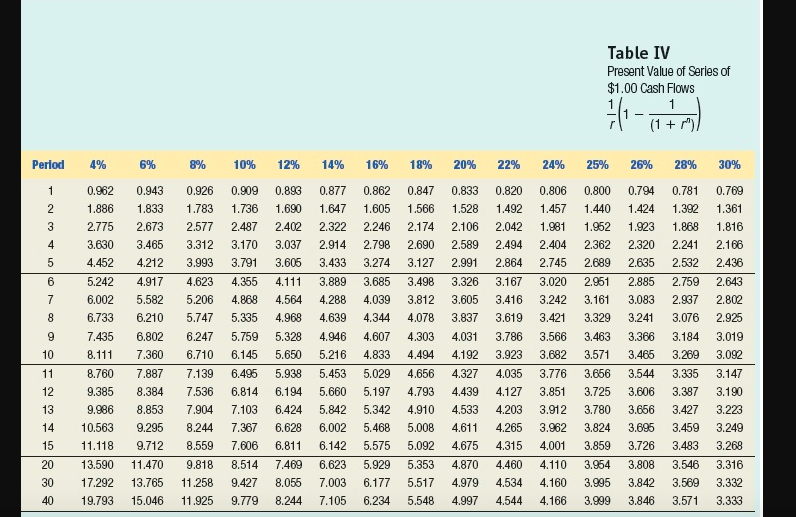

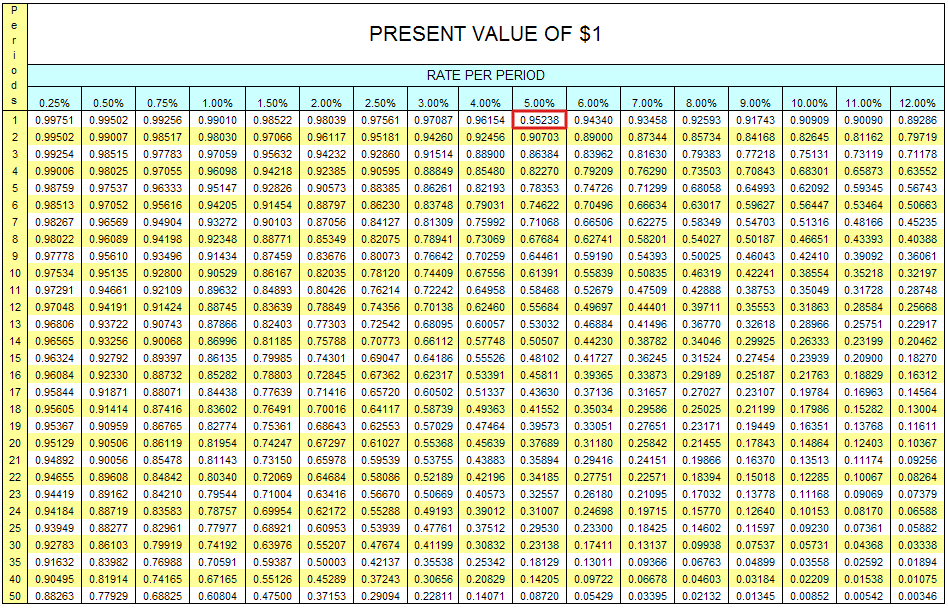

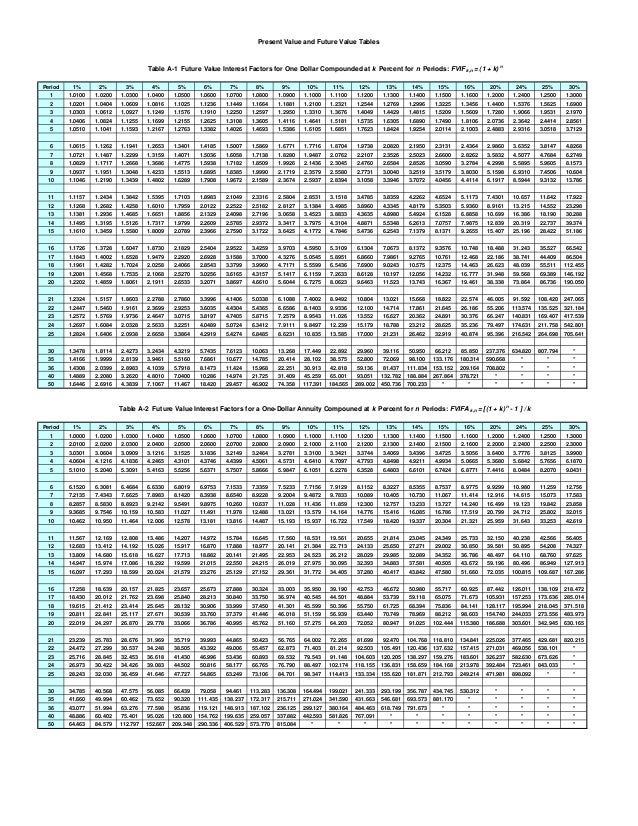

Present And Future Value Charts - Web present and future value. Future cash flows are discounted at the discount rate, and the higher. Table ai.4 present value of an annuity of $1 interest rate 509. Web this rs 100, which you are investing today, is called the present value of rs 110. It is used to calculate the future value of any single amount. C1 = cash flow from 1. Table 1 future value of $1 fv = $1 (1 + i ) n n / i Spi94029_pvtable.qxd 9/28/05 3:09 pm page 1203 You take it to the bank. Web free calculator to find the future value and display a growth chart of a present amount or periodic deposits. You take it to the bank. Table 1 future value of $1 fv = $1 (1 + i ) n n / i Table ai.2 future value of an annuity of $1 interest rate 507. What is the future value formula? It's an improvised version and an alternative to traditional future value calculator to determine the future sum of money. C1 = cash flow from 1. Spi94029_pvtable.qxd 9/28/05 3:09 pm page 1204 Present value is $100, future value is $121. Here’s what each symbol means: Web present and future value tables this table shows the future value of $1 at various interest rates ( i) and time periods ( n). Web this tool allows the users to prepare the future value chart for a given present value of money invested. It is used to calculate the future value of any single amount. Web present and future value tables this table shows the future value of $1 at various interest rates (i) and time periods (n). Web remote workers, in comparison,. Table 1 future value of $1 fv = $1 (1 + i ) n n / i The number of period terms should be calculated to match the interest. How much you have now. Here’s what each symbol means: Web future value (fv) is the value of a current asset at some point in the future based on growth rate. Present value is $100, future value is $121. Table ai.3 present value of $1 interest rate 508. How much what you have now grows to when compounded at a given rate. It's an improvised version and an alternative to traditional future value calculator to determine the future sum of money based on the range of interest percentage and time period. How much what you have now grows to when compounded at a given rate. Web future value (fv) is the value of a current asset at some point in the future based on growth rate. I give you 100 dollars. Future cash flows are discounted at the discount rate, and the higher. It is used to calculate the future value. Web in this equation, the present value of the investment is its price today, and the future value is its face value. Web present and future value tables this table shows the future value of $1 at various interest rates ( i) and time periods ( n). The present value formula is calculated by dividing the cash flow of one. Future cash flows are discounted at the discount rate, and the higher. This chart assumes that annuity payments (if any) occur at the end of the payment interval. Web this table shows the present value of $1 at various interest rates (i) and time periods (n). Investors can reasonably assume an investment’s profit using the future value formula. Web table. It is used to calculate the future value of any single amount. The present value formula is calculated by dividing the cash flow of one period by one plus the rate of return to the nth power. Web table ai.1 future value of $1 interest rate 506. Web a present value (pv) chart is a graphical representation used in finance. It helps individuals and businesses make informed decisions by visually depicting the value of money at different points in the future, considering factors such as interest rates and time periods. Web this tool allows the users to prepare the future value chart for a given present value of money invested. Spi94029_pvtable.qxd 9/28/05 3:09 pm page 1204 By plugging in the. It sounds confusing, but it’s quite simple. Period $0 $250 $500 $750 $1k $1.25k 0 5 10 accumulated deposits accumulated interest. Table ai.3 present value of $1 interest rate 508. Spi94029_pvtable.qxd 9/28/05 3:09 pm page 1203 So here rs 110 is the future value of rs 100 at 10%. This chart assumes that annuity payments (if any) occur at the end of the payment interval. What is the future value formula? By plugging in the values and solving the formula, you can determine the amount you’d need to invest today to receive the. Here’s what each symbol means: Web present value tables are used to calculate the present value of future amounts using the formula pv=fv/(1+i)^n. Web this rs 100, which you are investing today, is called the present value of rs 110. The present value formula is calculated by dividing the cash flow of one period by one plus the rate of return to the nth power. Web remote workers, in comparison, make an average of $19,000 more than those in the office [1]. Table 1 future value of $1 fv = $1 (1 + i ) n n / i Web this table shows the present value of $1 at various interest rates (i) and time periods (n). How to calculate present value (pv) present value formula (pv) how does the discount rate affect.

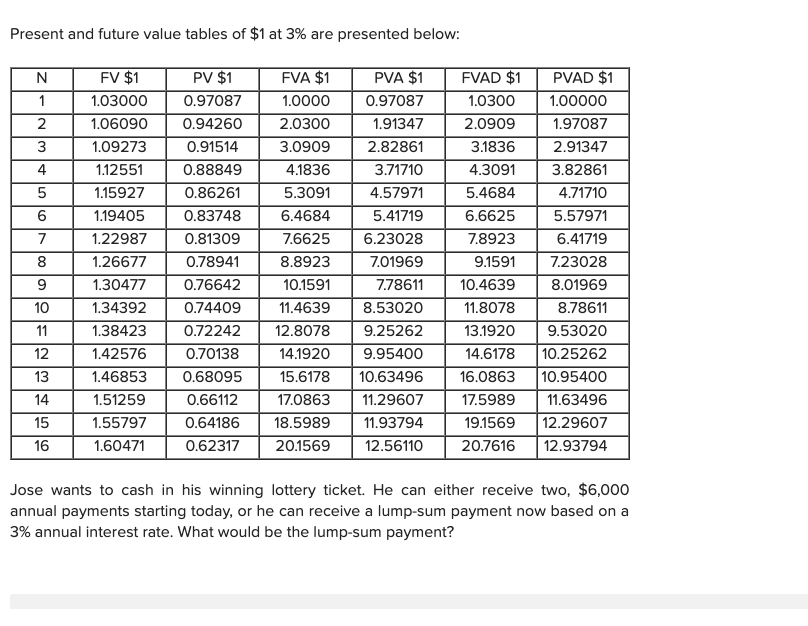

Solved Present and future value tables of 1 at 3 are

Solved Present and future value tables of 1 at 3 are

Present Value Table.pdf Present Value Personal Finance

Present and Future Value

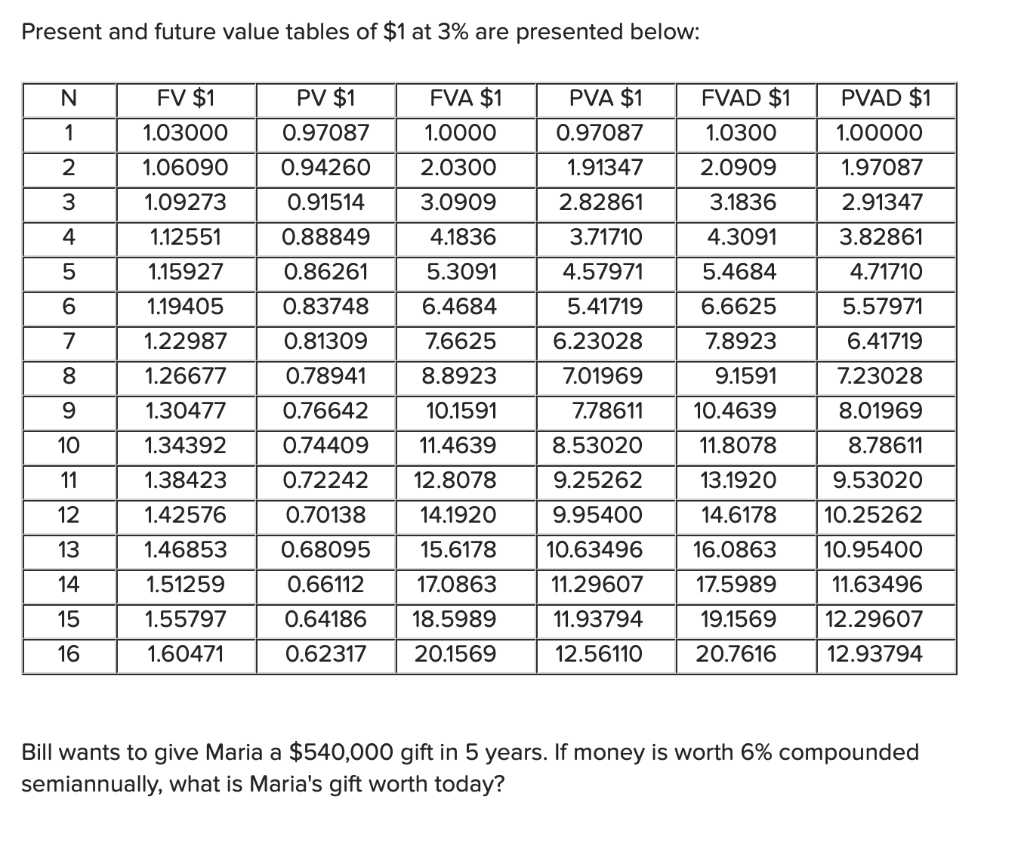

Solved Present and future value tables of 1 at 3 are

Solved Future Value and Present Value Tables Table 1 Future

What is a Present Value Table? Definition Meaning Example

Present Value and Future Value Tables

Present and Future Value (2022)

Future Value Tables Double Entry Bookkeeping

A $100 Invested In A Bank @ 10% Interest Rate For 1 Year Becomes $110 After A Year.

Table Ai.4 Present Value Of An Annuity Of $1 Interest Rate 509.

How Much What You Have Now Grows To When Compounded At A Given Rate.

It Is Used To Calculate The Present Value Of Any Single Amount.

Related Post: