Printable 1040 Sr Form

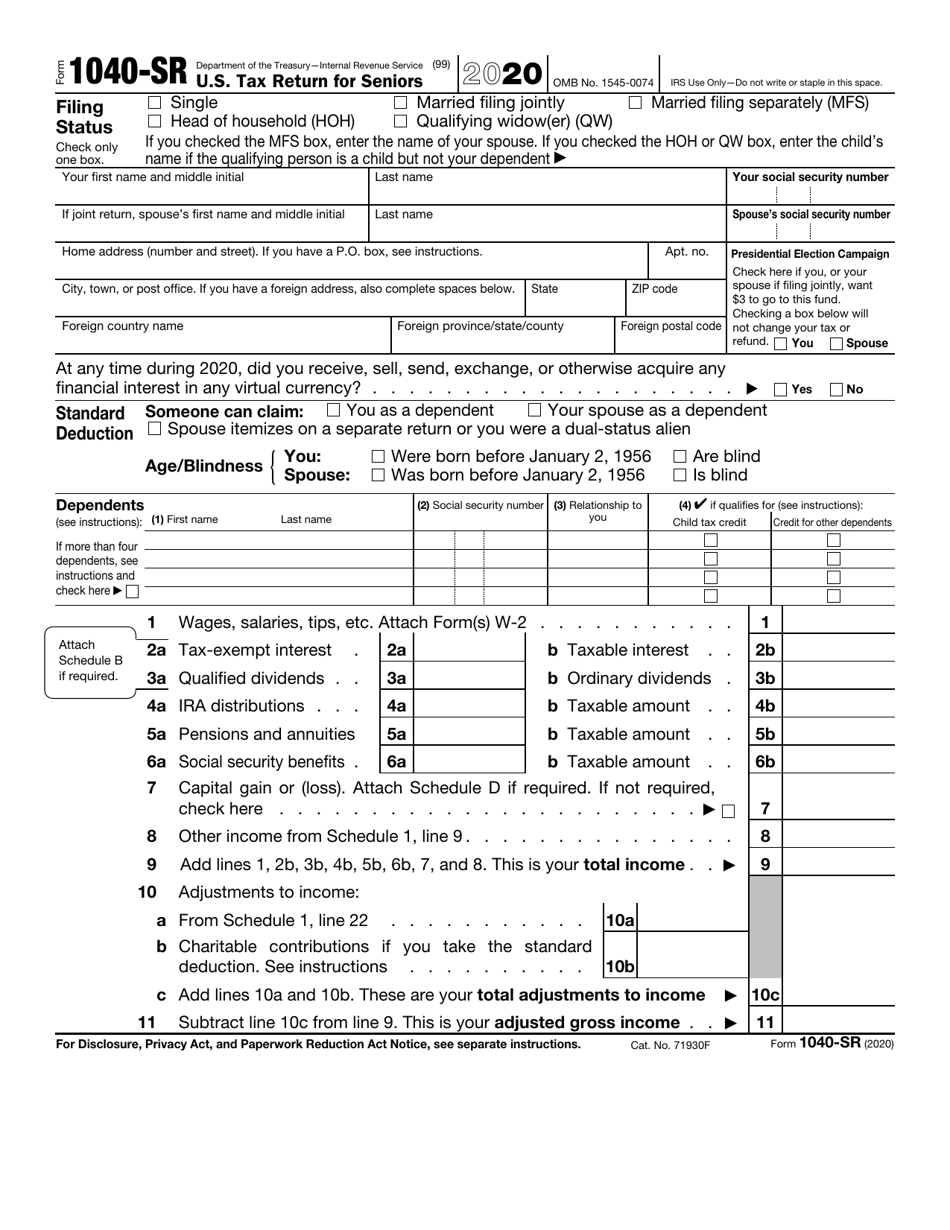

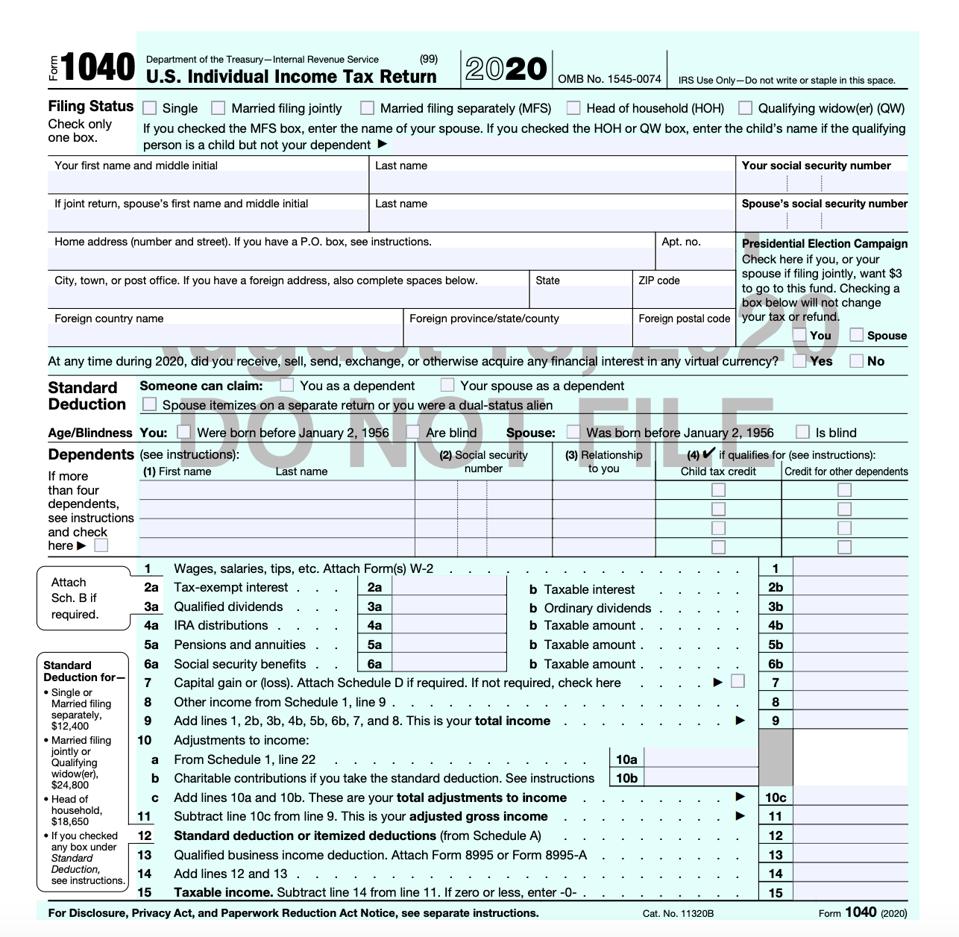

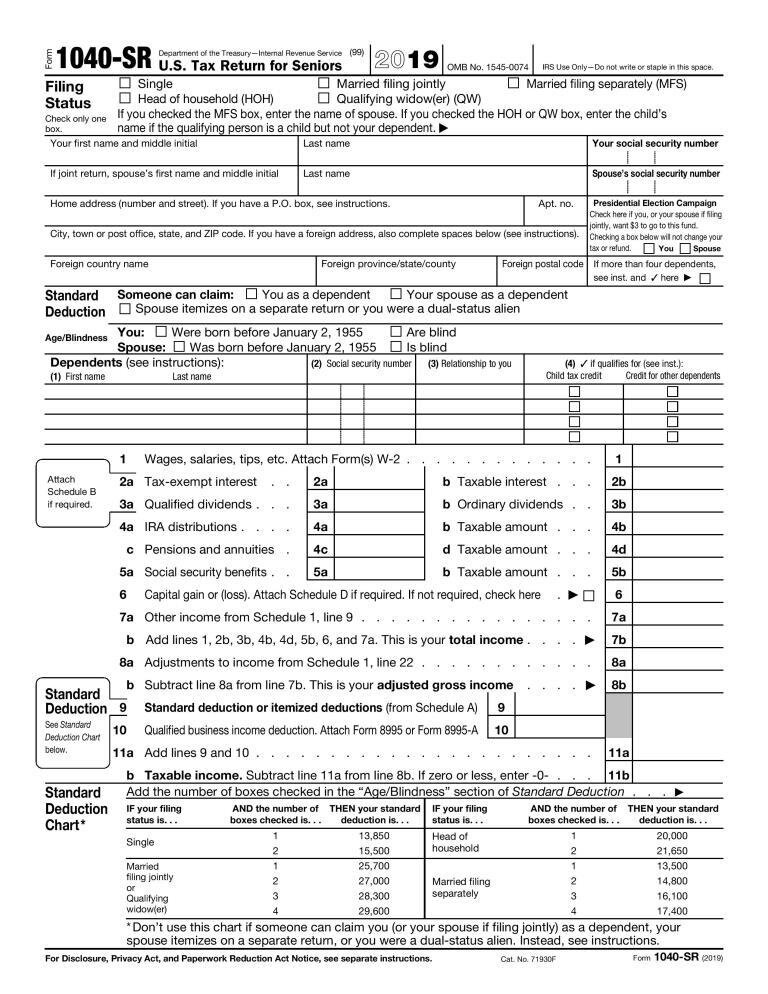

Printable 1040 Sr Form - Wages, salaries, tips, taxable scholarships, and taxable fellowship grants. Assume the dependent is not eligible for the child dependent care credit or the other dependent credit. Filing single married filing jointly. If you’re married and filing jointly , only one spouse is required to meet the age limit. Use schedule d to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts. 31, 2023, or other tax year beginning , 2023, ending , 20. Federal income tax forms and instructions are generally published in december of each year by the irs. Seniors may continue to use the standard 1040 for tax filing if they prefer. If you or your spouse were born before jan. Irs use only—do not write or staple in this space. Web name(s) shown on return. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of spouse. 31, 2023, or other tax year beginning , 2023, ending , 20. Department of the treasury—internal revenue service. You don't have to be retired to. Keep in mind, these are draft samples only and not to be filed. Taxpayer's date of birth is january 17, 1954. Web the tax cuts and jobs act, signed into law in december 2017, consolidated the 1040, 1040a and 1040ez into a single and redesigned form 1040. If you checked the mfs box, enter the name of your spouse. Dependent. Web the bipartisan budget act of 2018 introduced a new tax form for seniors effective for 2019 taxes. Tax return for seniors” could make filing season a bit less taxing for some older taxpayers — provided you qualify to use it. Individual income tax return form 1040 for fiscal year 2021. Dependent date of birth is july 20, 2020. Irs. Your first name and middle initial. If you checked the mfs box, enter the name of your spouse. Seniors may continue to use the standard 1040 for tax filing if they prefer. E taxable dependent care benefits from form 2441, line 26. You get an added $1,850 if using the single or head of household filing status. This includes items such as: Web calculating your tax liability. Irs use only—do not write or staple in this space. Note that you do not have to be retired to use this form. Filing single married filing jointly. Tax return for seniors, including recent updates, related forms and instructions on how to file. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Tax return for seniors department of the treasury—internal revenue service (99) 2020 omb no. A document published by. Test scenario 1 includes the following forms: Web taxpayer qualification requirements. Web name(s) shown on return. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Use schedule d to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain. Individual income tax return form 1040 for fiscal year 2021. Department of the treasury—internal revenue service. Federal income tax forms and instructions are generally published in december of each year by the irs. Taxpayer's date of birth is january 17, 1954. Web name(s) shown on return. You get an added $1,850 if using the single or head of household filing status. Its creation was mandated by. Web the tax cuts and jobs act, signed into law in december 2017, consolidated the 1040, 1040a and 1040ez into a single and redesigned form 1040. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow. Web irs publication 554: Web name(s) shown on return. Wages, salaries, tips, taxable scholarships, and taxable fellowship grants. If you checked the mfs box, enter the name of your spouse. Web kingdom of the planet of the apes: You don't have to be retired to. If you or your spouse were born before jan. Tax return for seniors, including recent updates, related forms and instructions on how to file. Wages, salaries, tips, taxable scholarships, and taxable fellowship grants. Assume the dependent is not eligible for the child dependent care credit or the other dependent credit. This includes items such as: Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of spouse. E taxable dependent care benefits from form 2441, line 26. Its creation was mandated by. Web the internal revenue service's new “u.s. Spouse name is marcia garcia. Test scenario 1 includes the following forms: Note that you do not have to be retired to use this form. Filing single married filing jointly. Use schedule d to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts. C tip income not reported on line 1a (see instructions).

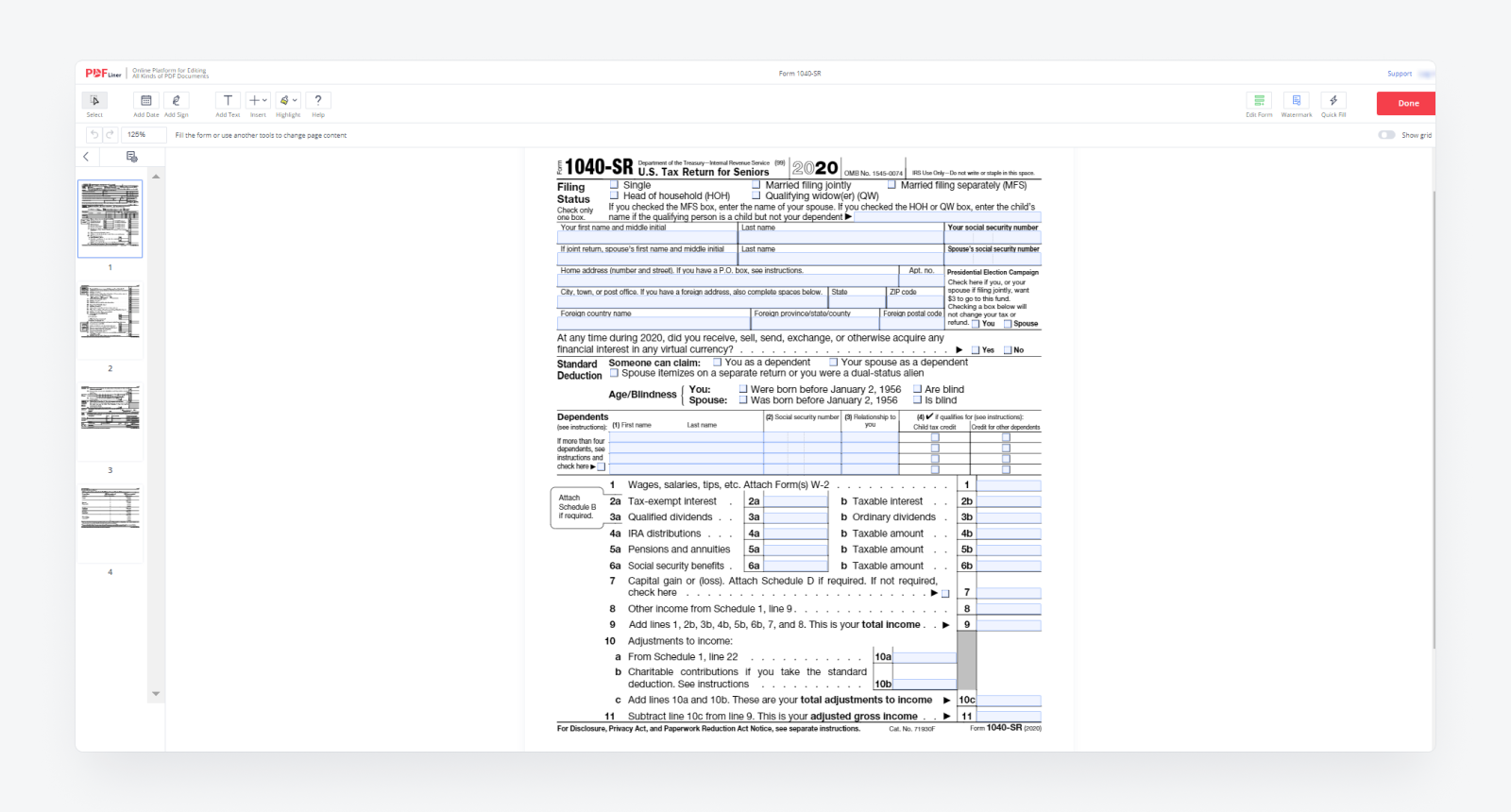

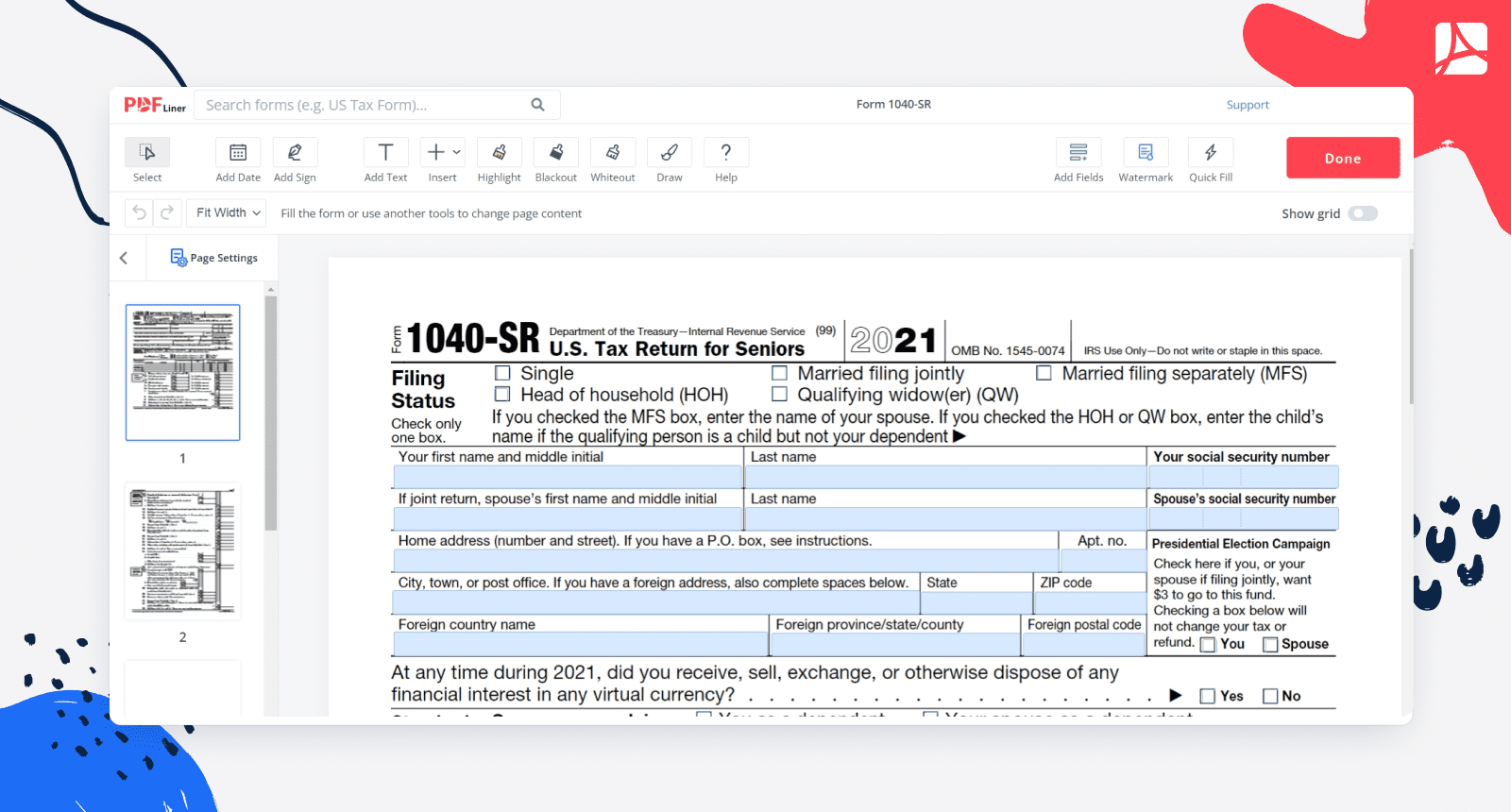

How to Fill Out Form 1040SR Expert Guide

Form 1040SR (2022) Sign Online, Print Form PDFliner

Irs 1040 Form / Best Use for 1040SR Tax Form for Seniors Irs form

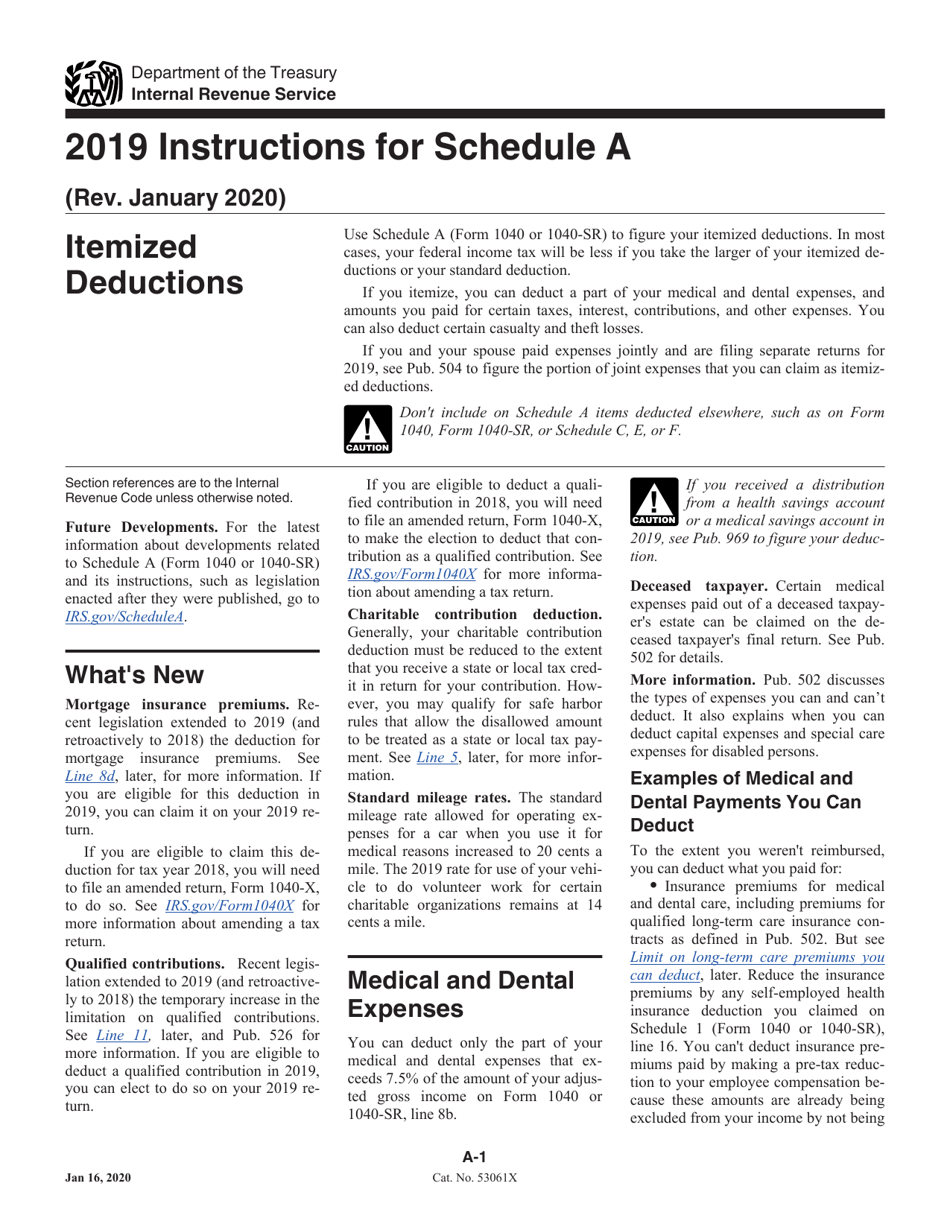

Download Instructions for IRS Form 1040, 1040SR Schedule A Itemized

IRS Form 1040SR Download Fillable PDF or Fill Online U.S. Tax Return

Irs Fillable Form 1040 Irs Schedule 1 Form 1040 Or 1040 Sr Fill Out

How to Fill Out Form 1040SR Expert Guide

Irs 1040 Form / Best Use for 1040SR Tax Form for Seniors Irs form

The New 2019 Form 1040 SR U S Tax Return For Seniors 1040 Form Printable

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)

2023 Form 1040sr Printable Forms Free Online

You Get An Added $1,850 If Using The Single Or Head Of Household Filing Status.

This Year, That Means You Must Have Been Born Before January 2, 1957.

Taxpayer's Date Of Birth Is January 17, 1954.

Many Years After The Reign Of Caesar, A Young Ape Goes On A Journey That Will Lead Him To Question Everything He's Been Taught About The Past And Make Choices That Will Define A Future For Apes And Humans Alike.

Related Post: