Printable 1099 Nec Forms

Printable 1099 Nec Forms - Your name, address, tin, and the recipient’s details (name, address, tin). Select all vendors you wish to print 1099s for. Payer’s information, including name, address and taxpayer identification number (tin). Click “print 1099” or “print 1096” if you only want that form. Persons with a hearing or speech disability with access to tty/tdd equipment can. Shop today online, in store or buy online and pick up in stores. Report payments of $10 or. Once you find it, scan for part i: Web 1099 tax forms at office depot & officemax. 2024 nec 1099 form else nollie, this 1099 is for rent, fees, and other cash over $600 that was paid out during the year. 1099 nec editable pdf fillable template 2022 with print and clear, i am using desktop 2022 and. Specify the date range for the forms then choose ok. Payer’s information, including name, address and taxpayer identification number (tin). Web 1099 tax forms at office depot & officemax. Web these 1099 forms allow you to print your information using your laser 1099. Your name, address, tin, and the recipient’s details (name, address, tin). Once you find it, scan for part i: File copy a of this form with the irs. Quickbooks will print the year on the forms for you. Web these 1099 forms allow you to print your information using your laser 1099 nec state filing requirements 2024 pdf. You’ll get this form if you’re in a state that requires it and have earned $600 or more in these types of earnings. Web recipient’s taxpayer identification number (tin). File copy a of this form with the. Your name, address, tin, and the recipient’s details (name, address, tin). File copy a of this form with the irs. Web the ssa shares the information with the internal revenue service. Your name, address, tin, and the recipient’s details (name, address, tin). Web 1099 tax forms at office depot & officemax. Persons with a hearing or speech Report payments of $10 or. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Select all vendors you wish to print 1099s for. December 15, 2023 10:24 am. Furnish copy b of this form to the recipient by january 31,. These “continuous use” forms no longer include the tax year. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Persons with a hearing or speech Web 1099, 3921, or 5498 that you print from the irs website. Web 1099, 3921, or 5498 that you print from. Web recipient’s taxpayer identification number (tin). Prepare 1099 forms to print. Report payments of $10 or. Shop today online, in store or buy online and pick up in stores. Web these 1099 forms allow you to print your information using your laser 1099 nec state filing requirements 2024 pdf. Quickbooks will print the year on the forms for you. Shop today online, in store or buy online and pick up in stores. Select each contractor you want to print 1099s for. Web 1099, 3921, or 5498 that you print from the irs website. Next, enter the payment details in box 1, recording the total amount paid to the recipient. File copy a of this form with the irs. However, the issuer has reported your. Web 1099 form nec 2024 abbey, aug 30, 2022 • 2 min read. Select all vendors you wish to print 1099s for. Web updated november 27, 2023. Shop today online, in store or buy online and pick up in stores. Select print 1096s instead, if printing form 1096. Web updated november 27, 2023. Provide form 1099 to independent contractors & file with irs. 1099 nec editable pdf fillable template 2022 with print and clear, i am using desktop 2022 and. Prepare 1099 forms to print. Click “print 1099” or “print 1096” if you only want that form. These “continuous use” forms no longer include the tax year. However, the issuer has reported your. You made the payment to someone who is not your employee. Web updated november 27, 2023. Specify the date range for the forms then choose ok. Shop today online, in store or buy online and pick up in stores. Persons with a hearing or speech Used to report payments other than wages, tips and salaries made. This documents the income they received from you so it can be properly reported on their tax return. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Provide form 1099 to independent contractors & file with irs. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Quickbooks will print the year on the forms for you. You’ll get this form if you’re in a state that requires it and have earned $600 or more in these types of earnings.

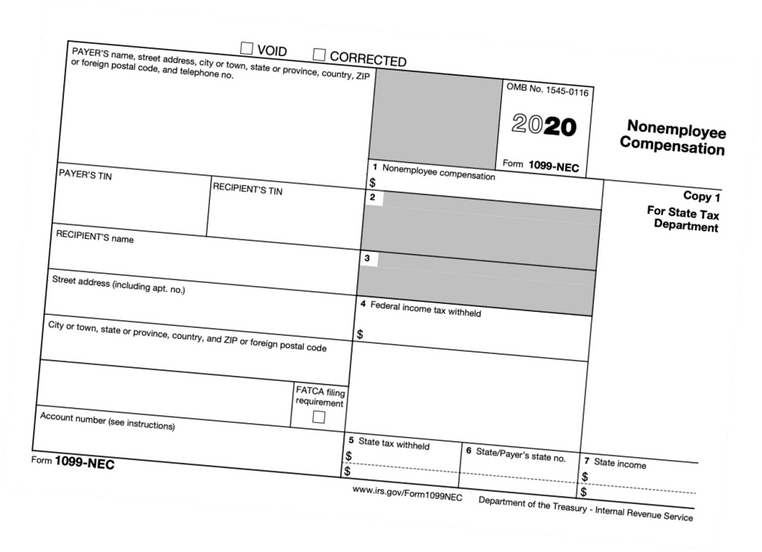

2020 1099NEC Form Print Template for Word or PDF 1096 Etsy Israel

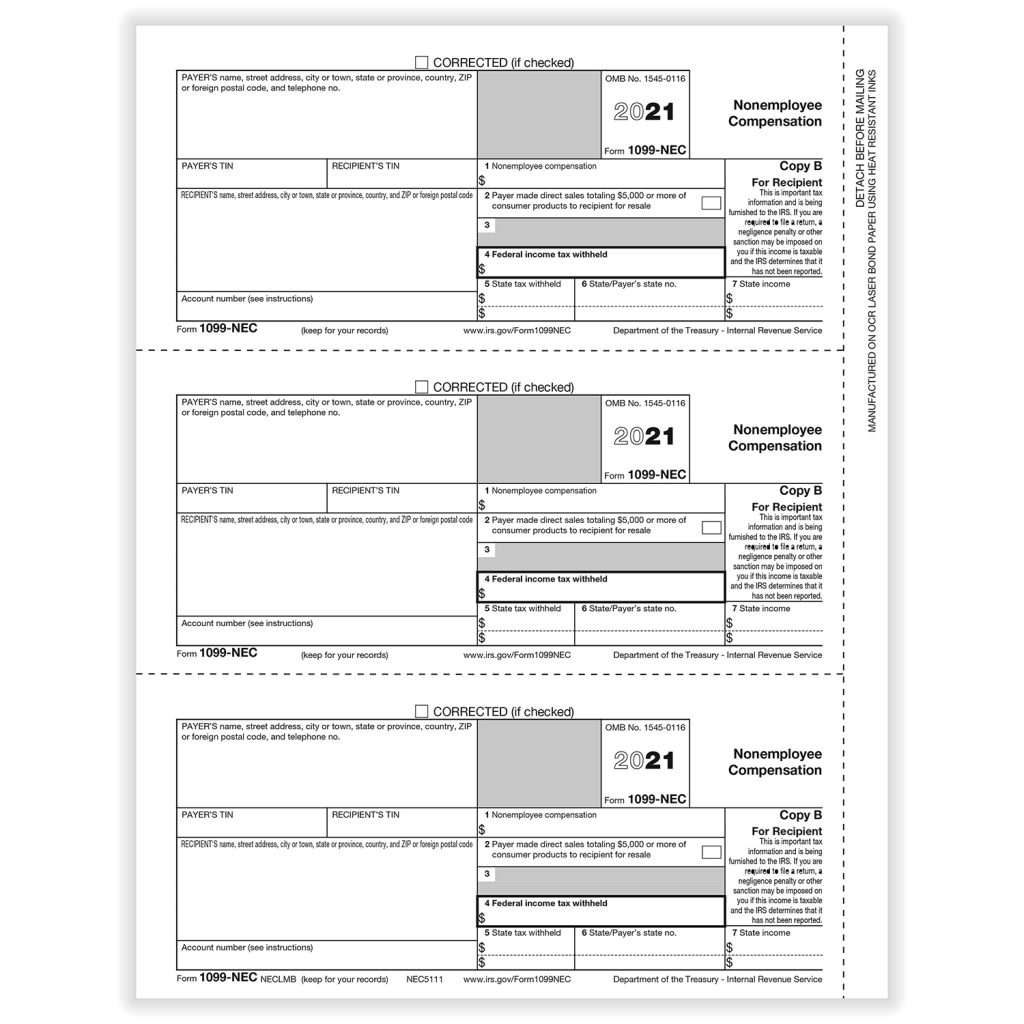

2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

Free 1099NEC Create & File With TaxFormGuide

IRS Form 1099NEC Non Employee Compensation

How to Fill Out and Print 1099NEC Forms

Fillable 1099nec Form 2023 Fillable Form 2023

How To Use the IRS 1099NEC Form FlyFin

How to File Your Taxes if You Received a Form 1099NEC

1099 NEC Editable PDF Fillable Template 2022 With Print and Clear

Printable Form 1099 Nec

If You Made Less Than $600, You’ll Still Need To Report Your Income On Your Taxes, Unless You Made Under The Minimum Income To File Taxes.

Persons With A Hearing Or Speech

Web These 1099 Forms Allow You To Print Your Information Using Your Laser 1099 Nec State Filing Requirements 2024 Pdf.

You Will Also Have A Copy You Can Send To Your State Tax Department, If Required.

Related Post: