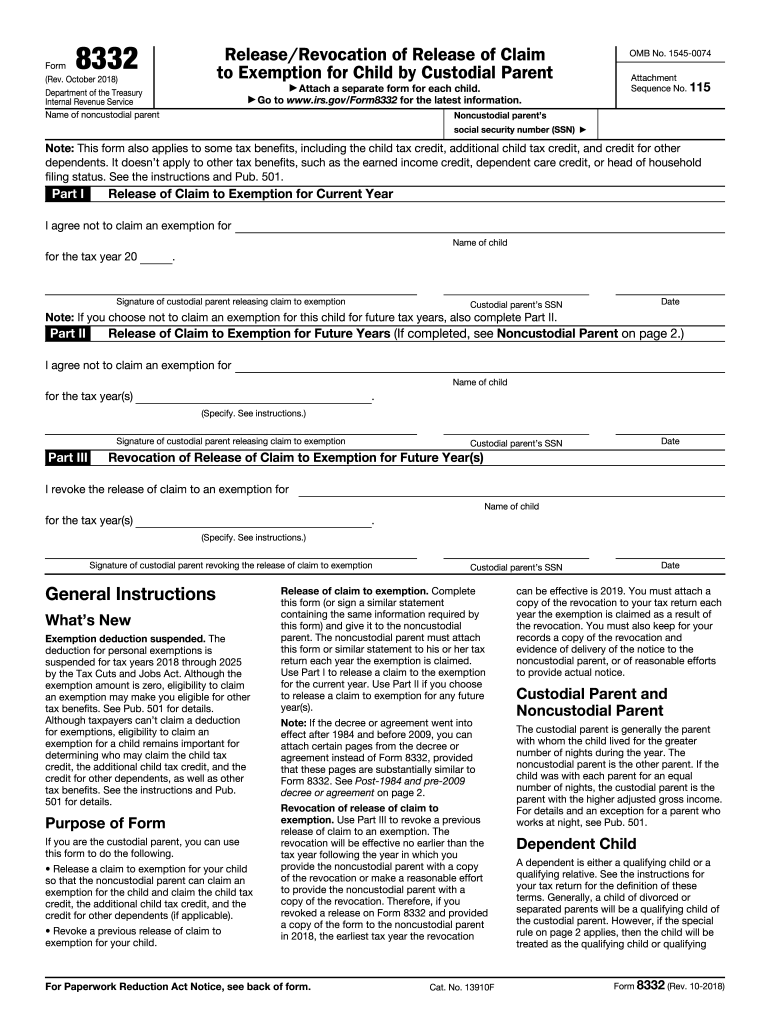

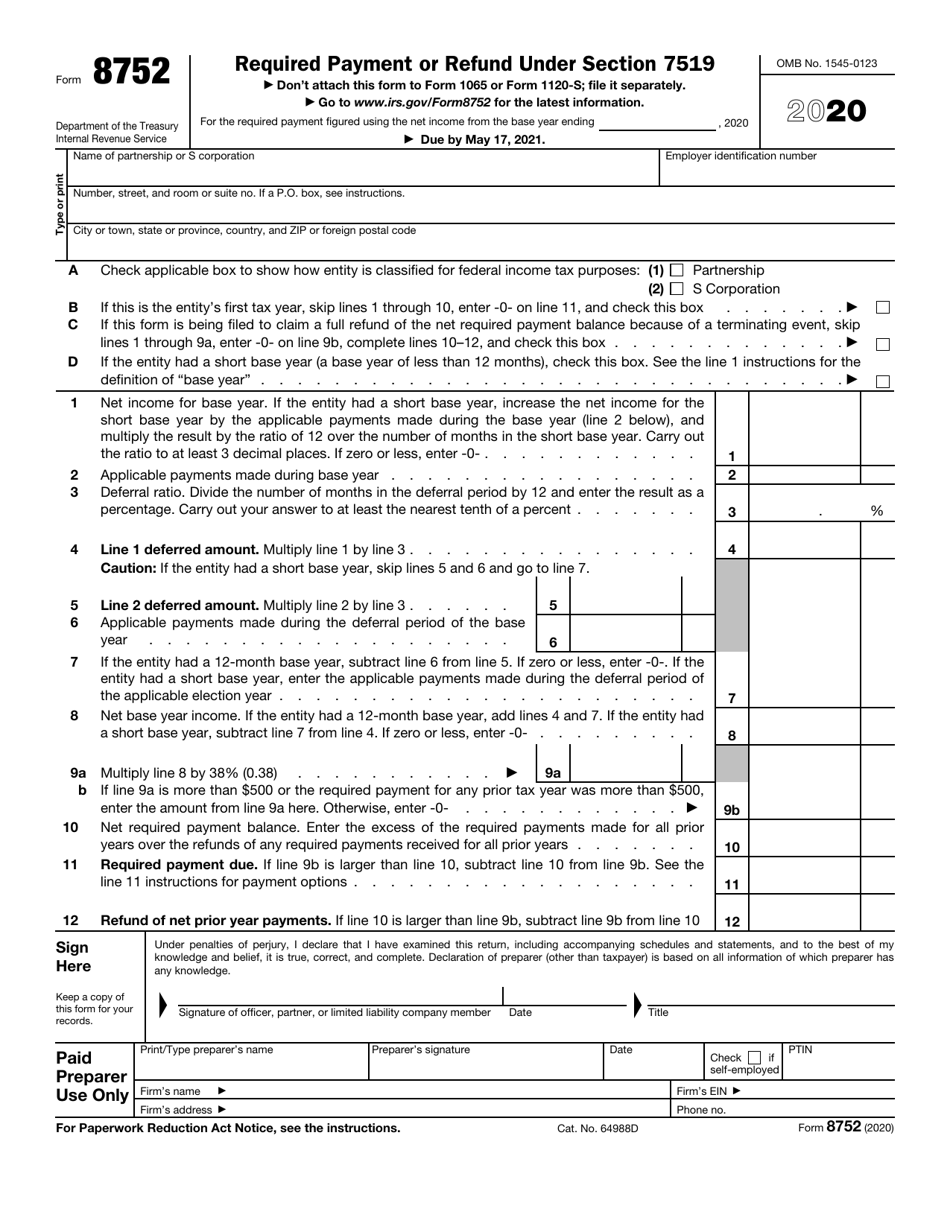

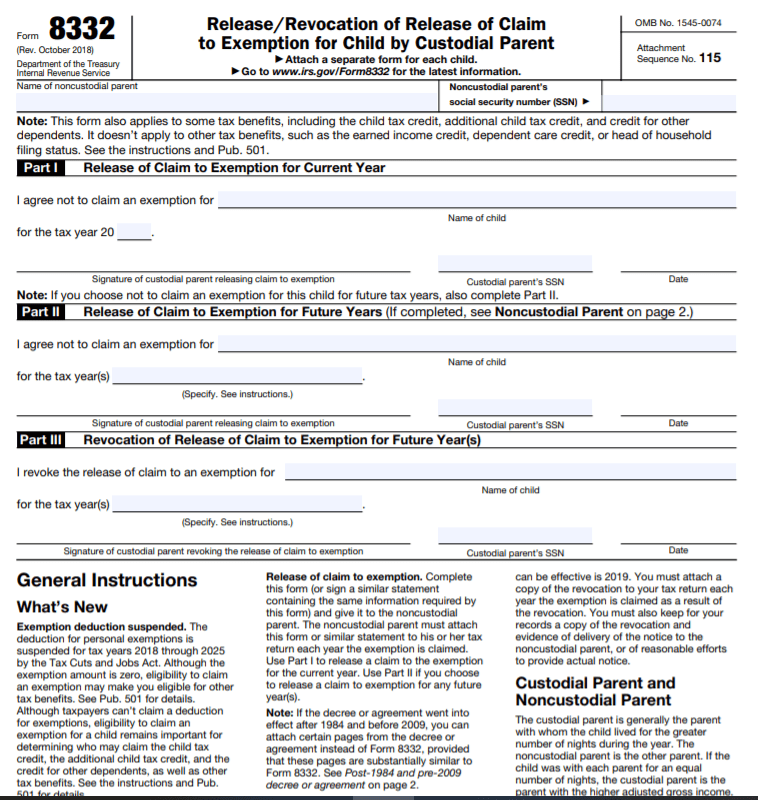

Printable 8332 Tax Form

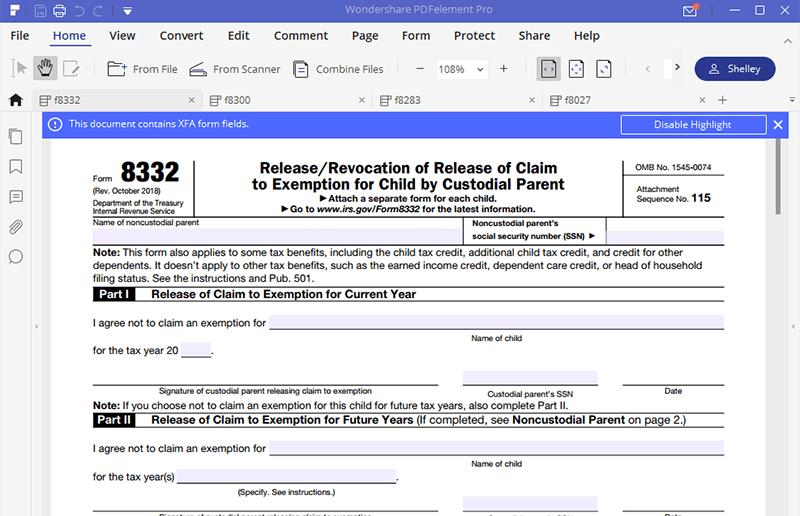

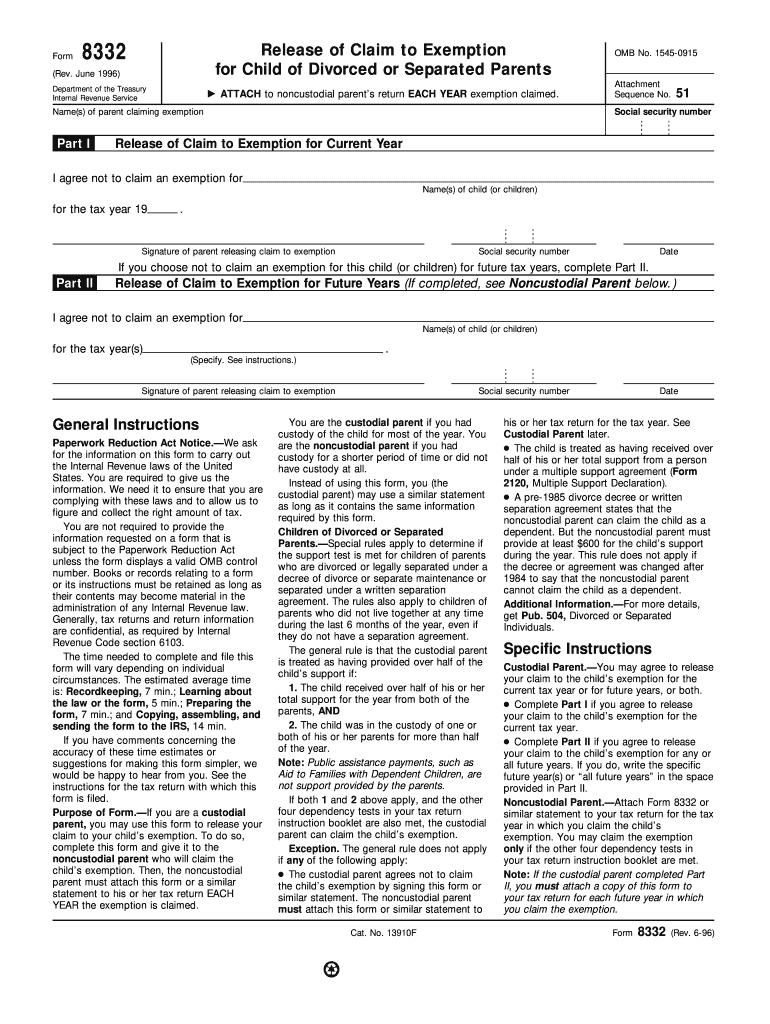

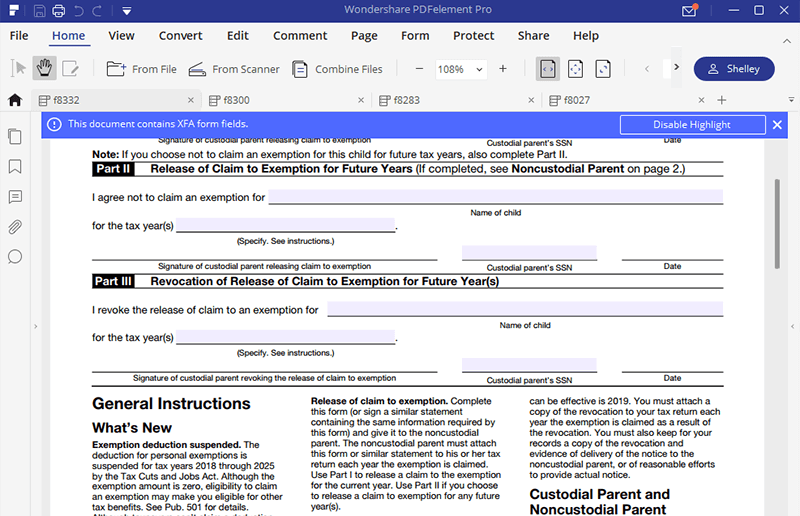

Printable 8332 Tax Form - 4.5/5 (111k reviews) If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. Documents are in adobe acrobat portable. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in january 2024, so this is the latest version of form 8332, fully. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Tax day has passed, and refunds are being processed! Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related. Instructions for form 1040 pdf. Web generating form 8332 release of claim to exemption in proconnect tax. Web 2023 individual income tax forms. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s. Web 2023 individual income tax forms. To generate form 8332. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in january 2024, so this is the latest version of form 8332, fully. The release of the dependency exemption will. Web when to use form 8332. Instructions for form 1040 pdf. Tax day has passed, and refunds are being processed! Web find out which forms are supported by h&r block’s online tax preparation program. Most federal forms are available but might not be available immediately. 4.5/5 (111k reviews) Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. If you are a custodial. Solved•by intuit•updated july 17, 2023. Instructions for form 1040 pdf. The release of the dependency exemption will. A custodial parent can also use the form. Web irs form 8332: Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web form 8332 is used to release. The release of the dependency exemption will. Tax day has passed, and refunds are being processed! Request certain forms from idor. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s. A custodial parent can also use the form. A custodial parent can also use the form. Web when to use form 8332. Tax day has passed, and refunds are being processed! If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web find out which forms are supported by h&r block’s online tax preparation program. Web irs form 8332: Solved•by intuit•updated july 17, 2023. Tax table from instructions for form 1040 pdf. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Use this form for payments that are due on april 15, 2024, june 17, 2024, september. Instructions for form 1040 pdf. To generate form 8332 in the program: Request certain forms from idor. Web form 1040 pdf. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s. Web when to use form 8332. 4.5/5 (111k reviews) Release of claim to exemption for child by custodial parents. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related. Request certain forms from idor. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Tax day has passed, and refunds are being processed! Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to. Web irs form 8332: Web generating form 8332 release of claim to exemption in proconnect tax. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in january 2024, so this is the latest version of form 8332, fully. The release of the dependency exemption will. Solved•by intuit•updated july 17, 2023. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s. Web form 1040 pdf. Tax table from instructions for form 1040 pdf. Instructions for form 1040 pdf. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Most federal forms are available but might not be available immediately.

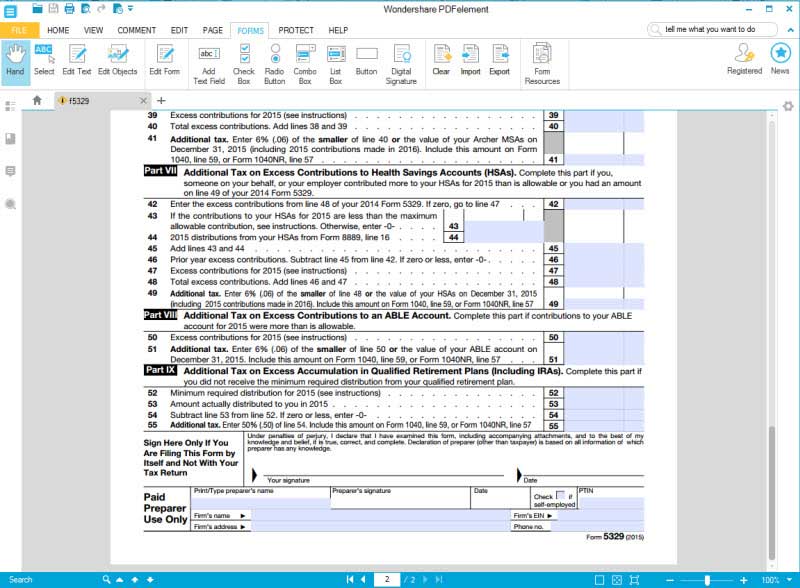

8332 PDF 20182024 Form Fill Out and Sign Printable PDF Template

Irs Form 8332 Printable Printable World Holiday

Irs Form 8332 Printable

Printable 8332 Tax Form Printable Forms Free Online

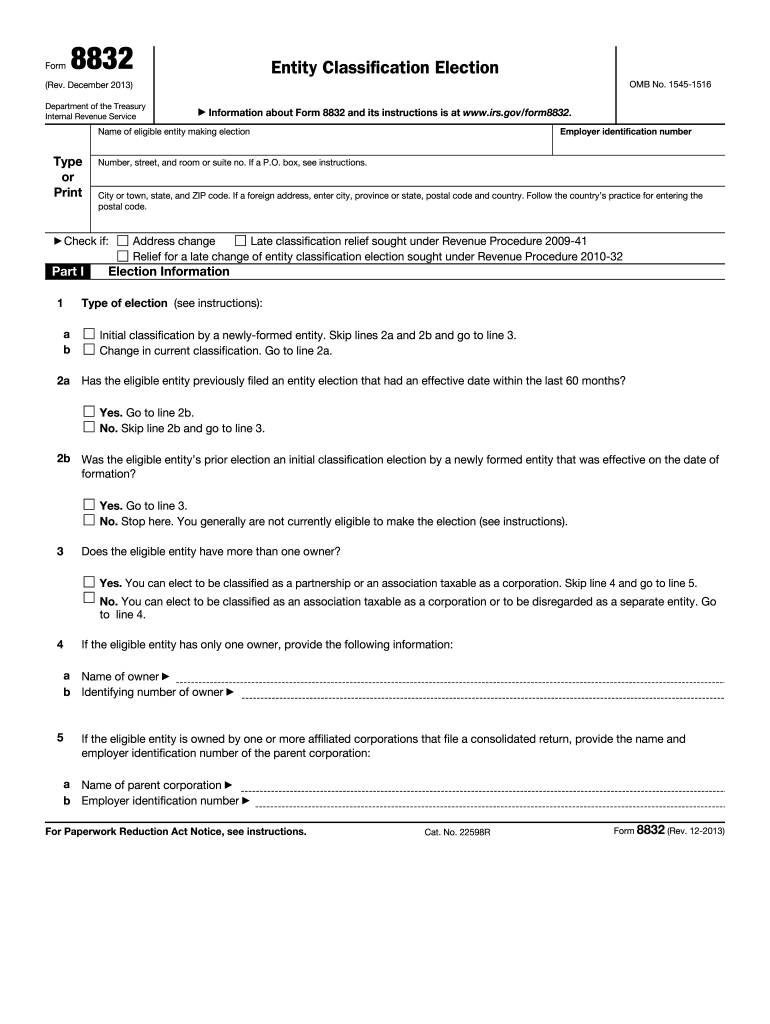

IRS 8832 20132021 Fill and Sign Printable Template Online US Legal

Irs Form 8332 Printable

Tax Form 8332 Printable Master of Documents

Form 8332 pdf Fill out & sign online DocHub

Fillable Form 8332 (Rev. January 2006) Release Of Claim To Exemption

Tax Form 8332 Printable Master of Documents

Release Of Claim To Exemption For Child By Custodial Parents.

4.5/5 (111K Reviews)

Web When To Use Form 8332.

Documents Are In Adobe Acrobat Portable.

Related Post: