Printable Form 1096

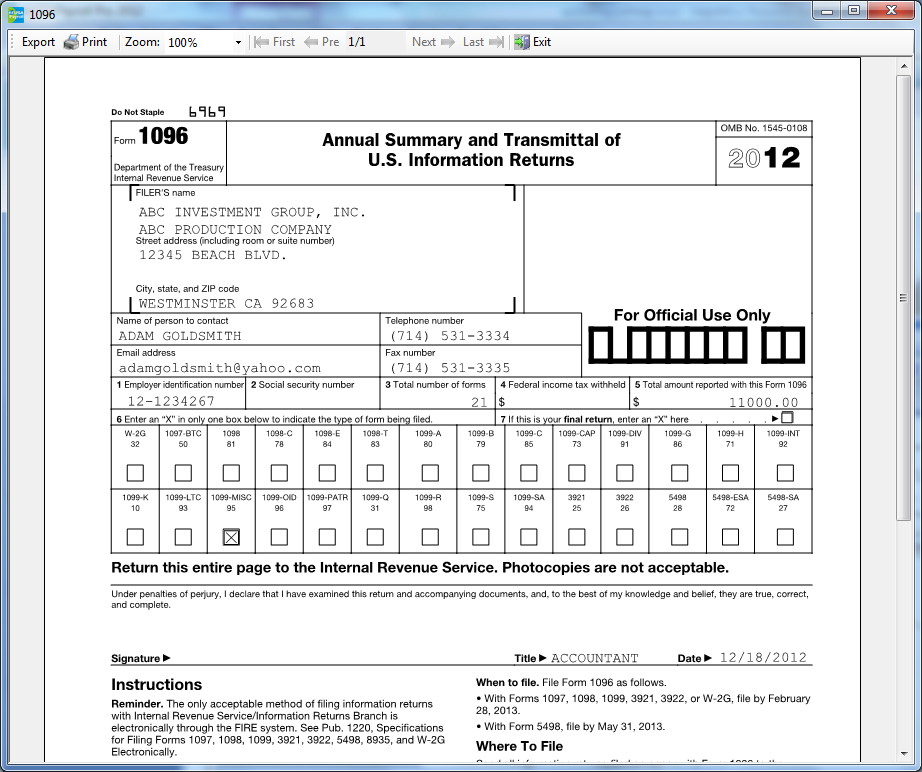

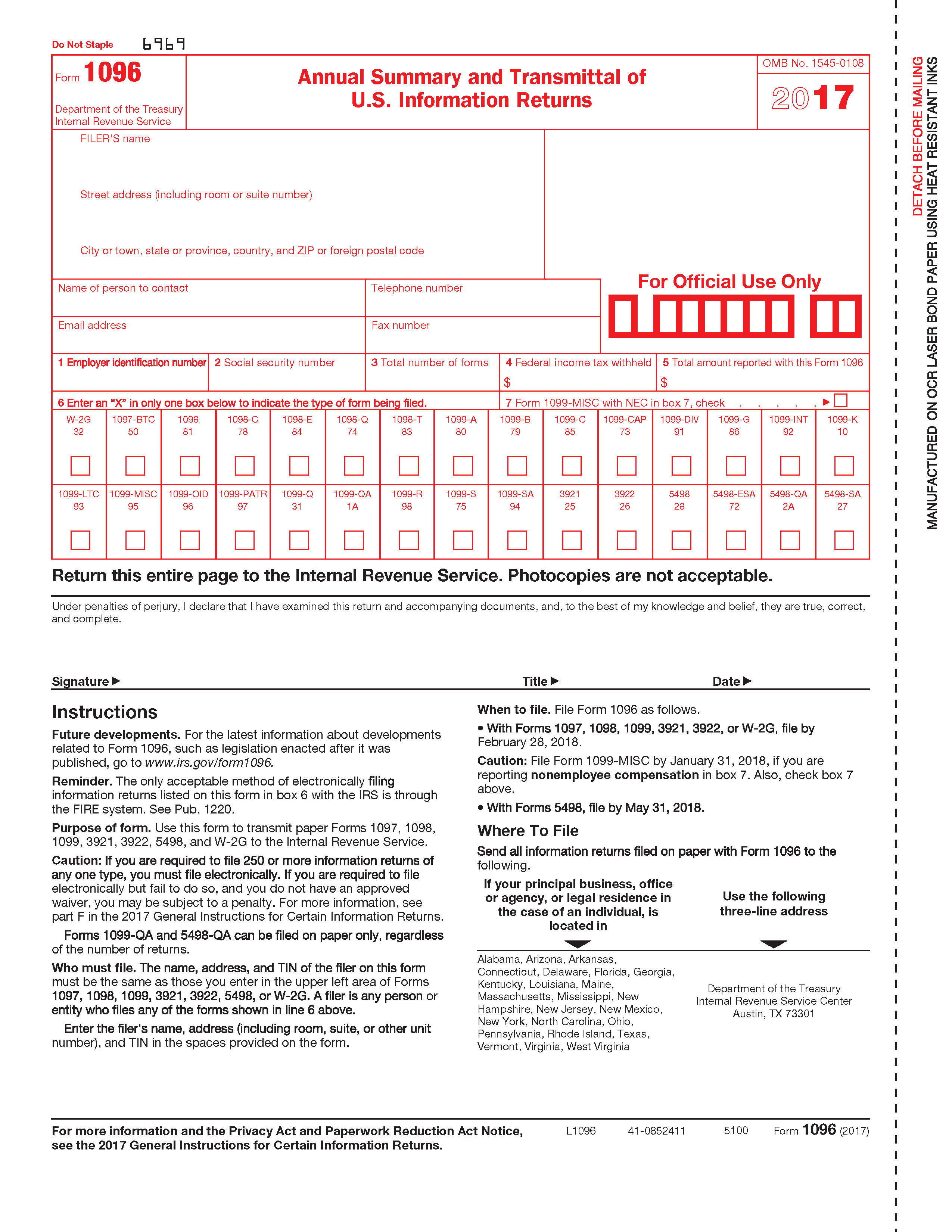

Printable Form 1096 - Information returns, including recent updates, related forms and instructions on how to file. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. The primary function of this form is to provide the irs with a quick overview of the information returns being submitted. Learn about the purpose of this irs tax form, how to file, & who needs to file with block advisors. 1 what is irs form 1096 and what is it used for? Web form 1096 is the annual summary and transmittal of us information returns, issued by the internal revenue service (irs). Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. It appears in red, similar to the official irs form. Web from your dashboard, go to “filings.” next, select the 1099s that you want to create a 1096 summary form for, such as the nec, misc, etc. This form is provided for informational purposes only. Attention filers of form 1096: The official printed version of this irs form is scannable, but a copy, printed from this website, is not. It appears in red, similar to the official irs form. Form 1096, annual summary and transmittal of u.s. In this case, we’re printing onto a blank sheet of paper. Attention filers of form 1096: Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. It appears in red, similar to the official irs form. The official printed version of this irs form is scannable, but a copy, printed from. Information returns) for free from the federal internal revenue service. Explaining the basics of form 1096. Web irs form 1096, annual summary and transmittal of u.s. This form is provided for informational purposes only. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Web the official printed version of this irs form is scannable, but a copy, printed from this website, is not. Form 1096, or the annual summary and transmittal of u.s. Web form 1096, officially known as the annual summary and transmittal of u.s. Information returns,” is a summary document used when filing certain irs information returns by mail. It appears. Information returns) for free from the federal internal revenue service. The primary function of this form is to provide the irs with a quick overview of the information returns being submitted. You also don't need to send 1096s to your contractors. Web the official printed version of this irs form is scannable, but a copy, printed from this website, is. Web form 1096 is used when you're submitting paper 1099 forms to the irs. Information returns,” is a summary document used when filing certain irs information returns by mail. Your business needs to use it only when you submit those forms to the irs in a paper format. The official printed version of this irs form is scannable, but a. It appears in red, similar to the official irs form. It is submitted as an accompanying. Web irs form 1096, officially known as the annual summary and transmittal of u.s. You don't need to submit form 1096 if you're filing electronically. Attention filers of form 1096: Web print your 1099 and 1096 forms. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Information returns, including recent updates, related forms and instructions on how to file. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Web irs. Web form 1096 is the annual summary and transmittal of us information returns, issued by the internal revenue service (irs). Web what is form 1096? This form is provided for informational purposes only. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. It is submitted as an accompanying. Information returns,” is a summary document used when filing certain irs information returns by mail. Web if you hire contractors, you may need to file form 1096. If you are filing electronically, form 1096 isn't required by the irs. Web irs form 1096, officially known as the annual summary and transmittal of u.s. Explaining the basics of form 1096. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. It is submitted as an accompanying. Web what is form 1096? Explaining the basics of form 1096. Your business needs to use it only when you submit those forms to the irs in a paper format. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Web irs form 1096, annual summary and transmittal of u.s. Web form 1096 is the annual summary and transmittal of us information returns, issued by the internal revenue service (irs). This form is provided for informational purposes only. Form 1096, annual summary and transmittal of u.s. You also don't need to send 1096s to your contractors. Like form 1099, it serves as a summary page for different irs tax forms. Information returns, is used as a summary or “cover sheet” to various types of other forms only when submitting a paper filing to the irs. Why do you need it? Attention filers of form 1096: Web the official printed version of this irs form is scannable, but a copy, printed from this website, is not.

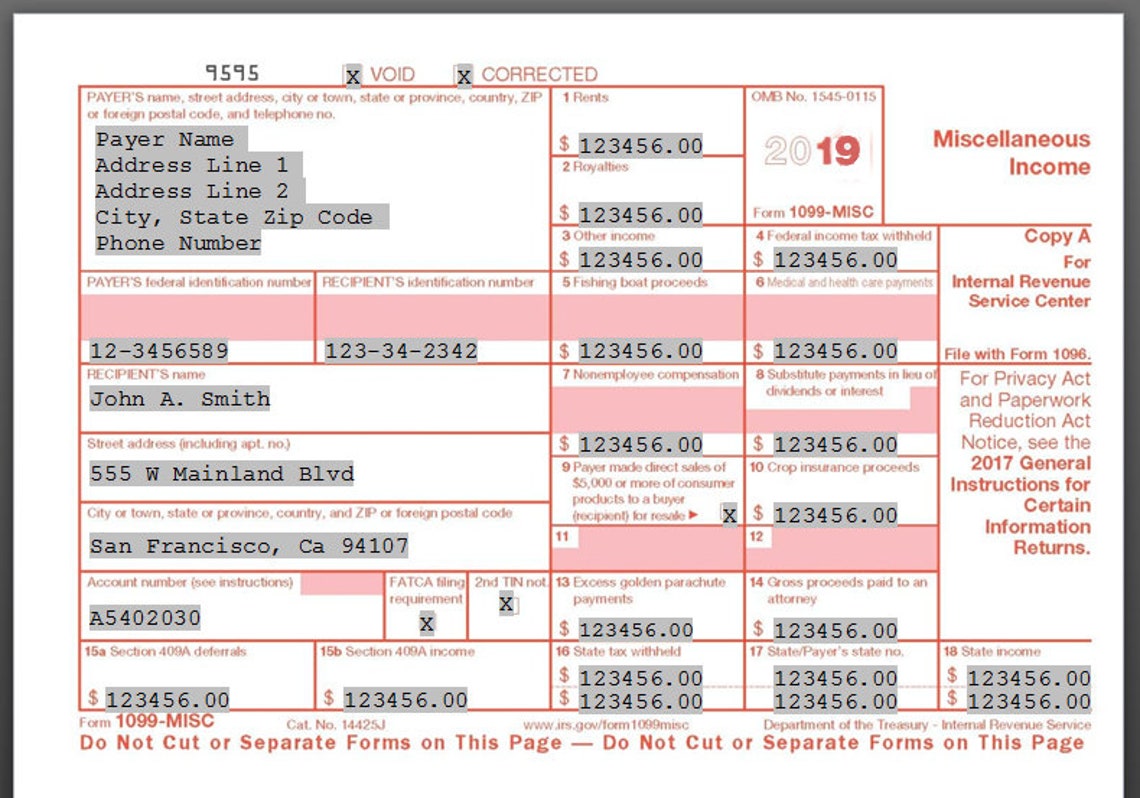

2019 1099MISC/1096 IRS Copy A Form Print Template for Word Etsy

Tax Form 1096 Annual Summary & Transmittal Costco Checks

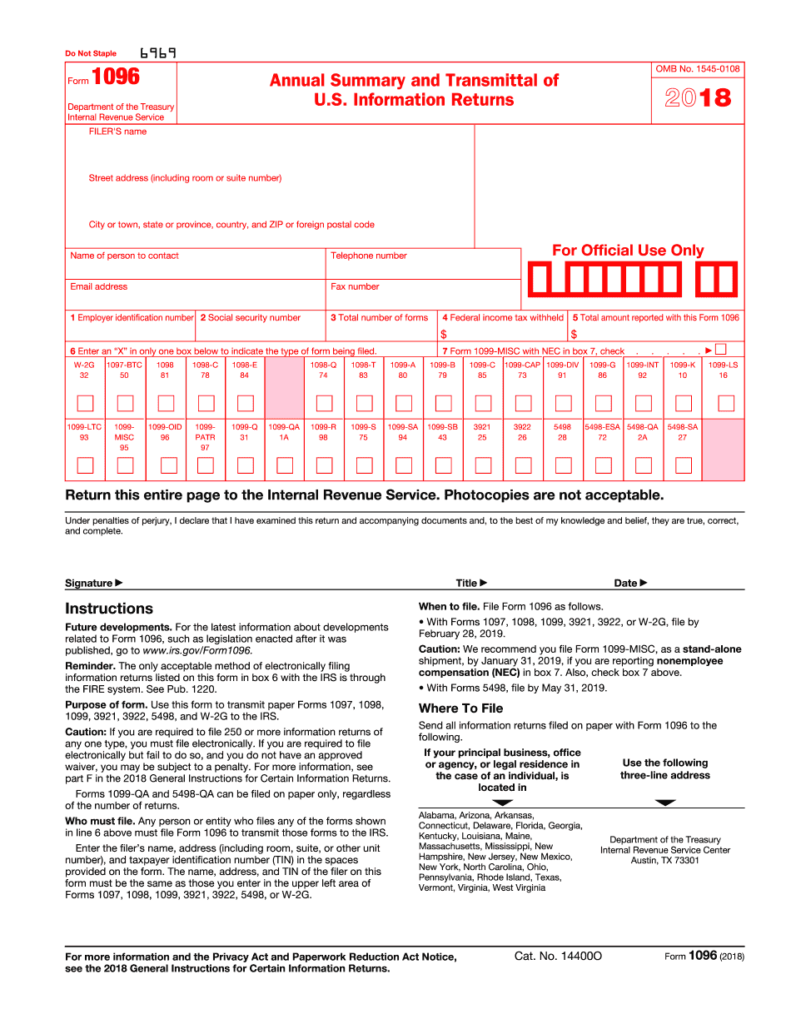

1096 template for preprinted forms 2018 Tracsc

Cómo llenar el Formulario 1096. Guía 2022 paso a paso

Form 1096

1096 Annual Summary Transmittal Forms & Fulfillment

Form 1096 Annual Summary and Transmittal of U.S. Information Returns

Fill Free fillable Form 1096 2019 Annual Summary and Transmittal of

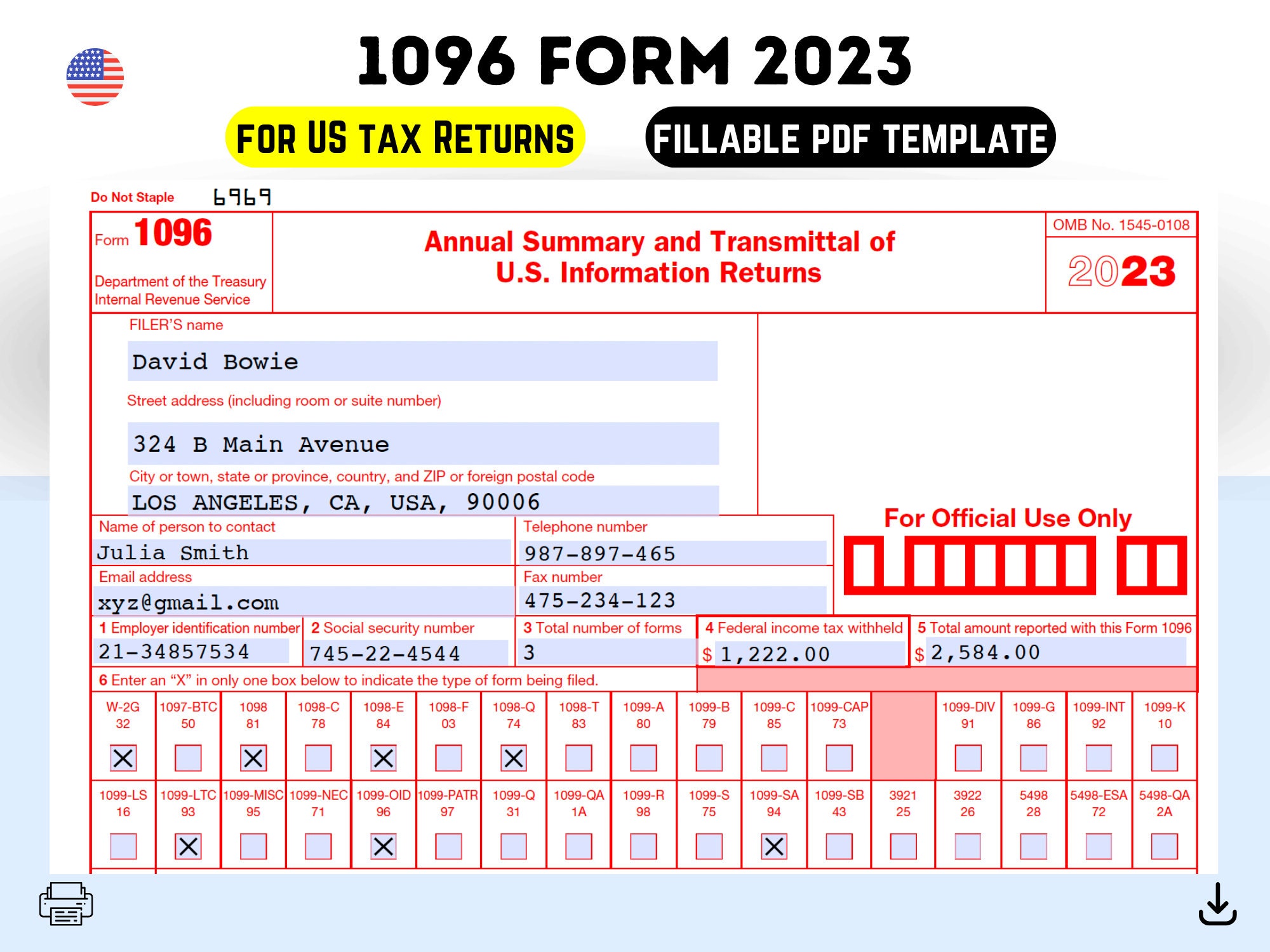

1096 IRS PDF Fillable Template 2023, USA Tax Form for 2023 Filing

2018 2019 IRS Form 1096 Editable Online Blank In PDF Printable Form 2021

It Appears In Red, Similar To The Official Irs Form.

Form 1096 Is Only Necessary If You Are Submitting Paper Forms, Not If You Are Submitting Your Forms Electronically.

You Don't Need To Submit Form 1096 If You're Filing Electronically.

This Form Is Provided For Informational Purposes Only.

Related Post: