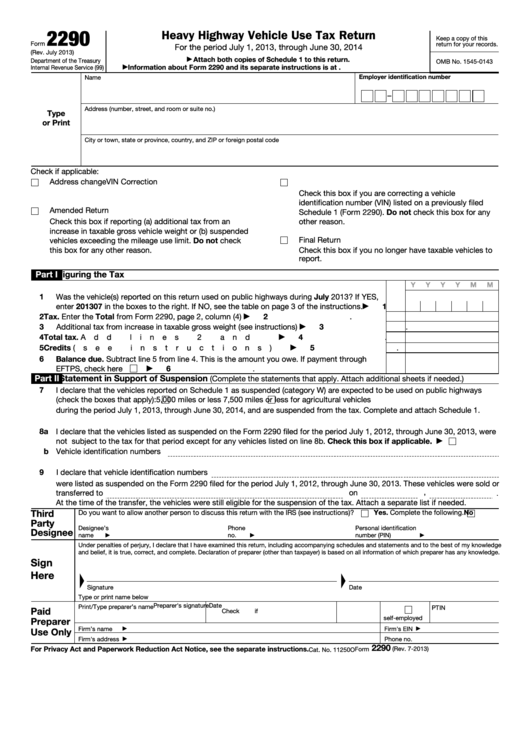

Printable Form 2290

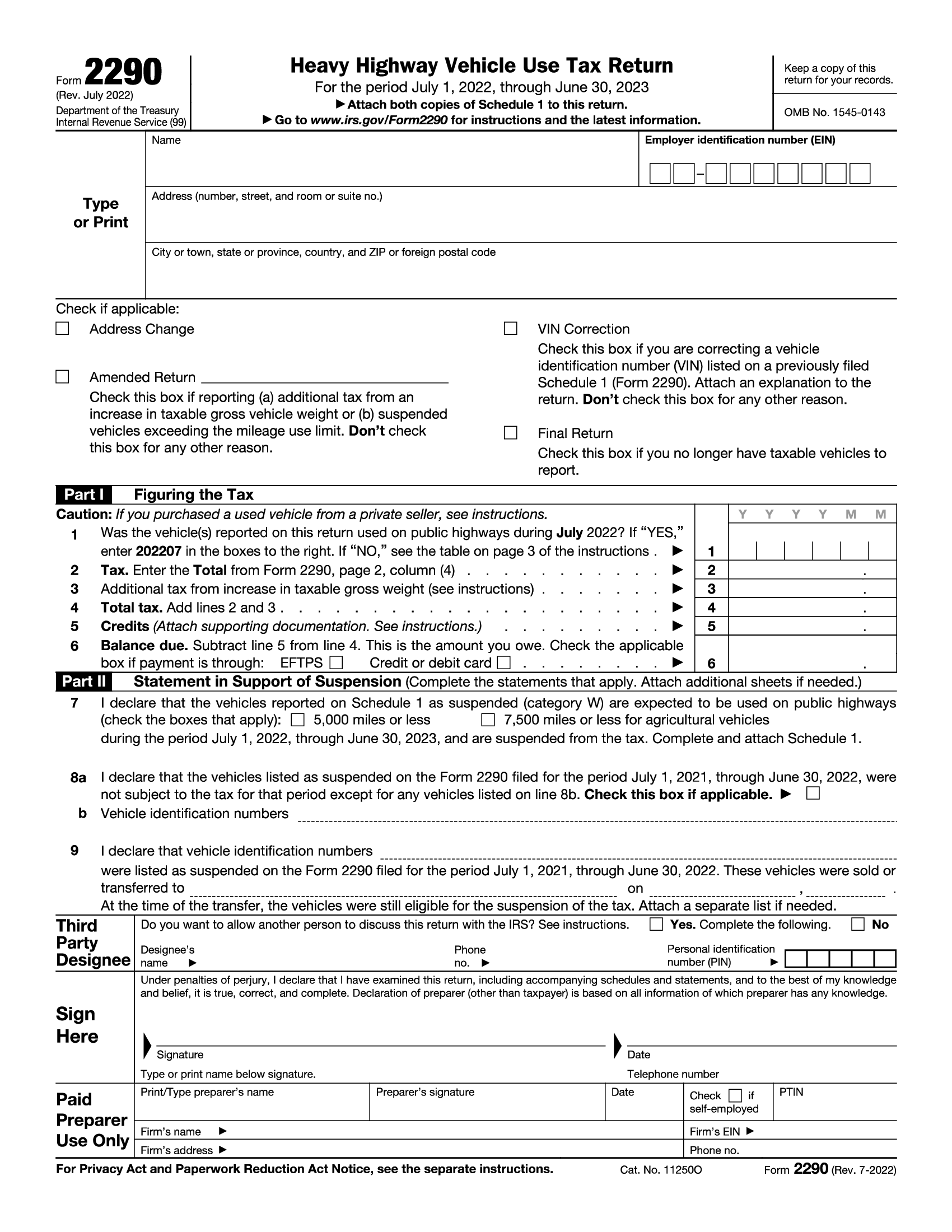

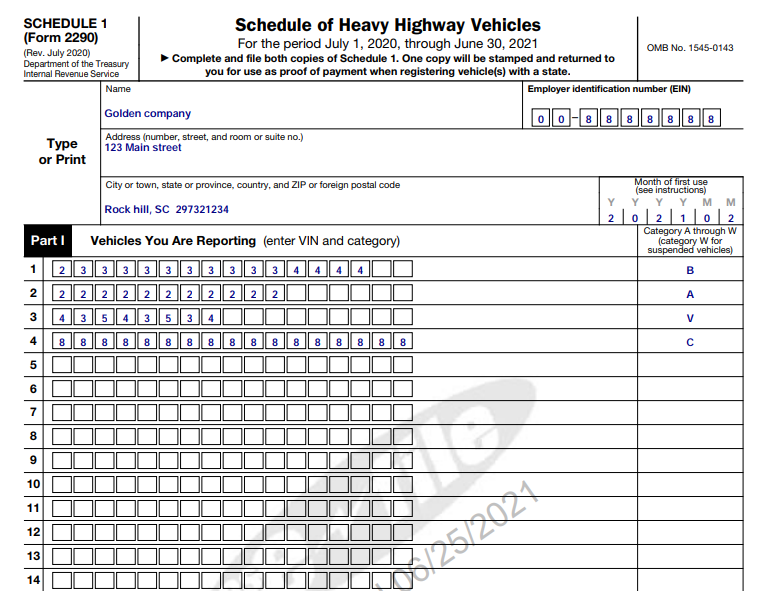

Printable Form 2290 - Efw, eftps, check or money order. Web john uses a taxable vehicle on a public highway by driving it home from the dealership on july 2, 2022, after purchasing it. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is legally registered. Ez2290 | may 31, 2022 | form 2290 | no comments. Attach both copies of schedule 1 to this return. Complete and file both copies of schedule 1. Keep a copy of this return for your records. For the period july 1, 2023, through june 30, 2024. Why should you choose expressefile. Keep a copy of this return for your records. The vehicle is required to be registered in his name. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. Attach both copies of schedule 1 to this return. Schedule of heavy highway vehicles. You must file this form 2290 (rev. Web form 2290 is used to report and pay the hvut for vehicles having a taxable gross weight of 55,000 pounds or more that you operate on public highways. For the period july 1, 2022, through june 30, 2023. You must file this form 2290 (rev. July 2023) department of the treasury internal revenue service. Schedule of heavy highway vehicles. Do not include vehicles you intend to suspend. Click any of the irs 2290 form links below to download, save, view, and print the file for the corresponding year. This return must also be filed when the acquisition of used vehicles is made for the current tax period. July 2022) department of the treasury. For instructions and the latest information. Heavy highway vehicle use tax return. Irs form 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that operate on public highways. Go to www.irs.gov/form2290 for instructions and the latest information. Why should you choose expressefile. July 2020) departrnent. Every year, millions of trucking companies file their 2290 forms. Web form 2290 is used to report and pay the hvut for vehicles operating on public highways with a gross weight of 55,000 pounds or more. Web what information is required to get the printable 2290 form? Why should you choose expressefile. For instructions and the latest information. Pay heavy vehicle use taxes (hvut) for the vehicles with a taxable gross weight of 55,000 lbs or more. Click any of the irs 2290 form links below to download, save, view, and print the file for the corresponding year. The penalty amount is 4.5% of the unpaid taxes, which accumulates for each month or part of a month that. Department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Web failing to file form 2290 by august 31st of the tax year can result in heavy penalties by the irs. Web what information is required to get the printable 2290 form? Do not include vehicles you intend to suspend. Keep a. Don’t use this revision if you need to file a return for a tax period that began on or before june 30, 2019. July 2021) heavy highway vehicle use tax return. Irs form 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for heavy highway motor vehicles with a taxable gross weight of 55,000. For instructions and the latest information. Web form 2290 is used to report and pay the hvut for vehicles operating on public highways with a gross weight of 55,000 pounds or more. The vehicle is required to be registered in his name. Web what information is required to get the printable 2290 form? Why should you choose expressefile. Why should you choose expressefile. Web set up an account or login. The penalty amount is 4.5% of the unpaid taxes, which accumulates for each month or part of a month that the 2290 tax return is overdue. Department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. You must file this. Experienced teamstamped schedule 1file any year return!file any tax year! Department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Click any of the irs 2290 form links below to download, save, view, and print the file for the corresponding year. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. This penalty begins to accrue the day after the tax filing due date and will not exceed 25% of the unpaid taxes. Taxable gross weight of each vehicle. For instructions and the latest information. Suspend any vehicles not expected to exceed 5,000 miles during the filing year. Don’t use this revision if you need to file a return for a tax period that began on or before june 30, 2019. July 2021) heavy highway vehicle use tax return. Web failing to file form 2290 by august 31st of the tax year can result in heavy penalties by the irs. Schedule of heavy highway vehicles. John must file form 2290 by august 31, 2022, for the period beginning july 1,. July 2022) department of the treasury. These free pdf files are unaltered and are sourced directly from the publisher. Do not include vehicles you intend to suspend.

File IRS 2290 Form Online for 20232024 Tax Period

Form 2290 2023 Printable Forms Free Online

Irs 2290 Form 2021 Printable Customize and Print

Understanding Form 2290 StepbyStep Instructions for 20232024

IRS Form 2290. Heavy Highway Vehicle Use Tax Return Forms Docs 2023

Irs 2290 Form 2021 Printable Customize and Print

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

IRS Form 2290 Printable (2022) 2290 Tax Form, Online Instructions

Every Year, Millions Of Trucking Companies File Their 2290 Forms.

Complete And File Both Copies Of Schedule 1.

Web Form 2290 Is Used To Report And Pay The Hvut For Vehicles Operating On Public Highways With A Gross Weight Of 55,000 Pounds Or More.

July 2019) For The Tax Period Beginning On July 1, 2019, And Ending On June 30, 2020.

Related Post: