Printable Nc Form D 410

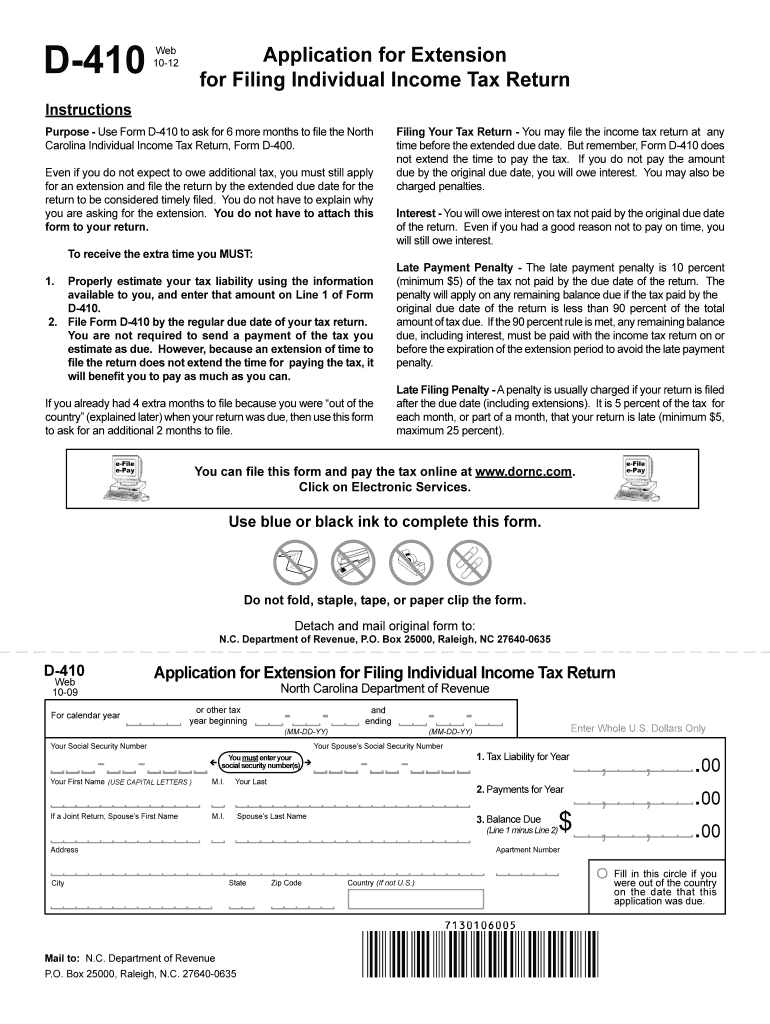

Printable Nc Form D 410 - This form is not required if you were granted an automatic extension to file your federal income tax return. Modified on wed, 12 apr 2023 at 05:20 am. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. Complete this web form for assistance. Web ncdor has recently redesigned its website. If you want to download a tax form, use the navigation above, search the site, or choose a link below: Nc net operating loss worksheet. Find the page handling section. Paperless solutions30 day free trialfree mobile appedit on any device This form is for income earned in tax year 2023, with tax returns due in april 2024. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. If you want to download a tax form, use the navigation above, search the site, or choose a link below: This form is for income earned in tax year 2023, with tax returns due in. This form is for income earned in tax year 2023, with tax returns due in april 2024. The waiver applies to the failure to pay a tax if the tax that is due on april 15, 2021, is paid by may 17, 2021. After clicking the print icon or selecting print from the file menu, you will see the print. Find the page handling section. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. Set page scaling to none. Complete this web form for assistance. Modified on wed, 12 apr 2023 at 05:20 am. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. Web ncdor has recently redesigned its website. The waiver applies to the failure to pay a tax if the tax that is due on april 15, 2021, is paid by may 17, 2021. Set page scaling to none. This form is. Web ncdor has recently redesigned its website. The waiver applies to the failure to pay a tax if the tax that is due on april 15, 2021, is paid by may 17, 2021. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. We will. The waiver applies to the failure to pay a tax if the tax that is due on april 15, 2021, is paid by may 17, 2021. This form is for income earned in tax year 2023, with tax returns due in april 2024. If you were granted an automatic extension to file your federal income tax return, federal form 1040,. Modified on wed, 12 apr 2023 at 05:20 am. The form will open in the main window. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. The waiver applies to the failure to pay a tax if the tax that is due on april 15, 2021, is paid by may. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. Complete this web form for assistance. Paperless solutions30 day free trialfree mobile appedit on any device The form will open in the main window. The waiver applies to the failure to pay a tax if. This form is for income earned in tax year 2023, with tax returns due in april 2024. Set page scaling to none. If you want to download a tax form, use the navigation above, search the site, or choose a link below: Even if you do not expect to owe additional tax, you must still apply for an extension and. Nc net operating loss worksheet. Set page scaling to none. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. This form is for income earned in tax year 2023, with tax returns due in april 2024. If you want to download a tax form,. Modified on wed, 12 apr 2023 at 05:20 am. Set page scaling to none. Even if you do not expect to owe additional tax, you must still apply for an extension and file the return by the extended due date for the return to be considered timely filed. If you want to download a tax form, use the navigation above, search the site, or choose a link below: Complete this web form for assistance. We will update this page with a new version of the form for 2025 as soon as it is made available by the north carolina government. This form is for income earned in tax year 2023, with tax returns due in april 2024. Paperless solutions30 day free trialfree mobile appedit on any device This form is not required if you were granted an automatic extension to file your federal income tax return. Find the page handling section. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. After clicking the print icon or selecting print from the file menu, you will see the print options screen. The waiver applies to the failure to pay a tax if the tax that is due on april 15, 2021, is paid by may 17, 2021.

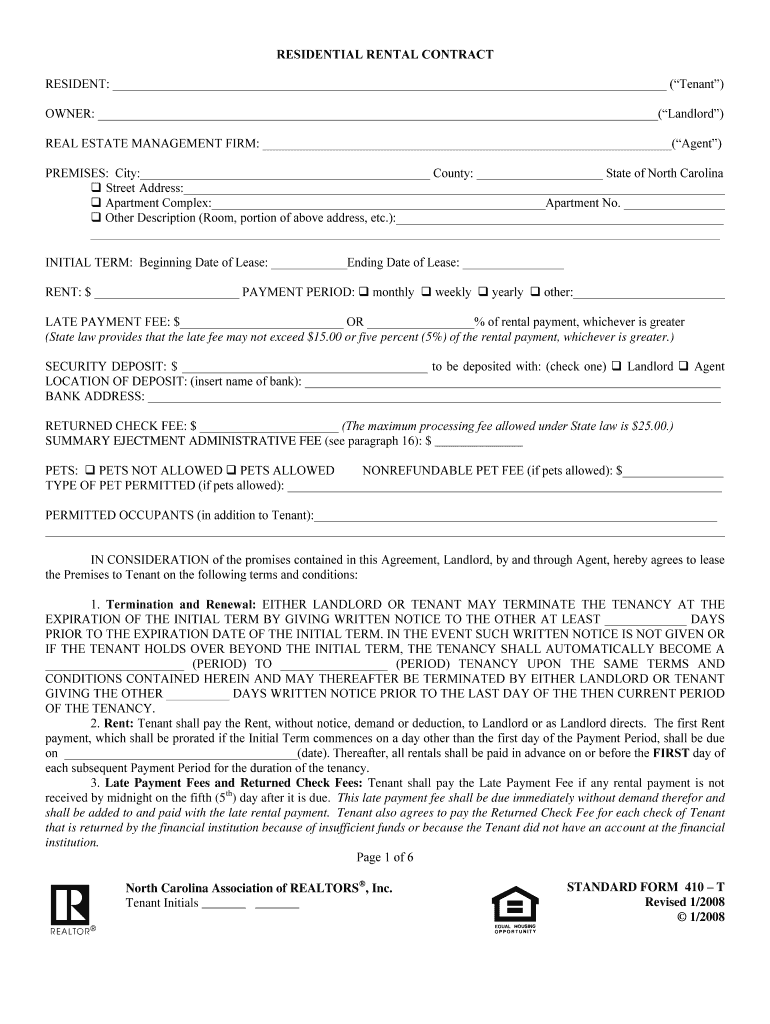

Standard Form 410 T Revised 2020 Fill and Sign Printable Template

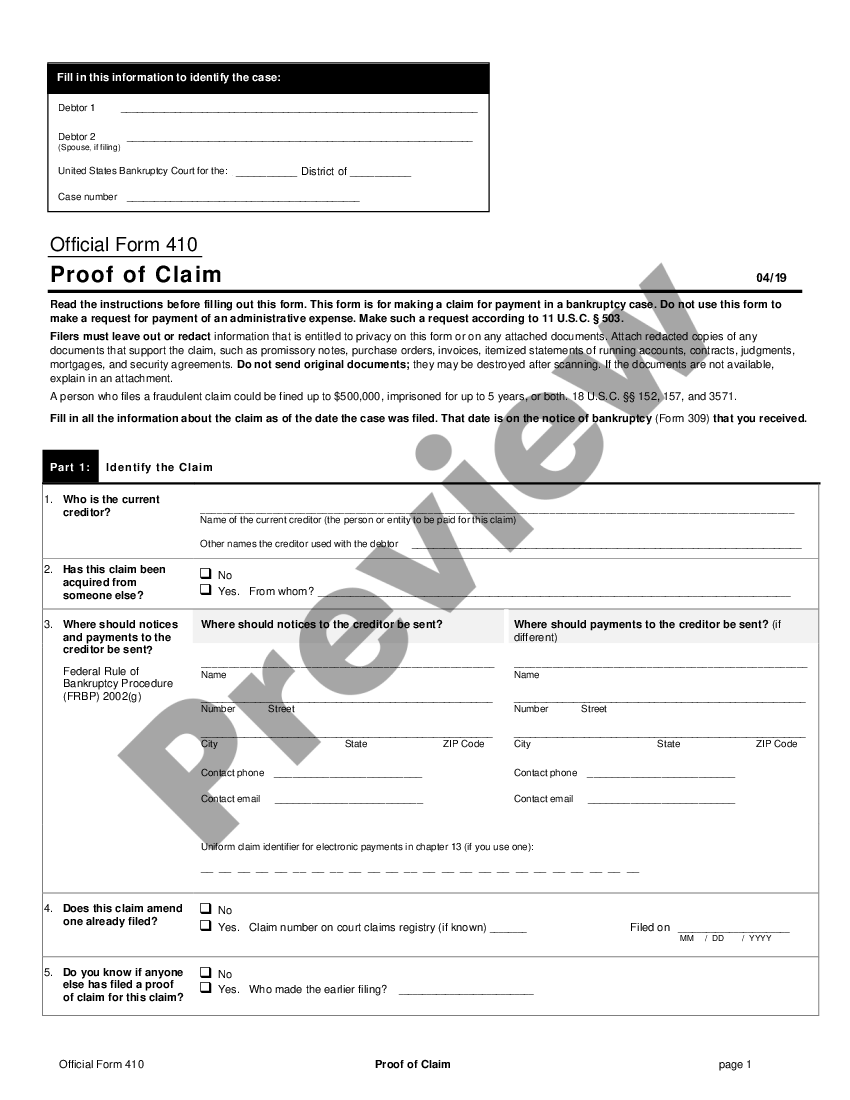

DA Form 410 Receipt For Accountable Form Free Online Forms

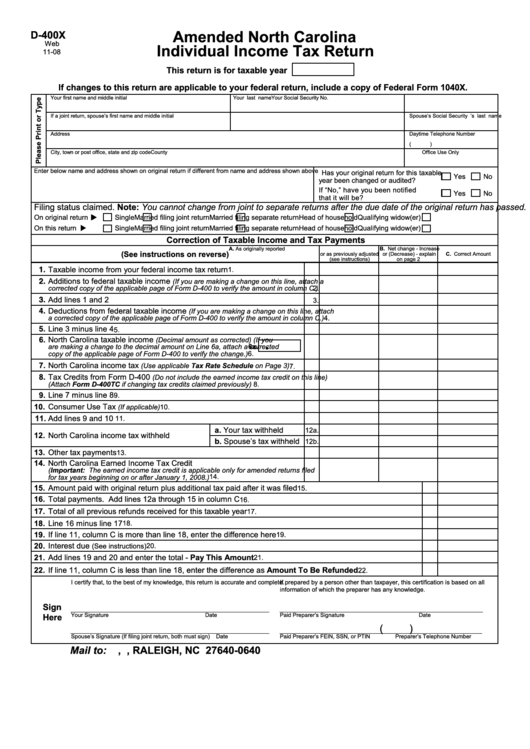

Nc D410 Complete with ease airSlate SignNow

Printable Nc Form D 410 Printable Word Searches

Printable Nc Form D 410 Printable Word Searches

North carolina association of realtors standard form 410 t Fill out

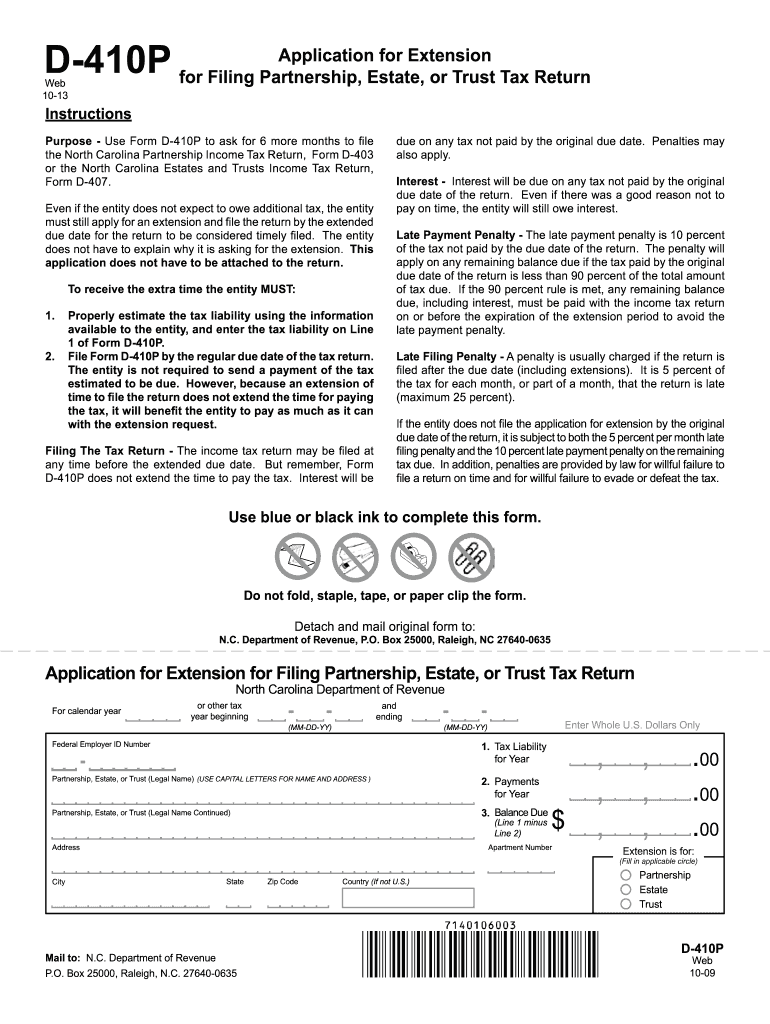

2011 Form NC D410P Fill Online, Printable, Fillable, Blank pdfFiller

Printable Nc Form D410

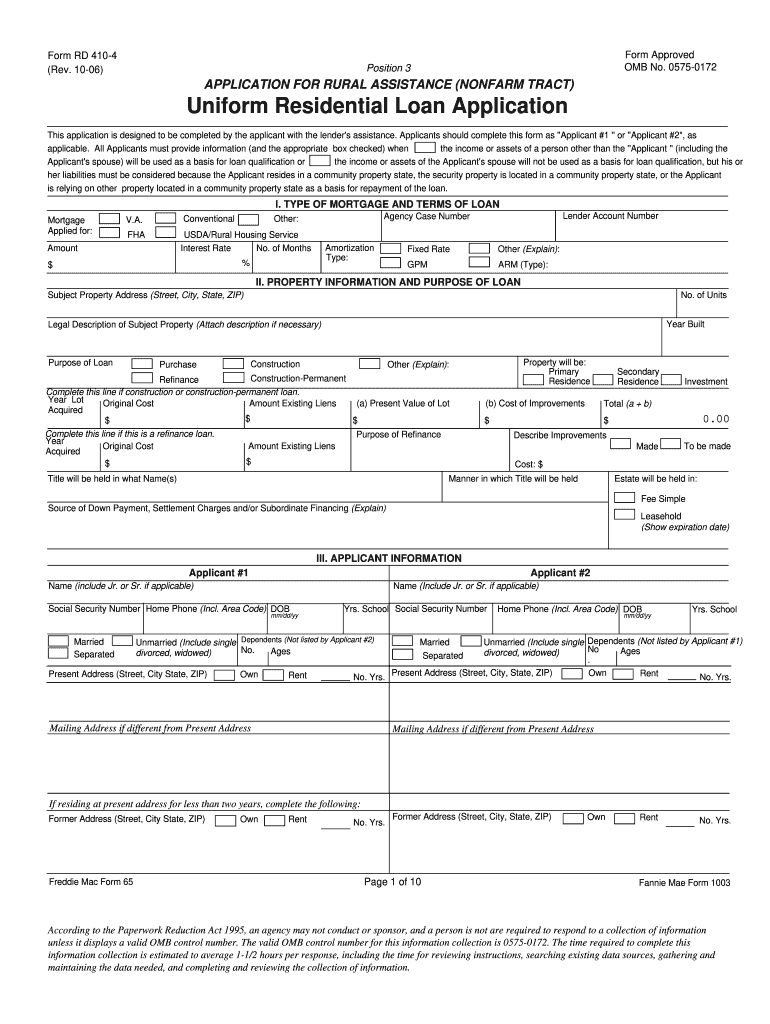

Application for Rural Assistance Nonfarm Tract Uniform Residential

Nc D400V Printable Form

Nc Net Operating Loss Worksheet.

If You Were Granted An Automatic Extension To File Your Federal Income Tax Return, Federal Form 1040, You Do Not Have To File Form D.

The Form Will Open In The Main Window.

Web Ncdor Has Recently Redesigned Its Website.

Related Post: