Printable Schedule C Worksheet

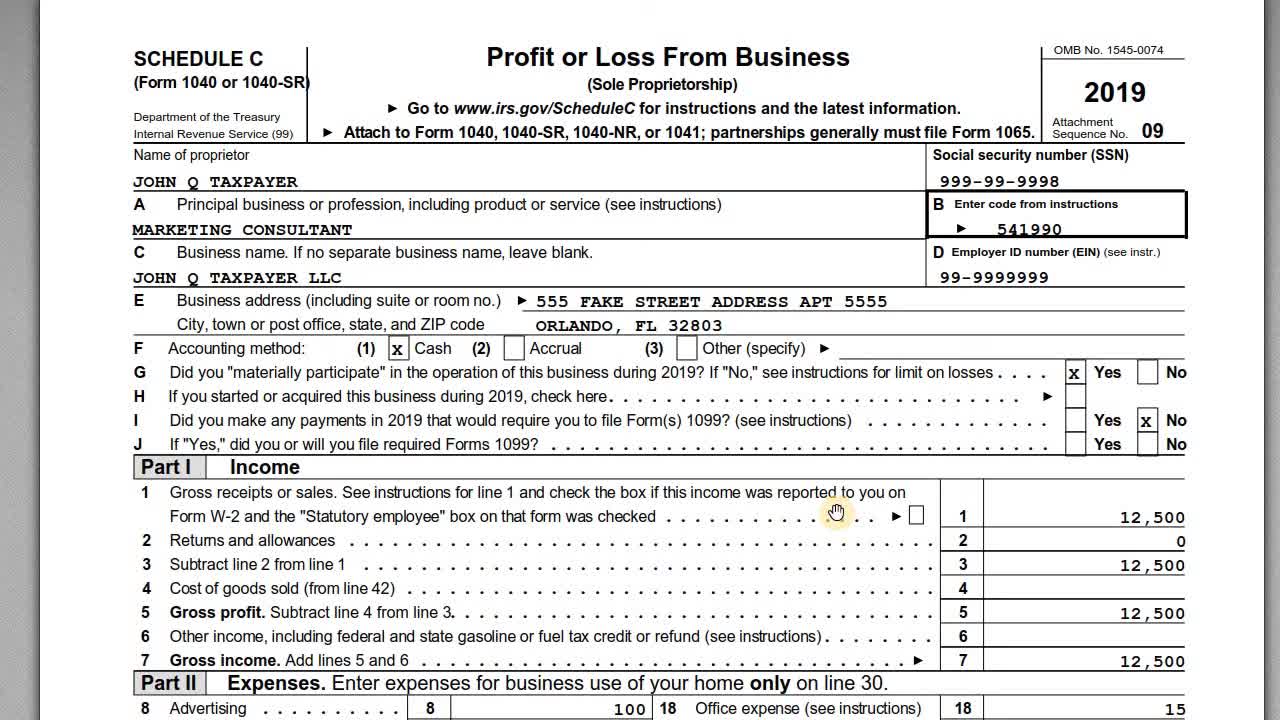

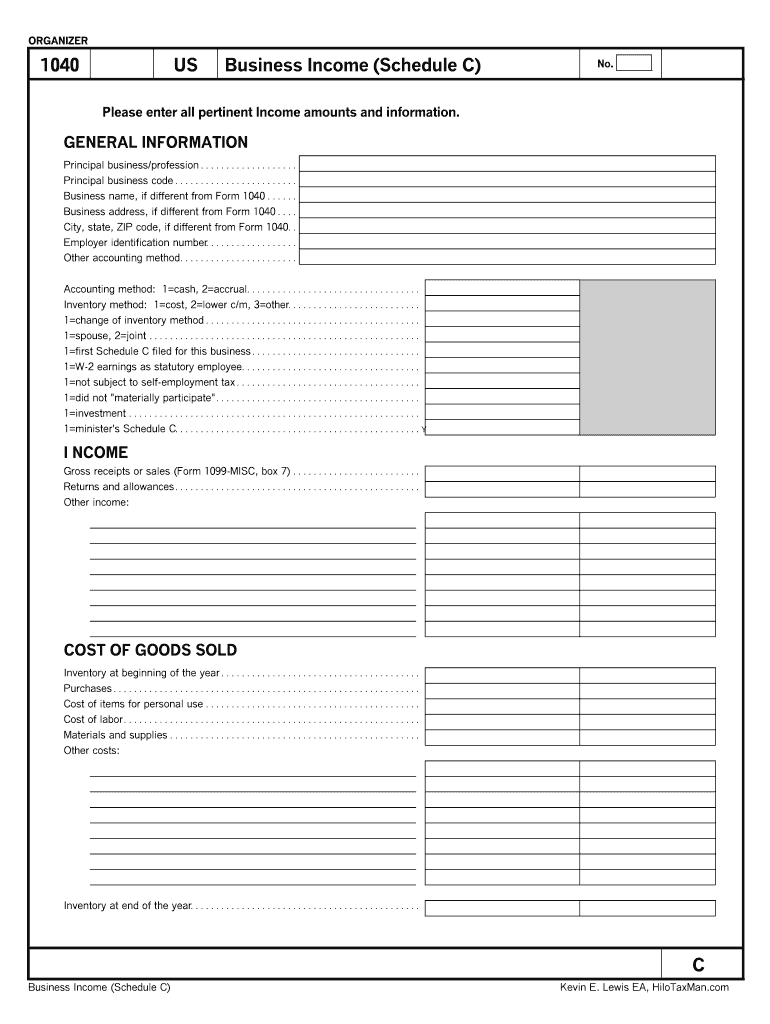

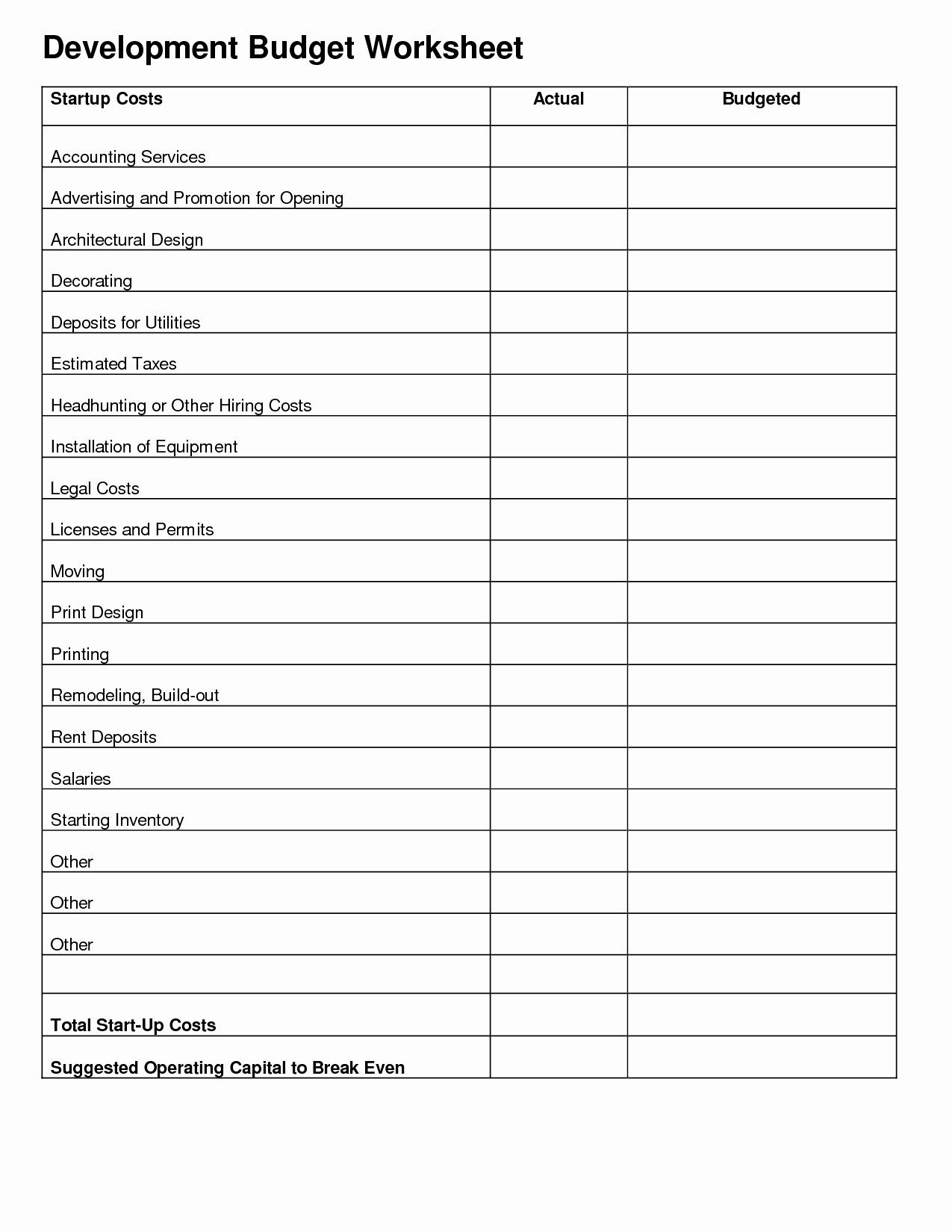

Printable Schedule C Worksheet - Web self employment worksheets (sched c) pg 1&2. Use separate sheet for each business. Free mobile apppaperless solutionsform search engine30 day free trial Web business use of home form. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Please refer to the instructions for the simplified method worksheet located in the schedule c instructions. Last year's amounts are provided for your reference. Web schedule c worksheet hickman & hickman, pllc. Profit or loss from business. Please enter all pertinent 2022 amounts. Web schedule c business worksheet. Web to complete irs schedule c—the form most small businesses need to fill out to state their income for tax purposes—you'll need to know your business income, cost of goods sold, and business expenses. Member llc and sole proprietors. For self employed businesses and/or independent contractors. City, state & zip code. Web schedule c business worksheet. Multiply line 3a by line 3b and enter result to 2 decimal places. Member llc and sole proprietors. Web business use of home form. Web to complete irs schedule c—the form most small businesses need to fill out to state their income for tax purposes—you'll need to know your business income, cost of goods sold,. Member llc and sole proprietors. Web self employment worksheets (sched c) pg 1&2. Irs requires we have on file your own information to support all schedule c’s. Web these credits under sections 3131 and 3132 are available for qualified leave wages paid for leave taken after march 31, 2021, and before october 1, 2021. Free mobile apppaperless solutionsform search engine30. Member llc and sole proprietors. An activity qualifies as a. Changes to the 2023 instructions for. Use separate sheet for each business. This document will list and explain the information and documentation that we will need in. Irs requires we have on file your own information to support all schedule c’s. Web schedule c worksheet hickman & leckrone, pllc. Please enter all pertinent 2022 amounts. Member llc and sole proprietors. This document will list and explain the information and documentation that we will need in. Free mobile apppaperless solutionsform search engine30 day free trial This document will list and explain the information and documentation that we will need in. Irs requires we have on file your own information to support all schedule c’s. Web these credits under sections 3131 and 3132 are available for qualified leave wages paid for leave taken after march 31, 2021,. Web business use of home form. Web schedule c worksheet hickman & hickman, pllc. Web schedule c (form 1040) pdf. Web here’s who should file irs schedule c in 2023, how to fill it out and a few things to remember — plus tips and tricks that could save you money and time. Web self employment worksheets (sched c) pg. City, state & zip code. Instructions for schedule c (form 1040) | print version pdf | ebook (epub) epub. We highly recommend using it before you attempt the official irs form. Profit or loss from business. Member llc and sole proprietors. An activity qualifies as a. Irs requires we have on file your own information to support all schedule c’s. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in svc_____ _____ _____. This document will list and explain the information and documentation that we will need in. Web these credits under sections 3131 and 3132 are available for qualified leave wages paid for leave taken after march 31, 2021, and before october 1, 2021. Please refer to the instructions for the simplified method worksheet located in the schedule c instructions. Web schedule. City, state & zip code. Web to complete irs schedule c—the form most small businesses need to fill out to state their income for tax purposes—you'll need to know your business income, cost of goods sold, and business expenses. Web these credits under sections 3131 and 3132 are available for qualified leave wages paid for leave taken after march 31, 2021, and before october 1, 2021. Changes to the 2023 instructions for. Web schedule c worksheet hickman & hickman, pllc. Instructions for schedule c (form 1040) | print version pdf | ebook (epub) epub. Web schedule c worksheet hickman & hickman, pllc. Web schedule c worksheet hickman & leckrone, pllc. Profit or loss from business. Web depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in svc_____ _____ _____ _____ basis $_____ Multiply line 3a by line 3b and enter result to 2 decimal places. Last year's amounts are provided for your reference. Web here’s who should file irs schedule c in 2023, how to fill it out and a few things to remember — plus tips and tricks that could save you money and time. Web business use of home form. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web schedule c (form 1040) pdf.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Printable Schedule C Form

IRS Schedule C with Form 1040 Self Employment Taxes

Schedule C Business Codes Fill Online, Printable, Fillable, Blank

Fillable Online Schedule C Worksheet.docx Fax Email Print pdfFiller

Schedule C Instructions With FAQs Printable Form 2021

Schedule C Worksheet Excel

Schedule C What Is It, How To Fill, Example, Vs Schedule E

Printable Schedule C Worksheet

2019 Schedule C Worksheet A Guide To Tax Preparation Style Worksheets

For Self Employed Businesses And/Or Independent Contractors.

This Document Will List And Explain The Information And Documentation That We Will Need In.

An Activity Qualifies As A.

Web Self Employment Worksheets (Sched C) Pg 1&2.

Related Post: