Printable W 9 Form Free

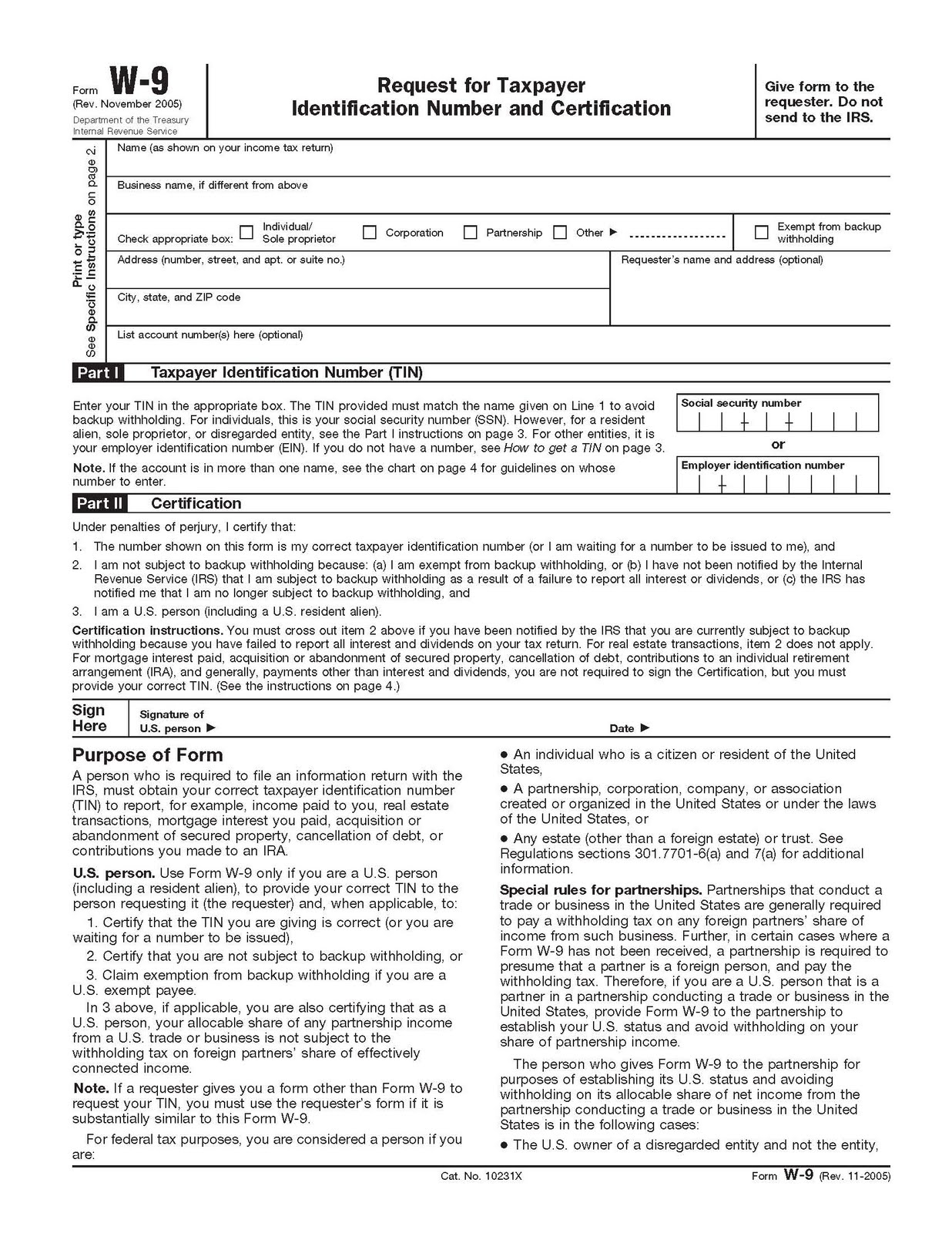

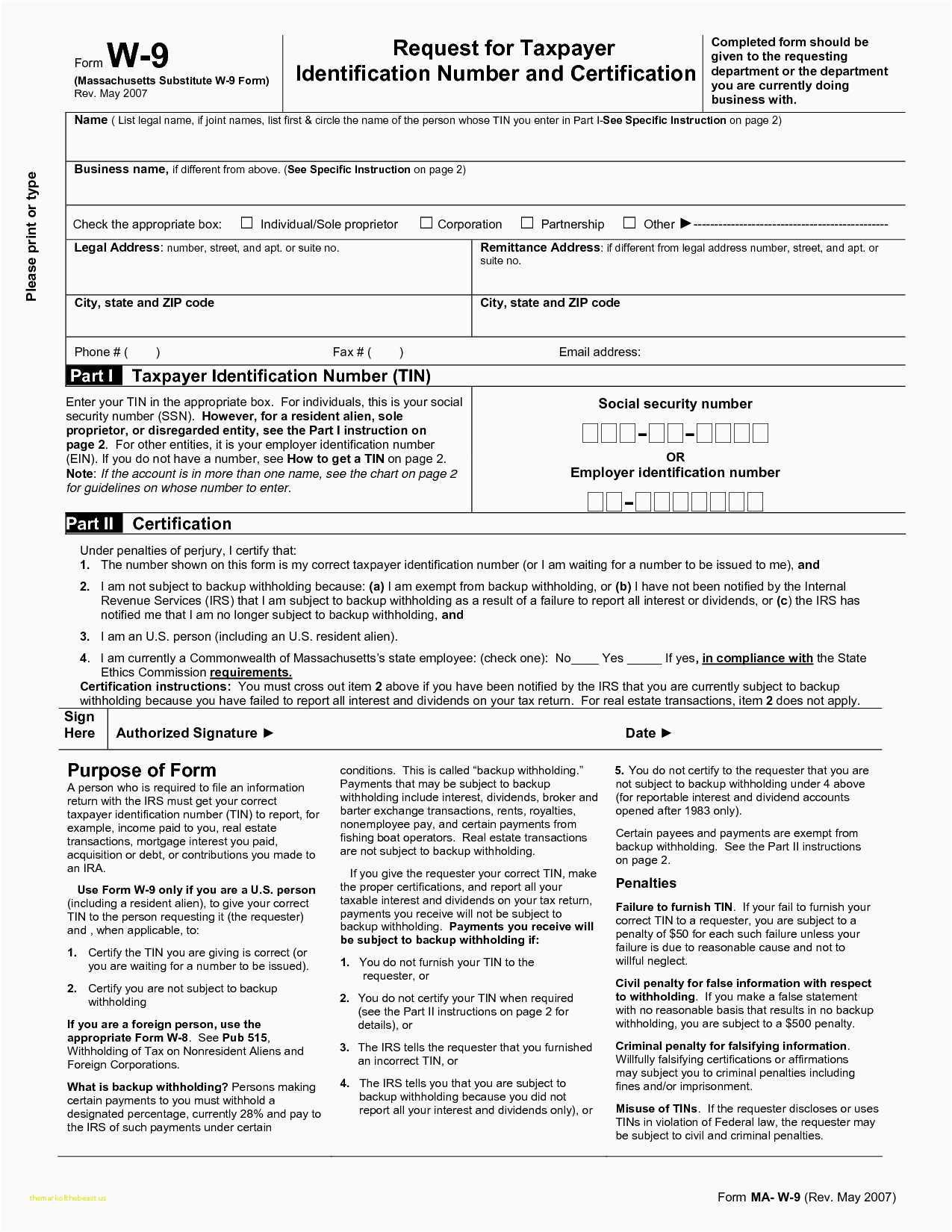

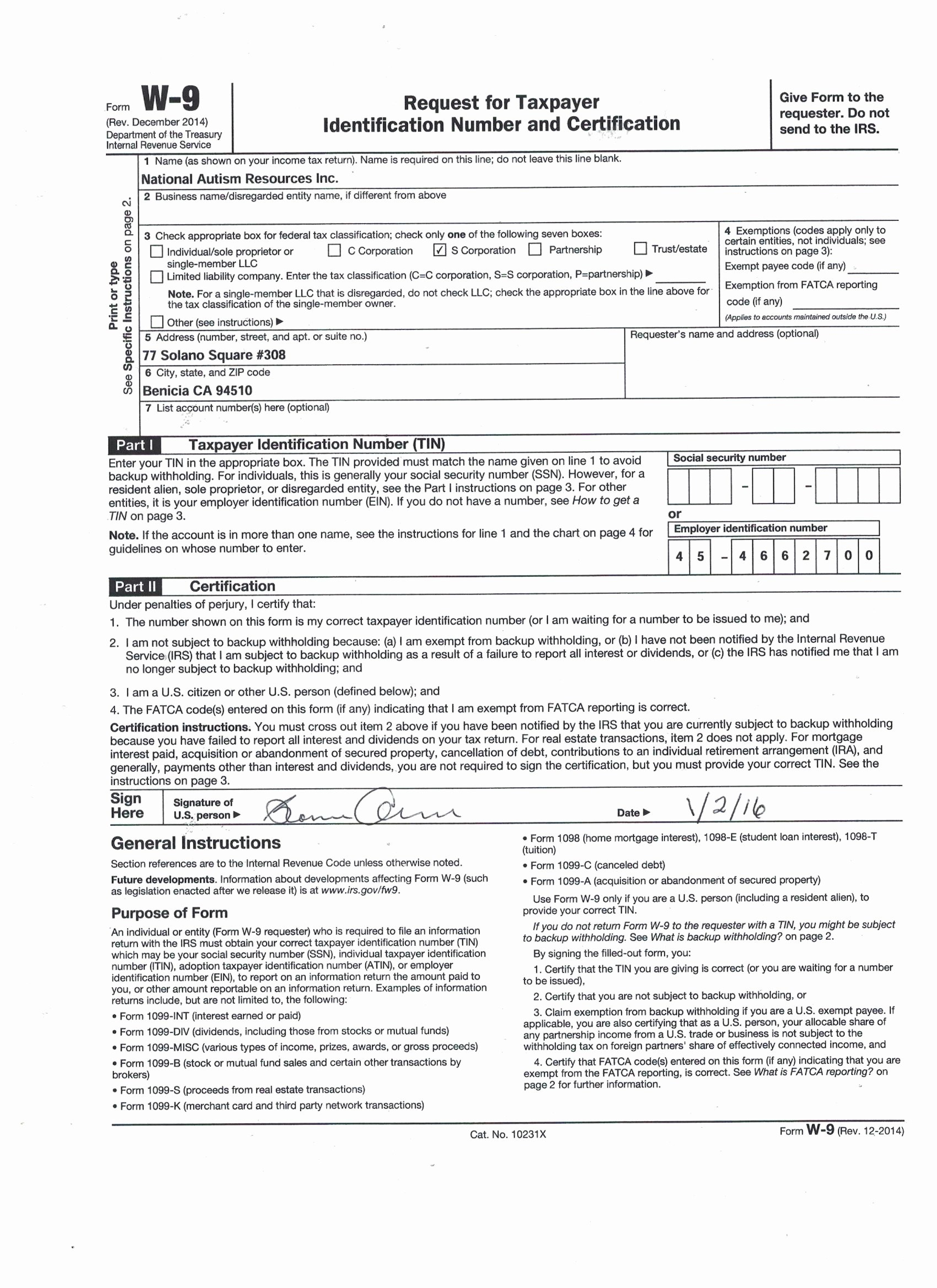

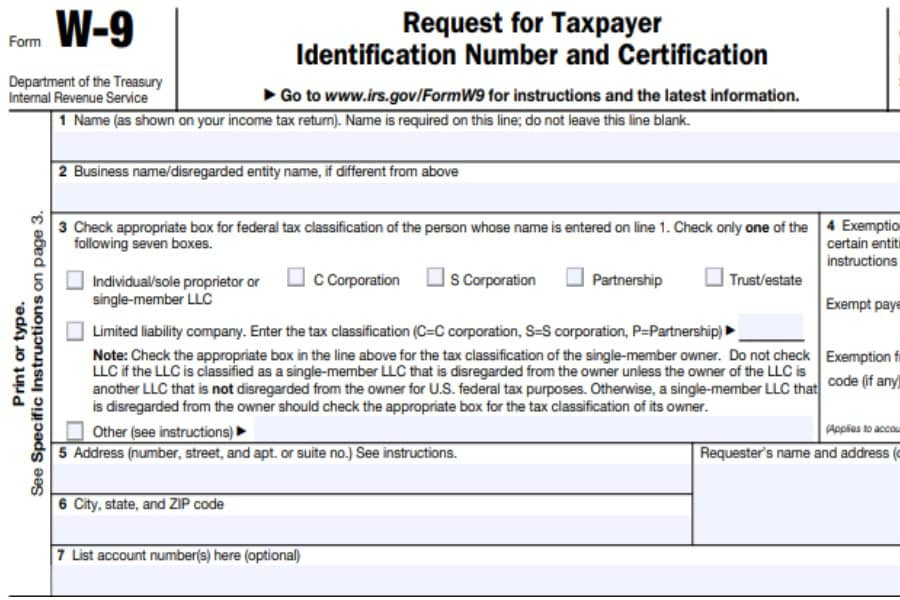

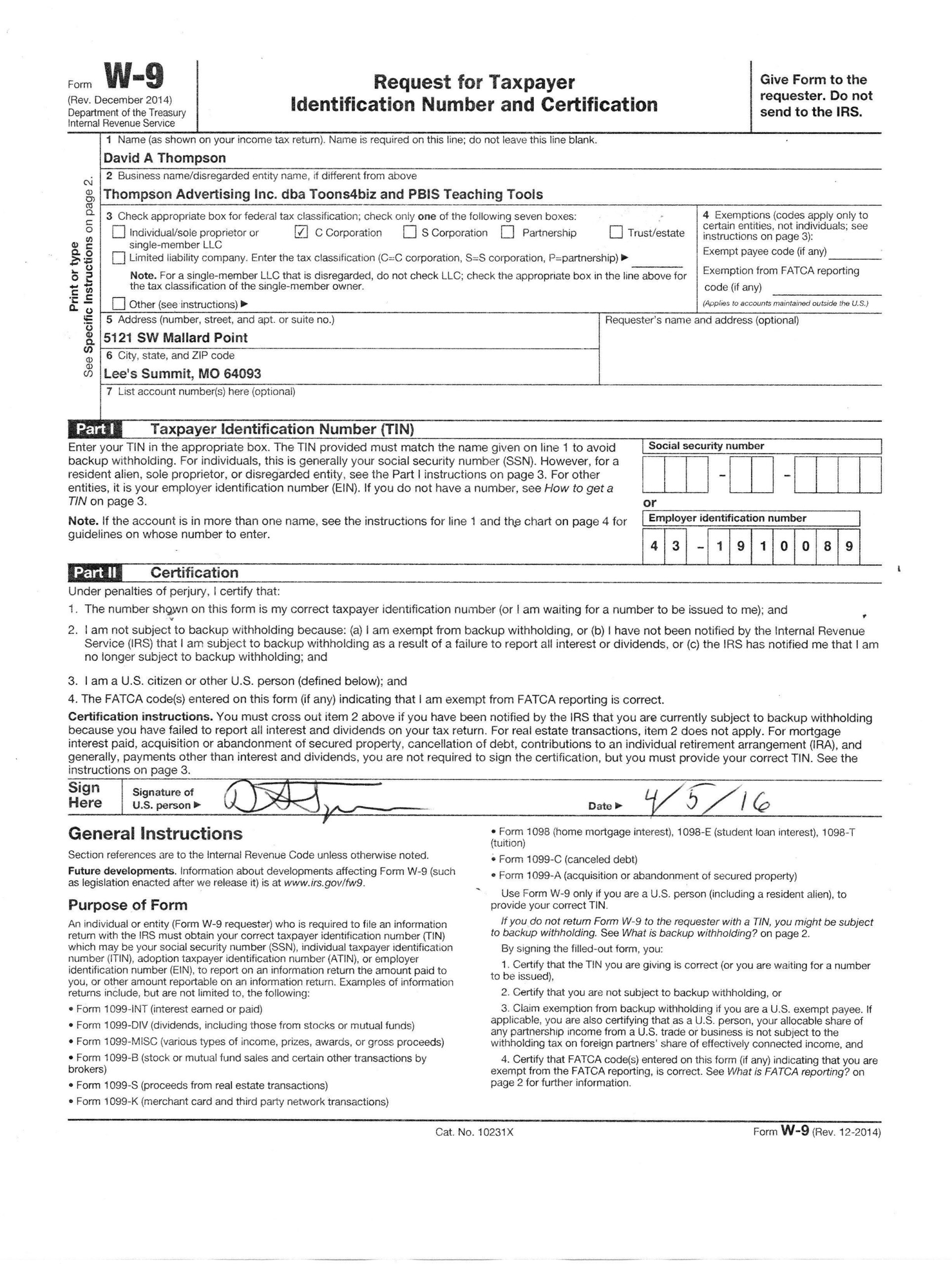

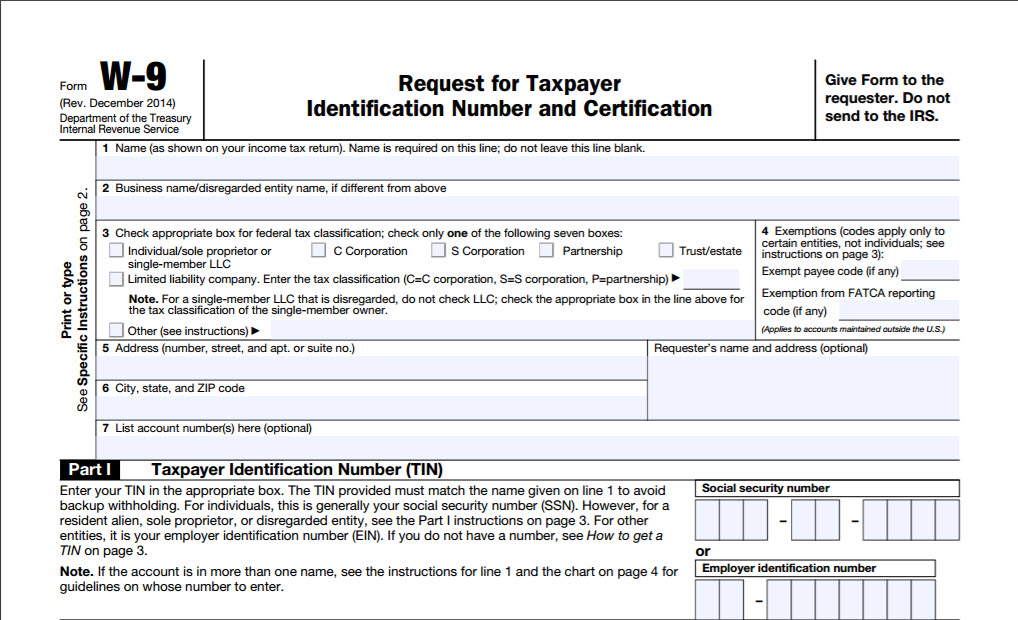

Printable W 9 Form Free - Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. See what is backup withholding, later. Request for taxpayer identification number and certification. For instructions and the latest information. Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income tax forms. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Person date employer identification number print or type. Related federal corporate income tax forms: W9 forms are required for contractor identification. Other common irs tax forms. The form helps businesses obtain important information from payees to prepare information returns for the irs. Sign here signature of u.s. For a joint account, only the person whose tin is shown in part i should sign (when required). For federal tax purposes, you are considered a u.s. You can print other federal tax forms here. Related federal corporate income tax forms: The form helps businesses obtain important information from payees to prepare information returns for the irs. Sign here signature of u.s. See what is backup withholding, later. Web if you have a form 1040 return and are claiming limited credits only, you can file for free yourself with turbotax free edition, or you can. Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income tax forms. Check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more. It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social. If an account. October 2018) department of the treasury internal revenue service. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. W9 forms are required for contractor identification. For federal tax purposes, you are considered a u.s. The form helps businesses obtain important information from payees to prepare information returns for the irs. You can print other federal tax forms here. For instructions and the latest information. It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social. October 2018) department of the treasury internal revenue service. The form asks for information such as the ic's name, address, social security number (ssn), and more. W9 forms are required for contractor identification. October 2018) department of the treasury internal revenue service. This is the form you’ll share and ask freelancers and contractors to complete. You may be requested to sign by the withholding agent even if item 1, below, and items 4 and 5 on page 4 indicate otherwise. And contributions to an ira. Individual tax return form 1040 instructions; Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. Do not send to the irs. For instructions and the latest information. Other common irs tax forms. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Afterward, you can print or save the completed form on your computer or mobile to send to your client. Request for transcript of tax return Acquisition or abandonment of secured property; Certify that the tin you are giving is correct (or you are waiting. You can print other federal tax forms here. Give form to the requester. Independent contractors who were paid at least $600 during the year need to fill out a. Person (including a resident alien), to provide your correct tin. Request for taxpayer identification number and certification. W9 forms are required for contractor identification. It is commonly required when making a payment and withholding taxes are not being deducted. You may be requested to sign by the withholding agent even if item 1, below, and items 4 and 5 on page 4 indicate otherwise. Person date employer identification number print or type. This is the form you’ll. W9 forms are required for contractor identification. Claim exemption from backup withholding if you are a u.s. It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social. Give form to the requester. Frequently asked questions about w9 forms. And contributions to an ira. If you are a u.s. Related federal corporate income tax forms: October 2018) department of the treasury internal revenue service. Check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more. Other common irs tax forms. Web download a free w9 form. For a joint account, only the person whose tin is shown in part i should sign (when required). For federal tax purposes, you are considered a u.s. Anyone who owns a company knows that taxes are an inevitable part of business. Sign here signature of u.s.

Blank Printable W9 Form

Printable W 9 Form For Word Format Printable Forms Free Online

Free Printable W 9 Form Free Printable

Free Printable W 9 Form Free Printable

Printable W 9 Form For 2021

Blank W 9 Editable Online PDF Forms to Fill out and Print

W9 Forms 2021 Printable Pdf Example Calendar Printable

Form W9 Request for Taxpayer Identification Number and Certification

W9 Form Pdf Printable I9 Form 2021 Printable

Printable W 9 Irs Form

Individual Tax Return Form 1040 Instructions;

Web Check The Status Of Your Income Tax Refund For The Three Most Recent Tax Years.

Web This Form Is Used To Provide The Correct Taxpayer Identification Number (Tin) To The Person Who Is Required To File An Information Return With The Irs To Report, For Example:

See What Is Backup Withholding, Later.

Related Post: