Put Call Skew Chart

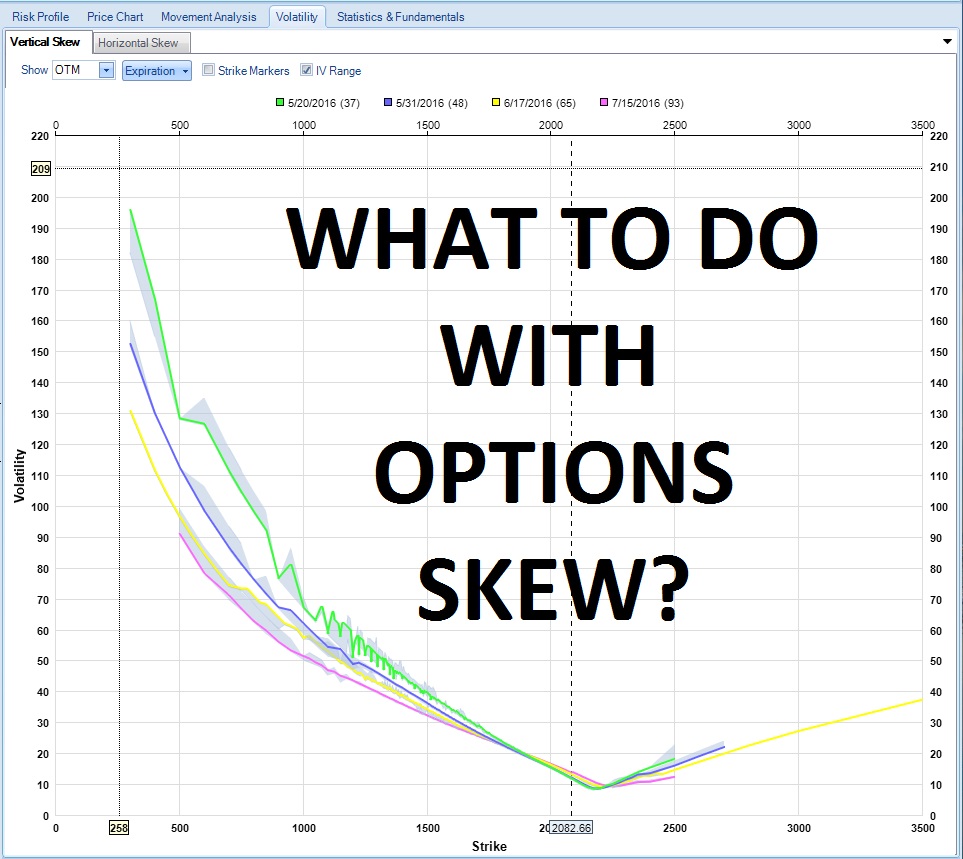

Put Call Skew Chart - Call iv30 skew by delta iv smile graph compare expirations. Hei) q2 2024 results conference. The delta at a given contract is the probability that the. This view quickly shows the user. May 25, 2024, 6:28 a.m. Web the call skew history chart tracks the call skew, which is the delta of calls at one standard deviation above current stock price minus the delta of puts at one standard. Web after dropping to support at $67,000 overnight, bitcoin ( btc) reversed course on thursday afternoon to hit a high of $69,536. Web by desiree ibekwe. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over. Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. It shows the skew within cvol, the relative preference for gbp upside (call) options vs. Including but not limited to any. May 25, 2024, 6:28 a.m. For a more comprehensive view of implied volatility skew across all. Web the skew chart allows the user to identify option volatility skews in a line graph view to display implied volatility across various. Implied volatility skew is a graphical representation of the implied volatility (iv) for different strike prices of call and put options for a specific. The delta at a given contract is the probability that the. Web the skew chart allows the user to identify option volatility skews in a line graph view to display implied volatility across various strikes. View. Web the call skew history chart tracks the call skew, which is the delta of calls at one standard deviation above current stock price minus the delta of puts at one standard. The volatility strike skew chart shows the option volatility and volume for option contracts for the selected expiration. Web volatility strike skew for spx. Web option skew chart.. Gamma exposure (gex) highest volume options. Web the second chart may be more telling. Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. Web price chart & technicals. View an implied volatility skew chart for apple (aapl) comparing historical and most recent. Web the call skew history chart tracks the call skew, which is the delta of calls at one standard deviation above current stock price minus the delta of puts at one standard. Some interpretations of the volatility skew include: May 25, 2024, 6:28 a.m. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and. Web the skew chart allows the user to identify option volatility skews in a line graph view to display implied volatility across various strikes. It shows the skew within cvol, the relative preference for gbp upside (call) options vs. Call iv30 skew by delta iv smile graph compare expirations. This view quickly shows the user. See open interest of options. Web the skew chart allows the user to identify option volatility skews in a line graph view to display implied volatility across various strikes. The delta at a given contract is the probability that the. This view quickly shows the user. Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. Web calculating/searching for put. Hei) q2 2024 results conference. [ [ strike ]] x. Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. Call iv30 skew by delta iv smile graph compare expirations. The put call ratio chart shows the ratio of open interest or volume on put options versus call options. View an implied volatility skew chart for apple (aapl) comparing historical and most recent. Web price chart & technicals. Web the call skew history chart tracks the call skew, which is the delta of calls at one standard deviation above current stock price minus the delta of puts at one standard. Ivol price volume ivol price volume; For a more. Web price chart & technicals. Implied volatility skew is a graphical representation of the implied volatility (iv) for different strike prices of call and put options for a specific. Call iv30 skew by delta iv smile graph compare expirations. [ [ strike ]] x. Web option skew chart. Ivol price volume ivol price volume; As we know, most indexes and etfs (like spy) have high levels of put skew, making puts much more expensive than calls. The put call ratio chart shows the ratio of open interest or volume on put options versus call options. Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. It shows the skew within cvol, the relative preference for gbp upside (call) options vs. Web the second chart may be more telling. Web you can filter the chart by calls or puts and can click on a point on the chart to navigate to the option's page. Implied volatility skew is a graphical representation of the implied volatility (iv) for different strike prices of call and put options for a specific. Web the skew chart allows the user to identify option volatility skews in a line graph view to display implied volatility across various strikes. The put call ratio can be an indicator of investor. This is often seen in. [ [ strike ]] x. View an implied volatility skew chart for spdr s&p 500 etf trust (spy) comparing historical. Web the call skew history chart tracks the call skew, which is the delta of calls at one standard deviation above current stock price minus the delta of puts at one standard. May 25, 2024, 6:28 a.m. Call iv30 skew by delta iv smile graph compare expirations.

Put Call Ratio/Volatility Skew Curve for COINBASEBTCUSD by BitOoda_LLC

Volatility Skews Defined, Explained and Updated LaptrinhX

What does an option trader do and also how to get loads of money on chobots

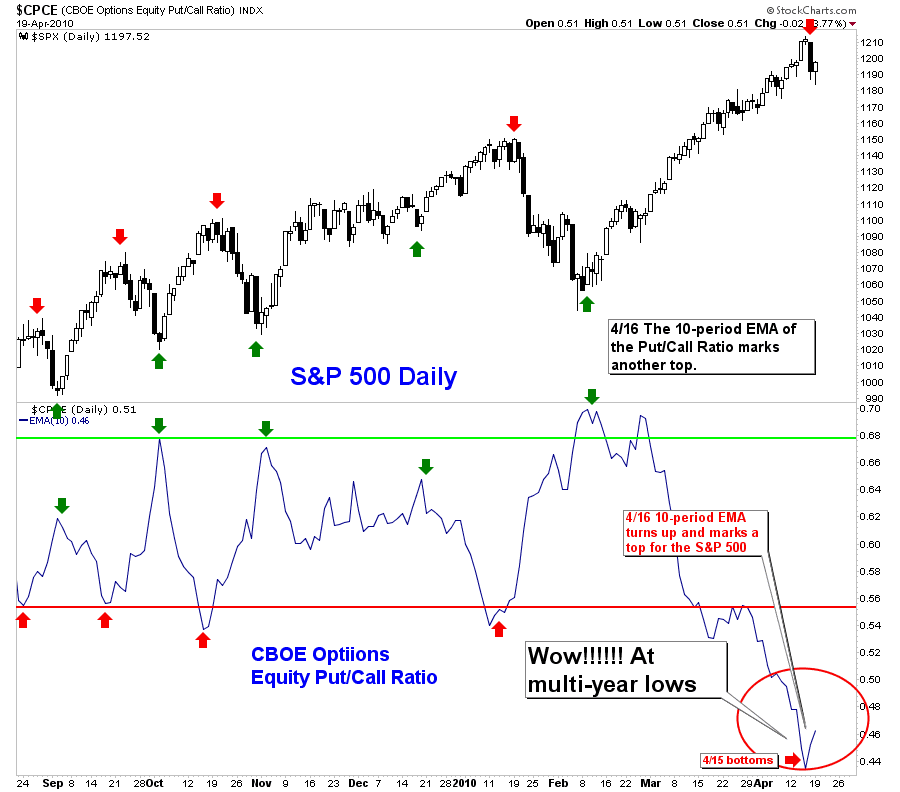

PutCall Skew Dips in Coincidence with Market Rallies

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Investopedia Basics Of Technical Analysis Options Alpha Put

Feature Skew Chart

Volatility Skews Defined, Explained and Updated LaptrinhX

Bitcoin's OI and volume put/call ratio close to historical low AMBCrypto

chartramblings Put/call chart

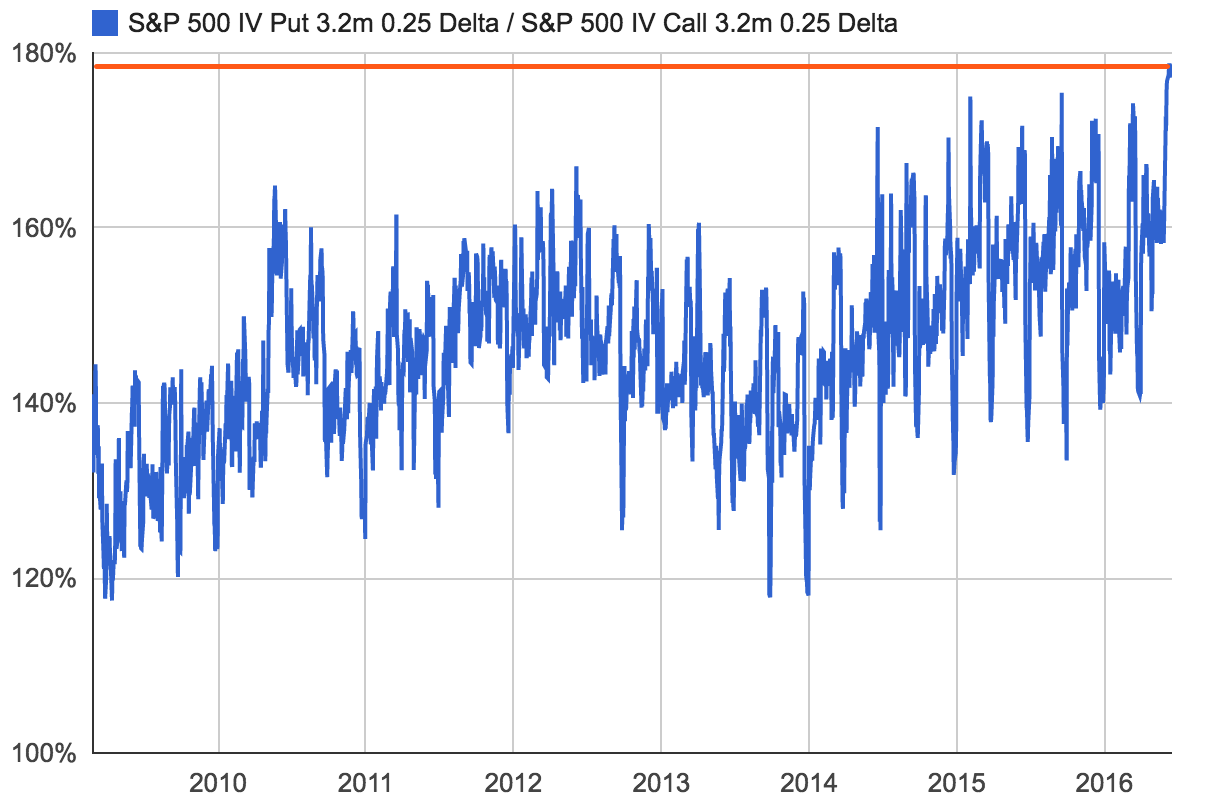

Put vs. call options skew is at the highest level in seven years

Call Iv30 Skew By Delta Iv Smile Graph Compare Expirations.

The Volatility Strike Skew Chart Shows The Option Volatility And Volume For Option Contracts For The Selected Expiration.

Hei) Q2 2024 Results Conference.

Web After Dropping To Support At $67,000 Overnight, Bitcoin ( Btc) Reversed Course On Thursday Afternoon To Hit A High Of $69,536.

Related Post: