Risk Reward Chart

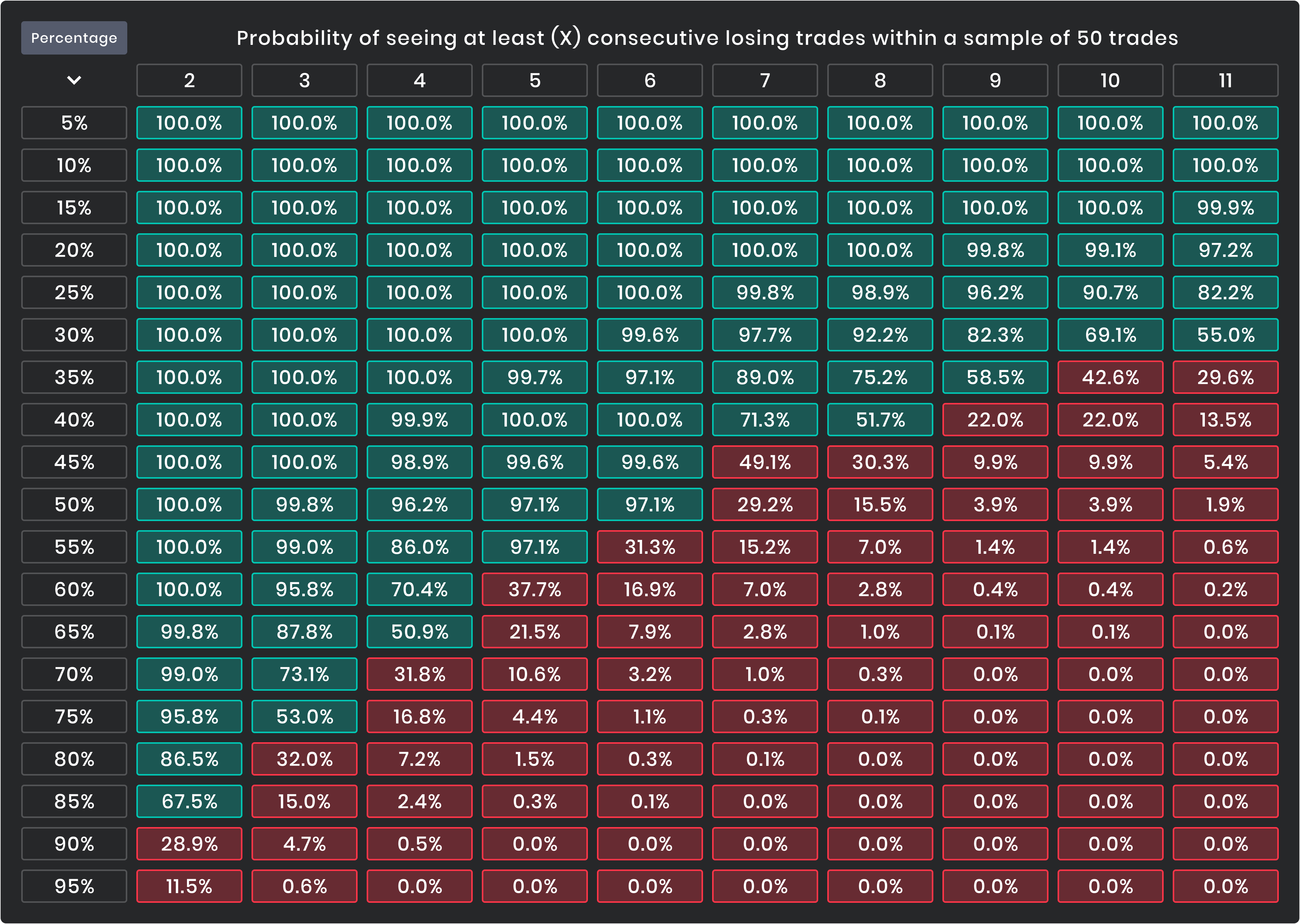

Risk Reward Chart - Using it allows traders to better manage their capital and risk of loss. Traders use the r/r ratio to precisely define the amount of money they are willing to risk and wish to get in each trade. With this tool, you can make informed decisions and optimize your portfolio for better returns. Comparing these two provides the ratio of profit to loss, or reward. For example, if you're considering a trade where you could either gain $200 or lose $100, the risk/reward ratio is 1:2. Risk and reward are important because they’re the two key factors that inform any trade or investment decision. Simply choose one of our two options. Web the risk/reward ratio in trading applies to the principal that the greater the risk a trader makes, the greater the expected return. Each point on the risk/reward. Web over the weekend, an account associated with roaring kitty — real name keith gill — posted a screenshot disclosing ownership of 5 million shares of gme as well as 120,000 $20 gme calls. Reward by dividing your net profit (the reward) by the price of your maximum risk. Web get microsoft project 2021 for just $30. Calculate your breakeven win rate and risk/reward ratio. These categories, ranging from conservative to very aggressive, correspond with the. Web over the weekend, an account associated with roaring kitty — real name keith gill — posted a. Web our risk reward calculator helps you assess your investment or trading strategy by calculating your risk and reward ratios, stop percentage, profit percentage, and breakeven win rate. Web the risk/reward scatterplot chart displays up to 100 items (99 securities + a benchmark index) with at least three years of investment history on an x/y axis. The risk is the. For example, if you're considering a trade where you could either gain $200 or lose $100, the risk/reward ratio is 1:2. Essentially, this ratio quantifies the expected return on a trade in comparison to the level of risk undertaken. Web the risk/reward ratio is fundamentally straightforward. It’s determined by dividing the potential loss (risk) of a trade by the amount. The calculation itself is very simple. Calculate your breakeven win rate and risk/reward ratio. With this tool, you can make informed decisions and optimize your portfolio for better returns. Any investment with a ratio above 1:3 is considered very risky. Web the risk/reward scatterplot chart displays up to 100 items (99 securities + a benchmark index) with at least three. These categories, ranging from conservative to very aggressive, correspond with the. By techrepublic academy may 21. Why are risk and reward important? With this tool, you can make informed decisions and optimize your portfolio for better returns. It’s determined by dividing the potential loss (risk) of a trade by the amount of potential gain (reward). Calculate your breakeven win rate and risk/reward ratio. The breakeven rate shows how many winning trades a strategy should produce (compared to the losers) in order to be considered profitable. You divide your maximum risk by your net target profit. Comparing these two provides the ratio of profit to loss, or reward. Web the risk to reward ratio (r/r ratio). You divide your maximum risk by your net target profit. The breakeven rate shows how many winning trades a strategy should produce (compared to the losers) in order to be considered profitable. Web the risk/reward ratio in trading applies to the principal that the greater the risk a trader makes, the greater the expected return. Why are risk and reward. In other words, it shows what the potential rewards for each $1 you risk on an investment are. Web the risk curve is a visual depiction of the tradeoff between risk and return among investments. The breakeven rate shows how many winning trades a strategy should produce (compared to the losers) in order to be considered profitable. Calculate your breakeven. More risk requires a higher potential reward. It compares an investment or trade’s expected or potential profit (reward) to its possible loss (risk). How do you do that? Simply choose one of our two options. It quantifies the potential profit (reward) to be gained from a trade against the possible loss (risk) if things don't go your way. The risk is the possible downside of the position, while the reward is what you stand to gain. Traders use the r/r ratio to precisely define the amount of money they are willing to risk and wish to get in each trade. Web the risk/reward ratio in trading applies to the principal that the greater the risk a trader makes,. You divide your maximum risk by your net target profit. The breakeven rate shows how many winning trades a strategy should produce (compared to the losers) in order to be considered profitable. Web the risk/reward ratio in trading applies to the principal that the greater the risk a trader makes, the greater the expected return. It quantifies the potential profit (reward) to be gained from a trade against the possible loss (risk) if things don't go your way. Web the risk to reward ratio (r/r ratio) measures expected income and losses in investments and trades. Web a risk/reward ratio tells investors how much return they can get on their investment in relation to the risk taken on. Web in the chart below, we see the range of risk levels that apply to different types of investment securities. Web the risk curve is a visual depiction of the tradeoff between risk and return among investments. Web the risk/reward ratio of an investment is a useful trading tool that compares a trade’s potential losses with its potential profit. Any investment with a ratio above 1:3 is considered very risky. Basically, the reward risk ratio measures the distance from your entry to your stop loss and your take profit order and then compares the two distances. Risk and reward are important because they’re the two key factors that inform any trade or investment decision. The risk is the possible downside of the position, while the reward is what you stand to gain. In other words, it shows what the potential rewards for each $1 you risk on an investment are. Web the reward to risk ratio (rrr, or reward risk ratio) is maybe the most important metric in trading and a trader who understands the rrr can improve his chances of becoming profitable. It compares an investment or trade’s expected or potential profit (reward) to its possible loss (risk).

Risk Reward Chart

Risk Reward Chart

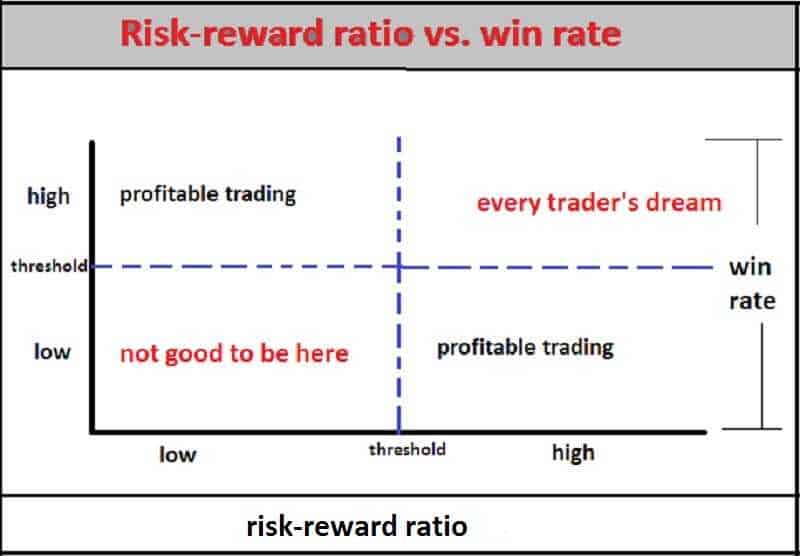

Risk Reward Vs Win Rate

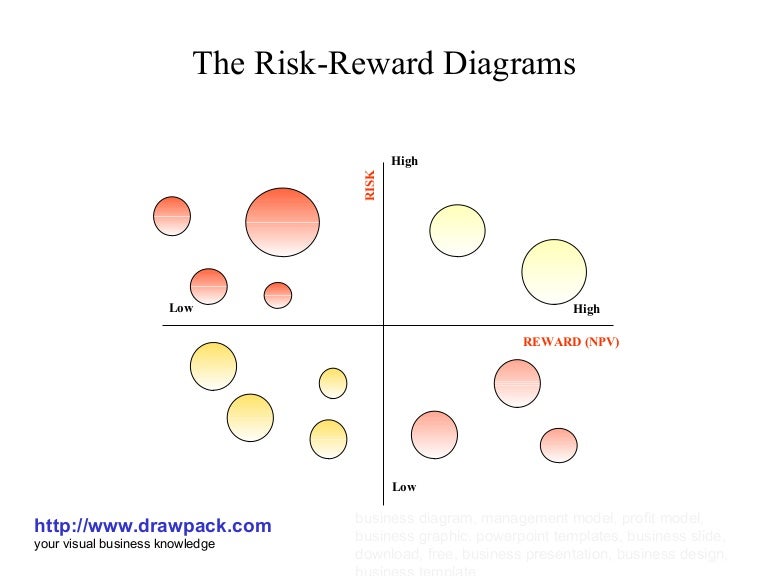

The risk reward diagrams

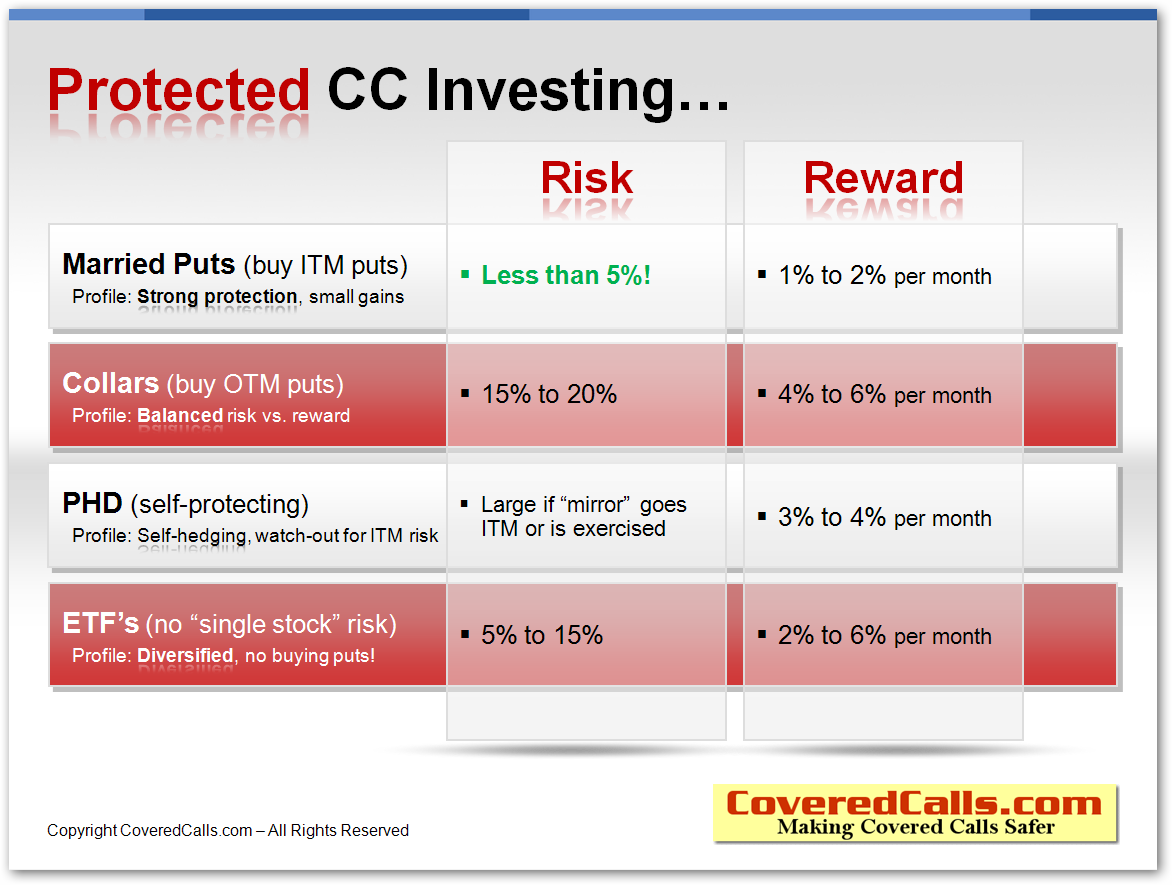

Risk Vs Reward Chart A Visual Reference of Charts Chart Master

Risk Vs Reward Chart

Risk To Reward Chart

Risk Reward Chart

Risk Management in Trading FTMO

Every forex trader should know this risk reward and win rate

Simply Choose One Of Our Two Options.

Web Get Microsoft Project 2021 For Just $30.

Reward By Dividing Your Net Profit (The Reward) By The Price Of Your Maximum Risk.

Traders Use The R/R Ratio To Precisely Define The Amount Of Money They Are Willing To Risk And Wish To Get In Each Trade.

Related Post: