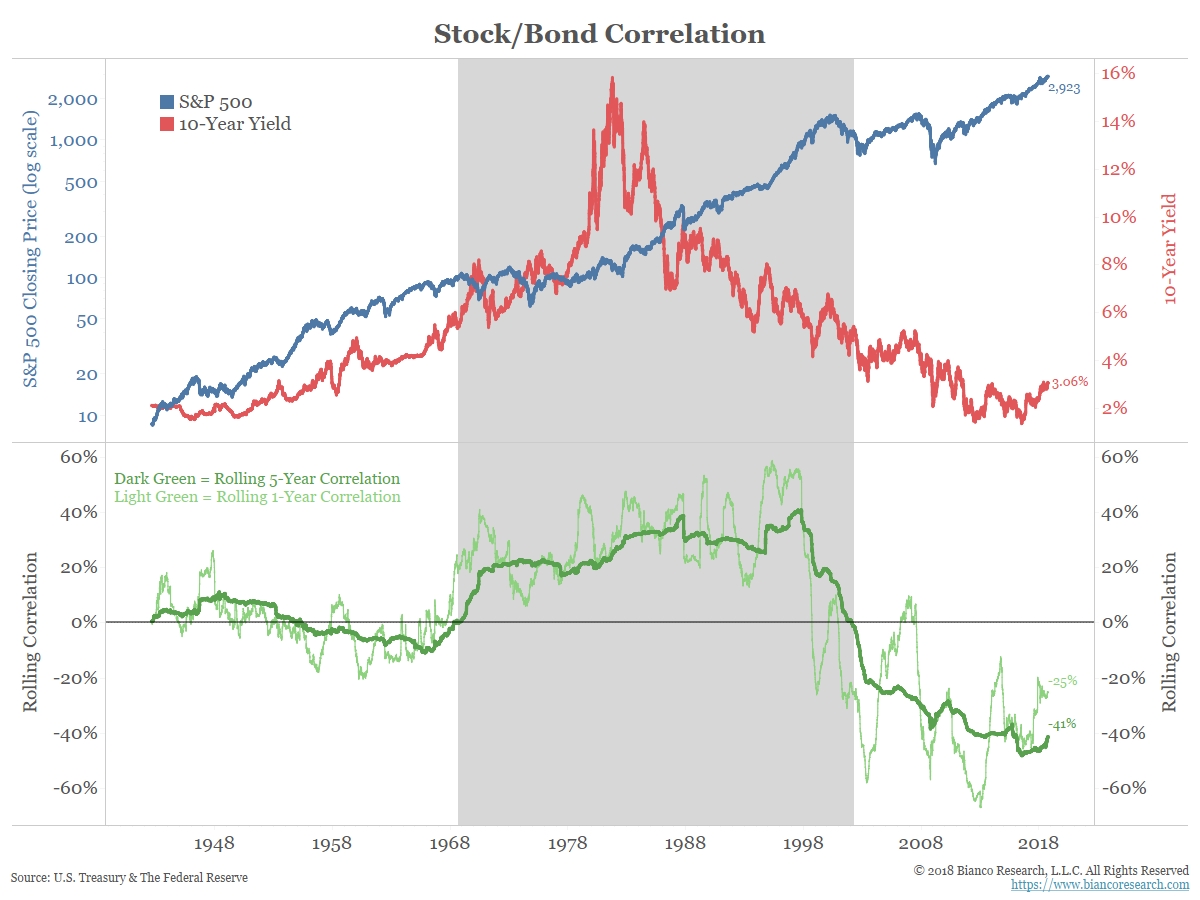

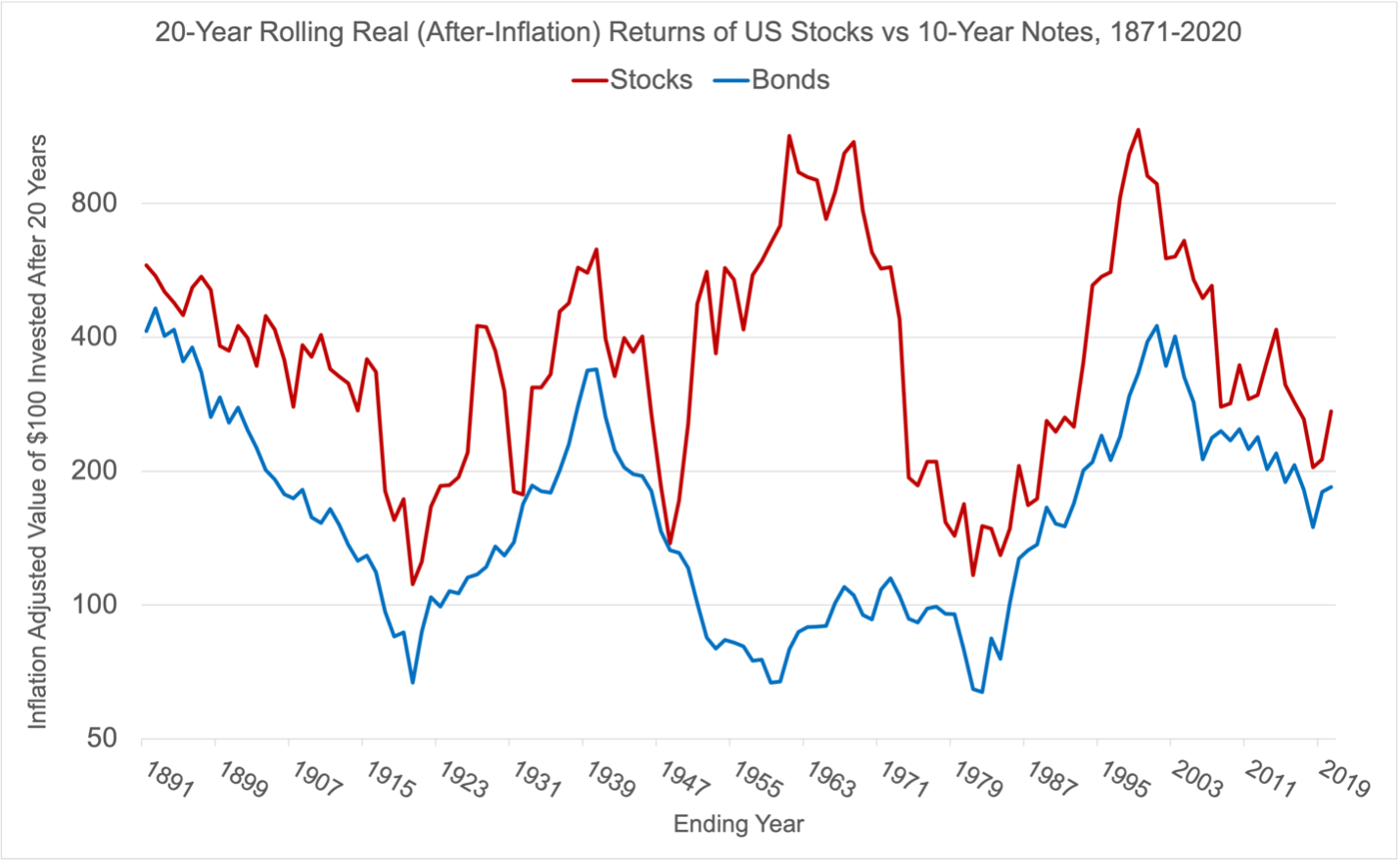

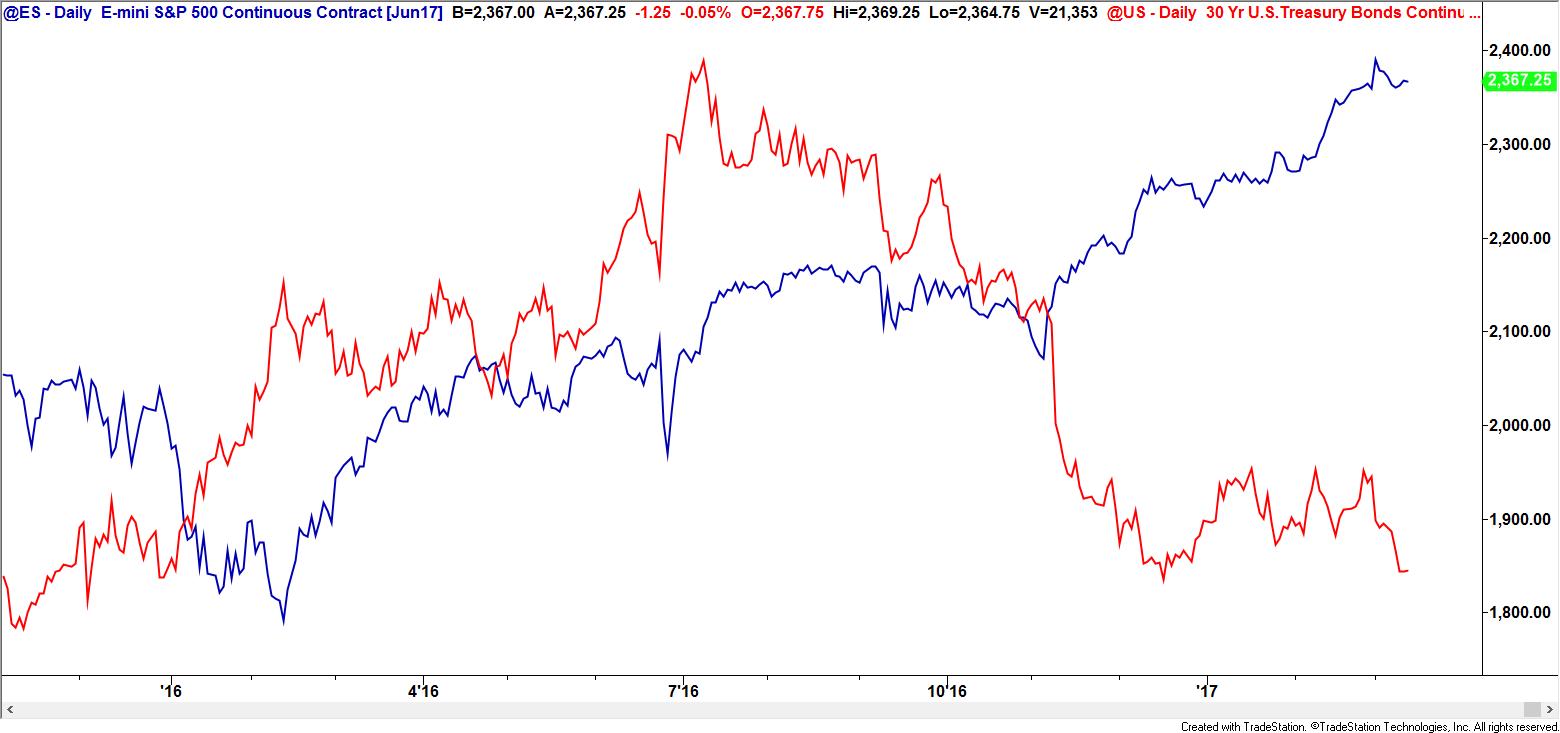

Stock Bond Correlation Chart

Stock Bond Correlation Chart - June 17, 2022 | 2 minute read. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. Web truthfully, correlations between stocks and bonds have been positive for a few years now, not just in 2022. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. Nio), a prominent electric vehicle manufacturer, down to $5.90 from the previous $6.50. Trump media & technology group corp (nasdaq: So all else being equal, if earnings growth moves. Nobody seemed to mind the positive correlation when. Agg across various inflation environments. Web the chart below provides an idea of the various factors that at different times may support a positive or negative correlation between stocks and bonds. Agg across various inflation environments. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. This week’s chart looks at how it exacerbates the diversification challenge. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. A correlation coefficient of +1 indicates a perfect positive correlation,. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. Web the chart below shows the results. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that stocks and bonds moved in the same direction during. So all else being equal, if earnings growth moves. In fact, we don't expect interest rates to. We consider how negative correlation could resurface. Web the chart below provides an idea of the various factors that at different times may support a positive or negative correlation between stocks and bonds. Web the chart below shows the results. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that stocks and bonds moved in the same direction. June 17, 2022 | 2 minute read. One thing it clearly shows is the volatile nature of equity market returns,. Web the chart below shows the results. Web the chart highlights the correlation between the s&p 500 and the bloomberg u.s. Trump media & technology group corp (nasdaq: This week’s chart looks at how it exacerbates the diversification challenge. Web the chart below provides an idea of the various factors that at different times may support a positive or negative correlation between stocks and bonds. Web on tuesday, bofa securities revised its price target for nio inc. One thing it clearly shows is the volatile nature of equity. Djt ), a media and technology company whose majority owner is donald trump, saw its. June 17, 2022 | 2 minute read. Web however, this hasn’t always been the case, and a positive stock/bond correlation could reappear due to macroeconomic changes. So all else being equal, if earnings growth moves. Trump media & technology group corp (nasdaq: In fact, we don't expect interest rates to rise unless. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. June 17, 2022 | 2 minute read. In this article, we assess the broad. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. So all else being equal, if earnings growth moves. June 17, 2022 | 2 minute read. Web however, this hasn’t always been the case, and a positive stock/bond correlation could reappear due to macroeconomic changes. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. In this article, we assess the. One thing it clearly shows is the volatile nature of equity market returns,. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. So all else being equal, if earnings growth moves. Nobody seemed to mind the positive correlation when. In this article, we assess the broad. One thing it clearly shows is the volatile nature of equity market returns,. Djt ), a media and technology company whose majority owner is donald trump, saw its. Web the chart below shows the results. Nio), a prominent electric vehicle manufacturer, down to $5.90 from the previous $6.50. In fact, we don't expect interest rates to rise unless. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. Nobody seemed to mind the positive correlation when. We consider how negative correlation could resurface. Agg across various inflation environments. Growth and volatility shocks tend to push. Djt ), a media and technology company whose majority owner is donald trump, saw its. So all else being equal, if earnings growth moves. In this article, we assess the broad. One thing it clearly shows is the volatile nature of equity market returns,. Web truthfully, correlations between stocks and bonds have been positive for a few years now, not just in 2022. Nio), a prominent electric vehicle manufacturer, down to $5.90 from the previous $6.50. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. Next time, we’ll look at the correlation of stock and bond returns and the effect of inflation on. Trump media & technology group corp (nasdaq: Web the chart below provides an idea of the various factors that at different times may support a positive or negative correlation between stocks and bonds. Web earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices.

A Century of StockBond Correlations Bulletin September 2014 RBA

With inflation, stockbond correlation jumps FS Investments

Correlation Between Stocks And Bonds Business Insider

StockBond Correlation, an InDepth Look QuantPedia

Revisiting The Change In The Stock/Bond Relationship Bianco Research

Quick Chart 20Year Rolling Returns of Stocks vs Bonds GFM Asset

A Century of StockBond Correlations Bulletin September 2014 RBA

Is The StockBond Correlation Positive Or Negative Russell Investments

Stock and Bond Correlation Explained

Historical Asset Class Correlations Which Have Been the Best Portfolio

A Correlation Coefficient Of +1 Indicates A Perfect Positive Correlation, Meaning That Stocks And Bonds Moved In The Same Direction During.

In Fact, We Don't Expect Interest Rates To Rise Unless.

Web The Chart Below Illustrates That Us Equities And Government Fixed Income Are Diverging Ever So Slightly In Performance.

This Week’s Chart Looks At How It Exacerbates The Diversification Challenge.

Related Post: