Tax Equivalent Yield Chart

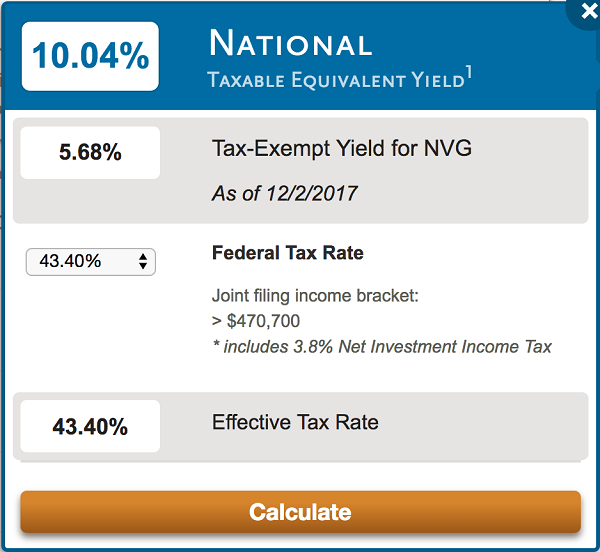

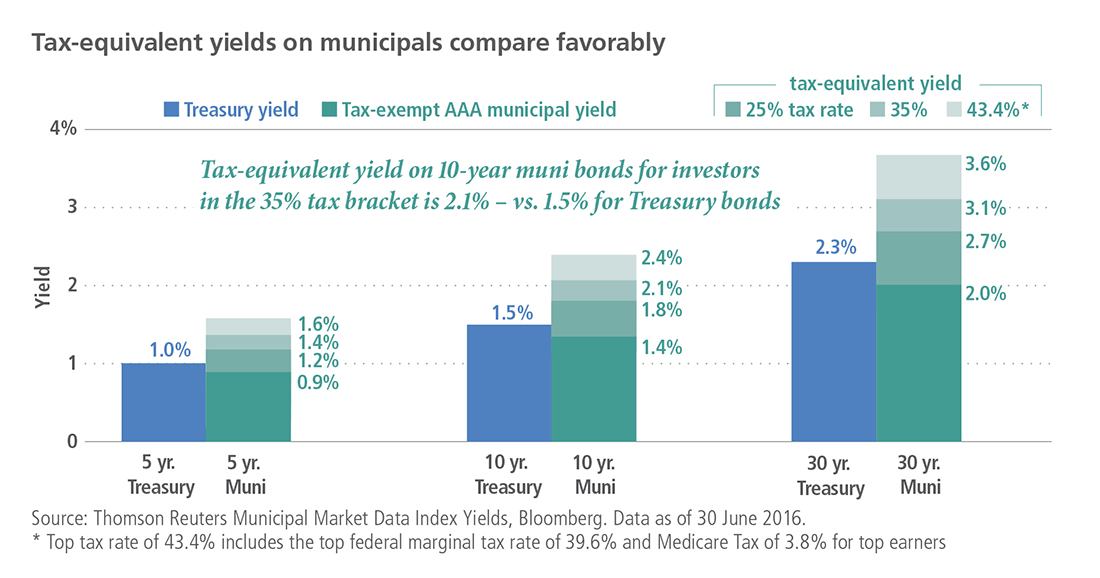

Tax Equivalent Yield Chart - Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. When presented with investments that are free from taxation at the state, federal, and/or local. Determine your total tax rate. Web 2024 taxable equivalent yield table for california. Web 22% tax equivalent yield. Determine your total tax rate. Web the tax equivalent yield will be 11.11%. Thus, the higher a bond's displayed yield, the more taxes incurred. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. Web the shift is apparent. This table is for illustrative purposes. Web use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond. Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such. The chart to the right shows how much more you will have to earn with a taxable investment to equal the return of a. Web 2024 taxable equivalent yield table for california. The chart below displays the amount of additional yield that is required from a “taxable” fixed. Web this tax equivalent yield calculator solves a taxable investment's interest rate. You can calculate this metric using the tax equivalent yield formula below: This table is for illustrative purposes. Web the tax equivalent yield will be 11.11%. Web 22% tax equivalent yield. In other words, the calculator. This is the annual yield of your municipal bond or bond fund. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. Determine your total tax rate. Web 2024 taxable equivalent yield table for california. Determine your total tax rate. When presented with investments that are free from taxation at the state, federal, and/or local. Determine your total tax rate. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. This is the annual yield of your municipal bond or bond fund. Web the tax equivalent yield will be 11.11%. When presented with investments that are free from taxation at the state, federal, and/or local. You can calculate this metric using the tax equivalent yield formula below: Web the shift is apparent. Web 22% tax equivalent yield. Web use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. You can calculate this metric using the tax equivalent yield formula below: In other words, the calculator. The chart below displays the amount of additional yield that is required from a “taxable” fixed. Web 2024 taxable equivalent yield table for california. This is your total income, after. Your bond is highlighted in green. Web use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond. This table is for illustrative purposes. In other words, the calculator. Web the tax equivalent yield will be 11.11%. Determine your total tax rate. You can calculate this metric using the tax equivalent yield formula below: Your bond is highlighted in green. Web use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond. This is your total income, after. When presented with investments that are free from taxation at the state, federal, and/or local. Web how to use this calculator: This table is for illustrative purposes. The chart to the right shows how much more you will have to earn with a taxable investment to equal the return of a. This is the annual yield of your municipal bond or bond fund. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. Web 2024 taxable equivalent yield table for california. In other words, the calculator. Determine your total tax rate. The chart below displays the amount of additional yield that is required from a “taxable” fixed. Web the shift is apparent. Web the tax equivalent yield will be 11.11%. Your bond is highlighted in green. Web 22% tax equivalent yield. Thus, the higher a bond's displayed yield, the more taxes incurred. The chart to the right shows how much more you will have to earn with a taxable investment to equal the return of a. Determine your total tax rate. Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. This is your total income, after. You can calculate this metric using the tax equivalent yield formula below:

The Best 6+ Yields for the New Tax Plan

Tax Equivalent Yield Definition, Formula, How to Calculate Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

TaxEquivalent Yield Definition

Taxequivalent Yields on Municipal Bonds The Big Picture

My Favorite Fund To Get High Yields Without Paying Taxes Reliable

TaxEquivalent Yields and the New Tax Law Breckinridge Capital Advisors

TaxEquivalent Yields and the New Tax Law Breckinridge Capital Advisors

Rieger Report “Belly of the Curve” Good for Muni & Corporate Bonds S

Tax Equivalent Yield What Is It, Calculator, Formula

Tax Equivalent Yield Calculator Begin To Invest

This Table Is For Illustrative Purposes.

Web How To Use This Calculator:

Web Use This Tax Equivalent Yield Calculator To Determine The Yield Required By A Fully Taxable Bond To Earn The Same After Tax Income As A Municipal Bond.

When Presented With Investments That Are Free From Taxation At The State, Federal, And/Or Local.

Related Post: