Tax Form 8962 Printable

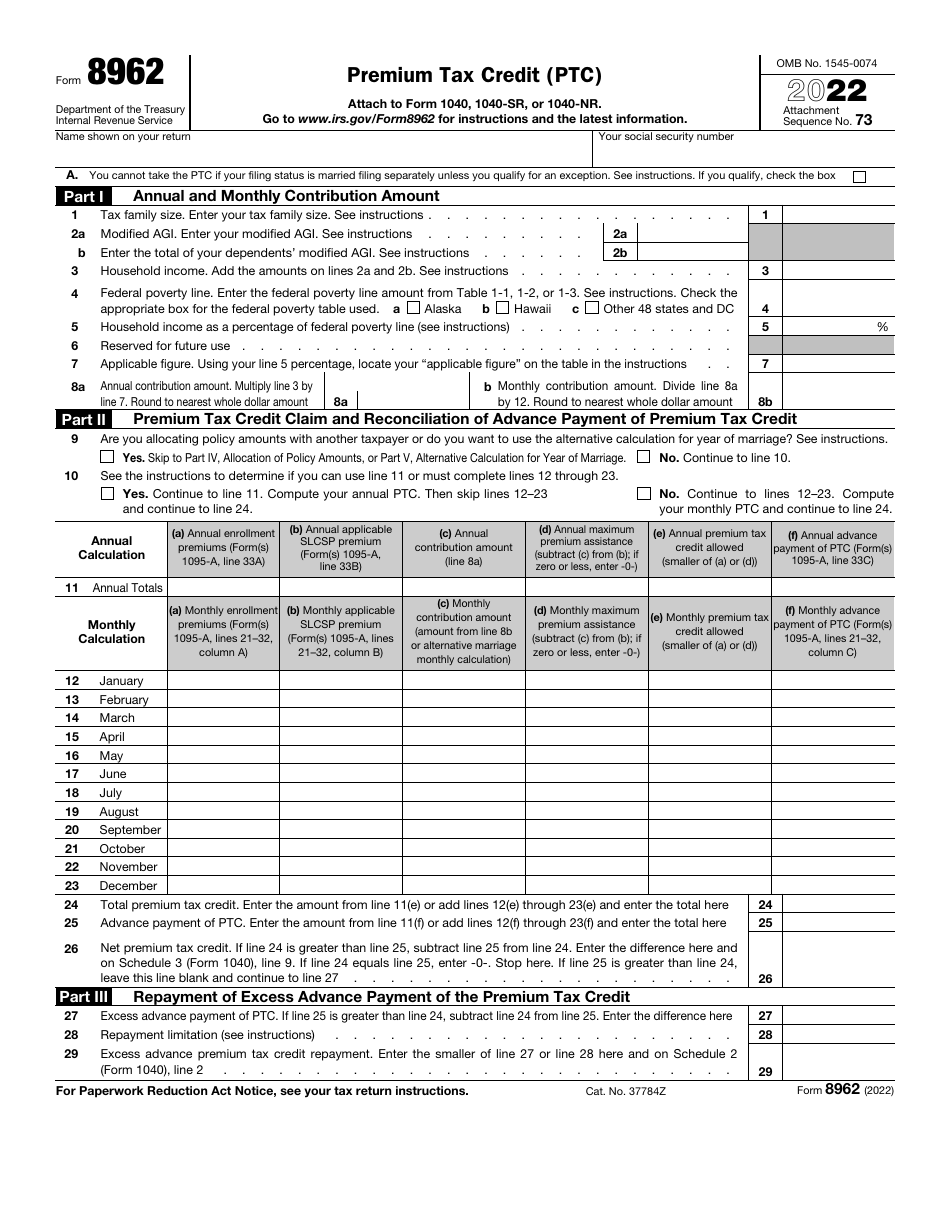

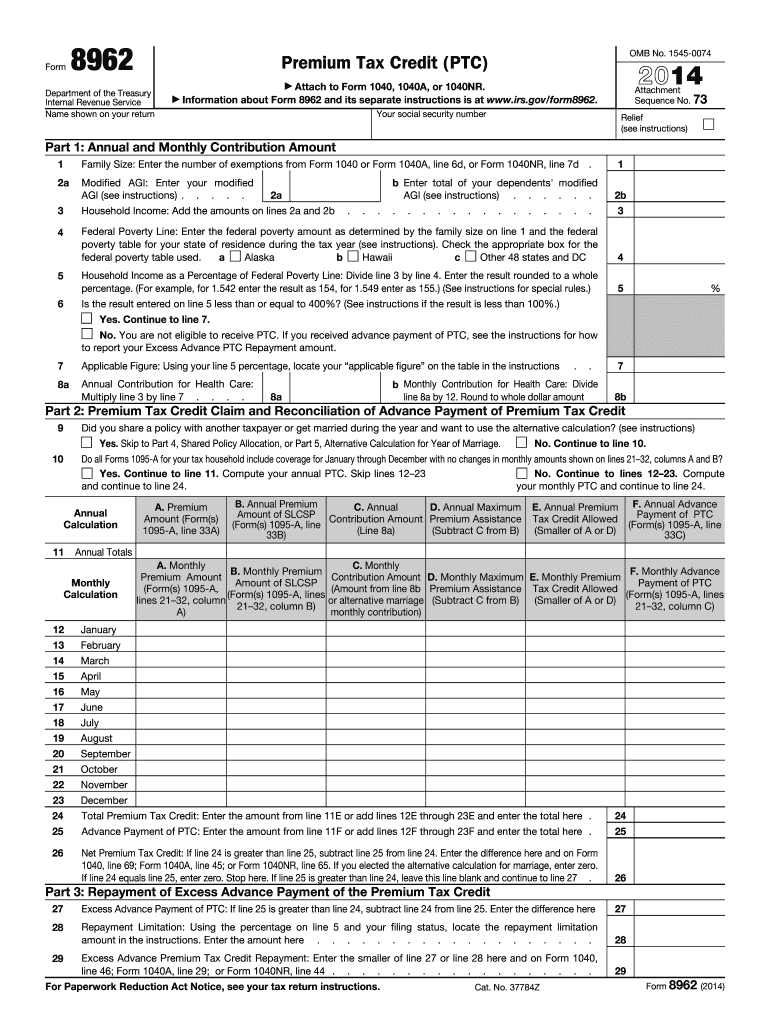

Tax Form 8962 Printable - What is the premium tax credit? You qualified for the premium tax credit in. This form includes details about the marketplace insurance you and household members had in 2023. You’ll need it to complete form 8962, premium tax credit. What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those who qualify. Web the net premium tax credit a taxpayer can claim (the excess of the taxpayer’s premium tax credit over aptc) will appear on form 1040, schedule 3. Form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance through the health insura… Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. You’ll need it to complete form 8962, premium tax credit. This form includes details about the marketplace insurance you and household members had in 2023. What is the premium tax credit? What is a 8962 form form. If a taxpayer must repay aptc or gets additional ptc, remember to adjust the insurance premium deduction on schedule a. This amount will increase taxpayer’s refund or reduce the balance due. Eligibility requirements for the premium tax credit. Web the net premium tax credit a taxpayer can claim (the excess of the taxpayer’s premium tax credit over aptc) will appear. Sign on any devicepaperless solutionscompliant and securefree mobile app Web how to print 8962 form here are the blank template in pdf and doc. This amount will increase taxpayer’s refund or reduce the balance due. The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those. You qualified for the premium tax credit in. When should i include form 8962 with my tax return? Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. More about the federal form 8962 other ty 2023. Eligibility requirements for the premium tax credit. We last updated the premium tax credit in january 2024, so this is the latest version of form 8962, fully updated for tax year 2023. Eligibility requirements for the premium tax credit. If a taxpayer must repay aptc or gets additional ptc, remember to adjust the insurance premium deduction on schedule a. Web form 8962, also known as the premium. Eligibility requirements for the premium tax credit. The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those who qualify. You have to include form 8962 with your tax return if: If there's a change to your refund amount or the amount you owe, print and. This form includes details about the marketplace insurance you and household members had in 2023. If a taxpayer must repay aptc or gets additional ptc, remember to adjust the insurance premium deduction on schedule a. Web when you're done in turbotax, print out form 8962 and mail or fax it to the irs, along with any other items requested in. This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including healthcare.gov. Web how to print 8962 form here are the blank template in pdf and doc. Sign on any devicepaperless solutionscompliant and securefree mobile app Web when you're done in turbotax, print out form 8962 and mail or fax it to the. This amount will increase taxpayer’s refund or reduce the balance due. Web the net premium tax credit a taxpayer can claim (the excess of the taxpayer’s premium tax credit over aptc) will appear on form 1040, schedule 3. Filing irs form 8962 can save you some money you spend on your health plan. Form 8962 is used to calculate the. Web when you're done in turbotax, print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. The. We last updated the premium tax credit in january 2024, so this is the latest version of form 8962, fully updated for tax year 2023. Web irs 8962 form printable 2020 📝 get tax form 8962 printable blank in pdf, fill online template instructions. More about the federal form 8962 other ty 2023. Web the net premium tax credit a taxpayer can claim (the excess of the taxpayer’s premium tax credit over aptc) will appear on form 1040, schedule 3. Web how to print 8962 form here are the blank template in pdf and doc. Sign on any devicepaperless solutionscompliant and securefree mobile app Filing irs form 8962 can save you some money you spend on your health plan. Eligibility requirements for the premium tax credit. The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those who qualify. You’ll need it to complete form 8962, premium tax credit. Form 8962 must be completed if you received advance payments of the premium tax credit (aptc) or if you want to claim the credit on your tax return. This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including healthcare.gov. This form includes details about the marketplace insurance you and household members had in 2023. Web form 8962, also known as the premium tax credit (ptc) form, is used to reconcile and calculate the premium tax credit for those who have health insurance through the health insurance marketplace. What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. When should i include form 8962 with my tax return?

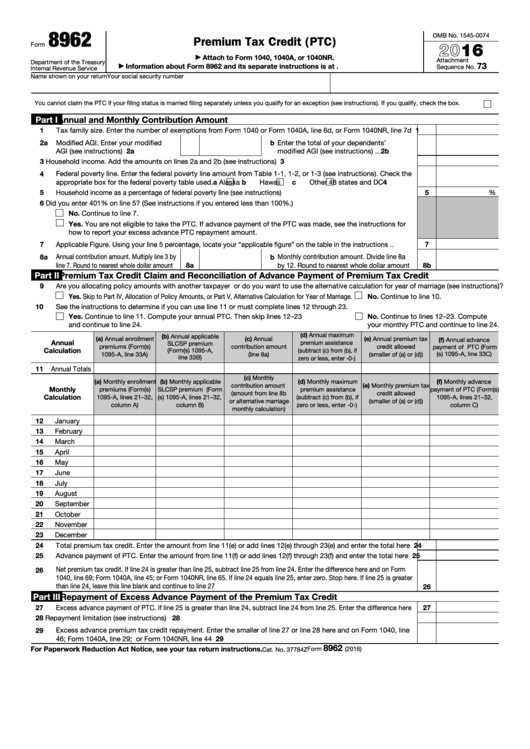

Irs form 8962 Fillable Brilliant form 8962 Instructions 2018 at Models

Fillable Form 8962 Premium Tax Credit (Ptc) 2016 printable pdf download

pasezine Blog

![74 [PDF] 8962 FORM APPROVAL 2017 FREE PRINTABLE DOCX 2020 ApprovalForm2](https://www.irs.gov/pub/xml_bc/33455805.gif)

74 [PDF] 8962 FORM APPROVAL 2017 FREE PRINTABLE DOCX 2020 ApprovalForm2

How to Fill out IRS Form 8962 Correctly?

Fillable Online Instructions Tax Form 8962 Fax Email Print pdfFiller

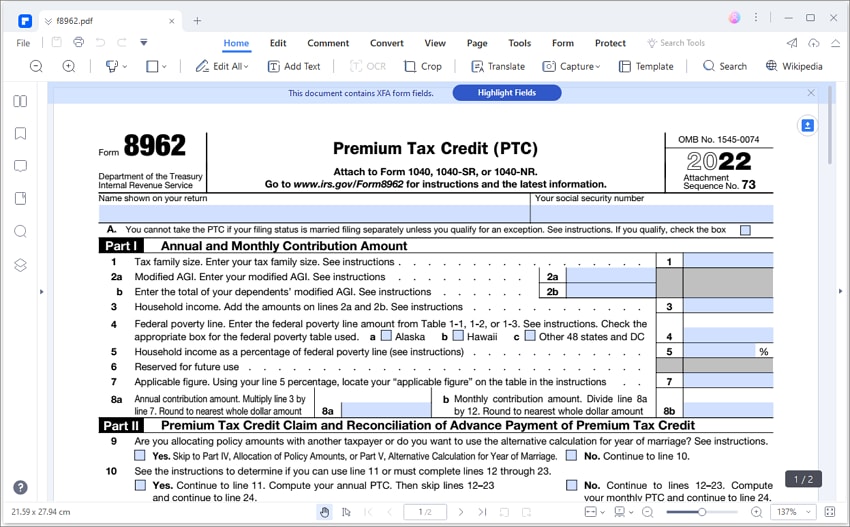

IRS Form 8962 Download Fillable PDF or Fill Online Premium Tax Credit

8962 Form 2021 Printable

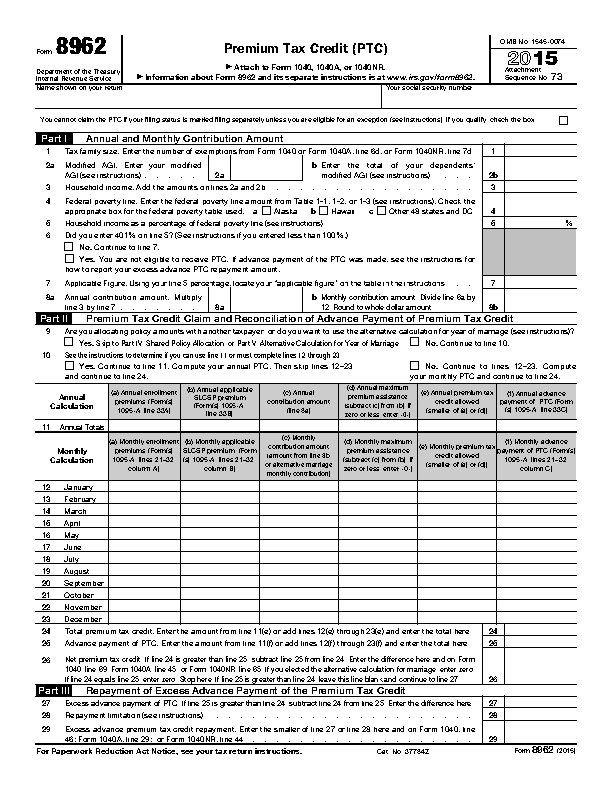

Best IRS 8962 For 2015 (US) 2019 Update FormsPro.io

Form 8962 Fill out & sign online DocHub

Solved•By Turbotax•2677•Updated November 22, 2023.

This Amount Will Increase Taxpayer’s Refund Or Reduce The Balance Due.

Purpose Of Form Use Form 8962 To Figure The Amount Of Your Premium Tax Credit (Ptc) And Reconcile It With Advance Payment Of The Premium Tax Credit (Aptc).

You Have To Include Form 8962 With Your Tax Return If:

Related Post: