Ted Spread Chart

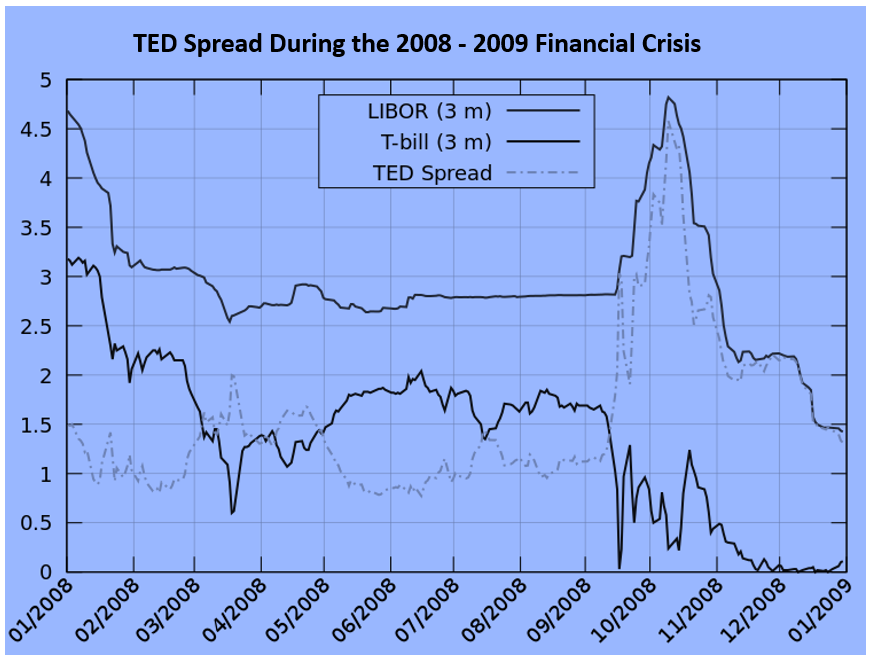

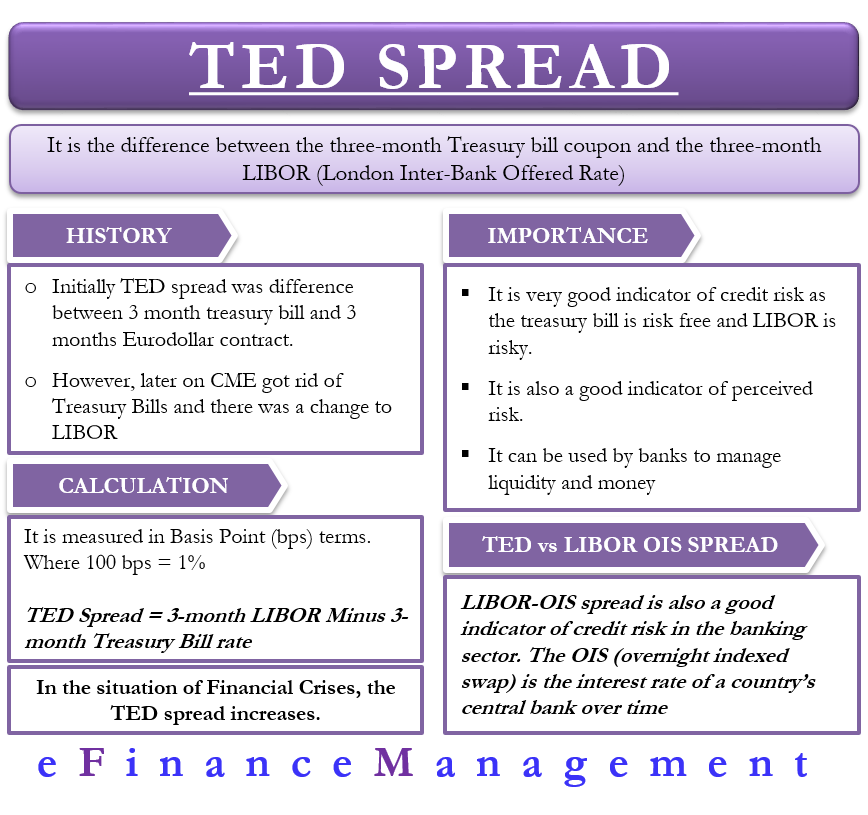

Ted Spread Chart - We believe that no investment. Web ted spread (fred:tedrate) — historical data and chart — tradingview — india. 0.000 (0.00%) delayed data 19/06. It is used as a measure of credit risk and can be. Let us consider a simple example to understand this spread. The size of the spread is usually denominated in basis points (bps). 0.000 ( 0.00 %) 1 day. Web 26 rows view and export historical data of ted spread, the difference between us. May 29, 2024 4:01 pm cdt. 1y | 5y | 10y | max. Let's talk about the ted spread. Web ted spread (fred:tedrate) — historical data and chart — tradingview — india. Let us consider a simple example to understand this spread. Typical value range is from 0.13 to 0.43. Web learn what the ted spread is, how to calculate it, and how to interpret it as a gauge of financial market confidence. 0.000 ( 0.00 %) 1 day. Web what is your sentiment on ted spread? Typical value range is from 0.13 to 0.43. Vote to see community's results! Web macromicro is committed to consolidating global economic data, while deploying technology to efficiently discover the clues to economic cycles. Web learn what the ted spread is, how to calculate it, and how to interpret it as a gauge of financial market confidence and risk. Let us consider a simple example to understand this spread. The size of the spread is usually denominated in basis points (bps). Web free economic data, indicators & statistics. Find out how the ted spread. Web macromicro is committed to consolidating global economic data, while deploying technology to efficiently discover the clues to economic cycles. Typical value range is from 0.13 to 0.43. Web 38 rows see the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s. The chart shows the historical.. It is used as a measure of credit risk and can be. Web 26 rows view and export historical data of ted spread, the difference between us. The size of the spread is usually denominated in basis points (bps). Web historically, the ted spread reached a record high of 4.58 and a record low of 0.06, the median value is. Web ted spread (fred:tedrate) — historical data and chart — tradingview — india. 0.000 ( 0.00 %) 1 day. The chart shows the historical. May 29, 2024 4:01 pm cdt. We believe that no investment. 1y | 5y | 10y | max. Let us consider a simple example to understand this spread. Let's talk about the ted spread. Web free economic data, indicators & statistics. Web what is your sentiment on ted spread? The chart shows the historical. Let's talk about the ted spread. 0.000 ( 0.00 %) 1 day. It is used as a measure of credit risk and can be. Web historically, the ted spread reached a record high of 4.58 and a record low of 0.06, the median value is 0.42. Web macromicro is committed to consolidating global economic data, while deploying technology to efficiently discover the clues to economic cycles. May 29, 2024 4:01 pm cdt. Let's talk about the ted spread. Typical value range is from 0.13 to 0.43. It is used as a measure of credit risk and can be. Web 26 rows view and export historical data of ted spread, the difference between us. The size of the spread is usually denominated in basis points (bps). We believe that no investment. Vote to see community's results! Web historically, the ted spread reached a record high of 4.58 and a record low of 0.06, the median value is 0.42. Find out how the ted spread can be. Web free economic data, indicators & statistics. Web 26 rows view and export historical data of ted spread, the difference between us. Typical value range is from 0.13 to 0.43. 0.000 ( 0.00 %) 1 day. Vote to see community's results! 0.000 (0.00%) delayed data 19/06. The size of the spread is usually denominated in basis points (bps). Web ted spread (fred:tedrate) — historical data and chart — tradingview — india. It is used as a measure of credit risk and can be. Web what is your sentiment on ted spread? Let's talk about the ted spread. May 29, 2024 4:01 pm cdt. We believe that no investment. Web learn what the ted spread is, how to calculate it, and how to interpret it as a gauge of financial market confidence and risk. Web 38 rows see the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s.

TED Spread What You Need to Know Seeking Alpha

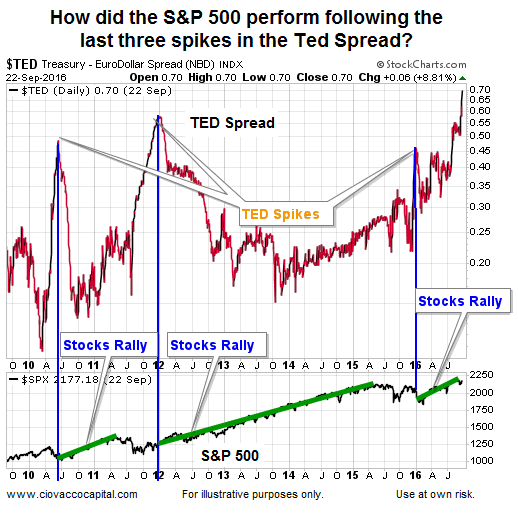

Here's Why the "TED Spread" is Meaningless for Stocks ETF Daily News

Ted Spread Chart A Visual Reference of Charts Chart Master

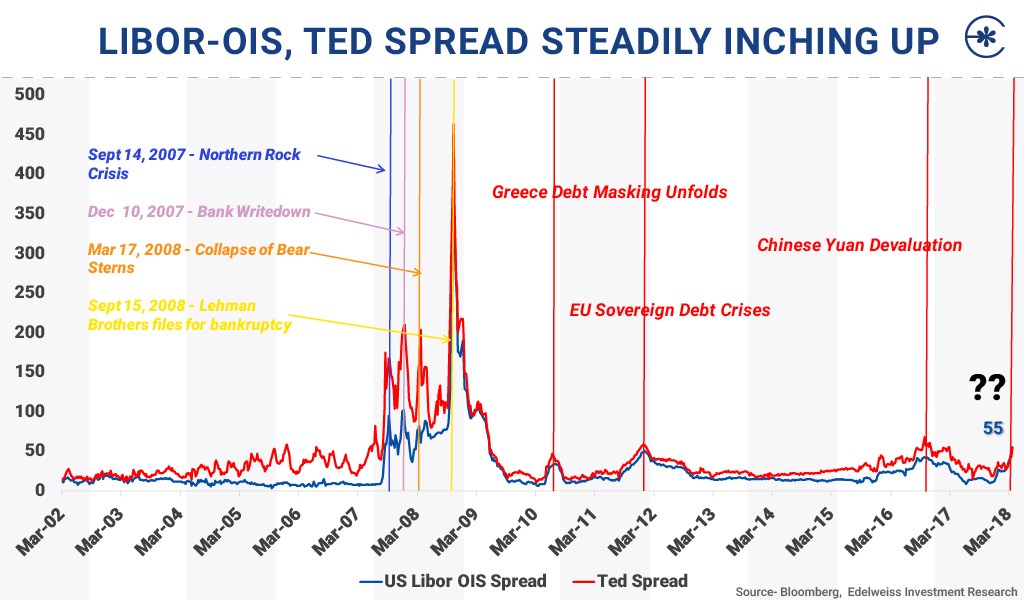

Chart TED Spread and LIBOROIS

Chart of the Day MacroBusiness

The US Microeconomics LIBOR & Ted Spread Chart (05/21/2010)

The TED Spread's Economic Signal Collaborative Wealth

PPT Leading Economic and Stock Market Indicators PowerPoint

TED spread CFA, FRM, and Actuarial Exams Study Notes

TED Spread Meaning, Calculation, Importance, Variation and more

Web Macromicro Is Committed To Consolidating Global Economic Data, While Deploying Technology To Efficiently Discover The Clues To Economic Cycles.

The Chart Shows The Historical.

Let Us Consider A Simple Example To Understand This Spread.

1Y | 5Y | 10Y | Max.

Related Post: