Texas Property Tax Penalty And Interest Chart

Texas Property Tax Penalty And Interest Chart - Web how do i calculate penalties and interest for past due taxes? Web the comptroller’s property tax assistance division provides the penalty and interest ( p&i) chart below for use in calculating the total amount due on delinquent property tax. Web the comptroller’s property tax assistance division provides this penalty and interest p&i map below for use in calculating the whole amount due on delinquent objekt tax bills. Web interest begins to accrue 61 days after the date of the payment or the due date of the tax report, whichever is later. The comptroller’s property tax assistance division provides the penalty and interest p&i chart below for use in calculating the total amount due on delinquent property tax bills based on the p&i rates established by tax. The following schedule provides penalty and interest rates for use in calculating the total amount of penalty and. Web check out our penalty chart here. Texas comptroller, 2023 and 2024 penalty. Statutory penalty on past due taxes are calculated as follows: Web a request for a waiver of penalties and interest under subsection (a) (1) or (3), (b), (h), (j), or (k) must be made before the 181st day after the delinquency date. Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding. Web (1) accrues interest at a rate of six percent for each year or portion of a year the tax remains unpaid; Web taxes property tax assistance. Not only are you faced with penalties,. Web the comptroller’s property tax assistance division provides the penalty and interest ( p&i) chart below for use in calculating the total amount due on delinquent property tax. Not only are you faced with penalties, interest, and fees when you become delinquent, but a lien will also be placed on your. Web check out our penalty chart here. The comptroller’s. Statutory penalty on past due taxes are calculated as follows: Web a request for a waiver of penalties and interest under subsection (a) (1) or (3), (b), (h), (j), or (k) must be made before the 181st day after the delinquency date. Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the. Delinquency dates, penalty and interest by type of property tax bill. Web 2022 and 2023 penalty and interest chart. (2) does not incur a penalty. Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding. Web check out our penalty chart here. Web for a more detailed breakdown of the penalty and interest fees for texas property tax, read the chart below: Web 2022 and 2023 penalty and interest chart. Web the following schedule provides penalty and interest rates for use in calculating the total amount of penalty and interest due on delinquent tax bills. Web type of tax bill delinquency date. Web taxes property tax assistance. 2021 and 2022 penalty and interest chart. The rates in this schedule. Not only are you faced with penalties, interest, and fees when you become delinquent, but a lien will also be placed on your. Web check out our penalty chart here. Web typically, you will incur an immediate penalty of 6% of your original tax bill on the first business day of february, 1% interest rate per month for each month it goes unpaid in. Web penalty interest total p&i; (2) does not incur a penalty. Web the comptroller’s property tax assistance division provides this penalty and interest p&i map below. Web for a more detailed breakdown of the penalty and interest fees for texas property tax, read the chart below: Web failure to pay texas real estate taxes exposes property owners to severe penalties, interest, and legal complications, up to and including losing their homes. The following schedule provides penalty and interest rates for use in calculating the total amount. Delinquency dates, penalty and interest by type of property tax bill. Web a 12 percent penalty is assessed on the unpaid tax as well as interest at the rate of 1 percent per month and attorney collection fees until paid. Web check out our penalty chart here. Web how do i calculate penalties and interest for past due taxes? These. (2) does not incur a penalty. Web a request for a waiver of penalties and interest under subsection (a) (1) or (3), (b), (h), (j), or (k) must be made before the 181st day after the delinquency date. Property tax bills flyer (pdf) tax. 2021 and 2022 penalty and interest chart. Taxes are calculated by subtracting the value of any. Not only are you faced with penalties, interest, and fees when you become delinquent, but a lien will also be placed on your. Web check out our penalty chart here. Web how do i calculate penalties and interest for past due taxes? Web a request for a waiver of penalties and interest under subsection (a) (1) or (3), (b), (h), (j), or (k) must be made before the 181st day after the delinquency date. Web 2022 and 2023 penalty and interest chart. These tax bills include the back taxes and if an. Property tax bills flyer (pdf) tax. Web failure to pay texas real estate taxes exposes property owners to severe penalties, interest, and legal complications, up to and including losing their homes. Web the following schedule provides penalty and interest rates for use in calculating the total amount of penalty and interest due on delinquent tax bills. (2) does not incur a penalty. Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding. 2021 and 2022 penalty and interest chart. The comptroller’s property tax assistance division provides the penalty and interest p&i chart below for use in calculating the total amount due on delinquent property tax bills based on the p&i rates established by tax. Delinquency dates, penalty and interest by type of property tax bill. Credit interest does not accrue for amounts subject to title 6,. The following schedule provides penalty and interest rates for use in calculating the total amount of penalty and.

Property Tax Penalty Chart Texas Property Tax Penalties and Interest

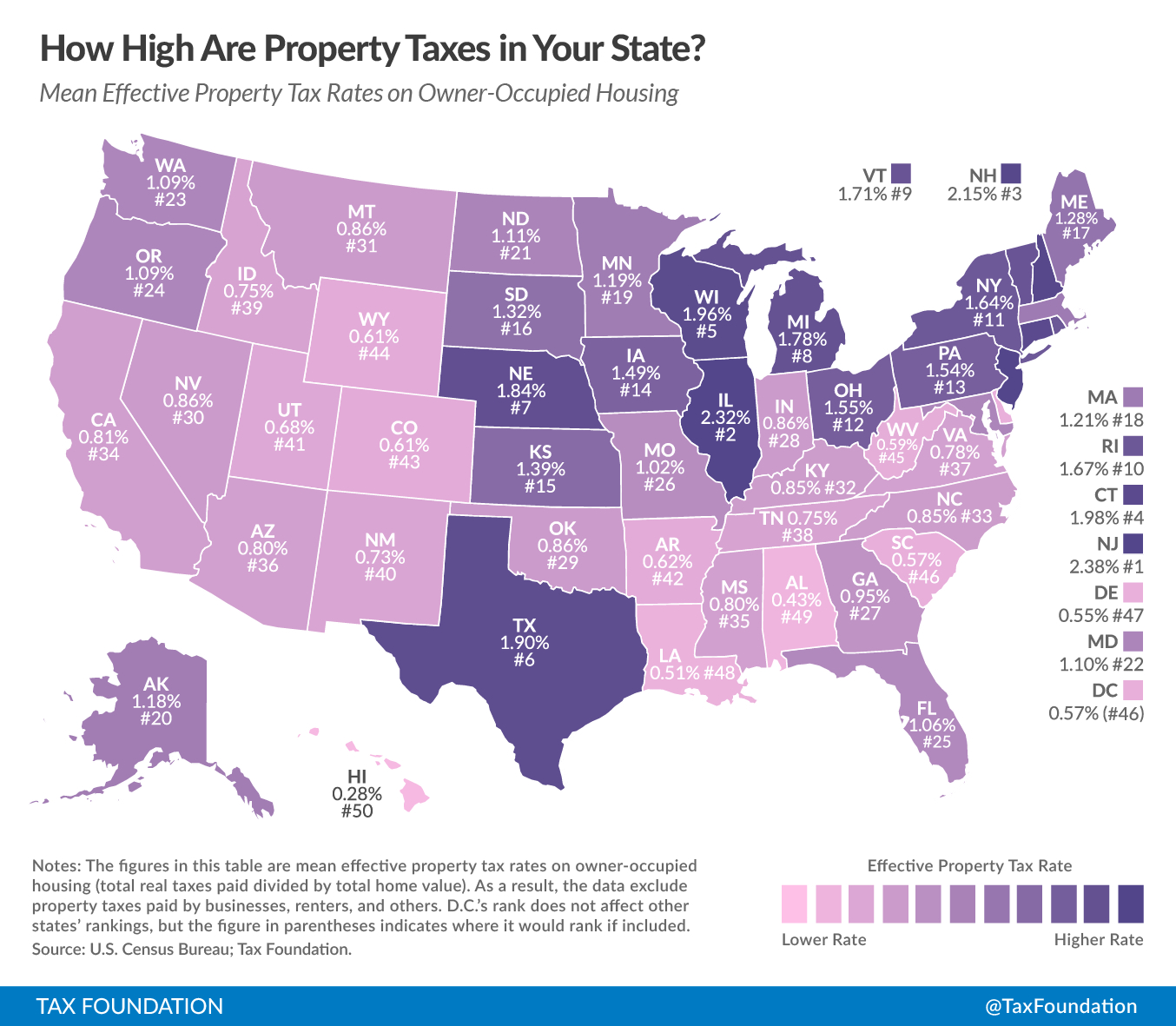

Real Estate Property Tax By State

Property Taxes In Texas 2024 Adel Loella

Texas Tax Chart Printable

Property Tax Due Date 2024 In Texas Emily Ingunna

The Kiplinger Tax Map Guide To State Taxes, State Sales Texas

Due Dates and Penalties Isanti County, MN

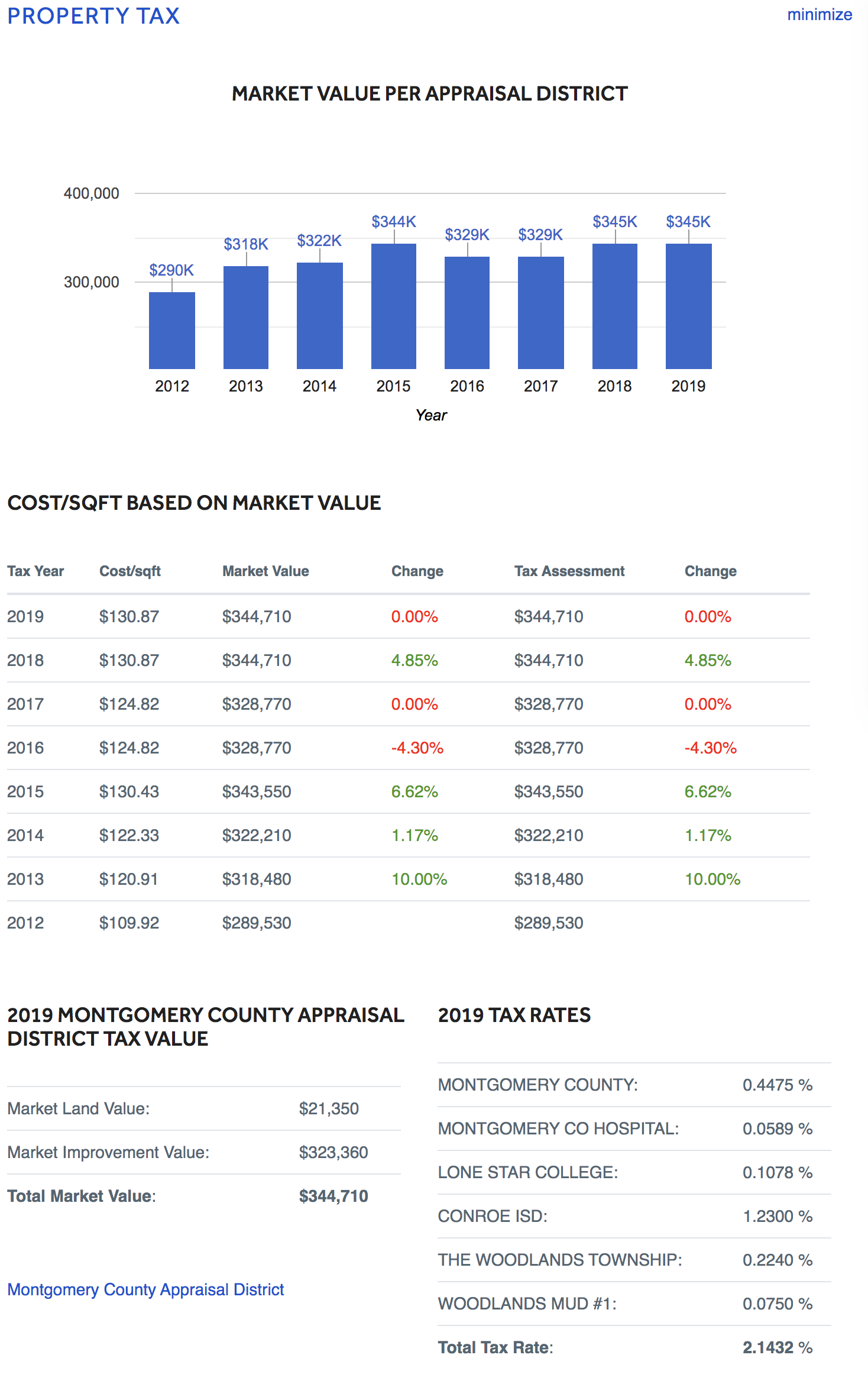

How do property taxes in Texas work?

![Property Taxes in Texas [OC][1766x1868] r/MapPorn](https://external-preview.redd.it/7G7f91ymVE9-ZZTbski4ilqEmbk_FPYaDLtTOvr-M2c.png?auto=webp&s=3293fdc8ada3aa0ba7c42f0adbdb0a9ece0dfcf9)

Property Taxes in Texas [OC][1766x1868] r/MapPorn

Texas Property Tax Penalty and Interest Chart Johnson & Starr

Web Type Of Tax Bill Delinquency Date Penalty Interest;

The Rates In This Schedule.

Texas Comptroller, 2023 And 2024 Penalty.

Web Taxes Property Tax Assistance.

Related Post: