Triple Bottom Chart

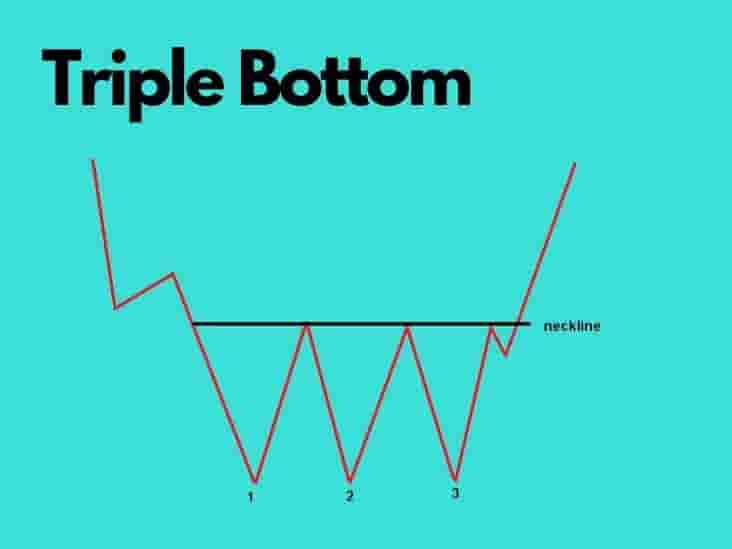

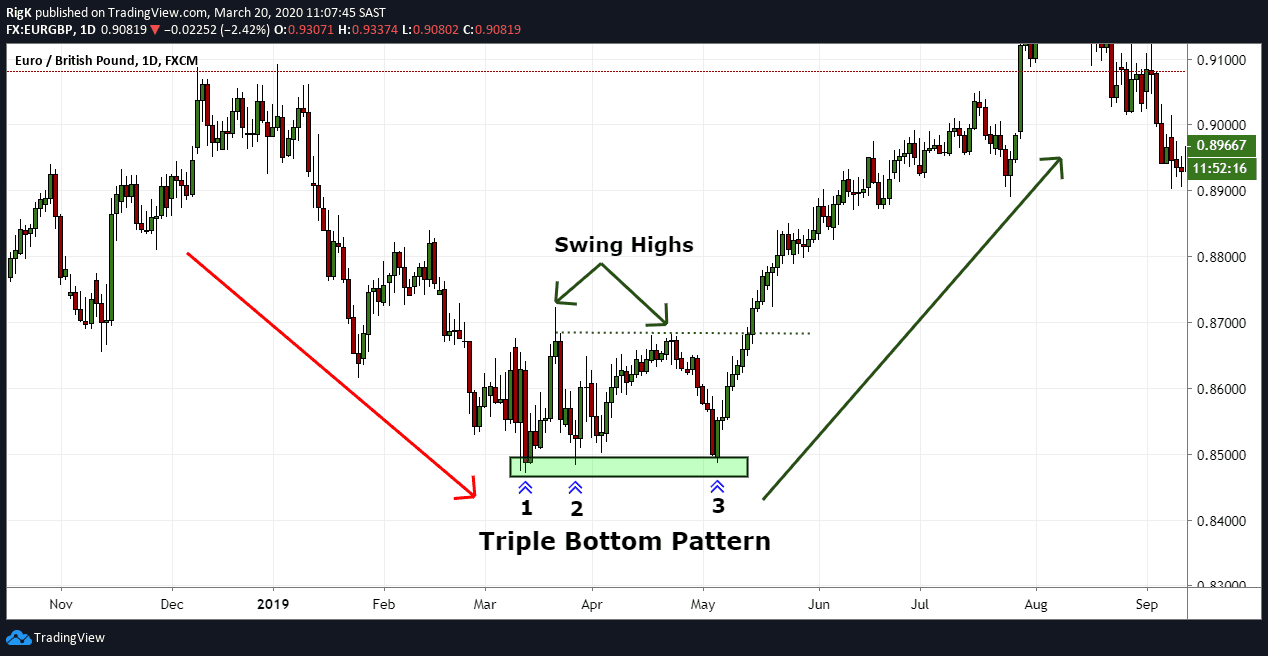

Triple Bottom Chart - Traders look for three consecutive low points separated by intervening peaks,. It involves monitoring price action to find a distinct pattern before the price launches higher. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between them. Web triple bottom chart patterns are easy to identify and, if seen, can be readily used as an aspect of technical analysis to develop a trading strategy. It consists of 3 swing low levels in the price and it signals that a bearish trend may be ending. The chart example above shows a triple bottom formation that turned the eur/gbp forex pair to the upside after a downtrend. Three troughs follow one another, indicating strong support. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. Three troughs follow one another, indicating strong support. It consists of a neckline and three distinct bottoms, forming during market indecision and taking time to develop. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. Web the triple bottom is a bullish reversal chart pattern that could be an. Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. Traders look for three consecutive low points separated by intervening peaks,. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. Triple top und triple bottom. Diese. It consists of a neckline and three distinct bottoms, forming during market indecision and taking time to develop. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between them. Web a triple bottom is a bullish reversal chart pattern. Web triple bottom chart patterns are easy to identify and, if seen, can be readily used as an aspect of technical analysis to develop a trading strategy. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. The pattern appears on a price chart as three equal low levels followed by an uptrend that. Triple top und triple bottom. Think of this pattern like a trusty ally that nudges you, suggesting, “the market’s tide might be turning.” It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. Diese. It’s characterized by three equal lows followed by a breakout above the resistance level. These troughs are formed as a result of price action, where the asset’s price reaches a low point before bouncing back up. The characteristics are almost completely the same as the double bottom with the only difference that the support base of the pattern consists of. These troughs are formed as a result of price action, where the asset’s price reaches a low point before bouncing back up. Web the triple bottom pattern is an extension of the double bottom pattern and is also cataloged as a bullish reversal pattern. Beim triple top sollten die höchstkurse wiederum auf einer höhe liegen, toleranz etwa 3 prozent. Think. The “triple bottom” name comes. Web the triple bottom chart pattern is a technical analysis formation that occurs when the price of an asset creates three distinct troughs at approximately the same level. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. Web the triple bottom is a bullish reversal chart pattern. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. Web the triple bottom pattern is an extension of the double bottom pattern and is also cataloged as a bullish reversal pattern. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. Web triple. The characteristics are almost completely the same as the double bottom with the only difference that the support base of the pattern consists of not two but three bottoms with a temporary price recovery in between. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of. Web the triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. Web in technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. Web the triple bottom chart pattern is used in technical analysis. It consists of a neckline and three distinct bottoms, forming during market indecision and taking time to develop. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. Web the triple bottom is a bullish reversal chart pattern that could be an indication that sellers (bears) are losing control of a downtrend and that buyers (bulls) are taking over. Web the triple bottom pattern is an extension of the double bottom pattern and is also cataloged as a bullish reversal pattern. Web the triple bottom chart pattern is a technical analysis formation that occurs when the price of an asset creates three distinct troughs at approximately the same level. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. Web triple bottom chart patterns are easy to identify and, if seen, can be readily used as an aspect of technical analysis to develop a trading strategy. It appears rarely, but it always warrants consideration, as it is a strong signal for a significant uptrend in price. But what does a triple bottom pattern look like? Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance.

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Chart Pattern Trading charts, Stock trading strategies

Chart Pattern Triple Bottom — TradingView

Triple Bottom Chart Pattern Definition With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Bottom_Definition_Jun_2020-01-38534512050d4a0a8e7cefc9ebb3509f.jpg)

What Is a Triple Bottom Chart in Technical Analysis?

The Triple Bottom Pattern is a bullish chart pattern. It occurs

Triple Bottom Pattern Explanation and Examples

The Triple Bottom Candlestick Pattern ThinkMarkets AU

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

How To Trade Triple Bottom Chart Pattern TradingAxe

It Involves Monitoring Price Action To Find A Distinct Pattern Before The Price Launches Higher.

But What Do Triple Bottom Patterns Look Like?

Typically, The Pattern Follows A Prolonged Downtrend Where Bears Are Controlling The Trading Market.

Diese Beiden Formationen Sind Charakteristisch Mit Dem Double Top / Double Bottom Vergleichbar, Besitzen Jedoch Drei Hochs Bzw.

Related Post: