Us Credit Default Swap Chart

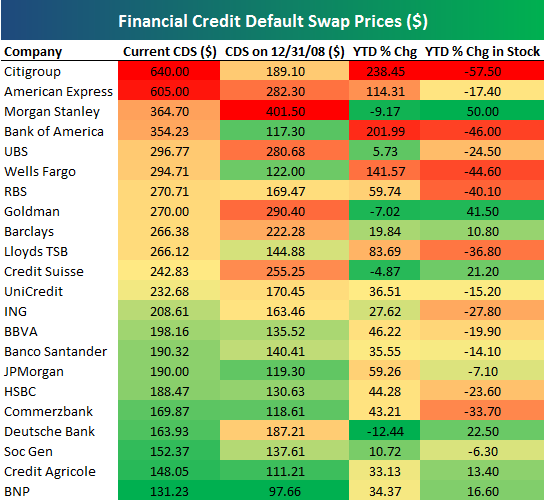

Us Credit Default Swap Chart - Credit default swaps (cds) are the most common type of credit derivative. Web cdx indices are a family of tradable credit default swap (cds) indices covering north america and emerging markets. Support your price discovery, risk management, compliance, research and valuations requirements. Credit default swaps, also known as , are financial instruments which the buyer pays premiums to the seller in exchange for compensation in case of a credit. Government implied a 3.9% probability that the u.s. Web us for more detailed information. Download, graph, and track economic data. Credit default swaps act like. Would default — double the level. This paper provides a brief history of the cds market and discusses its main characteristics. This metric is a crucial indicator used by investors to gauge the credit risk associated with italy's sovereign debt. October 15, 2021 this draft: This section is followed by detailed pieces on cds indices, index tranches and index options. Web us for more detailed information. Web cdx indices are a family of tradable credit default swap (cds) indices covering north. Get instant access to a free live. Introduction to credit default swaps credit default. October 15, 2021 this draft: Web credit default swaps (cds) are the most common type of credit derivative. This metric is a crucial indicator used by investors to gauge the credit risk associated with italy's sovereign debt. Credit default swaps act like. Cdx covers multiple sectors, including: What is a credit default swap (cds)? This section is followed by detailed pieces on cds indices, index tranches and index options. Web the credit default swap index (cdx) is a benchmark index that tracks a basket of u.s. This section is followed by detailed pieces on cds indices, index tranches and index options. Credit default swaps, also known as , are financial instruments which the buyer pays premiums to the seller in exchange for compensation in case of a credit. Fact checked by kirsten rohrs schmitt. Web updated june 01, 2024. Would default — double the level. Web access cds indices covering a broad range of the credit derivatives market. Web the credit default swap index (cdx) is a benchmark index that tracks a basket of u.s. Web us for more detailed information. Default risk is flashing red as talks over the government's debt ceiling drag on, with speculation driven by the lure of a quick profit.. Would default — double the level. Introduction to credit default swaps credit default. Web updated june 01, 2024. Support your price discovery, risk management, compliance, research and valuations requirements. Action to guarantee deposits at. Fact checked by kirsten rohrs schmitt. Web us for more detailed information. Introduction to credit default swaps credit default. Credit default swaps act like. This section is followed by detailed pieces on cds indices, index tranches and index options. Web as of the latest update on 1 jun 2024 13:45 gmt+0, the united states 5 years credit default swap (cds) value stands at 36.87 basis points. Find the 5 years cds value across us, uk and more. Fact checked by kirsten rohrs schmitt. Get instant access to a free live. Web access cds indices covering a broad range of. Web an index of credit default swaps (cds) on u.s. Action to guarantee deposits at. Web access the market’s most extensive source of credit default swaps data. Fact checked by kirsten rohrs schmitt. Web as of the latest update on 1 jun 2024 13:45 gmt+0, the united states 5 years credit default swap (cds) value stands at 36.87 basis points. Credit default swaps, also known as , are financial instruments which the buyer pays premiums to the seller in exchange for compensation in case of a credit. Fact checked by kirsten rohrs schmitt. Web the credit default swap market is generally divided into three sectors: Web 75 economic data series with tag: Web the credit default swap index (cdx) is. This paper provides a brief history of the cds market and discusses its main characteristics. Find the 5 years cds value across us, uk and more. Web explore our comprehensive list of credit default swaps (cds) for major countries and manage your credit risk. Credit default swaps act like. Web the credit default swap index (cdx) is a benchmark index that tracks a basket of u.s. Web as of the latest update on 1 jun 2024 13:45 gmt+0, the united states 5 years credit default swap (cds) value stands at 36.87 basis points. Get instant access to a free live. Web access the market’s most extensive source of credit default swaps data. Web updated june 01, 2024. Download, graph, and track economic data. Web access cds indices covering a broad range of the credit derivatives market. Support your price discovery, risk management, compliance, research and valuations requirements. Action to guarantee deposits at. Cdx covers multiple sectors, including: Web cdx indices are a family of tradable credit default swap (cds) indices covering north america and emerging markets. Government implied a 3.9% probability that the u.s.Cost of US corporate default protection soars Financial Times

Credit Risk Indicators Problem Of Financial Debt

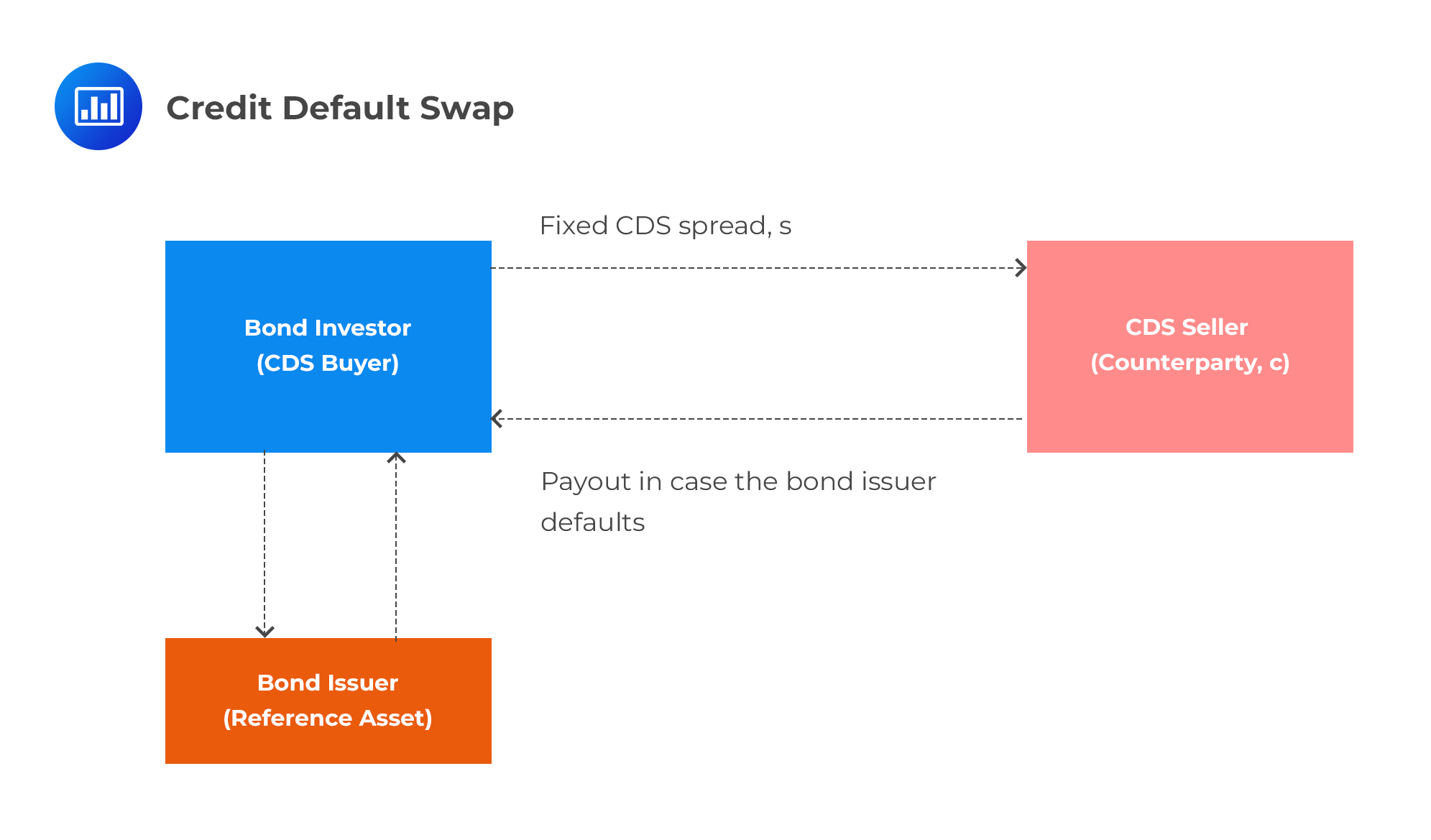

Credit Default Swap Simple Explanation Accounting Education

Can you purchase credit default swaps? Leia aqui Can anyone buy credit

credit default swap CFA, FRM, and Actuarial Exams Study Notes

Year Spread Telegraph

Credit Default Swaps explained

Financial Credit Default Swap Prices Seeking Alpha

Cost of US corporate default protection soars Financial Times

Credit default swap definition and meaning Market Business News

Credit Default Swaps (Cds) Are The Most Common Type Of Credit Derivative.

This Section Is Followed By Detailed Pieces On Cds Indices, Index Tranches And Index Options.

Get Free Historical Data For United States Cds 1 Year Usd Bond Yield.

Would Default — Double The Level.

Related Post: