Wage Chart On Form Njw4

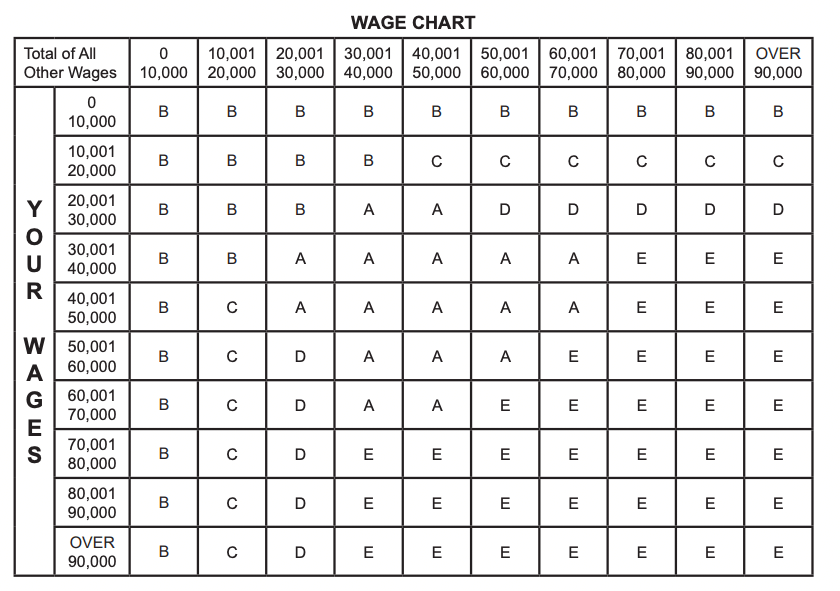

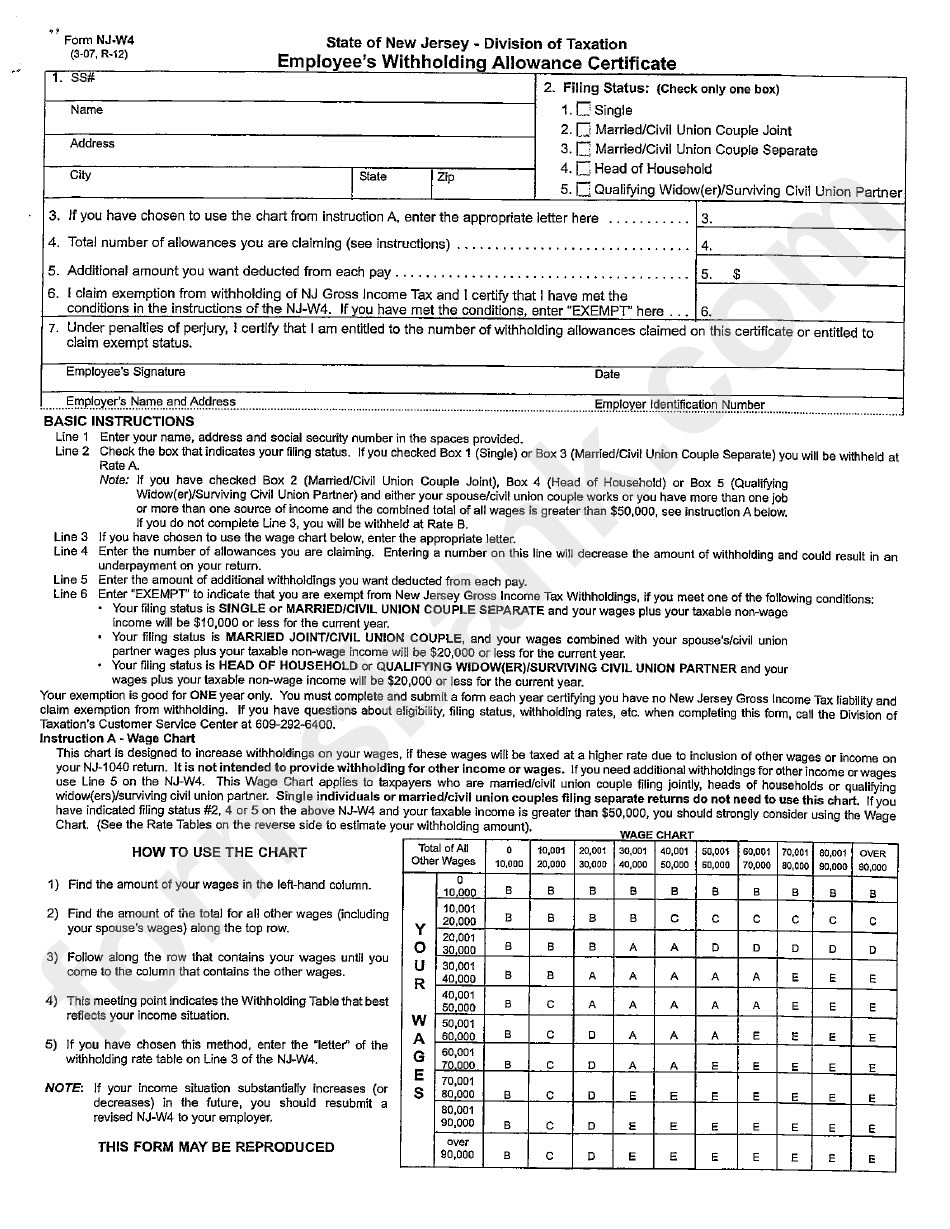

Wage Chart On Form Njw4 - This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. Use the tax bracket calculator to find out what percent should be withheld to zero out. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web federal w4 changed so allowances are no longer a thing. Web divide the annual new jersey tax withholding by 26 to obtain the biweekly new jersey tax withholding. (see the rate tables on the reverse side to estimate your withholding. Find the amount of the total for all other wages (including. $ 0 $ 384 $ 673 $ 769 $ 1,442 $ 9,615. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. Claim for refund of estimated gross income tax payment required on the sale of real property located in new jersey,. (see the rate tables on the reverse side to estimate your withholding. Use the tax bracket calculator to find out what percent should be withheld to zero out. Under penalties of perjury, i certify that i am entitled to the number of withholding. $ 384 $ 673 $ 769 $. Claim for refund of estimated gross income tax payment required. Ex, marginal tax rate 10%. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. This chart is designed to increase. How to use the chart. If you have met the conditions, enter exempt here. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Claim for refund of estimated gross income tax payment required on the sale of real property located in new jersey,. Web all wages and employee compensation paid to. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Annual payroll period (allowance $1,000) if the amount of taxable wages is: Ex, marginal tax rate 10%. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. Find the amount of the total. Ex, marginal tax rate 10%. $ 0 $ 384 $ 673 $ 769 $ 1,442 $ 9,615. Annual payroll period (allowance $1,000) if the amount of taxable wages is: (see the rate tables on the reverse side to estimate your withholding. Web federal w4 changed so allowances are no longer a thing. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. If you have met the conditions, enter exempt here. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web all. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. If. Ex, marginal tax rate 10%. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. (see the rate tables on the reverse side to estimate your withholding. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. $ 384 $ 673 $ 769. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. Ex, marginal tax rate 10%. If you have met the conditions, enter exempt here. $ 0 $ 384 $ 673 $ 769 $ 1,442 $ 9,615. Use the tax bracket calculator to find out what percent should be withheld to zero. $ 384 $ 673 $ 769 $. Claim for refund of estimated gross income tax payment required on the sale of real property located in new jersey,. (see the rate tables on the reverse side to estimate your withholding. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. This chart is. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. (see the rate tables on the reverse side to estimate your withholding. If you employ new jersey residents working in new jersey, you must. Under penalties of perjury, i certify that i am entitled to the number of withholding. Web divide the annual new jersey tax withholding by 26 to obtain the biweekly new jersey tax withholding. $ 0 $ 384 $ 673 $ 769 $ 1,442 $ 9,615. (see the rate tables on the reverse side to estimate your withholding. If you have met the conditions, enter exempt here. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Claim for refund of estimated gross income tax payment required on the sale of real property located in new jersey,. Find the amount of the total for all other wages (including. How to use the chart. $ 384 $ 673 $ 769 $. Web federal w4 changed so allowances are no longer a thing. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding.

Fill Free fillable Njw4 Form NJ W4 WT 07 PDF form

How Do I Fill out Form W4? StepbyStep Guide to Calculating Your

Wage Chart On Form Njw4

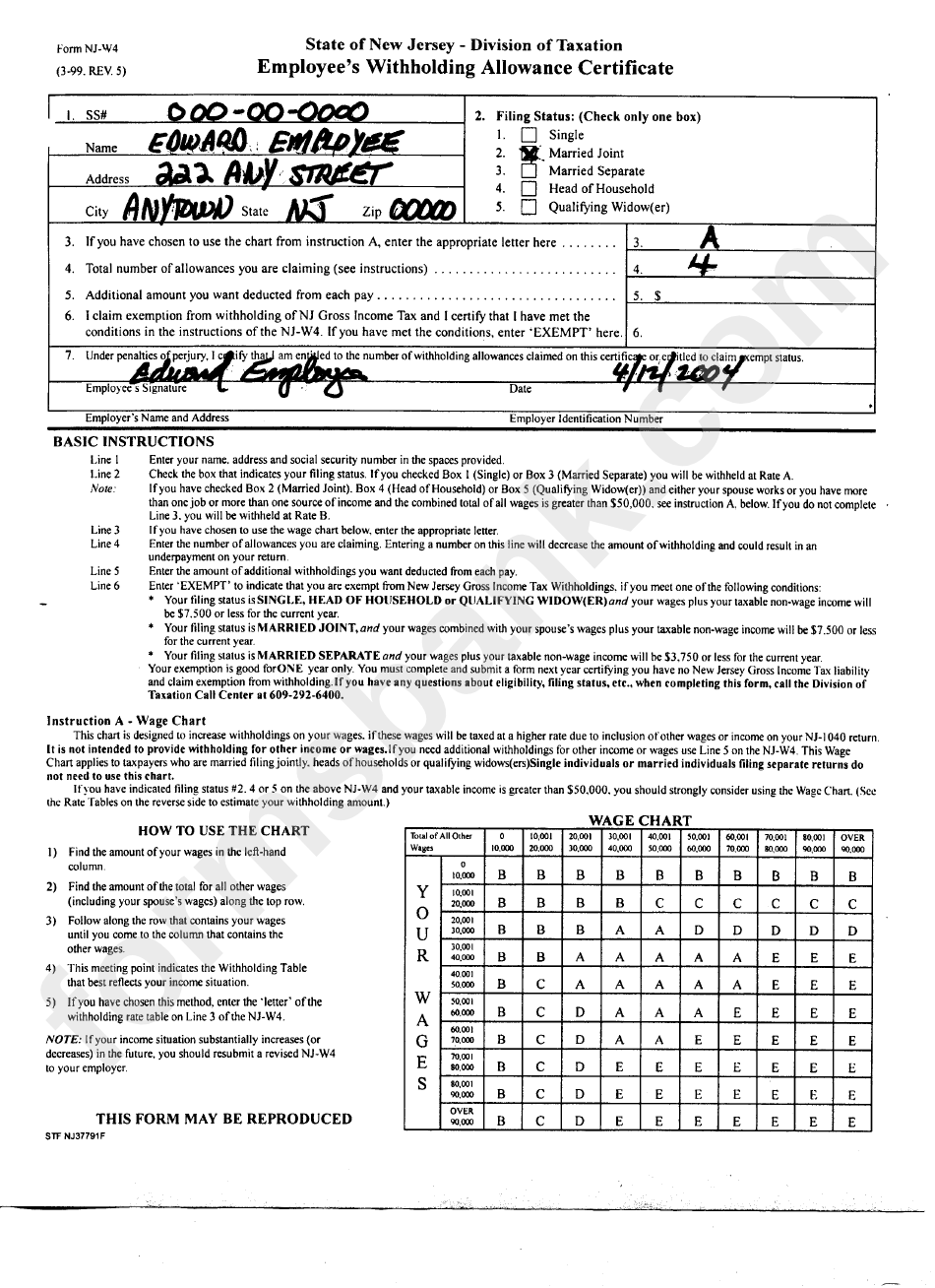

Form NjW4 Example Employee'S Withholding Allowance Certificate New

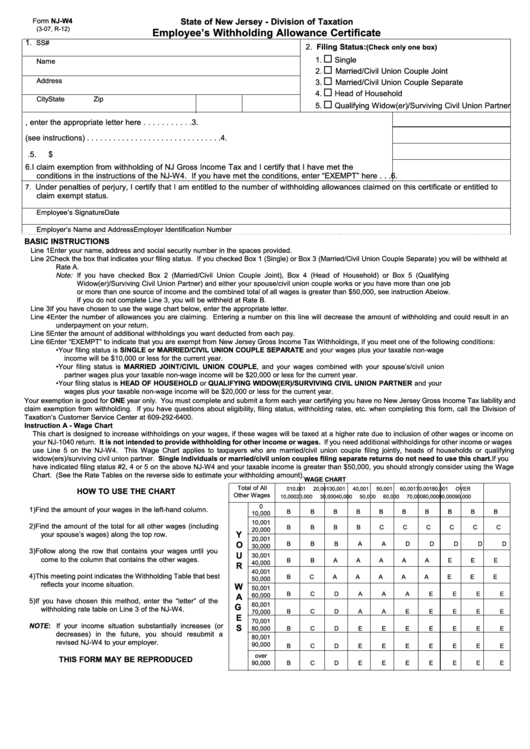

Fillable Form NjW4 Employee'S Withholding Allowance Certificate

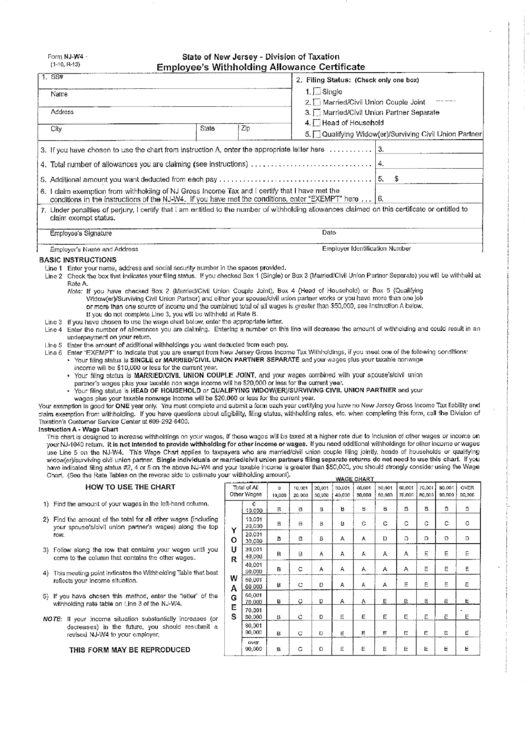

Form NjW4 Employee'S Withholding Allowance Certificate printable pdf

Nj w4 Fill out & sign online DocHub

How to Fill Out New Jersey Withholding Form NJW4 in 2023 + FAQs

New Jersey W4 2024 Roze Wenona

Employee's Withholding Allowance Certificate New Jersey Free Download

Annual Payroll Period (Allowance $1,000) If The Amount Of Taxable Wages Is:

Its Purpose Is To Determine The Withholding Rates You Are Subjected To, Particularly If Your Household Works Two Jobs.

This Chart Is Designed To Increase Withholdings On Your Wages, If These Wages Will Be Taxed At A Higher Rate Due To Inclusion Of Other Wages Or Income.

Ex, Marginal Tax Rate 10%.

Related Post: