Sofr Vs Libor Chart

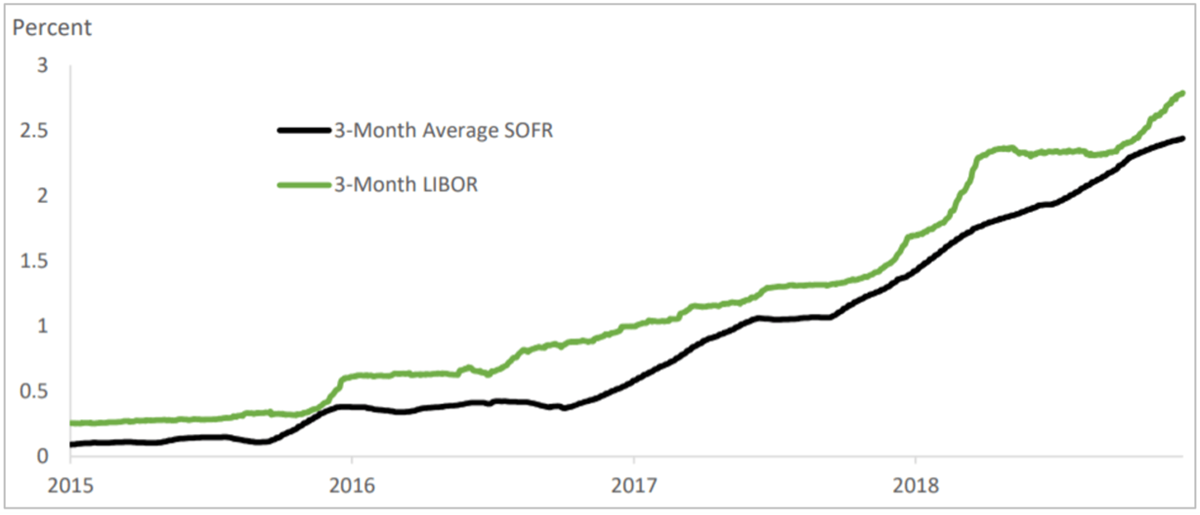

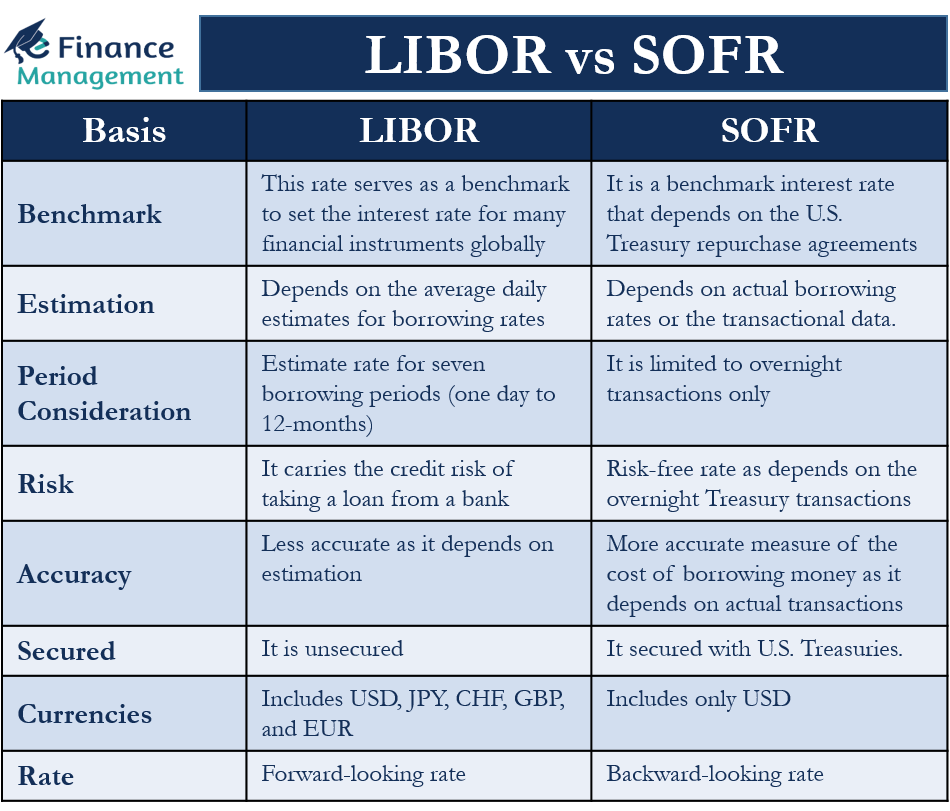

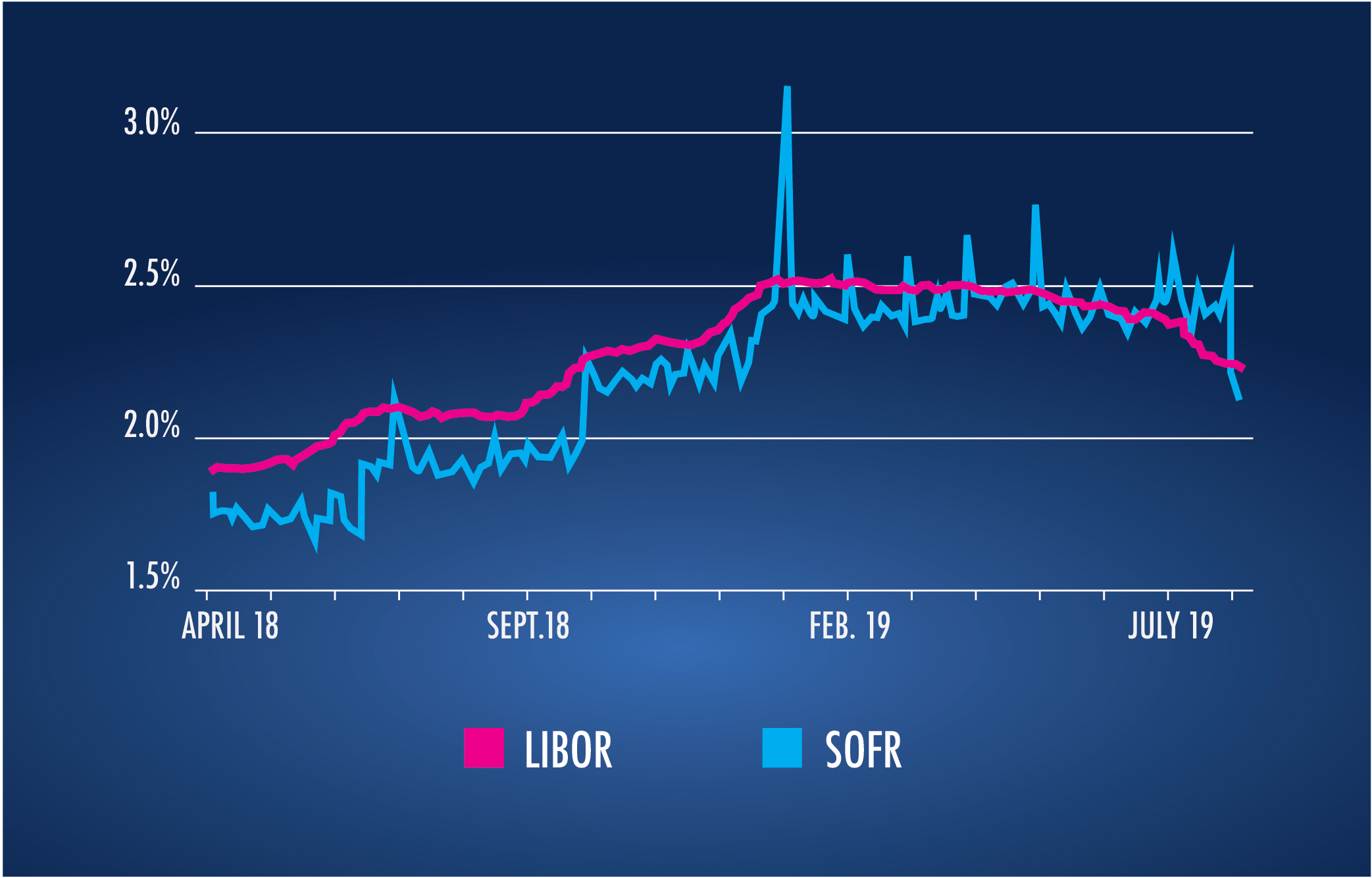

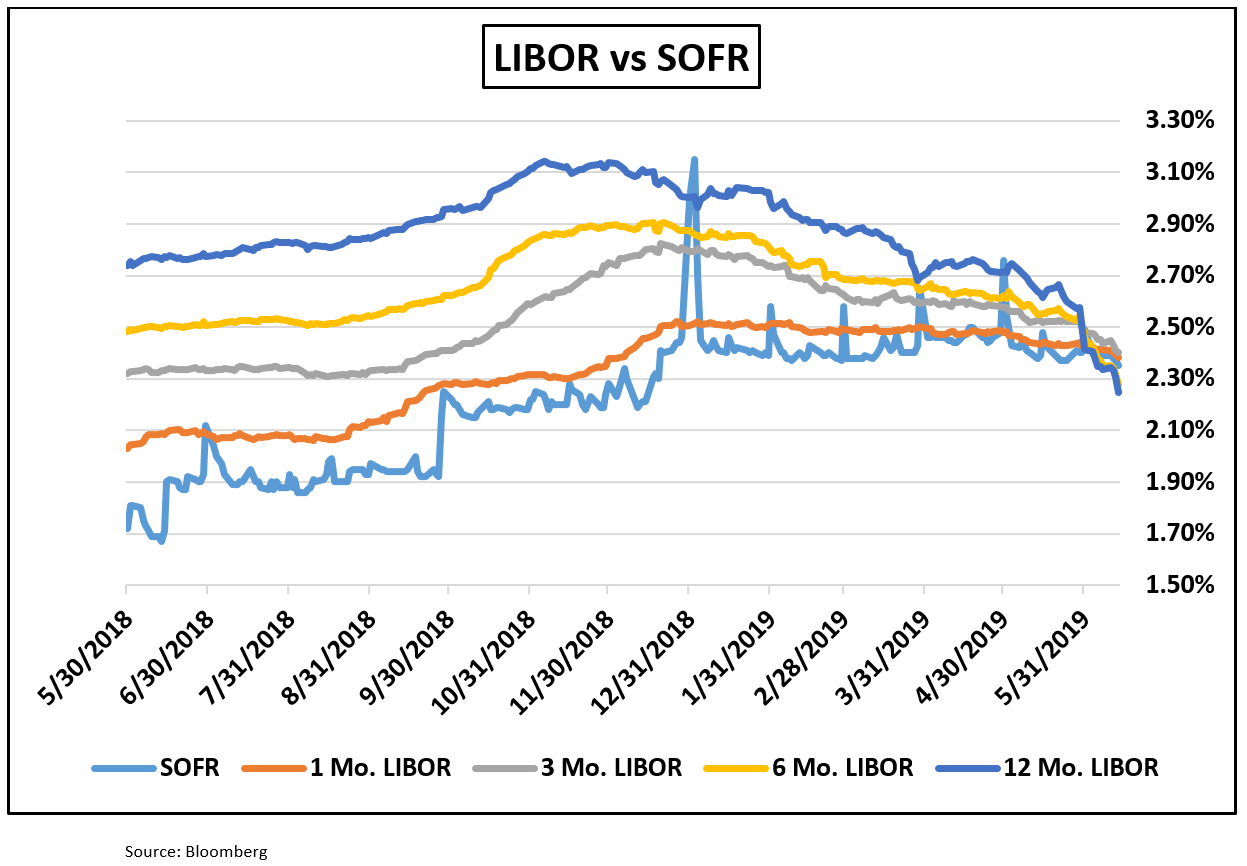

Sofr Vs Libor Chart - The transaction volumes underlying sofr regularly are over $1 trillion in daily volumes. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. Web there are some key differences between libor and sofr. Secured overnight financing rate is at 5.34%, compared to 5.33% the previous market day and 5.08% last year. Treasury repurchase agreements data, reflecting borrowing. Since sofr derivatives markets are based on collateral, sofr has a credit risk premium. The transition from libor to sofr in june 2023 marked a significant shift in interest rate benchmarks, enhancing reliability in financial markets. Web the secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Points 2 and 3 particularly make the transition from libor to sofr challenging. Web sofr is nearly risk free as an overnight secured rate collateralized with u.s. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. Sofr is based on actual transactions and not an estimate of where interest rates may be in the future. Points 2 and 3 particularly make the transition from libor to sofr challenging. Web there are three major differences. Secured overnight financing rate (sofr) is a benchmark interest rate for derivatives and loans in usd that has replaced the london interbank offered rate (libor). Web sofr is nearly risk free as an overnight secured rate collateralized with u.s. Since sofr derivatives markets are based on collateral, sofr has a credit risk premium. Web in 2014, the federal reserve convened. Sofr is a benchmark interest rate that depends on the u.s. As an overnight secured rate, sofr better reflects the way financial institutions fund themselves today. The new york federal reserve releases it. Since sofr derivatives markets are based on collateral, sofr has a credit risk premium. Sofr is based on actual transactions and not an estimate of where interest. Morgan’s preferred alternative to usd libor. Secured overnight financing rate is at 5.34%, compared to 5.33% the previous market day and 5.08% last year. Web there are three major differences between sofr and usd libor. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an. This is higher than the long term average of 2.10%. For example, sofr is calculated using actual transactions and is considered a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web the secured overnight financing rate (sofr) is j.p. Secured overnight financing rate (sofr) is a benchmark interest rate for derivatives and loans in usd. The secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. The new york federal reserve releases it. Web as you. Web what’s the main difference between libor vs. Web the resulting overnight libor fallback rate for may 31, 2024 is 5.34644% using the fixed 0.00644% overnight fallback spread. Web there are some key differences between libor and sofr. Since sofr derivatives markets are based on collateral, sofr has a credit risk premium. Sofr is a benchmark that financial institutions use. Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Web there are some key differences between libor and sofr. Web as you can see in the chart above, we employ the 5yr median spread between sofr and libor as calculated by the international swaps and derivatives association (isda). Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. The secured overnight financing rate or sofr is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web there are some key differences between libor and sofr. Web as you can see in the chart above, we. Web the secured overnight financing rate (sofr) is j.p. Since sofr derivatives markets are based on collateral, sofr has a credit risk premium. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. Secured overnight financing rate is at 5.34%, compared. Web sofr is a much more resilient rate than libor was because of how it is produced and the depth and liquidity of the markets that underlie it. As an overnight secured rate, sofr better reflects the way financial institutions fund themselves today. The new york federal reserve releases it. Sofr is a benchmark interest rate that depends on the u.s. The transaction volumes underlying sofr regularly are over $1 trillion in daily volumes. Web founded in the 1980s and marred by manipulation during the great financial crisis, the u.s. Points 2 and 3 particularly make the transition from libor to sofr challenging. For example, sofr is calculated using actual transactions and is considered a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. This is higher than the long term average of 2.10%. Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Secured overnight financing rate (sofr) is a benchmark interest rate for derivatives and loans in usd that has replaced the london interbank offered rate (libor). The transition from libor to sofr in june 2023 marked a significant shift in interest rate benchmarks, enhancing reliability in financial markets. Treasury repurchase agreements data, reflecting borrowing. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. Secured overnight financing rate is at 5.34%, compared to 5.33% the previous market day and 5.08% last year.

The LIBOR Transition, Part 2 Challenges Associated with SOFR

The impact of Reference Rate reform Transition from LIBOR to SOFR

Flooring It! LIBOR vs. SOFR LSTA

An Update on the Transition from LIBOR to SOFR

LIBOR vs SOFR Meaning, Need, and Differences

The LIBOR Transition Mission Capital

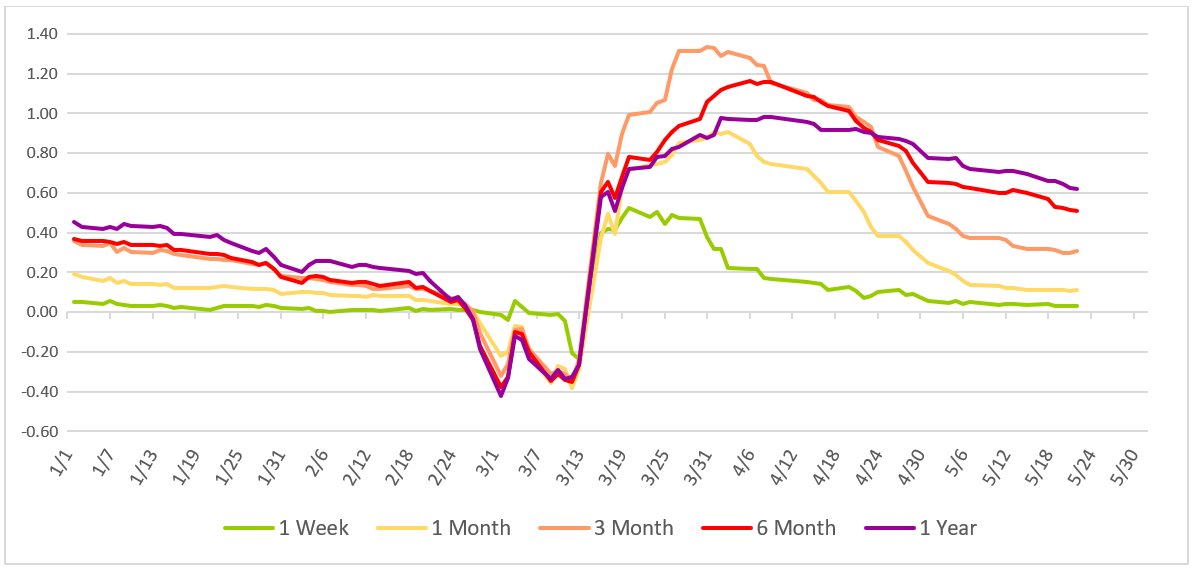

Sofr Vs Libor Chart 2021

Comparing LIBOR, BSBY & SOFR Curves LSTA

Libor To Sofr Spread

Libor Vs Sofr Rate Chart 2023

Sofr Is A Benchmark That Financial Institutions Use To Price Loans For Businesses.

The Federal Reserve Created The Alternative Reference Rates Committee (Arrc) In 2014 To Develop Sofr As An Alternative Rfr, Which Has Been Published On An Overnight Basis Since 2018.

Web The Secured Overnight Financing Rate (Sofr) Is J.p.

Web Here’s What You Need To Know About Sofr, How It Differs From Libor And How You Might Be Impacted By The Change.

Related Post: